Vitalik Buterin Withdraws 760 ETH As Market Turmoil Strikes Ethereum

09 Setembro 2024 - 10:00PM

NEWSBTC

Ethereum co-founder Vitalik Buterin has been in the news of late

with his 760 ETH withdrawal–a move that raised eyebrows as

speculations about what such external wallet transactions by him

could do to the Ethereum market. Related Reading: Ether Liquidity

Plummets 40% On Exchanges After ETF Debut Transactions are part of

a broader trend that has seen wallets associated with Buterin and

the Ethereum Foundation actively sell large portions of Ether. It

is this aggressive selling that has added to the bearish pressure

on Ethereum’s price, which lately slipped to the low $2,150 level

before recovering slightly. Vitalik Buterin: Details Of The

Withdrawal The wallet, according to reports, has been selling since

it received Buterin’s ETH in two transactions on Aug. 9 and Aug. 30

totaling 3,800 ETH. In the wake of the two transfers, the wallet

has sold 760 ETH for approximately 1.835 million USDC or roughly

$2,414 per ETH. The multi-signature wallet that got $ETH from

@VitalikButerin is on a selling streak! After receiving 3,800 $ETH

($9.99M) from Vitalik on Aug 9 and 30, it’s been cashing out,

selling 760 $ETH for 1.835M $USDC at ~$2,414 per ETH. The latest

sale happened just 21 hours ago.… pic.twitter.com/ELcjpPSg4K — Spot

On Chain (@spotonchain) September 9, 2024 The recent sale was made

just 21 hours ago and has become a part of a streak of aggressive

liquidations that have sparked speculations in the crypto

community. Buterin was even accused of “dumping” his ETH holdings,

which he always publicly denied, claiming that funds go to support

development in the Ethereum ecosystem and philanthropy. While he

has been reassuring, the continuous sales from wallets attributed

to him have greatly contributed to increased bearish sentiment

among investors. Broader Market Implications This selling is not a

one-man activity carried out by Buterin; Ethereum Foundation is

also notorious for offloading huge quantities of ETH. According to

reports, it has sold over 3,066 ETH this year alone. Such sustained

sales have raised questions about the whole Ethereum market’s

health. According to analysts, sales such as these, together with

large holder store reductions, have made life tough for ETH,

struggling to hold its value. Besides Buterin’s sell-offs, one of

the largest Ethereum whales liquidated a total of 28,554 ETH in

cash in order to pay back his debt on Aave, a decentralized

borrowing platform. That amount translates into approximately $64.4

million. This further added to the ETH sell-off pressure, making

things even more complicated for ETH in the market. These

cumulative activities have stirred talks that this aggressive ETH

sell-off might cause ETH to plunge even below $2,000 if it proceeds

this way. Related Reading: Cardano Bull Sees ADA Jumping 1,000% In

An ‘Insane’ Rally A Call For Transparency With the situation still

developing, there are some calling for more transparency on

Buterin’s part and that of the Ethereum Foundation with respect to

how they are selling the cryptocurrency. 🚨🚨 After Vitalik, the

Ethereum Foundation is the next to sell $ETH! Just 10 minutes ago,

the #EthereumFoundation sold 450 $ETH for 1.029M $DAI. In total,

they’ve sold 550 $ETH ($1.28M) at an average price of $2,324 in the

past 4 days. Follow @spotonchain for more updates…

https://t.co/d2bP0WLo9C pic.twitter.com/cjgFvMeOvw — Spot On Chain

(@spotonchain) September 9, 2024 Insiders close to the foundation

have said its sales are part of a planned financial policy aimed at

managing operational expenses, including grants and salaries.

According to Aya Miyaguchi, executive director of the Ethereum

Foundation, one requirement is the need to convert portions of the

ETH it holds into stablecoins like DAI to cover certain financial

obligations. This casts a shadow on the Ethereum community, as to

where this could lead in the long run. Though the idea of Buterin

and the Foundation could be genuinely valid, this dumping

perception plays a significant role in investor perception. With

this action, the market would respond to such withdrawals, and

recovery or fall in ETH value is something the stakeholders keenly

await. Featured image from Shrimpy Blog, chart from TradingView

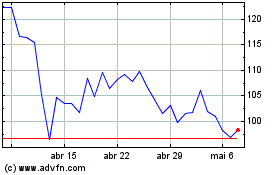

Quant (COIN:QNTUSD)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Quant (COIN:QNTUSD)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024