Bitcoin Facing Potential Capitulation Amid On-Chain Liquidity Squeeze, Analyst Says

10 Outubro 2024 - 10:00PM

NEWSBTC

According to a crypto analyst, Bitcoin (BTC) may be heading towards

a capitulation due to tightening on-chain liquidity. However, this

capitulation could be followed by a “full bull” market. Bitcoin

Headed Lower Before Higher In a detailed thread on X about BTC

price analysis, crypto analyst Cole Garner stated that capitulation

might be on the horizon for the leading digital asset. Garner

attributes the potential downturn to tightening on-chain liquidity.

Related Reading: Bitcoin ETF Options Set To Supercharge Price

Volatility, Expert Warns Tracking global liquidity from central

banks worldwide, the analyst said he sees a “buy signal” for

digital assets. However, more downsides for cryptocurrencies could

come before liquidity-enhancing measures undertaken by central

banks buoy them. In his analysis, Garner stated that “if China

doesn’t ring that bell, the Fed or Japan should do the job,” likely

pointing toward the recent economic stimulus injected by the

Chinese central bank in a bid to boost the country’s grim economic

outlook. Garner referenced the recent economic stimulus from

China’s central bank but noted that this week, the People’s Bank of

China (PBoC) refrained from injecting additional liquidity,

tempering expectations for risk-on assets like crypto. Garner

emphasized the low supply of stablecoins compared to the beginning

of October 2024. Analyzing the “Bitfinex grail,” which is

essentially the total supply of two leading stablecoins on the

exchange – USDT and USDC – Garner noted its quarterly rate of

change is declining, potentially leading to lower prices for

digital assets in the short term. Despite these concerns, Garner

pointed out that Bitcoin has printed a higher high on the 8-hour

chart, and the market structure remains bullish. Even if BTC dips

to its range lows in the high $40k range, the overall price action

is still considered positive. Garner suggested that should BTC hit

its range of lows, traders and investors can consider buying at

that price. Even if they are low on liquid cash, they must ensure

they don’t get spooked by the market and panic-sell their current

holdings. Another crypto analyst, Ali, seemed to echo Garner’s

outlook, stating that Bitcoin is stuck in a descending parallel

channel and runs the risk of sliding to channel lows of around

$52,000. The analyst stressed that BTC must overcome the $66,000

level for a bullish breakout. Can Bitcoin Hit New All-Time Highs In

2024? With the remainder of 2024 ahead, Bitcoin bulls anticipate

interest rate cuts by the US Federal Reserve (Fed) to fuel a new

rally. However, BTC must clear several hurdles to sustain its

bullish momentum. Related Reading: Bitcoin’s Puell Multiple Signals

A Bullish Surge: Could A New ATH Be Near? Crypto analyst Carl

Runefelt recently noted that BTC must overcome the $64,000

resistance level to trigger a rally in Q4 2024. Failure to break

through this price level could lead to further downside.

Further, Bitcoin’s price finally turned green in October,

giving bulls hopes of another “uptober” for the asset, which

was marked by significant price increases. BTC trades at

$60,711 at press time, down 2.4% in the last 24 hours. Featured

Image from Unsplash.com, Charts from X and TradingView.com

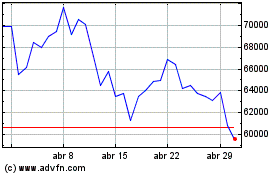

Bitcoin (COIN:BTCUSD)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Bitcoin (COIN:BTCUSD)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024