Commodity Currencies Slide Amid Risk Aversion

27 Março 2024 - 12:00AM

RTTF2

The commodity currencies such as Australia, the New Zealand and

the Canadian dollars weakened against their major currencies in the

Asian session on Wednesday amid risk aversion, as traders continued

to be cautious and look ahead to key U.S. and European inflation

readings later in the week and comments from central bank officials

for additional clues on the interest rate outlook.

Traders also were concerned about the economic impact of the

indefinite suspension of vessel traffic into and out of the Port of

Baltimore. Vessel traffic was suspended after a cargo ship crashed

into a pillar of the Francis Scott Key Bridge early Tuesday

morning, leading to the bridge's collapse.

The Australian dollar started falling against its major rivals,

after the release domestic inflation data that beat market

expectations, and the reading is the lowest since November

2021.

Data from the Australian Bureau of Statistics showed that the

monthly consumer price index rose by 3.4 percent annually in

February, the same as in previous month but slightly below

economists' forecast of 3.5 percent.

Trading volumes are likely to remain thin as investors brace for

the Easter weekend.

Oil extended overnight losses as the API report showed a large

build in U.S. inventories. Crude oil prices settled lower with

traders assessing oil demand and supply positions amid the tensions

in the Middle East. West Texas Intermediate Crude oil futures for

May ended lower by $0.33 at $81.62 a barrel.

In the Asian trading today, the Australian dollar fell to a

5-day low of 1.6622 against the euro, from yesterday's closing

value of 1.6567. The aussie may test support near the 1.67

region.

Against the U.S. dollar and the yen, the aussie slipped to 2-day

lows of 0.6511 and 98.74 from Tuesday's closing quotes of 0.6538

and 99.00, respectively. If the aussie extends its downtrend, it is

likely to findc support around 0.64 against the greenback and 97.00

against the yen.

Against the Canada and the New Zealand dollars, the aussie slid

to 5-day lows of 0.8854 and 1.0868 from yesterday's closing quotes

of 0.8880 and 1.0884, respectively. On the downside, 0.87 against

the loonie and 1.07 against the kiwi are seen as the next support

level for the aussie.

The NZ dollar fell to more than a 4-month low of 1.8078 against

the euro and a 2-day low of 0.5988 against the U.S. dollar, from

Tuesday's closing quotes of 1.8032 and 0.6007, respectively. If the

kiwi extends its downtrend, it is likely to find support around

1.82 against the euro and 0.58 against the greenback.

Against the yen, the kiwi edged down to 90.79 from yesterday's

closing value of 90.96. The kiwi is likely to find support around

the 89.00 region.

The Canadian dollar fell to a 2-day low of 1.3599 against the

U.S. dollar, from yesterday's closing value of 1.3582. The loonie

is likely to find support around the 1.36 region.

Against the euro and the yen, the loonie dropped to 1.4723 and

111.41 from Tuesday's closing quotes of 1.4711 and 111.51,

respectively. If the loonie extends its downtrend, it is likely to

find support around 1.48 against the euro and 110.00 against the

yen.

Meanwhile, the U.S. dollar rose against its major rivals in the

Asian session amid risk aversion.

The U.S. dollar appreciated to a 34-year high of 151.97 against

the yen, from Tuesday's closing value of 151.52. The greenback may

test resistance near the 153.00 region.

Against the euro and the pound, the greenback rose to 2-day

highs of 1.0820 and 1.2609 from yesterday's closing quotes of

1.0833 and 1.2628, respectively. If the greenback extends its

uptrend, it is likely to find resistance around 1.07 against the

euro and 1.25 against the pound.

The greenback edged up to 0.9403 against the Swiss franc, from

an early low of 0.9033. On the upside, 0.91 is seen as the next

resistance level for the greenback.

Looking ahead, the European Commission is set to release euro

area economic sentiment survey results for March at 6:00 am ET in

the European session on Wednesday.

In the New York session, U.S. MBA mortgage approvals data and

U.S. EIA crude oil data are slated for release.

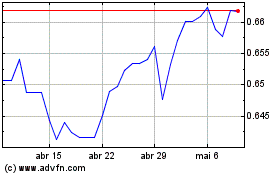

AUD vs US Dollar (FX:AUDUSD)

Gráfico Histórico de Câmbio

De Mar 2024 até Abr 2024

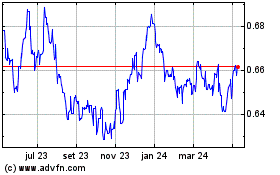

AUD vs US Dollar (FX:AUDUSD)

Gráfico Histórico de Câmbio

De Abr 2023 até Abr 2024