Bitcoin Bulls Poised For Action As Market Flashes Bullish Divergence—Details

17 Março 2025 - 6:00PM

NEWSBTC

Market watchers have taken notice of Bitcoin’s recent price swings

after a notable surge in transactions from affluent individuals.

Market observers think that this might lead to a brief price spike,

even while larger economic worries still throw a shadow over the

cryptocurrency scene. Crucial price levels that can signal the next

big rise in Bitcoin are the focus of traders’ attention. Related

Reading: XRP $15 Breakout? Not A Far-Fetched Idea—Analysis Whale

Movements Show Interest In Buying According to reports, Bitcoin

whales—those legendary beings with huge cryptocurrency

fortunes—have been remarkably busy in the past several months.

Because these market movers rarely make impulsive purchases, their

accumulation patterns usually come before price increases.

According to recent blockchain statistics, there has been a

significant increase in the purchase of Bitcoin, which could

stimulate good market vibe. Prices of Bitcoin have responded

majorly to the displayed Regular Bullish Divergence pattern and

this suggests that bears are weakening and that bulls can be coming

to take even more control! These patterns can signal major bullish

reversals 👀…$BTC https://t.co/aR2BwrEwzd pic.twitter.com/KIUiwH9Vb1

— JAVON⚡️MARKS (@JavonTM1) March 16, 2025 Recently, Javon Marks,

who spends his time analyzing on-chain indicators, highlighted a

“bullish divergence pattern.” This happens when technical

indicators like the Relative Strength Index rise as the price of

Bitcoin falls—a market contradiction that usually anticipates price

reversals. There are numerous traders who interpret this

discrepancy as the market murmurs information regarding an imminent

rebound. Bitcoin’s Objective: To Hit $100k Despite weeks of

sideways and downward price action, numerous market veterans

believe that Bitcoin may be preparing for another attempt to breach

the elusive $100,000 threshold. Historically, whale accumulation

has occurred during price declines prior to the commencement of

significant rallies. So here’s the way I remember the rules

working. Close between 80K and 84K means the rally can continue

from here … probably up to 100K by month-end. If it closes at 84K

exactly, we run the table … HISTORIC moves. Above 84K —> we slip

back down and the rally fails.… https://t.co/phh3Rz5L16 — Josh Man

(@JoshMandell6) March 14, 2025 Bitcoin’s long-term outlook is still

optimistic, nevertheless. A well-known analyst and millionaire with

over 79,000 followers on X, Josh Mandell, claims that if the price

of Bitcoin closes above $84,000 at the end of the month, it may hit

$100,000. Meanwhile, market mood is still clearly erratic. While

day traders are always changing their approach, HODLers see today’s

prices as tomorrow’s deals. But the possibility of a macroeconomic

storm clouds keeps many investors from fully committing themselves.

Related Reading: Bitcoin To $10,000? Top Analyst Issues A Stark

Warning FOMC Meeting The next FOMC meeting could have a big

influence on the direction of Bitcoin. On the calendars of

speculators, the forthcoming Federal Open Market Committee meeting

marks a major event since it might either lead Bitcoin to climb or

fall depending on interest rate policies. Any sign of financial

easing could act as a trigger for the explosive expansion of risk

assets including Bitcoin. On the other hand, the existence of

hawkish signals could help to reduce the excitement about

cryptocurrencies. Market players are closely examining every

Federal Reserve statement in quest of signals about the future

direction of Bitcoin. Featured image from Gemini Imagen, chart from

TradingView

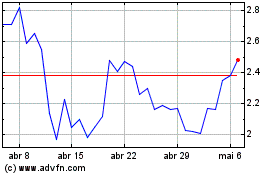

Fetch (COIN:FETUSD)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Fetch (COIN:FETUSD)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025