Canadian Dollar Weakens In Cautious Trade

25 Outubro 2024 - 9:40AM

RTTF2

The Canadian dollar declined against its major counterparts in

the New York session on Friday, as investors became cautious ahead

of the U.S presidential election, jobs data and key tech

earnings.

As the election draws near, a tight race between Republican and

Democratic candidates triggered uncertainty about the outcome.

Former President Trump plans a radical shift in trade policy and

tax cuts for individuals and corporations if re-elected. Some

economists predict that his policies could trigger inflation.

Data from Statistics Canada showed retail sales likely increased

by 0.4 percent from the previous month in September, according to

flash estimate.

Retail sales increased 1.4 percent in August over the same month

in the previous year.

Manufacturing sales in Canada decreased by 0.8 percent in

September from -1.3 percent in August.

Another data from Statistics Canada said the new house price

index in Canada remained unchanged at 0 percent in September. On

yearly basis, the index increased to 0.2 percent in September from

0 percent in August.

The loonie fell to a 2-1/2-month low of 1.3886 against the

greenback and a 10-day low of 1.5024 against the euro, off its

early highs of 1.3838 and 1.4979, respectively. The currency is

seen finding support around 1.41 against the greenback and 1.51

against the euro.

The loonie weakened to a 2-day low of 0.9207 against the aussie,

from an early 2-day high of 0.9169. If the currency falls further,

it is likely to test support around the 0.94 region.

The loonie eased to 109.51 against the yen. This may be compared

to an early 2-day low of 109.34. The currency is likely to locate

support around the 106.00 level.

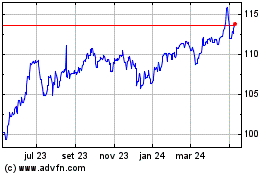

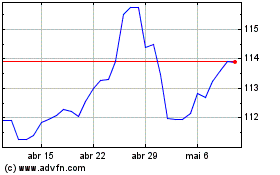

CAD vs Yen (FX:CADJPY)

Gráfico Histórico de Câmbio

De Set 2024 até Out 2024

CAD vs Yen (FX:CADJPY)

Gráfico Histórico de Câmbio

De Out 2023 até Out 2024