Antipodean Currencies Rise Amid Optimism Over China's Consumption Stimulus

17 Março 2025 - 1:02AM

RTTF2

The Antipodean currencies such as the Australia and the New

Zealand dollars strengthened against their major currencies in the

Asian session on Monday, as markets react positively to China

unveiling a special action plan over the weekend to revive

consumption and to boost the stock and real estate market. The

ongoing concerns about the impact of President Donald Trump's trade

policies are hurting market sentiment.

China's industrial production and retail sales expanded more

than expected in the January to February period driven by fiscal

stimulus, but the property market remained a drag on the

economy.

Data from the National Bureau of Statistics showed that China

industrial production registered an annual growth of 5.9 percent

but slower than the 6.2 percent rise in December. Nonetheless, the

pace of growth exceeded forecast of 5.3 percent.

Meanwhile, growth in retail sales improved to 4.0 percent in

January to February from 3.7 percent in December. The rate was also

better than the expected expansion of 3.8 percent.

Fixed investment growth rose to 4.1 percent in January and

February from 3.2 percent in 2024.

In economic news, data from BusinessNZ showed that the services

sector in New Zealand slipped into contraction territory in

February, with a Performance of Services Index score of 49.1.

That's down from the downwardly revised 50.3 in January

(originally 50.4) and it falls beneath the boom-or-bust line of 50

that separates expansion from contraction.

In the Asian trading today, the Australian dollar rose to near

2-week highs of 0.6339 against the U.S. dollar and 94.39 against

the yen, from Friday's closing quotes of 0.6323 and 93.97,

respectively. If the aussie extends its uptrend, it is likely to

find resistance around 0.65 against the greenback and 96.00 against

the yen.

Against the euro, the aussie advanced to a 1-week high of 1.7174

from last week's closing value of 1.7203. On the upside, 1.67 is

seen as the next resistance level for the aussie.

The aussie edged up to 0.9107 against the Canadian dollar, from

Friday's closing value of 0.9086. The next possible upside target

for the aussie is seen around the 0.92 region.

The NZ dollar rose to nearly a 3-week high of 85.92 against the

yen and nearly a 2-week high of 1.8863 against the euro, from

Friday's closing quotes of 85.37 and 1.8923, respectively. If the

kiwi extends its uptrend, it is likely to find resistance around

88.00 against the yen and 1.85 against the euro.

Against the U.S. and the Australian dollars, the kiwi advanced

to a 3-week high of 0.5768 and nearly a 1-1/2-month high of 1.0983

from last week's closing quotes of 0.5744 and 1.0998, respectively.

The kiwi may test resistance around 0.59 against the greenback and

1.08 against the aussie.

Looking ahead, Canada housing starts for February, U.S. retail

sales for February, U.S. NY Empire State manufacturing index for

March, U.S. NAHB housing market index for March and U.S. NOPA crush

report, are slated for release in the New York session.

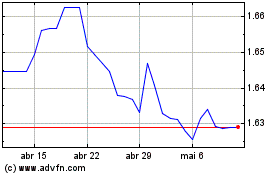

Euro vs AUD (FX:EURAUD)

Gráfico Histórico de Câmbio

De Fev 2025 até Mar 2025

Euro vs AUD (FX:EURAUD)

Gráfico Histórico de Câmbio

De Mar 2024 até Mar 2025