Which Altcoins Could Skyrocket Next? Analytics Firm Points To These

12 Setembro 2024 - 9:00PM

NEWSBTC

The on-chain analytics firm Santiment has pointed out how these

three altcoins may be more likely to see price jumps in the coming

future. These Altcoins Are Being Heavily Shorted On Binance Right

Now In a new post on X, Santiment has discussed about some altcoins

that could be worth keeping an eye on because of a trend forming in

their Binance Funding Rate. The Funding Rate here refers to an

indicator that tracks the periodic amount of fees that traders on a

given derivatives exchange (in this case, Binance) are paying each

other right now. Related Reading: Dogecoin Vs Shiba Inu Vs Pepe:

How Do The Top Memecoins Compare In Investor Profits? When the

value of this metric is positive, it means the long investors are

paying a fee to the short holders in order to keep their positions.

Such a trend suggests the majority of the derivatives users share a

bullish sentiment. On the other hand, the indicator being negative

implies the shorts are outweighing the longs, so a bearish

mentality could be assumed to be the dominant one in the sector.

Now, here is the chart shared by the analytics firm that shows the

trend in the Binance Funding Rate for three altcoins, Aave (AAVE),

The Graph (GRT), and Decentraland (MANA), over the past week: As is

visible in the above graph, the Binance Funding Rate has recently

switched from green to red for all three of these altcoins. This

would suggest that the investors have opened a large amount of

short positions on the exchange related to these assets, thus

shifting the balance. Interestingly, this heavy shorting from the

investors has come as the cryptocurrency market as a whole has been

rebounding, led by Bitcoin’s recovery back above $58,000. It would

appear that derivatives users don’t expect AAVE, GRT, and MANA to

continue the bullish wave. This pessimism around the altcoins,

however, can actually play into the benefit of their prices. This

is because mass liquidation events are more likely to affect the

side of the market with the most positions. At present, the

dominant side is the bearish one, so mass short liquidations could

likely occur in the coming days. Whenever a large amount of

liquidations take place at once (an event that’s popularly known as

a squeeze), the price can see a burst of volatility arising out of

all this fuel. As such, Santiment believes that should these shorts

get caught in a liquidation event, the altcoins could see big price

jumps. Related Reading: Bitcoin Recovery: Has BTC Prevented A Fall

To $41,000 With This Surge? It only remains to be seen, though,

whether Aave and others would show price surges from here and

punish these investors betting on a bearish outcome. Aave Price

Aave has been enjoying bullish momentum during the last few days as

its price has risen to $147 after witnessing a surge of over 11% in

the last seven days. Featured image from Shutterstock.com,

Santiment.net, chart from TradingView.com

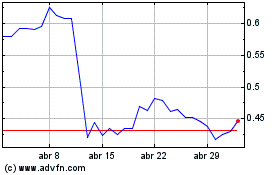

Decentraland (COIN:MANAUSD)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Decentraland (COIN:MANAUSD)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024