Yen Rises After Japan's Real Wages Unexpectedly Rise

05 Setembro 2024 - 1:09AM

RTTF2

The Japanese yen strengthened against other major currencies in

the Asian session on Thursday, after data showed that the Japan's

real wages unexpectedly increased in July, signaling that the Bank

of Japan is likely on the track for another rate hike this

year.

Data from the labor ministry showed that the Japan's Labor Cash

Earnings climbed by 3.6 percent annually in July, compared with a

rise of 4.5 percent in June. Meanwhile, the economists had expected

a rise of 3.1 percent.

Also, Japanese wages adjusted for inflation rose 0.4 percent

from a year earlier in July - marking the second consecutive month

of increase after falling for more than two years.

Japan's Nikkei 225 fell 1.5 percent, below the 36,900 level,

with weakness in some index heavyweights and technology stocks.

After Wednesday's weak labor market data, U.S. reports on

jobless claims, private sector employment and service sector

activity may shed further light on the health of the world's

largest economy today.

Investors also eagerly await the release of more closely watched

monthly jobs report on Friday that could influence the Fed's plans

for how it trims its benchmark interest rates.

Traders currently expect that the U.S. central bank will cut its

benchmark rate by 1 percent by the end of 2024.

In the Asian trading today, the yen rose to nearly a 1-month

high of 158.78 against the euro and a 1-month high of 143.31

against the U.S. dollar, from yesterday's closing quotes of 159.28

and 143.73, respectively. If the yen extends its uptrend, it is

likely to find resistance around 155.00 against the euro and 140.00

against the greenback.

The yen advanced to nearly a 3-week high of 188.36 against the

pound, from yesterday's closing value of 188.89. On the upside,

182.00 is seen as the next resistance level for the yen.

Against the Swiss franc and the New Zealand dollars, the yen

climbed to near 3-week highs of 169.36 and 88.62 from Wednesday's

closing quotes of 169.77 and 89.08, respectively. The next possible

upside targets for the yen is seen around 165.00 against the franc

and 82.00 against the kiwi.

Against the Australia and the Canadian dollars, the yen jumped

to near 1-month highs of 96.23 and 106.09 from yesterday's closing

quotes of 96.64 and 106.41, respectively. The yen is likely to be

seen around 89.00 against the aussie and 101.00 against the

loonie.

Looking ahead, U.K. construction PMI for August and Eurozone

retail sales for July are due to be released in the European

session.

In the New York session, U.S. weekly jobless claims data, U.S.

and Canada PMI data for August and U.S. EIA crude oil data are

slated for release.

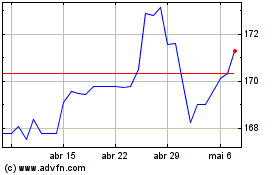

CHF vs Yen (FX:CHFJPY)

Gráfico Histórico de Câmbio

De Nov 2024 até Dez 2024

CHF vs Yen (FX:CHFJPY)

Gráfico Histórico de Câmbio

De Dez 2023 até Dez 2024