Sweden Central Bank Trims Rate By 25 Bps

29 Janeiro 2025 - 4:20AM

RTTF2

Sweden's central bank reduced its benchmark rate by a

quarter-point on Wednesday to further support the economy and

stabilize inflation at the target and also signaled that the easing

cycle is coming to an end.

The Executive Board of Riksbank decided to cut the policy rate

by 25 basis points to 2.5 percent. The outcome of the meeting

widely matched expectations.

The policy rate has been reduced by a 1.5 percentage points

since May.

"If the outlook for inflation and economic activity remains

unchanged, the policy rate may be cut once again during the first

half of 2025," the bank said.

Policymakers observed that the interest rate has been lowered

rapidly and monetary policy affects the economy with a lag. This

argues for a more tentative approach when monetary policy is

formulated going forward, they noted.

The bank said it will carefully evaluate the need for future

interest rate adjustments, in light of the effect of earlier cuts

as well as shifts in the risk profile regarding the outlook for

inflation and economic activity.

Today's rate cut will be the final reduction of this cycle,

Capital Economics' economist Adrian Prettejohn said.

There will need to be deterioration in the outlook for the

economy in order for policymakers to consider loosening policy

further, the economist said.

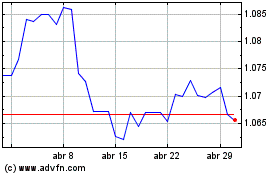

Euro vs US Dollar (FX:EURUSD)

Gráfico Histórico de Câmbio

De Dez 2024 até Jan 2025

Euro vs US Dollar (FX:EURUSD)

Gráfico Histórico de Câmbio

De Jan 2024 até Jan 2025