U.S. Dollar Falls On Weak U.S. Economic Data

04 Março 2025 - 3:04AM

RTTF2

The U.S. dollar weakened against other major currencies in the

European session on Tuesday, as traders' confidence was tempered by

weak U.S. economic data.

Data from the Institute for Supply Management on Monday showed

its reading on U.S. manufacturing edged slightly lower in February,

although the index still indicated growth in the sector for the

second straight month.

The ISM said its manufacturing PMI slipped to 50.3 in February

after rising to 50.9 in January, but a reading above 50 still

indicates growth. Economists had expected the index to dip to

50.5.

The production index also fell to 50.7 in February from 52.5 in

January, while the employment index slid to 47.6 in February from

50.3 in January.

Data from the Commerce Department showed on Monday that the

construction spending in the U.S. unexpectedly edged modestly lower

in the month of January.

The Commerce Department said construction spending slipped by

0.2 percent to an annual rate of $2.193 trillion in January after

climbing by 0.5 percent to a revised rate of $2.196 trillion in

December. Economists had expected construction spending to come in

unchanged.

The unexpected dip by construction spending came as spending on

private construction fell by 0.2 percent to an annual rate of

$1.686 trillion.

Investors wait for the European Central Bank policy meeting on

Thursday, with traders pricing in another 25-basis point cut.

Meanwhile, trade tensions weighed on markets after U.S.

President Donald Trump's long-threatened tariffs against Canada,

Mexico and China went into effect today.

Canada announced 25 percent tariffs on $107 billion worth of

U.S. goods, with $20.7 billion in immediate effect. Mexican

President Claudia Sheinbaum said her country is preparing

countermeasures.

China has announced 15 percent tariffs on U.S. chicken, wheat,

corn and cotton, plus 10 percent cent tariffs on soybeans, pork,

beef and dairy beginning March 10.

In the European trading today, the U.S. dollar fell to a 1-week

low of 148.60 against the yen and a 6-day low of 1.0528 against the

euro, from early highs of 149.57 and 1.0471, respectively. If the

greenback extends its downtrend, it is likely to find support

around 144.00 against the yen and 1.06 against the euro.

Against the pound and the Swiss franc, the greenback slipped to

near 3-month lows of 1.2741 and 0.8906 from early highs of 1.2679

and 0.8972, respectively. The greenback may test support near 1.28

against the pound and 0.87 against the franc.

The greenback edged down to 1.4410 against the Canadian dollar,

from an early high of 1.4521. On the downside, 1.41 is seen as the

next support level for the greenback.

Looking ahead, U.S. Redbook report and U.S. RCM/TIPP economic

optimism index for March are slated for release in the New York

session.

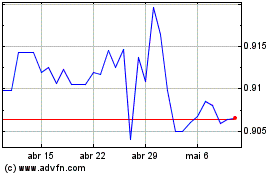

US Dollar vs CHF (FX:USDCHF)

Gráfico Histórico de Câmbio

De Fev 2025 até Mar 2025

US Dollar vs CHF (FX:USDCHF)

Gráfico Histórico de Câmbio

De Mar 2024 até Mar 2025