Bitcoin Price Prediction: Analyst Releases Bullish End Of Year Forecast Despite Failure At $100,000

08 Dezembro 2024 - 2:00AM

NEWSBTC

The Bitcoin price seems to be facing somewhat of a price failure

since it crossed above the $100,000 price level. In the few hours

after crossing above this psychological threshold, the Bitcoin

price faced rejection and corrected until it reached $94,000.

Related Reading: Market Expert: Not Long On XRP? You’re

‘Disrespecting’ Yourself However, this correction does not

necessarily signal a bleak outlook for the world’s largest

cryptocurrency, especially as investor sentiment continues to hover

in the extreme greed zone. According to technical analysis, the

Bitcoin price is still open to climbing well above $100,000 by the

end of December 2024. Record Bitcoin Liquidations Shake The

Market Bitcoin’s broader market dynamics and investor sentiment

suggest that Bitcoin’s failure at $100,000 could be a temporary

pause rather than a long-term reversal. Interestingly, a detailed

analysis posted on the TradingView platform supports this outlook

and offers a bold prediction for the year’s end. The analysis

highlighted December 5, 2024, as a historic day for cryptocurrency

liquidations. Total liquidations reached a staggering $1.1 billion,

surpassing the previous record of $950 million set on August 5,

2024. The breakdown included $820 million in liquidated long

positions and $280 million in liquidated short positions. Although

price data from Coinmarketcap and CoinGecko shows a bottom around

$93,600, the Bitcoin price dipped to $89,000–$90,000 depending on

the exchange. According to the analysis, such a dramatic move is

described as a “helicopter” on the BTCUSDT chart, and it reflects a

cooling-off period due to overheating from all technical

indicators. Despite the correction and crazy liquidations,

the analyst maintained that Bitcoin’s uptrend remains intact. This

is because the Fear and Greed Index, a popular sentiment indicator,

remained in the “greed” zone at 71 despite Bitcoin’s sharp drop. At

the time of writing, the Fear and Greed Index has increased to the

“extreme greed” zone at 82, suggesting that market participants are

still optimistic about Bitcoin’s future trajectory. Bold Year-End

Price Prediction Interestingly, the altcoin market barely reacted

to the Bitcoin price reaction, which also creates the possibility

of another wave downwards before a broader market recovery.

The analyst outlined a scenario for the Bitcoin price probably

going on another decline and break below $90,000. The forecast

suggests Bitcoin could drop further to the $84,000–$85,000 range

before rallying to $110,000. Adding to the bullish narrative

is the upcoming Federal Open Market Committee (FOMC) meeting, which

is scheduled to take place on December 18. Market expectations

point to a 0.25% rate cut by the Federal Reserve, a move that could

inject further momentum into Bitcoin’s price recovery much like the

September and November rate cuts. Related Reading: Dogecoin Days At

The Top Numbered? Cardano Set To Take Over — Analyst At the time of

writing, the Bitcoin price is trading at $99,450 and is about to

break above $100,000 again. On-chain data shows that Bitcoin whales

have taken advantage of the price decline to load up more BTC.

Particularly, addresses holding between 100 and 1,000 BTC have

increased their collective holdings by 20,000 BTC in the past 24

hours, valued at $2 billion. Featured image from Pixabay,

chart from TradingView

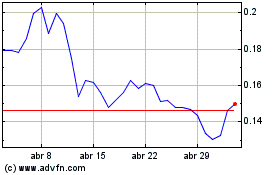

Dogecoin (COIN:DOGEUSD)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Dogecoin (COIN:DOGEUSD)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024