Commodity Currencies Rise Amid Risk Appetite

16 Março 2023 - 11:56PM

RTTF2

Commodity currencies such as the Australian, New Zealand and the

Canadian dollars strengthened against their major rivals in the

Asian session on Friday, as stocks rebounded from recent losses

with risk sentiment improving after First Republic Bank and Credit

Suisse secured a lifeline, which helped ease recent concerns about

turmoil in the banking sector.

Credit Suisse said it would borrow up to $54 billion from the

Swiss National Bank to enhance its liquidity. Meanwhile, JP Morgan

Chase, Morgan Stanley and several other big banks are reportedly

discussing a potential deal with First Republic Bank to shore up

the beleaguered lender.

Crude oil prices climbed higher Thursday on reports that Saudi

Arabia's energy minister and Russia's deputy prime minister met to

discuss ways to enhance market stability. West Texas Intermediate

Crude oil futures for April climbed $0.74 or 1.1 percent at $68.35

a barrel.

Trader focus on Federal Reserve's meeting next week, where the

U.S. central bank is expected to hike rates by a smaller 25 basis

points.

In the Asian session today, the Australian dollar rose to a

2-week high of 0.9194 against the Canadian dollar and a 4-day high

of 0.6715 against the U.S. dollar, from yesterday's closing quotes

of 0.9129 and 0.6655, respectively. If the aussie extends its

uptrend, it is likely to find resistance around 0.94 against the

loonie and 0.68 against the greenback.

Against the euro and the yen, the aussie advanced to 2-day highs

of 1.5857 and 89.45 from yesterday's closing quotes of 1.5934 and

88.96, respectively. The aussie may find its resistance 1.55

against the euro and 92.00 against the yen.

The aussie edged higher to 1.0762 against the NZ dollar, from

yesterday's closing value of 1.0734. The next resistance level for

the AUD/NZD pair is seen around the 1.09 area.

The NZ dollar rose to 2-day highs of 0.6243 against the U.S.

dollar and 83.15 against the yen, from yesterday's closing quotes

of 0.6195 and 82.88, respectively. If the kiwi extends its uptrend,

it is likely to find resistance around 0.64 against the greenback

and 86.00 against the yen.

The kiwi advanced to a 2-day high of 1.7057 against the euro,

from yesterday's closing value of 1.7116. The kiwi is likely to

find resistance around the 1.67 area.

The Canadian dollar rose to a 2-day high of 1.3683 against the

U.S. dollar, from yesterday's closing value of 1.3720. The loonie

may find its resistance around the 1.35 area.

Looking ahead, Eurozone final CPI for February is due to be

released at 6:00 am ET.

In the New York session, Canada PPI for February, U.S.

industrial production for February, U.S. Michigan's preliminary

consumer sentiment index for March and U.S. Baker Huges oil rig

count data are slated for release.

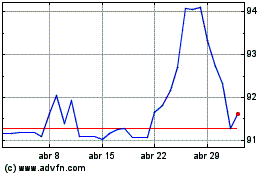

NZD vs Yen (FX:NZDJPY)

Gráfico Histórico de Câmbio

De Mar 2024 até Abr 2024

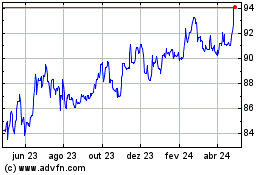

NZD vs Yen (FX:NZDJPY)

Gráfico Histórico de Câmbio

De Abr 2023 até Abr 2024