Yen Rises Amid BoJ Rate Hike Prospects

06 Março 2025 - 2:28AM

RTTF2

The Japanese yen strengthened against other major currencies in

the European session on Thursday, in reaction to the Bank of

Japan's (BoJ) hawkish monetary policy outlook. Additionally,

concerns about a worsening global trade war are driving up demand

for safe haven currency like JPY.

The yield on Japan's 10-year government bonds jumped beyond

1.5%, reaching its highest level in more than 15 years.

Following Germany's announcement of a €500 billion

infrastructure fund and proposals to alter borrowing laws, a wider

rally in European bond yields contributed to this increase. It is

anticipated that these actions will boost German GDP and improve

investor sentiment.

Recently, Deputy Governor Shinichi Uchida of the Bank of Japan

reiterated that if economic circumstances live up to forecasts, the

central bank will consider additional interest rate hikes.

Uchida also emphasized, Japan is only beginning to move away

from its extended monetary easing program, which could lead to a

more restraint.

In the European trading today, the yen rose to a 5-month high of

147.79 against the U.S. dollar and a 2-day high of 166.53 against

the Swiss franc, from early lows of 149.33 and 167.62,

respectively. If the yen extends its uptrend, it is likely to find

resistance around 144.00 against the greenback and 164.00 against

the franc.

Against the pound, the yen advanced to a 2-day high of 190.28

from an early near 3-week low of 192.53. The yen is likely to find

resistance around the 187.00 region.

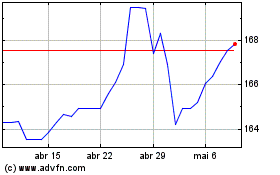

The yen edged up to 159.40 against the euro, from an early more

than a 1-month low of 161.28. On the upside, 154.00 is seen as the

next resistance level for the yen

Looking ahead, U.S. and Canada trade data for January, U.S.

weekly jobless data and Canada Ivey PMI data for February are set

to be published in the New York session.

At 8:15 am ET, the European Central Bank will announce its

monetary policy decision. The ECB is likely to cut its interest

rates on Thursday as inflation softened amid weaker economic

growth.

Markets expect the bank to lower the policy rates by 25 basis

points. The deposit facility rate is likely to be reduced to 2.50

percent from 2.75 percent.

Half-an-hour later, ECB President Christine Lagarde will hold

customary press conference.

Euro vs Yen (FX:EURJPY)

Gráfico Histórico de Câmbio

De Fev 2025 até Mar 2025

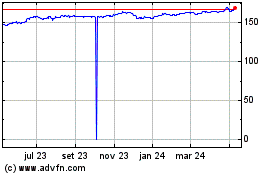

Euro vs Yen (FX:EURJPY)

Gráfico Histórico de Câmbio

De Mar 2024 até Mar 2025