Yen Rises Amid Strong Japan GDP Data

17 Fevereiro 2025 - 2:21AM

RTTF2

The Japanese yen strengthened against other major currencies in

the Asian session on Monday, after Japan's gross domestic product

expanded on quarter in the fourth quarter of 2024.

The strong GDP data led the market to speculate that the Bank of

Japan to raise interest rates further this year. The markets are

already accounting for an additional 37 basis points of increases

by December.

Data from the Cabinet Office said in Monday's preliminary report

showed that Japan's gross domestic product expanded a seasonally

adjusted 0.7 percent on quarter in the fourth quarter of 2024. That

beat forecasts for an increase of 0.3 percent and was up from the

upwardly revised 0.4 percent gain in the previous three months.

On an annualized basis, GDP was up 2.8 percent - again exceeding

expectations for an increase of 2.0 percent and up from the

upwardly revised 1.7 percent gain in the three months prior.

Capital expenditure was up 0.5 percent on quarter after slipping

0.1 percent in Q3, while external demand added 0.7 percent after

slipping 0.1 percent in the previous quarter.

The GDP price index was up 2.8 percent on year, in line with

estimates and up from 2.4 percent in the third quarter.

In other economics, data from the Ministry of Economy, Trade,

and Industry showed that Japan's industrial production decreased at

the end of the year, revised from a rebound estimated initially.

Industrial production fell by a seasonally adjusted 0.2 percent

month-on-month in December, which was slower than the 2.2 percent

fall in November. However, the decline in industrial production

came in contrast to the initial estimated growth of 0.3

percent.

On a yearly basis, the decline in industrial production was 1.6

percent, compared to a 2.7 percent fall a month ago.

Further, data showed that capacity utilization registered a

monthly drop of 0.2 in December, following a 1.9 percent decrease

in November.

Separate official data showed that tertiary activity rose 0.1

percent on a monthly basis in December, in contrast to a 0.3

percent decrease in November.

In the Asian trading today, the yen rose to 5-day highs of

158.92 against the euro, 190.71 against the pound and 168.26

against the Swiss franc, from Friday's closing quotes of 159.81,

191.71 and 169.29, respectively. If the yen extends its uptrend, it

is likely to find resistance around 155.00 against the euro, 186.00

against the pound and 165.00 against the franc.

Against the U.S. and the Canadian dollars, the yen advanced to a

1-week high of 151.48 and a 5-day high of 106.88 from last week's

closing quotes of 152.33 and 107.37, respectively. The yen may test

resistance around 150.00 against the greenback and 104.00 against

the loonie.

Looking ahead, Canada housing starts for January is set to be

published in the New York session.

U.S. stock markets are closed in account of Presidents' Day

holiday.

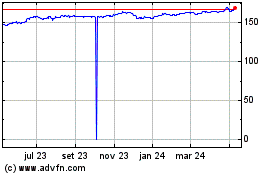

Euro vs Yen (FX:EURJPY)

Gráfico Histórico de Câmbio

De Jan 2025 até Fev 2025

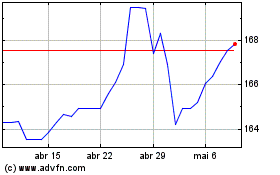

Euro vs Yen (FX:EURJPY)

Gráfico Histórico de Câmbio

De Fev 2024 até Fev 2025