Australian Dollar Falls Amid Risk Aversion

08 Maio 2024 - 12:45AM

RTTF2

The Australian dollar weakened against other major currencies in

the Asian session on Wednesday amid risk aversion, as traders

largely refrained from making significant moves after hawkish

comments from a few U.S. Fed officials again raised concerns about

the outlook for interest rates.

Minneapolis Federal Reserve President Neel Kashkari suggested

interest rates may need to remain at current levels for an

"extended period." He added that he could not rule out the Fed once

again raising rates, calling the bar for hiking rates "quite high"

but "not infinite.

Fed Bank of Richmond President Thomas Barkin said Monday that he

feels the risks are weighted towards more inflation. New York

counterpart John Williams said that the timing of rate cuts will

depend on the totality of the incoming data.

Crude oil prices settled slightly lower amid concerns about the

outlook for global oil demand. West Texas Intermediate Crude oil

futures for June ended lower by $0.10 at $78.38 a barrel.

In the Asian trading today, the Australian dollar fell to a

1-week low of 1.0969 against the NZ dollar, from yesterday's

closing value of 1.0987. The aussie may test support near the 1.08

region.

Against the U.S. dollar and the euro, the aussie slid to 5-day

lows of 0.6569 and 1.6349 from Tuesday's closing quotes of 0.6589

and 1.6315, respectively. If the aussie extends its downtrend, it

is likely to find support around 0.64 against the greenback and

1.66 against the euro.

Against the yen and the Canadian dollar, the aussie edged down

to 101.83 and 0.9033 from yesterday's closing quotes of 101.97 and

0.9049, respectively. On the downside, 98.00 against the yen and

0.88 against the loonie are seen as the next support levels for the

aussie.

Meanwhile, the safe-haven currency or the U.S. dollar

strengthened against other major currencies in the Asian session

amid risk aversion.

The U.S. dollar rose to 5-day highs of 1.0738 against the euro

and 0.5983 against the NZ dollar, from yesterday's closing quotes

of 1.0749 and 0.5997, respectively. If the greenback extends its

uptrend, it is likely to find resistance around 1.06 against the

euro and 0.58 against the kiwi.

Against the pound and the yen, the greenback advanced to 6-day

highs of 1.2484 and 155.29 from Tuesday's closing quotes of 1.2501

and 154.77, respectively. On the upside, 1.23 against the pound and

161.00 against the yen are seen as the next resistance levels for

the greenback.

The greenback edged up to 0.9093 against the Swiss franc, from

Tuesday's closing value of 0.9085. The next resistance levels for

the greenback is seen around the 0.91 region.

Against the Australia and the Canadian dollars, the greenback

climbed to 1-week highs of 1.0969 and 1.3756 from yesterday's

closing quotes of 1.0987 and 1.3734, respectively. The greenback

may test resistance around 1.08 against the aussie and 1.38 against

the loonie.

Looking ahead, U.K. BBA mortgage rate data for April is due to

be released at 5:00 am ET in the European session.

In the New York session, U.S. MBA mortgage approvals data and

U.S. EIA crude oil data are slated for release.

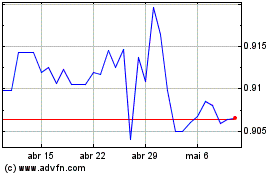

US Dollar vs CHF (FX:USDCHF)

Gráfico Histórico de Câmbio

De Abr 2024 até Mai 2024

US Dollar vs CHF (FX:USDCHF)

Gráfico Histórico de Câmbio

De Mai 2023 até Mai 2024