Bitcoin Investors Not Sold On Uptober As Sentiment Remains Neutral

08 Outubro 2024 - 3:30AM

NEWSBTC

Data shows that the Bitcoin trader sentiment is currently neutral,

a sign that investors are indecisive about the direction of the

cryptocurrency. Bitcoin Fear & Greed Index Is Right In The

Balance Right Now The “Fear & Greed Index” is an indicator

created by Alternative that tells us about the average sentiment

among the traders in the Bitcoin and wider cryptocurrency markets.

This index determines the sentiment by accounting for the data of

the following five factors: trading volume, volatility, market cap

dominance, social media sentiment, and Google Trends. To represent

the calculated sentiment, the indicator uses a scale that runs from

zero to hundred. When the metric’s value is greater than 53, it

means the investors are sharing a sentiment of greed right now. On

the other hand, the indicator being under 47 suggests the dominance

of fear in the sector. Naturally, the region in-between these

cutoffs corresponds to a neutral mentality. Related Reading:

Dogecoin Whales Scoop Up 1 Billion DOGE: Time For Rally To Return?

Now, here is how the latest value of the Bitcoin Fear & Greed

Index has been like: As is visible above, the indicator has a value

of 50, which implies that the market sentiment is exactly in the

balance at the moment. It’s also not just today that the metric has

been in this zone, as it had in fact signaled a neutral market

during the weekend as well. The below chart shows how the index’s

value has changed over the past month. From the graph, it’s

apparent that the Bitcoin Fear & Greed Index had slipped into

the fear region during the starting few days of this month, a

result of the bearish action that the market as a whole had

witnessed. The traders hadn’t become too fearful in this drop,

though, as the indicator had only reached a low of 37. With the

price recovery that has followed since then, the sentiment has

improved to the current 50 level. Interestingly, however, despite

the month of October being popularly dubbed ‘Uptober,’ a result of

BTC historically performing well in this period, the market is yet

to embrace greed. Related Reading: Bitcoin Miner Selloff Is Calming

Down: Green Sign For Rally To Continue? The fact that the investors

are still neutral despite a bullish wave seemingly starting with

the recovery would suggest the investors are currently hesitant

about getting excited over the prospect of a run. Historically,

Bitcoin has tended to move opposite to the expectations of the

majority, so a highly bullish sentiment has usually been a bad sign

for things to come. In this view, the fact that the investors are

currently not displaying hype could actually turn out to be a boon

for the coin’s rally. BTC Price Bitcoin had broken beyond the

$64,000 level earlier in the day, but the asset appears to have

seen a pullback since then as it’s back at $63,600. Featured image

from Dall-E, Alternative.net, chart from TradingView.com

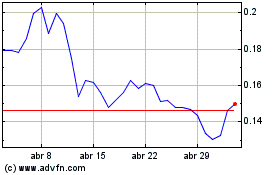

Dogecoin (COIN:DOGEUSD)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Dogecoin (COIN:DOGEUSD)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024