Solana ETF Prospects Brighten Amid Productive SEC Talks With Issuers

22 Novembro 2024 - 5:30AM

NEWSBTC

On Thursday, Fox reporter Eleanor Terret revealed that the US

Securities and Exchange Commission (SEC) is actively engaging in

discussions with several asset managers regarding the launch of the

new spot Solana ETF market. The firms involved include VanEck,

21Shares, Canary Capital, and Bitwise, all seeking to introduce

products tied to the Solana price. SEC Progresses On Solana ETF

Talks According to sources familiar with the matter cited by

Terret, discussions between SEC staff and issuers are currently

“progressing.” The SEC is reportedly reviewing S-1 filings,

critical to the Solana ETF approval process. Terret further

disclosed that there is growing optimism among stakeholders that

the industry may soon see 19b4 filings from exchanges representing

these issuers, a key step necessary to move forward with ETF

listings. Related Reading: FTX Provides Details On $16 Billion

Distribution Timeline For Customers And Creditors These 19b4 forms

will be submitted by exchanges, such as the Chicago Board Options

Exchange (CBOE), on behalf of the issuers, seeking SEC approval to

list the proposed ETFs. Upon receiving these filings, the SEC has a

240-day window to either approve or deny the products. To date,

VanEck and 21Shares, who are also in the Ethereum and Bitcoin ETF

markets approved by the agency earlier this year, along with Canary

Capital, have submitted their S-1 filings for a Solana ETF, while

Bitwise recently announced its intention to file earlier this

week. However, Terret notes that the submission of 19b4

filings does not guarantee approval. Previous applications from

VanEck and 21Shares faced setbacks, with their filings removed from

the CBOE’s website in August. The reporter claimed that

industry observers speculated that the regulatory agency, under its

chairman Gary Gensler, was reluctant to approve such listings

because of a tougher regulatory stance. Potential Shift In SEC

Approach For 2025 Despite these previous setbacks, there is renewed

optimism among investors following recent engagements with SEC

staff and the anticipated pro-crypto policies of the incoming

administration led by President-elect Donald Trump. This

change in leadership is expected to foster a more favorable

environment for cryptocurrency-related financial products,

potentially paving the way for a Solana ETF approval in 2025. The

anticipation around the Solana ETF gained additional traction after

Gensler announced his departure from the SEC, confirming that

January 20, 2025, will be his last day in office. This

announcement follows months of speculation regarding his future,

particularly as Donald Trump had previously indicated intentions to

replace Gensler on his first day in office. Related Reading:

Ethereum Sees Neutral Netflow On Binance: What Does This Signal?

Besides the Solana ETF, other cryptocurrency ETFs, including those

for XRP and Hedera’s HBAR token, are also in the pipeline and may

benefit from the evolving regulatory landscape. As the

situation unfolds, the potential for a more accommodating

regulatory approach could significantly reshape the cryptocurrency

investment landscape in the United States, even more so with the

plans Trump laid out during his presidential campaign. At the time

of writing, SOL is trading at $261, up 25% in the weekly time

frame, marking a new all-time high for what is now the fourth

largest cryptocurrency on the market. Featured image from DALL-E,

chart from TradingView.com

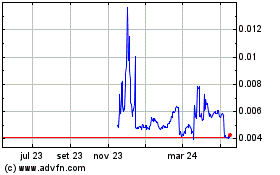

Four (COIN:FOURRUSD)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

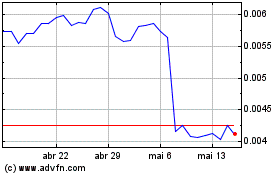

Four (COIN:FOURRUSD)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025