Antipodean Currencies Advance As Asian Shares Traded Higher, Yen Slides

29 Setembro 2023 - 12:20AM

RTTF2

Antipodean currencies such as the Australia and the New Zealand

dollars strengthened against their major currencies in the Asian

session on Friday, as Asian stock markets traded higher amid

China's Golden week holiday. Traders are indulging in bargain

hunting as they picked up stocks at reduced levels following recent

weakness even as concerns remain about interest rates and the

outlook for global economic growth.

In economic data, the Reserve Bank of Australia said that

Australia's monthly private sector credit rose 0.4 percent in

August, compared to the previous growth of 0.3 percent. On yearly

basis, the private sector credit rose 5.1 percent after rising 5.3

percent.

Meanwhile, the housing credit remained unchanged at 0.3 percent

in the month of August.

Data from ANZ-Roy Morgan showed that the New Zealand's consumer

confidence rose to 86.4 in September, from 85.0 in the prior

month.

The safe-haven yen weakened against other major currencies, as

Asian stock markets traded higher. Traders are also weighing the

possibility of the Japanese central bank intervening in the

currency market as the yen slides toward the 150 a dollar mark.

In economic news, the unemployment rate in Japan came in at a

seasonally adjusted 2.7 percent in August, the Ministry of Internal

Affairs and Communications or MIAC, said on Friday. That was

unchanged from the July reading, although it missed expectations

for 2.6 percent. The jobs-to-applicant ratio was 1.29, unchanged

and in line with forecasts. The participation rate also was

unchanged, at 63.1 percent.

The MIAC also said overall consumer prices in the Tokyo region

of Japan were up 2.8 percent on year in September. That was in line

with forecasts and down from 2.9 percent in August. Core CPI, which

excludes the volatiles costs of food, was up an annual 2.5 percent

- shy of expectations for 2.6 percent and down from 2.8 percent in

the previous month.

Further, the Ministry of Economy, Trade and Industry or METI,

said the value of retail sales in Japan jumped 7.0 percent on year

in August, coming in at 13.391 trillion yen. That exceeded

expectations for a gain of 6.0 percent following the upwardly

revised 7.0 percent gain in July. On a monthly basis, retail sales

rose 0.1 percent, easing from 2.2 percent in the previous

month.

The METI also said Industrial output in Japan came in flat in

August, beating expectations for a decline of 0.8 percent following

the 1.8 percent drop in July. On a yearly basis, industrial

production fell 3.8 percent after slipping 2.3 percent in the

previous month.

In the Asian trading now, the Australian dollar rose to nearly a

3-month high of 96.52 against the yen and nearly a 2-month high of

1.6374 against the euro, from yesterday's closing quotes of 95.89

and 1.6429, respectively. If the aussie extends its uptrend, it is

likely to find resistance around 98.00 against the yen and 1.61

against the euro.

Against the U.S. and the Canadian dollars, the aussie advanced

to a 1-week high of 0.6461 and a 9-day high of 0.8708 from

Thursday's closing quotes of 0.6423 and 0.8662, respectively. The

aussie may test resistance around 0.66 against the greenback and

0.89 against the loonie.

The NZ dollar rose to nearly an 8-1/2-year high of 89.73 against

the yen, from yesterday's closing value of 89.11. The kiwi may test

resistance around the 91.00 region.

Against the U.S. dollar and the euro, the kiwi advanced to a

4-week high of 0.6007 and a 2-1/2-month high of 1.7614 from

Thursday's closing quotes of 0.5969 and 1.7678, respectively. If

the kiwi extends its uptrend, it is likely to find resistance

around 0.61 against the greenback and 1.71 against the euro.

The kiwi edged up to 1.0776 against the Australian dollar, from

yesterday's closing value of 1.0753. On the upside, 1.09 is seen as

the next resistance level for the kiwi.

The yen fell to an 8-day low of 182.67 against the pound, from

yesterday's closing value of 182.09. The next support level for the

yen is seen around the 187.00 region.

Against the euro and the Swiss franc, the yen dropped to 4-day

lows of 158.11 and 163.58 from Thursday's closing quotes of 157.64

and 163.12, respectively. If the yen extends its downtrend, it is

likely to find support around 160.00 against the euro and 167.00

against the franc.

Against the U.S. and the Canadian dollars, the yen edged down to

149.51 and 110.88 from yesterday's closing quotes of 149.29 and

110.67, respectively. The yen may test support around 152.00

against the greenback and 112.00against the loonie.

Looking ahead, Eurostat is set to issue euro area flash

inflation figures for September at 5:00 am ET. Inflation is

expected to slow to 4.5 percent from 5.2 percent in the previous

month.

At 3:40 am ET, European Central Bank President Christine Lagarde

will deliver a speech at the joint IEA-ECB-EIB conference on

"Ensuring an orderly energy transition: Europe's competitiveness

and financial stability in a period of global energy

transformation" in Paris, France.

In the New York session, Canada GDP data for August and budget

balance for July, U.S. PCE price index for August, U.S. goods trade

balance for August and personal income and spending for August,

retail and wholesale inventories for August, U.S. Chicago PMI for

September, U.S. University of Michigan's consumer sentiment for

September and U.S. Baker Hughes oil rig count data are slated for

release.

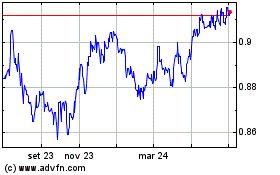

AUD vs CAD (FX:AUDCAD)

Gráfico Histórico de Câmbio

De Nov 2024 até Dez 2024

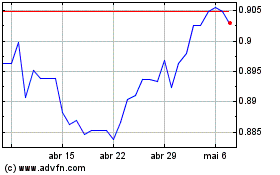

AUD vs CAD (FX:AUDCAD)

Gráfico Histórico de Câmbio

De Dez 2023 até Dez 2024