Pound Rises As European Shares Gain

05 Dezembro 2024 - 3:11AM

RTTF2

The British pound strengthened against other major currencies in

the European session on Thursday, as investor sentiment boosted

after the French President Emmanuel Macron seeks a way out of

France's political crisis.

Prime Minister Michel Barnier is expected to resign later today

after being ousted in a no-confidence vote over a budget dispute.

That makes him the shortest serving prime minister in modern French

history.

It is likely that the country will remain without a government

for several weeks, if not months, until Macron appoints a new prime

minister, who will have to form a new government.

The State budget and the social security budget for 2025 will

not be voted on, but the constitution allows special measures that

would avert a U.S.-style government shutdown.

The U.S. Federal Reserve Chair Jerome Powell delivered slightly

hawkish remarks in his commentary at the New York Times DealBook

Summit on Wednesday.

Powell said the U.S. economy is "in remarkably good shape," and

that downside risks from the labor market had receded.

The dollar was slightly softer as weaker-than-expected private

sector employment and service sector activity data contributed to

optimism about the outlook for interest rates.

Traders now expect a third consecutive interest-rate cut at the

U.S. central bank's Dec. 17-18 meeting.

CME Group's FedWatch Tool currently indicates a 75.5 percent

chance the Federal Reserve will lower interest rates by 25 basis

points later this month.

U.S. weekly jobless claims data may attract some attention later

in the day, although activity may be somewhat subdued ahead of the

release of the more closely watched monthly jobs report on Friday,

followed by inflation data for November expected next week.

In the European trading today, the pound rose to 3-day highs of

1.2740 against the U.S. dollar and 1.1264 against the Swiss franc,

from early lows of 1.2693 and 1.1222, respectively. If the pound

extends its uptrend, it is likely to find resistance around 1.30

against the greenback and 1.14 against the franc.

Against the euro and the yen, the pound edged up to 0.8273 and

191.21 from early lows of 0.8281 and 190.35, respectively. The

pound is likely to find resistance around 0.80 against the euro and

198.00 against the yen.

Looking ahead, Canada and U.S. trade data for October, U.S.

weekly jobless claims data and Canada Ivey PMI for November are

slated for release in the New York session.

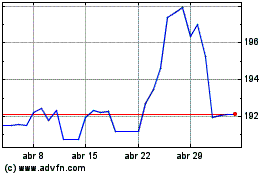

Sterling vs Yen (FX:GBPJPY)

Gráfico Histórico de Câmbio

De Nov 2024 até Dez 2024

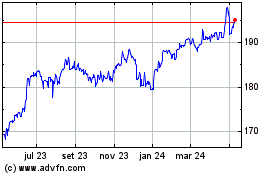

Sterling vs Yen (FX:GBPJPY)

Gráfico Histórico de Câmbio

De Dez 2023 até Dez 2024