Yen Falls Amid Risk-on Mood

04 Março 2025 - 11:41PM

RTTF2

The Japanese yen weakened against other major currencies in the

Asian session on Wednesday, as investors reacted positively to the

actions taken by China to counter the effects of deflation and a

slew of upbeat GDP and PMI data from the region. Markets are also

cautious following the imposition of tariffs by U.S. in Canada,

Mexico and China, and the retaliatory measures by China and

Canada.

Offering a temporary reprieve from tariff worries, U.S. Commerce

Secretary Howard Lutnick hinted that some relief could be around

the corner for Canada and Mexico.

A potential deal is expected to involve reducing, at least

partially, the new 25 percent tariffs on imports from both

countries.

Elsewhere, Beijing announced a 2025 economic growth target of

around 5 percent and pledged additional fiscal support to counter

the effects of deflation, a property crash and rising U.S.

tariffs.

The special initiatives to boost consumption include proposals

to cut the reserve ratios and interest rates, issue special

treasury bonds to support state-owned lenders in replenishing

capital and use monetary policy instruments to bolster property and

stock markets.

There is also some cheer on the data front as a private survey

showed China's services sector grew more than expected in February,

driven by a faster rebound in demand.

The Bank of Japan (BoJ) Deputy Governor Shinichi said that the

Japanese central bank will keep hiking interest rates if its

economic forecasts are met. Japan has only just started to move

away from its long-standing ultra-loose monetary policy, Uchida

added.

Uchida said, "I don't have a preset idea in mind on the pace of

future rate hikes."

In the Asian trading today, the yen fell to a 2-week low of

192.08 against the pound and a 2-day low of 150.18 against the U.S.

dollar, from yesterday's closing quotes of 191.72 and 149.84,

respectively. If the yen extends its downtrend, it is likely to

find support around 195.00 against the pound and 155.00 against the

greenback.

Against the euro and the Swiss franc, the yen slipped to more

than 2-week lows of 159.53 and 168.60 from Tuesday's closing quotes

of 157.17 and 168.36, respectively. The yen is likely to find

support 164.00 against the euro and 172.00 against the franc.

Against the Australia and the Canadian dollars, the yen dropped

to 2-day lows of 94.05 and 104.27 from yesterday's closing quotes

of 93.92 and 104.07, respectively. On the downside, 97.00 against

the aussie and 108.00 against the loonie are seen as the next

support levels for the yen.

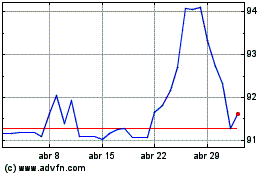

The yen fell to a 6-day low of 85.01 against the NZ dollar, from

yesterday's closing value of 84.81. The next possible downside

target for the yen are seen around the 87.00 region.

Looking ahead, PMI reports for February from various European

economies and U.K., Eurozone PPI for January are slated for release

in the European session.

In the New York session, U.S. MBA mortgage approvals data, U.S.

and Canada PMI data for February, U.S. factory orders for January

and U.S. EIA crude oil data are slated for release.

NZD vs Yen (FX:NZDJPY)

Gráfico Histórico de Câmbio

De Fev 2025 até Mar 2025

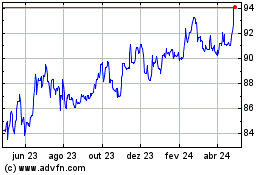

NZD vs Yen (FX:NZDJPY)

Gráfico Histórico de Câmbio

De Mar 2024 até Mar 2025