Australian Dollar Rises On Upbeat Aussie Jobs Data

11 Dezembro 2024 - 10:34PM

RTTF2

The Australian dollar strengthened against other major

currencies in the Asian session on Thursday, after the release of

nation's upbeat domestic jobs data that dimed hopes for an early

interest rate cut in 2025.

Data from the Australian Bureau of Statistics showed that the

unemployment rate in Australia came in at a seasonally adjusted 3.9

percent in November. That was lower than forecasts for 4.2 percent

and down from 4.1 percent in October.

The Australia economy added 35,600 jobs last month, topping

expectations for the addition of 26,000 jobs following the increase

of 15,900 jobs in the previous month.

Full-time employment increased by 52,600 to 10,068,100 people,

while part-time employment decreased by 17,000 to 4,467,400 people.

The participation rate was 67.0, shy of expectations for 67.1

percent - which would have been unchanged.

The Asian stock markets also traded higher amid optimism about

the outlook for interest rates following the release of the closely

watched U.S. inflation data that came in line with estimates. The

report has increased confidence that the U.S. Fed will lower

interest rates by another quarter-point next week. Persisting

tensions in the Middle East continues to weigh on the markets.

CME Group's FedWatch Tool is currently indicating a 98.6 percent

chance the Fed will cut rates by 25 basis points at its December

meeting.

Crude oil prices settled higher on possible sanctions on Russia

by the European Union, expectations of increased demand from China

and data showing a jump in gasoline stockpiles. West Texas

Intermediate crude oil futures for January closed up $1.70 or 2.5

percent at $70.29 a barrel.

Investors await interest-rate decisions from the Swiss National

Bank and the European Central Bank, due later in the day.

Both are expected to reduce interest rates, with markets

weighing the prospects of half-point and a 25-bps cut,

respectively.

In the Asian trading today, the Australian dollar rose to more

than a 2-week high of 1.1061 against the NZ dollar and a 10-day

high of 97.92 against the yen, from yesterday's closing quotes of

1.1006 and 97.06, respectively. If the aussie extends its uptrend,

it is likely to find resistance around 1.12 against the kiwi and

101.00 against the yen.

Against the U.S. and the Canadian dollars, the aussie advanced

to 2-day highs of 0.6420 and 0.9083 from Wednesday's closing quotes

of 0.6368 and 0.9014, respectively. The aussie may test resistance

around 0.65 against the greenback and 0.92 against the loonie.

The aussie jumped to a 3-day high of 1.6368 against the euro,

from yesterday's closing value of 1.6470. On the upside, 1.61 is

seen as the next resistance level for the aussie.

Looking ahead, the Swiss National Bank will announce its

monetary policy decision at 3:30 am ET in the early European

session. The SNB is seen cutting its interest rate by 25 basis

points. The bank has reduced its rate three times this year.

At 8:15 am ET, the European Central Bank will announce its

monetary policy decision. The ECB is widely expected to cut its

benchmark rates by 25 basis points for the third consecutive

meeting, citing weaker economic growth and moderating

inflation.

In the New York session, Canada building permits for October,

U.S. PPI for November and U.S. weekly jobless claims are slated for

release.

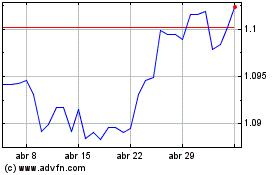

AUD vs NZD (FX:AUDNZD)

Gráfico Histórico de Câmbio

De Nov 2024 até Dez 2024

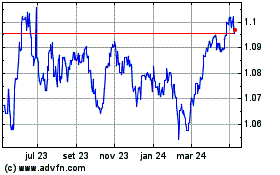

AUD vs NZD (FX:AUDNZD)

Gráfico Histórico de Câmbio

De Dez 2023 até Dez 2024