Ethereum Classic Maintains 32% Steady Rise – What’s Driving ETC Up?

16 Janeiro 2024 - 5:26AM

NEWSBTC

The recent approval of the first Bitcoin spot exchange-traded fund

(ETF) in the United States by the Securities and Exchange

Commission (SEC) has reverberated across the cryptocurrency

landscape, triggering a significant surge in various altcoins, with

Ethereum Classic (ETC) taking the spotlight. Often overshadowed by

its more well-known sibling, Ethereum, ETC has emerged as the clear

winner in the aftermath of the groundbreaking news, experiencing an

impressive surge of over 31% in the past seven days. Related

Reading: Solid TVL Slingshots SUI Price To Break $1 For New

All-Time High – Details Ethereum Classic Trading Volume Up Since

the SEC’s approval of the Grayscale Bitcoin ETF on January 10th,

Ethereum Classic has skyrocketed by a staggering 30%, currently

maintaining a trading value around $26. This meteoric rise has been

accompanied by a remarkable 270% increase in trading volume,

soaring to a substantial $1.8 billion. Such robust figures

underscore a palpable surge in investor confidence, suggesting the

potential for further gains in the near future. While Bitcoin

itself witnessed a modest price increase, briefly touching $47,000,

Ethereum stole the limelight by breaking a 20-month barrier and

surpassing $2,600. Ethereum Classic currently trading at $26.36 on

the daily chart: TradingView.com This remarkable 10% surge within a

mere 24 hours has positioned Ethereum at its highest value since

May 2022. Analysts attribute this impressive performance to

Ethereum’s robust underlying technology and recent network

upgrades, cementing its status as a favorable option for investors

after Bitcoin. The approval of the Bitcoin spot ETF is not the sole

catalyst for this altcoin rally; the much-anticipated Bitcoin

halving event, scheduled for later in the year, is also playing a

pivotal role in bolstering bullish sentiment. ETC price action in

the weekly timeframe. Source: Coingecko This event, occurring

approximately every four years, involves a reduction in the number

of newly minted Bitcoins and has historically coincided with price

appreciation in the cryptocurrency market. The confluence of these

factors has created a perfect storm for Ethereum Classic,

propelling it towards the coveted $30 mark. ETC Strong Performance

Industry experts anticipate that this milestone may be achieved

soon, fueled by Ethereum Classic’s impressive trading volume and

market capitalization, which has surged by 34% to cross the $4

billion mark since the ETF news broke. Related Reading: Chainlink

Rises 17% – Is LINK On Course To Hit $20 This Week? However, amidst

the euphoria surrounding this surge, it remains crucial to

acknowledge the inherent volatility of the cryptocurrency market.

While the approval of the Bitcoin spot ETF and the impending

halving event offer promising prospects, unforeseen factors can

swiftly alter market dynamics. The recent ascent of Ethereum

Classic serves as a compelling testament to the interconnectedness

of the cryptocurrency market and the substantial impact of major

regulatory decisions. As the industry continues to evolve, it will

be intriguing to observe how other altcoins respond to these

developments and whether Ethereum Classic can sustain its lead in

this post-ETF era. Featured image from Shutterstock

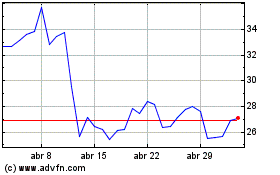

Ethereum Classic (COIN:ETCUSD)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Ethereum Classic (COIN:ETCUSD)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024