Euro Rises As Bond Prices Surge On Europe's Defense Buildup

06 Março 2025 - 1:38AM

RTTF2

The euro strengthened against other major currencies in the

Asian session on Thursday, following a spike in European bond

yields on Germany's proposed 500-billion-euro ($539.85 billion)

infrastructure fund and a revision to borrowing restrictions.

In addition to upgrading the growth estimate for the larger Euro

area, Goldman Sachs improved its economic growth projection for

Germany this year, noting the possibility of higher military and

infrastructure spending.

Goldman has increased its growth forecast for Europe's largest

economy by 0.2 percentage points to 0.2 percent growth.

Investors looked ahead to the European Central Bank's

interest-rate decision and President Christine Lagarde's press

conference later in the day for direction.

The central bank is likely to cut its interest rates again by 25

basis points as inflation softened amid weaker economic growth. The

policy announcement is due at 8.15 AM ET.

Meanwhile, the widely anticipated rate cut by the ECB is

unlikely to derail the euro's momentum.

In the Asian trading today, the euro rose to nearly a 5-week

high of 161.28 against the yen and a 4-month high of 1.0820 against

the U.S. dollar, from yesterday's closing quotes of 160.71 and

1.0794, respectively. If the euro extends its uptrend, it is likely

to find resistance around 165.00 against the yen and 1.09 against

the greenback.

Against the pound and the Swiss franc, the euro advanced to more

than a 1-month high of 0.8384 and nearly a 7-1/2-month high of

0.9636 from Wednesday's closing quotes of 0.8374 and 0.9616,

respectively. The euro is likely to find resistance around 0.84

against the pound and 0.97 against the franc.

Looking ahead, Eurostat publishes Eurozone retail sales data for

January is slated for release in the European session.

In the New York session, U.S. and Canada trade data for January,

U.S. weekly jobless data and Canada Ivey PMI data for February are

set to be published.

At 8:15 am ET, the European Central Bank will announce its

monetary policy decision. The ECB is likely to cut its interest

rates on Thursday as inflation softened amid weaker economic

growth.

Markets expect the bank to lower the policy rates by 25 basis

points. The deposit facility rate is likely to be reduced to 2.50

percent from 2.75 percent.

Half-an-hour later, ECB President Christine Lagarde will hold

customary press conference.

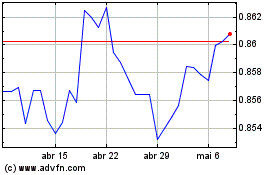

Euro vs Sterling (FX:EURGBP)

Gráfico Histórico de Câmbio

De Fev 2025 até Mar 2025

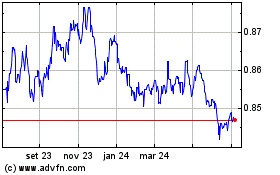

Euro vs Sterling (FX:EURGBP)

Gráfico Histórico de Câmbio

De Mar 2024 até Mar 2025