U.S. Dollar Falls, U.S. Inflation Report In Focus

15 Maio 2024 - 1:22AM

RTTF2

The U.S. dollar weakened against other major currencies in the

Asian session on Wednesday, as traders await the release of key

U.S. CPI data along with other reports on U.S. retail sales and

homebuilder confidence which is likely to influence the U.S.

Federal Reserve's near-term policy path.

Economists expect U.S. consumer prices to climb by 0.4 percent

in April, matching the increase seen in March.

The annual rate of consumer price growth is expected to dip to

3.4 percent in April from 3.4 percent in March, while the annual

rate of core consumer price growth is expected to slow to 3.6

percent from 3.8 percent.

In the Asian trading today, the U.S. dollar fell to more than a

1-month low of 1.0829 against the euro and nearly a 2-week low of

1.2601 against the pound, from yesterday's closing quotes of 1.0814

and 1.2588, respectively. If the greenback extends its downtrend,

it is likely to find support around 1.07 against the euro and 1.27

against the pound.

Against the yen and the Swiss franc, the greenback dropped to

2-day lows of 156.18 and 0.9054 from Tuesday's closing quotes of

156.52 and 0.9064, respectively. The greenback may test support

near 151.00 against the yen and 0.89 against the franc.

The greenback edged down to 1.3637 against the Canadian dollar,

from yesterday's closing value of 1.3654. On the downside, 1.35 is

seen as the next support level for the greenback.

Looking ahead, Eurozone flash GDP estimate for the first quarter

and industrial production figures for March are due to be released

at 5:00 am ET in the European session.

In the New York session, U.S. MBA mortgage approvals data,

Canada housing starts for April and manufacturing sales data for

March, U.S. CPI data for April, business inventories for March,

U.S. NAHB housing market index for May and U.S. EIA weekly crude

oil data are slated for release.

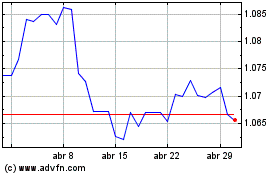

Euro vs US Dollar (FX:EURUSD)

Gráfico Histórico de Câmbio

De Out 2024 até Out 2024

Euro vs US Dollar (FX:EURUSD)

Gráfico Histórico de Câmbio

De Out 2023 até Out 2024