Yen Falls As Japanese Stock Market Traded Higher

01 Setembro 2024 - 11:30PM

RTTF2

The Japanese yen weakened against other major currencies in the

Asian session on Monday, as Japanese stock market traded higher,

adding to the gains in the previous session, with gains across most

sectors lead by index heavyweights and technology stocks.

The benchmark S&P/ASX 200 is moving to a tad shy of the

39,000 level for the first time since late July, following the

broadly positive cues from Wall Street on Friday.

Traders remain optimistic over the outlook for interest rates

after a report showing U.S. consumer prices increased in line with

estimates in July, while the annual rate of price growth was

unexpectedly flat.

While the U.S. data has reinforced expectations of an interest

rate cut by the Fed this month, traders expressed uncertainty about

the pace of rate cuts, leading to some volatility in the

markets.

According to CME Group's FedWatch Tool, there is a 69.5 percent

chance of a quarter-point rate cut next month and a 30.5 percent

chance of a half-point rate cut.

In economic news, the manufacturing sector in Japan continued to

contract in August, albeit at a slower rate, the latest survey from

Jibun Bank revealed on Monday with a manufacturing PMI score of

49.8. That's up from 49.1 in July, although it remains beneath the

boom-or-bust line of 50 that separates expansion from

contraction.

In the Asian trading today, the yen fell to a 6-day low of

161.84 against the euro, a 1-month low of 192.37 against the pound

and a 4-day low of 172.24 against the Swiss franc, from last week's

closing quotes of 161.50, 191.89 and , respectively. If the yen

extends its downtrend, it is likely to find support around 165.00

against the euro, 197.00 against the pound and 175.00 against the

franc.

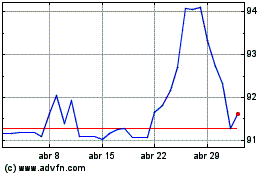

Against the Australia and the New Zealand dollars, the yen

slipped to 1-month low of 99.19 and 91.52 from last week's closing

quotes of 98.89 and 91.37, respectively. The yen may test suppoprt

near 102.00 against the aussie and 93.00 against the kiwi.

Against the U.S. and the Canadian dollars, the yen slipped to

nearly a 2-week low of 146.55 and more than a 2-week low of 108.62

from Friday's closing quotes of 146.16 and 108.33, respectively. On

the downside, 151.00 against the greenback and 111.00 against the

loonie are seen as the next support levels for the yen.

Looking ahead, manufacturing PMI results from various European

economies and U.K. for August are slated for release in the

European session.

U.S. and Canada markets are closed in account of Labor Day

holiday.

NZD vs Yen (FX:NZDJPY)

Gráfico Histórico de Câmbio

De Out 2024 até Nov 2024

NZD vs Yen (FX:NZDJPY)

Gráfico Histórico de Câmbio

De Nov 2023 até Nov 2024