Ethereum Staking Reaches Historic Milestone As ETH Price Barrels Past $2,400

08 Fevereiro 2024 - 7:30PM

NEWSBTC

Ethereum staking has been ramping up despite the poor performance

of the ETH price over the past year. Liquid staking protocols such

as Lido Finance have continued to see the amount of ETH being

staked rise, and as a result of this continued interest in staking

ETH, the total amount of supply that has been locked so far has

reached a new all-time high. 25% Of All ETH Are Now Staked In an

interesting turn of events, the total percentage of ETH supply that

is being staked has crossed the 25% mark. This was made public by

Lido Finance, which shared a screenshot of a Dune Analytics

dashboard showing that it has touched the 25% mark. Related

Reading: Bitcoin Miner Reserves Drop To June 2021 Levels, What This

Means For Price Looking at the Dune Analytics dashboard, it shows

that this figure continues to climb following this, with 25.08% of

the total ETH supply now staked. This figure is facilitated by a

total of 924,023 Ethereum validators that are currently running on

the network. Net flows have also gone against expectations and have

been positive since the Shanghai upgrade. This upgrade allowed

stakers to be able to finally withdraw their staked ETH. But rather

than withdrawals happening en masse, more ETH has flowed into

staking contracts. Dune’s data shows that over 10 million ETH have

flowed into staking contracts since the Shanghai upgrade.

Currently, there are over 30.14 million ETH in total staked so far,

and this figure seems to be rising fast. Lido Dominates Ethereum

Staking Of the total 30.14 million ETH figure that has been staked

so far, a large percentage are currently being staked through the

Lido platform, as the Dune Analytics platform accounts for 31.52%

of all staked ETH. This solidifies Lido’s position as the largest

Ethereum staking platform, with over 297,000 validators on the

protocol. Coinbase follows behind Lido, accounting for 14.4% of the

total ETH staked with more than 136,000 validators. This means that

together, Coinbase and Lido Finance currently control 45% of the

staked ETH market, giving them a head start over others. Related

Reading: Bitcoin Price Jumps Above $44,000, Here Are The Factors

Driving It Binance, another crypto exchange, is in third place,

with 4.3% of all staked ETH and 41,000 validates. Kiln, Figment,

and Rocket Pool control the 4th, 5th, and 6th positions,

respectively, controlling between 2.8% and 3.3% of the total staked

ETH. Looking at the rewards so far, Ethereum stakers have made

quite a lot since the initiative began. The total ETH earned so far

by Lido stakers has crossed 467,000 ETH, with 259,000 ETH earned on

Coinbase, and 139,000 ETH earned by Binance stakers. The ETH price

has also turned bullish during this time, beating the resistance at

$2,400. It is up 2.22% in the last day, with 7% gains in the last

week, according to data from CoinMarketCap. ETH price at $2,400 |

Source: ETHUSD on Tradingview.com Featured image from Dall.E, chart

from Tradingview.com

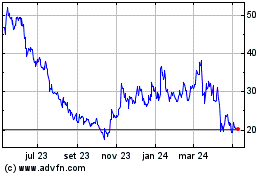

Rocket Pool (COIN:RPLUSD)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

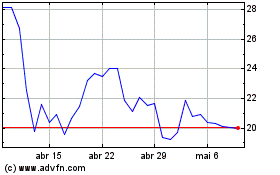

Rocket Pool (COIN:RPLUSD)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024