Pound Rises Amid Optimism Ukraine Peace Plan

03 Março 2025 - 3:44AM

RTTF2

The British pound strengthened against other major currencies in

the European session on Monday, as investors react to the latest

tariff news and Europe's peace efforts in Ukraine.

The British currency has also remained strong due to strong

anticipation that the Bank of England (BoE) will maintain a mild

policy-easing cycle and a likely positive trade agreement between

the US and the UK.

U.S. Commerce Secretary Howard Lutnick on Sunday said that the

tariffs on Mexico and Canada will go into effect as scheduled on

Tuesday, but President Donald Trump will determine their exact

levels before implementation.

Lutnick also indicated that an additional 10 percent tariff on

Chinese imports remains on the table for Tuesday. China has already

vowed to counter with all necessary measures.

Breaking his silence on the string of Trump's tariff

announcements, legendary investor Warren Buffet has called them,

"an act of war, to some degree" in an interview with CBS over the

weekend.

After the collapse of a hoped-for deal between Trump and

Volodymyr Zelenskyy, the European Union said it is ready to work

with all European partners and other allies on a peace plan to

Ukraine that will ensure a just and lasting peace for Ukrainian

people.

Although a trade agreement was not reached during Thursday's

meeting between US President Trump and UK Prime Minister Starmer,

Trump expressed confidence that a deal could be reached "pretty

quickly" in which tariffs "wouldn't be necessary."

Traders also shifted focus to the European Central Bank meeting

due on Thursday, with economists expecting another 25-bps rate

cut.

In the European trading today, the pound rose to a 4-day high of

1.2652 against the U.S. dollar, from an early low of 1.2582. On the

upside, 1.28 is seen as the next resistance level for the

pound.

Against the yen and the Swiss franc, the pound advanced to near

2-week highs of 190.97 and 1.1408 from early lows of 188.82 and

1.1343, respectively. If the pound extends its uptrend, it is

likely to find resistance around 198.00 against the yen and 1.15

against the franc.

The pound edged up to 0.8252 against the euro, from an early low

of 0.8267. The next possible upside target for the pound is seen

around the 0.80 region.

Looking ahead, U.S. and Canada PMI for February and U.S.

construction spending for January are set to be published in the

New York session.

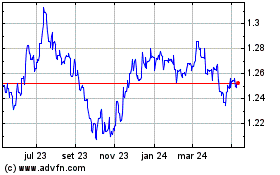

Sterling vs US Dollar (FX:GBPUSD)

Gráfico Histórico de Câmbio

De Fev 2025 até Mar 2025

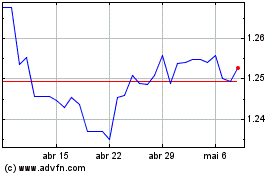

Sterling vs US Dollar (FX:GBPUSD)

Gráfico Histórico de Câmbio

De Mar 2024 até Mar 2025