NZ Dollar Slides As RBNZ Signals Pause On Further Rate Hike

23 Maio 2023 - 11:34PM

RTTF2

The New Zealand dollar came under pressure against other major

currencies in the Asian session on Wednesday, after the Reserve

Bank of New Zealand raised interest rates by a quarter-percentage

point, in line with expectations, but signaled that further rate

hike is over to curb inflation.

The Reserve Bank of New Zealand raised its benchmark rate by 25

basis points from 5.25 percent to 5.5 percent, as expected by the

economists.

"The OCR will need to remain at a restrictive level for the

foreseeable future, to ensure that consumer price inflation returns

to the 1% to 3% annual target range, while supporting maximum

sustainable employment," the RBNZ Monetary Policy Committee said in

its statement. Asian share markets traded lower, amid worries about

growth and interest rates, and increasing concerns over a standoff

in Republican-manufactured U.S. debt ceiling confrontation.

U.S. President Joe Biden and House Speaker Kevin McCarthy said

they held productive talks but there was no agreement on how to

raise the government's $31.4 trillion debt ceiling.

The minutes of the Fed's latest monetary policy meeting are also

likely to attract attention, as traders look for additional clues

on the outlook for interest rates.

In economic news, data from Statistics New Zealand showed that

the volume of overall retail sales in New Zealand was down a

seasonally adjusted 1.4 percent on quarter in the first quarter of

2023. That was shy of expectations for an increase of 0.2 percent

following the downwardly revised 1.0 percent contraction in the

previous three months (originally -0.6 percent).

The value of retail sales was up 4.7 percent on quarter. On a

yearly basis, retail sales fell 4.1 percent, again missing

expectations for a gain of 3.6 percent following the 4.0 percent

decline in the three months prior.

In the Asian session today, the NZ dollar fell to a 3-week low

of 0.6169 against the U.S. dollar and a 1-week low of 85.43 against

the yen, from yesterday's closing quotes of 0.6247 and 86.59,

respectively. If the kiwi extends its downtrend, it is likely to

find support around 0.58 against the greenback and 81.00 against

the yen.

Against the euro, the kiwi dropped to 9-day low of 1.7461 from

yesterday's closing value of 1.7228. The kiwi is likely to find

support around the 1.78 area.

Moving away from an early 2-day high of 1.0567 against the

Australian dollar, the kiwi slipped to an 8-day low of 1.0695. The

next support level for the kiwi is seen around the 1.08 area.

Meanwhile, the Australian dollar, the other Antipodean currency

partner of NZ dollar, also fell against its major rivals after the

RBNZ rate decision.

The Australian dollar fell to a 1-week low of 1.6351 against the

euro and a 6-day low of 91.19 against the yen, from yesterday's

closing quotes of 1.6284 and 91.59, respectively. If the aussie

extends its downtrend, it is likely to find support around 1.67

against the euro and 87.00 against the yen.

Against the U.S. and the Canadian dollars, the aussie dropped to

nearly a 4-week low of 0.6585 and a 6-month low of 0.8897 from

yesterday's closing quotes of 0.6609 and 0.8922, respectively. On

the downside, 0.63 against the greenback and 0.86 against the

loonie are seen as the next support level for the aussie.

Looking ahead, German Ifo business confidence index for May is

due to be released at 4:00 am ET. Economists expect the business

confidence index to fall to 93.0 in May from 93.6 in April.

At 5:30 am ET, Bank of England Governor Andrew Bailey gives a

keynote speech at the Net Zero Delivery Summit hosted by the City

of London Corporation.

At 6:00 am ET, the Confederation of British Industry publishes

Industrial Trends survey results. The UK order book balance is seen

at -19 percent versus -20 percent in April.

In the New York session, U.S. MBA mortgage rate data and U.S.

EIA weekly crude oil report are slated for release.

At 12:10 pm ET, Federal Reserve Board Governor Christopher

Waller will deliver a speech on economic outlook at the University

of California Santa Barbara conference: 2023 Santa Barbara County

Economic Summit.

At 1:45 am ET, the European Central Bank President Christine

Lagarde will deliver a speech, is expected to throw some light on

June's monetary policy.

Fifteen minutes later, Federal Open Market Committee (FOMC) will

issue minutes from its meeting of May 2-3, 2023.

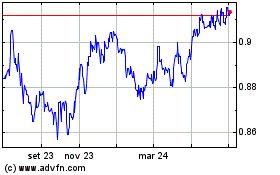

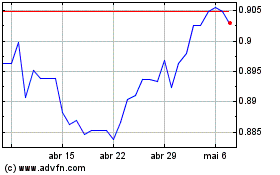

AUD vs CAD (FX:AUDCAD)

Gráfico Histórico de Câmbio

De Mar 2024 até Abr 2024

AUD vs CAD (FX:AUDCAD)

Gráfico Histórico de Câmbio

De Abr 2023 até Abr 2024