Australian Dollar Rises On Upbeat Economic Data

11 Abril 2023 - 12:12AM

RTTF2

The Australian dollar strengthened against other major

currencies in the Asian session on Tuesday, after the release of

data showing that the nation's consumer sentiment increased in

April.

Data from Australia Westpac Melbourne Institute showed that

Australia's consumer sentiment index rose to 85.8 in April, from

78.4 in March.

"This remarkable recovery can be largely attributed to RBA's

decision to pause rate hikes during its April meeting, breaking a

sequence of ten consecutive meetings with cash rate increases",

Westpac Chief Economist Bill Evans said.

He also said that the consumer confidence reached its highest

level since June 2022, although still 10.4% below April 2022, the

month before the RBA Board began raising the cash rate.

Also, the Asian stocks traded mostly higher, as traders return

to their desks after Easter holidays. Traders expect another

Federal Reserve rate hike by 25 basis points at its May 2-3

meeting.

A closely watched inflation report as well as the release of

minutes of the Fed's March meeting due this week may provide clear

guidance about interest rates.

In the Asian trading today, the Australian dollar rose to a

5-day high of 1.6309 against the euro, from yesterday's closing

value of 1.6352. The aussie may test resistance around the 1.58

area.

Against the yen and the NZ dollar, the aussie advanced to 6-day

highs of 89.03 and 1.0714 from yesterday's closing quotes of 88.67

and 1.0674, respectively. If the aussie extends its uptrend, it is

likely to find resistance around 91.00 against the yen and 1.08

against the kiwi.

The aussie edged up to 0.6674 against the U.S. dollar, from

yesterday's closing value of 0.6641. On the upside, 0.68 is seen as

the next resistance level for the aussie.

Moving away from an early near 5-month low of 0.8956 against the

Canadian dollar, the aussie climbed to 0.9002. The AUD/CAD pair is

likely to find its next resistance level around the 0.91 area.

Meanwhile, the safe-have yen came under pressure against other

major rivals, as most Asian stocks traded higher.

The yen fell to nearly a 4-week low of 147.09 against the Swiss

franc, from yesterday's closing value of 146.77. The yen may find

its support around the 149.00 area.

Against the euro and the pound, the yen dropped to 1-week lows

of 145.34 and 165.66 from yesterday's closing quotes of 145.01 and

165.36, respectively. If the yen extends its downtrend, it is

likely to find support around 147.00 against the euro and 167.00

against the pound.

The yen edged down to 133.69 against the U.S. dollar, from

yesterday's closing value of 133.58. The next support level for the

yen is seen around the 141.00 area.

Against the New Zealand and the Canadian dollars, the yen

dropped to a 6-day low of 83.19 and a 1-week low of 98.98 from

early highs of 82.97 and 96.68, respectively. On the d ownside,

85.00 against the kiwi and 101.00 against the loonie are seen as

the next support levels for the yen.

Looking ahead, Eurozone retail sales data for February and U.K.

BBA mortgage rate for March are due to be released in the European

session.

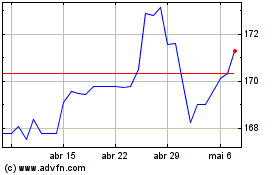

CHF vs Yen (FX:CHFJPY)

Gráfico Histórico de Câmbio

De Mar 2024 até Abr 2024

CHF vs Yen (FX:CHFJPY)

Gráfico Histórico de Câmbio

De Abr 2023 até Abr 2024