NZD Rises; JPY Drops Amid Risk-on Mood

18 Março 2025 - 2:09AM

RTTF2

The New Zealand dollar strengthened, and the safe-haven yen

weakened against major currencies in the Asian session on Tuesday

amid risk appetite, as traders continued to pick up stocks at

reduced levels following recent weakness. They also seemed

reluctant to make more significant moves ahead of the U.S. Fed's

monetary policy announcement on Wednesday.

Traders may also follow the latest geopolitical developments and

assess their impact on financial markets. Investor confidence was

raised by optimism for US-Russia peace talks, which contributed to

the NZD's rise as well as JPY's drop.

The optimism around China's stimulus initiatives continues to

provide strong support for the global risk mood.

Markets have been pricing in the possibility of the Bank of

Japan (BoJ) raising interest rates this year.

While the Fed is almost universally expected to leave interest

rates unchanged, traders will look to the accompanying statement

and officials' latest projections for clues about the outlook for

rates. The Bank of England, the Bank of Japan and the Swiss

National Bank are all scheduled to announce their monetary policies

later in the week.

The Fed is widely expected to leave interest rates unchanged,

with traders likely to scrutinize the accompanying statement as

well as officials' latest projections for clues about the outlook

for rates amid much uncertainty about the economic impact of

President Trump's trade policies.

Elsewhere, the Bank of Japan is set to hold the benchmark rate

at the current level of 0.5 percent on Wednesday.

The Bank of England is expected to take another pause on its

rate-cutting path Thursday while Switzerland's central bank looks

set to cut interest rates for the last time in the current

cycle.

The Kremlin confirmed that Russian President Vladimir Putin

would talk to the U.S. President Donald Trump by phone on

Tuesday.

Elsewhere, Israel carried out airstrikes in the Gaza Strip,

southern Lebanon and southern Syria on Monday, killing at least 10

people.

In the Asian trading today, the NZ dollar rose to more than a

1-month high of 87.20 against the yen and a 2-week low of 1.8723

against the euro, from yesterday's closing quotes of 86.99 and

1.8751, respectively. If the kiwi extends its uptrend, it is likely

to find resistance around 88.00 against the yen and 1.82 against

the euro.

Against the U.S. and the Australian dollars, the kiwi advanced

to more than 3-month highs of 0.5831 and 1.0951 from Monday's

closing quotes of 0.5823 and 1.0959, respectively. The kiwi may

test resistance around 0.60 against the greenback and 1.08 against

the aussie.

Meanwhile, the Japanese yen weakened against other major

currencies in the Asian session amid risk appetite.

The yen fell to near 2-month lows of 163.59 against the euro and

194.44 against the pound, from yesterday's closing quotes of 163.12

and 193.88, respectively. The next possible downside target for the

yen is seen around 165.00 against the euro and 195.00 against the

pound.

The yen slipped to nearly a 1-1/2-month low of 170.05 against

the Swiss franc, from Monday's closing value of 169.53. On the

downside, 172.00 is seen as the next support level for the yen.

Against the U.S., the Australia and the Canadian dollars, the

yen dropped to nearly a 2-week low of 149.88, nearly a 4-week low

of 95.56 and more than a 2-week low of 104.82 from early highs of

149.40, 95.33 and 104.49, respectively. If the yen extends its

downtrend, it is likely to find support around 155.00 against the

greenback, 99.00 against the aussie and 108.00 against the

loonie.

Looking ahead, Germany's ZEW economic sentiment survey results

for March and Eurozone foreign trade data for January are due to be

released in the European session.

In the New York session, Canada CPI for February, U.S. building

permits, housing starts, export and import price, industrial and

manufacturing production indices, all for February and U.S. Redbook

report are slated for release.

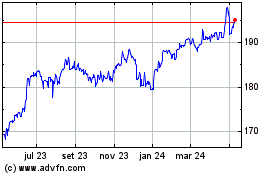

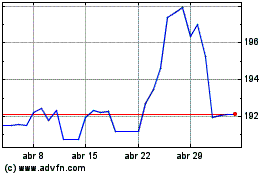

Sterling vs Yen (FX:GBPJPY)

Gráfico Histórico de Câmbio

De Fev 2025 até Mar 2025

Sterling vs Yen (FX:GBPJPY)

Gráfico Histórico de Câmbio

De Mar 2024 até Mar 2025