On-Chain Metrics Reveal Cardano Whales Are ‘Buying The Dip’ – Details

18 Dezembro 2024 - 9:00PM

NEWSBTC

Cardano (ADA) has been through a rollercoaster of volatility, with

the price experiencing significant ups and downs over recent weeks.

After hitting a local top of $1.32, ADA retraced over 30%, dropping

to $0.91 before returning to a critical support level. This price

action has left investors speculating whether the current recovery

marks the start of a new bullish phase or simply a temporary pause

before further downside. Related Reading: Solana Monthly Chart

‘Looks Ready For A Monster Run’ – Details Top analyst Ali Martinez

recently shared key insights on X, leveraging Santiment metrics to

shed light on whale activity driving Cardano’s market movements.

According to Martinez, large ADA holders began taking profits as

the price rallied from $1.15 to $1.33. However, the story shifted

dramatically as ADA dropped below $1, with whales accumulating

again at the $0.91, signaling renewed confidence in the token’s

potential. With whale activity and market dynamics heating up,

Cardano has returned to a pivotal price range that could define its

trajectory in the coming weeks. Investors are now closely watching

whether this accumulation phase will fuel a sustainable rally or if

further consolidation lies ahead for ADA. One thing is

certain—Cardano remains a token to watch as volatility continues to

shape its price action. Data Reveals Cardano Whales Behavior The

past few weeks have been highly volatile for Cardano (ADA),

reflecting the broader market’s unpredictable movements and the

strategic plays of smart money. ADA has become a focal point for

large investors making calculated moves as the market evolves. Top

analyst Ali Martinez recently highlighted data from Santiment that

underscores the pivotal role of whale activity in shaping ADA’s

price action. Martinez revealed that Cardano whales began

offloading their holdings as the price rallied from $1.15 to $1.33,

locking in significant profits. However, as the price dropped

sharply to $0.91, these same whales re-entered the market,

purchasing an impressive 160 million ADA during the dip. This

buying spree has sparked optimism, suggesting that smart money

views Cardano as bullish over the coming months. Such activity

often indicates confidence in the asset’s potential to rebound and

possibly outperform. However, it’s crucial to consider an

alternative perspective. This accumulation phase might also serve

as a short-term liquidity strategy designed to attract retail

investors into ADA, potentially setting the stage for another wave

of profit-taking by larger holders. Related Reading: Ethereum

Whales Load Up: Bullish Sign Or Bear Trap? As ADA hovers near

critical levels, its next moves will likely depend on how these

dynamics unfold. Whether this is a prelude to a sustained rally or

a tactical maneuver by smart money, Cardano remains a key asset to

watch in the weeks ahead. Price Holding Above $1 Cardano (ADA) is

trading at $1.04, marking a swift recovery after spending only a

few days below the critical $1 mark last week. This rebound

showcases strong buying interest around the $1 level, which has

historically acted as a psychological and technical support zone.

If ADA manages to sustain its position above $1 in the coming days,

the next target lies around $1.20—a price level that previously

triggered significant selling pressure. Reclaiming this level would

confirm bullish momentum and signal buyers are ready to challenge

higher resistance zones. For ADA bulls to maintain momentum and

drive the price higher, breaking and consolidating above the $1.20

mark is crucial. This would demonstrate the market’s strength and

potentially pave the way for a broader rally. However, failing to

claim $1.20 could result in another period of consolidation or even

a pullback, as sellers may step in to defend this resistance level.

Related Reading: Bitcoin Breaks ATH Pushing Back Into Price

Discovery – BTC To $130K? With recent whale accumulation adding

bullish sentiment, ADA’s ability to hold above $1 and target $1.20

will likely define its short-term trajectory. Traders will closely

monitor these levels to gauge whether Cardano can sustain its

recovery and regain upward momentum. Featured image from Dall-E,

chart from TradingView

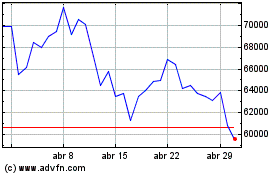

Bitcoin (COIN:BTCUSD)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Bitcoin (COIN:BTCUSD)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024