ECB Policymakers Focused On September Meet To Discuss Rate Cut, Minutes Show

22 Agosto 2024 - 10:36AM

RTTF2

Policymakers at the European Central Bank were keen to explore

the option of reducing interest rates in the monetary policy

meeting in September as they turned wary of the mixed bag of recent

economic data, minutes of the July 17-18 rate-setting session

showed Thursday.

The Governing Council, led by ECB President Christine Lagarde,

left the key interest rates for the euro area unchanged in July

after lowering them for the first time in five years in the

previous session. The main refinancing rate was held steady at 4.25

percent, the deposit facility rate at 3.75 percent and the marginal

lending rate at 4.50 percent.

Citing the mixed trends on the inflation front, the ECB minutes

said, "…these developments suggested that the last mile of

disinflation was more challenging and that the task of bringing

inflation down sustainably to the 2 percent target was not yet

assured, despite the significant progress made."

Policymakers chose to adopt a cautious stance in July as

Eurozone inflation was easing only gradually. They remained

concerned about the stickiness of services inflation and also

expressed worry over the deterioration in the short-term growth

outlook.

"Such a cautious approach was particularly warranted given the

prevailing uncertainties about the evolution of wages, profits,

productivity and services inflation," the minutes said.

Rate-setters were also of the view that a cautious approach

would allow them to respond by following a more gradual path of

reducing policy rates if inflation was more persistent than

currently foreseen.

"…a gradual attenuation of policy restriction was a balancing

act, as it was also important not to unduly harm the economy by

keeping rates at a restrictive level for too long," the minutes

said.

Stressing the need for no pre-commitment, ECB policymakers

agreed that it was "important to keep an eye on the real

economy."

"The September meeting was widely seen as a good time to

re-evaluate the level of monetary policy restriction," the minutes

said.

"That meeting should be approached with an open mind, which also

implied that data dependence was not equivalent to being overly

focused on specific, single data points."

A fresh set of ECB staff projections would be available in

September that could reveal the path inflation and growth is likely

to follow in the single currency bloc.

"The new stagflationary risk is not yet large enough to stop the

ECB from cutting rates again in September," ING economist Carsten

Brzeski said.

"However, it looks like a more complicated decision than markets

are currently pricing in."

Earlier on Thursday, data from the ECB showed that the rate of

increase in negotiated wages, a key component of inflation

trackers, slowed sharply to 3.6 percent from 4.7 percent in the

second quarter from the previous three months.

"The scale of the fall in negotiated wage inflation in Q2 was

largely due to one-off payments [to public sector employees] made

in Germany in March but not repeated in Q2," Capital Economics

economist Andrew Kenningham said.

"However, the underlying trend in wage inflation is clearly

downwards and is a good reason to expect the ECB to cut rates again

in September."

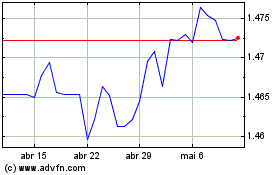

Euro vs CAD (FX:EURCAD)

Gráfico Histórico de Câmbio

De Out 2024 até Nov 2024

Euro vs CAD (FX:EURCAD)

Gráfico Histórico de Câmbio

De Nov 2023 até Nov 2024