Bitwise CIO Calls Ethereum The ‘Microsoft Of Blockchains’, Can ETH Make A Comeback?

19 Setembro 2024 - 1:30AM

NEWSBTC

Bitwise Chief Investment Officer Matt Hougan dubbed Ethereum (ETH)

the ‘Microsoft of blockchains’, adding that none of the smart

contract platform’s challenges are existential. Ethereum Has

Challenges, But None Of Them Are Existential In a recent memo

titled ‘A Contrarian Bet on Ethereum’, Hougan highlighted the

tumbling ETH/BTC trading pair, indicating the weakening Ethereum

price versus Bitcoin (BTC). At press time, the trading pair is

exchanging hands at 0.038, its lowest level in three years. Related

Reading: Ethereum-Bitcoin Ratio Breaks 0.04 Barrier: Could Altcoins

Be At Risk? Compared to some of the other leading digital

currencies, ETH hasn’t had an eventful 2024. On a year-to-date

basis, Bitcoin is up 38%, while the rival smart contract platform

Solana (SOL) is up 31%. Binance’s BNB token has surged by 72% in

the same period. However, ETH has remained flat, currently trading

at $2,306. Ethereum’s underperformance in terms of token

price, according to Hougan, has made it ‘cool to hate Ethereum

right now.’ Hougan noted several factors that might risk the

Ethereum ecosystem, including the prospect of Democratic US

presidential candidate Kamala Harris winning the election and

continuing Biden administration’s suspicious attitude toward

everything crypto. In addition, the Bitwise CIO acknowledged the

threats posed by competing blockchain projects, such as Solana,

that offer higher throughput and lower transaction costs. He also

admitted that ETH exchange-traded-funds (ETFs) haven’t had as much

success as Bitcoin ETFs. Although Hougan acknowledged the success

of several Layer-2 solutions such as Base, Arbitrum, and Optimism,

he stressed that their success has pulled so much transaction

volume from Ethereum that its revenues have crashed to a four-year

low. According to Hougan, these reasons are valid but ‘they miss

the broader point.’ Hougan stressed that blockchain applications

witnessing success in user adoption are all dominated by Ethereum,

such as stablecoins and decentralized finance (DeFi). Over 50% of

stablecoins are still issued on the ETH blockchain. Similarly, over

60% of DeFi assets are locked in various ETH-powered

protocols. Hougan Remains Bullish On ETH In the memo, Hougan

mentioned that institutional confidence in Ethereum remains high,

as seen in asset manager BlackRock’s decision to develop a

tokenized money market on Ethereum this year. Similarly, Nike chose

Ethereum to launch its Web 3 gear platform called Swoosh. Related

Reading: Time To Convert Bitcoin To Ethereum? ETH/BTC Charts Gears

Up For 180% Surge He noted: Ethereum has the most active

developers, the most active users, and a market cap that is 5x

bigger than its closest competitor. It’s the only programmable

blockchain that has a modicum of regulatory support in the U.S.,

with a booming regulated futures market and a multi-billion-dollar

ETF market. To bolster his argument, Hougan compared Ethereum to

software juggernaut Microsoft, saying that even though other tech

companies like Google, Zoom, and Slack have offered useful

services, Microsoft continues to be larger than all of them put

together. Concluding, Hougan said that Ethereum’s opportunities are

enormous. As the world inches closer to the November US

presidential elections, the market participants may reevaluate the

second largest cryptocurrency by market cap. At press time, ETH

trades at $2,306, commanding a total market cap of $277 billion.

Featured image from Unsplash, Chart from Tradingview.com

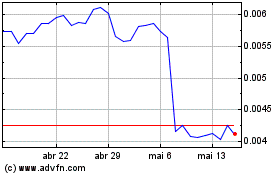

Four (COIN:FOURRUSD)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

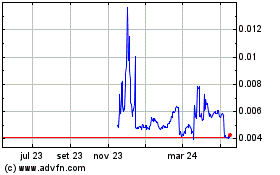

Four (COIN:FOURRUSD)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024