U.S. Dollar Higher Ahead Of Fed Decision

19 Março 2025 - 10:59AM

RTTF2

The U.S. dollar advanced against its major counterparts in the

New York session on Wednesday, ahead of the Federal Reserve's

monetary policy announcement, due shortly.

With the Fed almost universally expected to leave rates

unchanged, traders will look to the accompanying statement as well

as officials' latest projections for clues about the outlook for

rates.

CME Group's FedWatch Tool is currently indicating a 99.0 percent

chance the Fed will once again leave interest rates unchanged.

The FedWatch Tool currently suggests the Fed is likely to leave

rates unchanged again at its next meeting in early May, but the

chances of a rate cut increase in June and July.

At the Fed's most recent meeting in late January, the central

bank left rates unchanged after it lowered rates by a total of 100

basis points or 1.0 percentage point over the three previous

meetings, beginning with a 50 basis point cut last September.

The greenback climbed to a 2-day high of 1.0872 against the euro

and a 2-week high of 150.14 against the yen. The currency is poised

to challenge resistance around 1.03 against the euro and 151.00

against the yen.

The greenback edged up to 0.8809 against the franc and 1.2954

against the pound. The greenback may face resistance around 0.92

against the franc and 1.24 against the pound.

The greenback touched 0.6321 against the aussie, 0.5776 against

the kiwi and 1.4337 against the loonie, setting 2-day highs. The

currency is seen finding resistance around 0.61 against the aussie,

0.56 against the kiwi and 1.46 against the loonie.

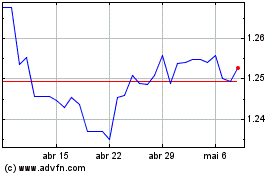

Sterling vs US Dollar (FX:GBPUSD)

Gráfico Histórico de Câmbio

De Fev 2025 até Mar 2025

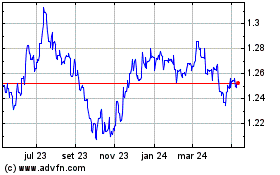

Sterling vs US Dollar (FX:GBPUSD)

Gráfico Histórico de Câmbio

De Mar 2024 até Mar 2025