Bitcoin Cost Basis Distribution Reveals Strong Demand At $97K – Can BTC Hold?

22 Dezembro 2024 - 4:30AM

NEWSBTC

Bitcoin has had a whirlwind few days, hitting an all-time high

(ATH) last Tuesday before tumbling into a sharp 15% correction.

This period of heightened volatility has left investors divided,

with some expecting a continued uptrend while others brace for more

downside. The market is closely watching Bitcoin’s ability to

reclaim its bullish momentum. Related Reading: XRP Whales Loading

Up – Data Reveals Buying Activity Top analyst Ali Martinez has

highlighted critical data from the Bitcoin cost basis distribution,

pointing to $97K as a crucial support level. Martinez stresses that

holding this level is essential for BTC to maintain its uptrend and

fend off deeper corrections. However, Bitcoin’s price action

remains uncertain as it struggles to break through the

psychological barrier at $100K. While many investors see the recent

correction as a healthy reset after BTC’s meteoric rise, the

failure to push higher could signal a more prolonged consolidation

phase. With Bitcoin trading near pivotal levels, the coming days

will be critical in determining whether it will resume its climb to

new highs or face additional headwinds. Bitcoin Holding Above Key

Demand Bitcoin is holding steady above a critical demand level

around $97,000, offering a beacon of hope for bulls after recent

volatility. This stability follows a brief test of lower demand at

$92,000, which reinforced the market’s ability to absorb selling

pressure. While the short-term recovery is encouraging, the price

remains at a pivotal point that could determine its trajectory

heading into the new year. Martinez recently shared insights from

the Bitcoin cost basis distribution, emphasizing the importance of

the $99,000–$97,000 range. His data highlights this zone as the

most significant support threshold for Bitcoin, acting as a

critical line in the sand for the current uptrend. However,

Martinez warns of the potential downside risk if Bitcoin fails to

hold this range: “We really don’t want this level to become

resistance.” As Bitcoin consolidates near these key levels,

sentiment across the market remains indecisive. Bulls are eager to

see BTC reclaim momentum and push toward all-time highs, but the

psychological resistance around $100,000 continues to loom large.

Meanwhile, bears argue that the recent pullback could be a sign of

an impending larger correction. Related Reading: On-Chain Metrics

Reveal Cardano Whales Are ‘Buying The Dip’ – Details The coming

days will be crucial as the year draws to a close. With market

participants looking for clarity, Bitcoin must hold this critical

support zone or risk losing its bullish structure. Whether the next

major move is up or down will depend heavily on how BTC reacts

within this price range. BTC Testing Liquidity Bitcoin is

trading at $97,000, showing resilience after rebounding from local

lows of $92,000. This bounce highlights the market’s strong demand

at lower levels, reinforcing the bullish narrative for now. The

price structure remains intact above $97,000, indicating that BTC

is well-positioned to stage another rally toward its ATH. However,

the $100,000 psychological barrier looms large as the next major

hurdle for bulls. This level has proven difficult to overcome, with

previous attempts falling short. A successful breakout above

$100,000 in the coming days would likely reignite bullish momentum

and set the stage for Bitcoin to reach new ATHs, restoring

confidence among investors and traders. Related Reading: BTC

Realized Losses Spike 3 Times The Weekly Average – Healthy

Correction Or Downturn? On the flip side, failure to breach this

critical resistance could trigger a less favorable scenario. If

Bitcoin struggles to gain traction above $100,000, market sentiment

may waver, leading to increased selling pressure. In such a case,

BTC could face another downturn, testing key support levels once

again. Featured image from Dall-E, chart from TradingView

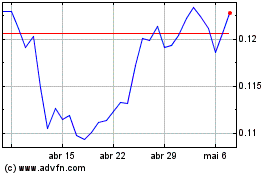

TRON (COIN:TRXUSD)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

TRON (COIN:TRXUSD)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024