Dogecoin Bollinger Bands Tighten On 12H Chart Hinting At Imminent Price Move – Insights

24 Março 2025 - 1:30PM

NEWSBTC

Meme coins have faced significant pressure in recent weeks, with

uncertainty and macro-driven selling hitting risk assets across the

board. Among them, Dogecoin remains in a consolidation range,

trading between crucial price levels. Despite holding above key

support, bulls have been unable to generate enough momentum to

reclaim higher levels and trigger a recovery rally. Related

Reading: Ondo Finance Eyes Breakout As Price Tests $0.89 Channel

Resistance – Analyst As volatility tightens, all eyes are now on

the next major move for DOGE. Analysts warn that a breakout—up or

down—is imminent, as the market compresses and sentiment remains

divided. Bulls must reclaim levels above $0.18 to shift short-term

momentum and avoid further downside. Top analyst Ali Martinez

shared technical insights on X, pointing to a notable pattern

emerging on the 12-hour chart. According to Martinez, Dogecoin’s

Bollinger Bands are narrowing, a technical signal that typically

precedes a significant price move. This “tight squeeze” suggests

that DOGE may be on the verge of breaking out of its current range,

with the direction likely determined by broader market sentiment

and short-term trading activity. For now, traders are watching

closely, as Dogecoin approaches a critical point where its next

move could shape the trend for the days ahead. Dogecoin Tightens as

Volatility Builds Dogecoin has been locked in a tight consolidation

range since March 11, hovering between $0.16 and $0.18 as broader

market uncertainty continues to weigh on investor sentiment. While

many altcoins have struggled under selling pressure, meme coins

like DOGE often see amplified volatility during such phases—making

the next move especially important for short-term traders and

long-term holders alike. With no clear direction established,

market participants are now waiting for a catalyst to push Dogecoin

decisively in either direction. Some analysts remain optimistic,

expecting the market to recover soon as economic fears stabilize.

Others are more cautious, warning that continued macroeconomic

uncertainty and inflation risks could lead to a deeper bear phase

for crypto. Amid this backdrop, Martinez has highlighted a

technical setup that may signal what’s next for DOGE. On the

12-hour chart, the Bollinger Bands are tightening significantly—a

pattern known as a “squeeze.” Historically, this setup has often

preceded sharp price movements, signaling that a breakout (or

breakdown) could be near. The narrowing of the bands reflects a

decline in volatility, but this calm is unlikely to last. Once

Dogecoin escapes its current range, the move could be swift and

decisive. Traders should watch closely as a breakout from this

setup could define DOGE’s trend for the weeks ahead. Related

Reading: Chainlink Poised For Recovery If $13 Support Holds –

Expert Sets Optimistic Targets DOGE Price Stuck in Tight Range — A

Breakout or Breakdown Looms Dogecoin is currently trading at $0.176

after several days of sideways consolidation within a tight range.

Price action has remained muted, with DOGE struggling to push above

the key $0.18 resistance level. This consolidation signals a

buildup in pressure, and a breakout could soon follow. Bulls are

eyeing a move above $0.18 as a critical step toward reclaiming

momentum and confirming a potential recovery rally. If DOGE can

break through $0.18 with volume and reclaim the psychological $0.20

level, it would signal strength and could attract fresh demand. The

$0.20 level, in particular, serves as a strong resistance and must

be cleared for a broader uptrend to take shape. On the downside,

however, failure to hold current levels—especially a drop below the

$0.15 mark—would be concerning for bulls. A breakdown below this

key support could trigger a wave of panic selling, sending DOGE

into a deeper retrace and testing lower demand zones. Related

Reading: Bitcoin Futures Data Shows Bullish Long/Short Ratio –

Details As market volatility remains low and technical indicators

tighten, all eyes are on DOGE’s next move. Whether it breaks upward

or downward, the result will likely set the tone for Dogecoin’s

trajectory in the coming weeks. Featured image from Dall-E, chart

from TradingView

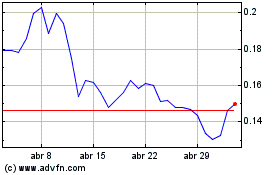

Dogecoin (COIN:DOGEUSD)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Dogecoin (COIN:DOGEUSD)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025