Yen Falls Amid Rising Concerns On Currency Intervention

14 Maio 2024 - 1:12AM

RTTF2

The Japanese yen weakened against other major currencies in the

Asian session on Tuesday, as traders are concerned about the

Japanese government's intervention in currency markets to prop up

the yen.

Meanwhile, traders remain cautious ahead of key U.S. inflation

data, including producer and consumer price inflation, due later in

the day that could offer more clarity on the US Fed's interest rate

trajectory.

The report on U.S. producer price inflation is likely to be in

focus on Tuesday along with Fed Chair Jerome Powell's remarks

during a moderate discussion with De Nederlandsche Bank President

Klaas Knot.

In economic news, producer prices in Japan were up 0.3 percent

on month in April, the Bank of Japan said on Tuesday, accelerating

from 0.2 percent in March. On a yearly basis, producer prices rose

0.9 percent - unchanged from the previous month following an upward

revision from 0.8 percent. Export prices were up 0.4 percent on

month and 1.3 percent on year, the bank said, while import prices

fell 0.1 percent on month and 4.3 percent on year.

The safe-haven yen started falling against its major rivals form

May 3rd, 2024.

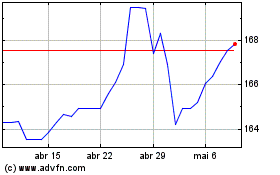

In the Asian trading today, the yen fell to more than 2-week

lows of 168.78 against the euro and 172.25 against the Swiss franc,

from yesterday's closing quotes of 168.61 and 172.06, respectively.

If the yen extends its downtrend, it is likely to find support

around 172.00 against the euro and 176.00 against the franc.

Against the pound and the U.S. dollar, the yen slipped to 2-week

lows of 196.50 and 156.51 from Monday's closing quotes of 196.23

and 156.24, respectively. The yen may test support near the 201.00

against the pound and 161.00 against the greenback.

Against the Australia and the New Zealand dollars, the yen

dropped to more than 2-week lows of 103.33 and 94.15 from

yesterday's closing quotes of 103.20 and 93.94, respectively. On

the downside, 105.00 against the aussie and 95.00 against the kiwi

are seen as the next support levels for the yen.

The yen edged down to 114.42 against the Canadian dollar, from

yesterday's closing value of 114.31. The next possible downside

target for the yen is seen around the 118.00 region.

Looking ahead, Germany's ZEW economic sentiment for May is due

to be released at 5:00 am ET in the European session.

In the New York session, U.S. NFIB business optimism index for

April, Canada new Motor vehicle sales and wholesale sales data for

March, U.S. PPI for April and U.S. Redbook report are slated for

release.

Euro vs Yen (FX:EURJPY)

Gráfico Histórico de Câmbio

De Abr 2024 até Mai 2024

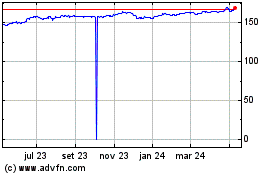

Euro vs Yen (FX:EURJPY)

Gráfico Histórico de Câmbio

De Mai 2023 até Mai 2024