Bitcoin Adoption Grows As Rumble Unveils $20 Million BTC Treasury Strategy

27 Novembro 2024 - 12:00AM

NEWSBTC

Bitcoin (BTC) corporate adoption continues to gain momentum as

video-sharing and cloud services platform Rumble recently unveiled

a BTC treasury strategy. This move aligns with a growing trend of

corporations worldwide embracing Bitcoin as a strategic asset.

Rumble Announces Bitcoin Treasury Strategy, Stock Rises The YouTube

competitor is the latest company to join the Bitcoin bandwagon, as

its Board of Directors approved a corporate treasury

diversification strategy that allocates a portion of its excess

cash reserves to BTC. Related Reading: Samara Asset Group Eyes

$32.8 Million Bond Issuance To Increase Bitcoin Holdings As part of

this strategy, Rumble plans to purchase up to $20 million worth of

BTC. The company described Bitcoin as a “valuable tool for

strategic planning.” Rumble CEO and Chairman Chris Pavlovski

explained: We believe that the world is still in the early stages

of the adoption of Bitcoin, which has recently accelerated with the

election of a crypto-friendly US presidential administration

and increased institutional adoption. Unlike any government-issued

currency, Bitcoin is not subject to dilution through endless

money-printing, enabling it to be a valuable inflation hedge and an

excellent addition to our treasury. The company stated that its

management would evaluate factors such as market conditions,

Bitcoin’s trading price, and Rumble’s cash flow needs to determine

the timing and amount of BTC purchases. However, it emphasized that

the strategy could be modified, paused, or discontinued.

Interestingly, the announcement followed a poll conducted by

Pavlovski on X, where he asked users whether Rumble should add

Bitcoin to its balance sheet. Over 93% of the 43,790 respondents

voted in favor of the proposal. Rumble’s stock price surged after

the announcement, reflecting investor confidence. The tech

company’s shares closed at $7.31, marking a 12.63% increase in a

single day. BTC as a Corporate Asset: A Winning Strategy? Rumble’s

decision to add BTC to its balance sheet mirrors the approach of

MicroStrategy (MSTR), a pioneer in Bitcoin treasury management.

Yesterday, the Michael Saylor-led firm revealed that it had

acquired an additional 55,000 BTC, bringing its holdings to $5.4

billion. Related Reading: Metaplanet’s Total Bitcoin Holdings

Exceed 1,000 BTC Following Latest Purchase MicroStrategy’s Bitcoin

play has worked tremendously for the company’s stock performance.

In the past year alone, MSTR price has increased by more than 670%,

outperforming both BTC and the S&P 500 regarding returns on

investment. Meanwhile, Japanese firm Metaplanet recently crossed

the 1,000 BTC milestone as it continues to bolster its Bitcoin

holdings with frequent purchases. Additionally, speculation about

major tech giants like Dell and Microsoft entering the Bitcoin

market could fuel demand and drive the asset’s price to new

highs. A recent analysis by crypto experts shows that BTC may

hit the highly-anticipated six-figure price target early next year.

BTC trades at $92,071 at press time, down 5.5% in the past 24

hours. Featured image from Unsplash, charts from Yahoo! Finance and

Tradingview.com

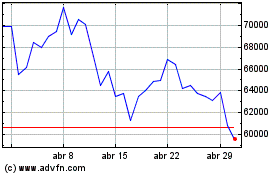

Bitcoin (COIN:BTCUSD)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Bitcoin (COIN:BTCUSD)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024