TIDMBSFA

RNS Number : 7863W

BSF Enterprise PLC

24 December 2021

BSF Enterprise PLC

C/o Locke Lord LLP

201 Bishopsgate

London EC2M 3AB

BSF Enterprise PLC - BSFA

24 December 2021

Acquisition Announcement

BSF Enterprise PLC attach herewith an Acquisition Announcement

containing Proposed Acquisition of 3D Bio-Tissues Limited and a

Proposed Placing of ordinary shares to raise up to GBP1.75

million.

This announcement has been authorised for release by the Board

of Directors.

Geoff Baker

Company Secretary

BSF Enterprise PLC

Ph 0208 194 9201

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN

PART, IN OR INTO THE UNITED STATES, AUSTRALIA, CANADA, JAPAN, THE

REPUBLIC OF SOUTH AFRICA, ANY MEMBER STATE OF THE EEA (OTHER THAN

THE UNITED KINGDOM) OR ANY OTHER JURISDICTION WHERE TO DO SO WOULD

CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OF THAT

JURISDICTION.

FURTHER, THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND

DOES NOT CONSTITUTE OR CONTAIN ANY INVITATION, SOLICITATION,

RECOMMATION, OFFER OR ADVICE TO ANY PERSON TO SUBSCRIBE FOR,

OTHERWISE ACQUIRE OR DISPOSE OF ANY SECURITIES IN ANY

JURISDICTION.

24 December 2021

BSF Enterprise plc

("BSF" or the "Company")

Proposed Acquisition of 3D Bio-Tissues Limited

Proposed Placing of Ordinary Shares to raise up to GBP1.75

million

BSF Enterprise plc (LSE: BSFA), the investment company

established to acquire businesses focused on early-stage

opportunities in the biotechnology, innovative marketing and

e-commerce sectors, is pleased to announce that further to the

announcement of 16 August 2021, the Company has now entered into a

conditional share sale and purchase agreement (the "Acquisition

Agreement") to acquire the entire issued share capital of 3D

Bio-Tissues Limited ("3DBT") in consideration for the allotment and

issue to the Sellers of an aggregate of 33,900,003 Consideration

Shares (the "Acquisition").

3DBT, a private company limited by shares, incorporated and

registered in England and Wales, is a biotechnology spin out from

Newcastle University (UK) founded by Professor Che Connon and Dr

Ricardo Gouveia. 3DBT's research and product development is focused

on producing biological tissue material, such as meat and skin, for

clinical and consumer use. Specialised technology enables 3DBT to

apply bio-focused manufacturing processes to generate complex

structures such as corneas for the human eye.

The Company also proposes to carry out a Placing of new Ordinary

Shares to raise funds of up to GBP 1.75 million (before expenses)

to finance the next phase of its development (including marketing

and sales avenues for serum alternatives and cosmetics) and working

capital. As such, the Acquisition is conditional, inter alia, on a

successful Placing.

Should the Acquisition complete, it will constitute a Reverse

Takeover under the Listing Rules and accordingly the Company

intends to apply for the re-admission of its shares to the Official

List and the Main Market of the London Stock Exchange. The

Company's shares remain suspended from trading pending the

publication of a prospectus prepared in accordance with the

Prospectus Regulation Rules of the FCA and approved by the FCA, or

an announcement that the Acquisition is not proceeding.

A circular together with a notice convening the General Meeting

to approve the Resolutions (which shall include the Whitewash

Resolution) will be posted to Shareholders in due course.

Key Highlights of the Acquisition

-- Acquisition of 3DBT for a consideration of GBP2.5 million, to

be satisfied by the issue of 33,900,003 Consideration Shares at

7.37 pence each per share;

-- 3DBT has developed a proprietary platform technology termed

"tissue templating" that facilitates the production of a variety of

animal tissue types for multiple uses, commonly referred to as

"tissue engineering".

-- 3DBT has developed, amongst other intellectual property, the following:

o Serum-free media : 3DBT's City-mix(TM) supplements, which are

a serum-free media for culturing muscle and fat cells (by way of an

animal-free process) that can be used for lab -grown meat and

leather production; and

o Skin Care Products : Lipopeptide Etsyl(TM) a product that

actively increases collagen production in human skin cells. It can

be used as an active ingredient in cosmetic skin cream and other

topical dermatological products.

-- 3DBT's business model is to develop intellectual property

around each of its applications, and to then licence out the

patent- protected intellectual property to manufacturers,

wholesalers and distributers of the end products. 3DBT currently

manufactures product for serum-free media and an active ingredient

for skin care products.

Further announcements will be made in due course, as

appropriate.

Enquiries:

BSF Enterprise plc Ph 0208 194 9201

For further information, please visit www.bsfenterprise.com.

LEI: 2138007PJT69H8FYLC06

This announcement contains inside information for the purposes

of Article 7 of the UK version of Market Regulation (EU) No

596/2014 on Market Abuse as it forms part of UK domestic law by

virtue of the

European Union (Withdrawal) Act 2018, as amended ("MAR"). Upon

the publication of this announcement via Regulatory Information

Service, this inside information is now considered to be in the

public domain.

DISCLAIMER

Shard Capital Partners LLP ("Shard Capital"), which is

authorised and regulated in the United Kingdom by the Financial

Conduct Authority (FRN: 538762), is acting as broker to the Company

in relation to the Placing. Persons receiving this announcement

should note that Shard Capital will not be responsible to anyone

other than the Company for providing the protections afforded to

its clients or for advising any other person on the arrangements

described in this announcement. Shard Capital has not authorised

the contents of, or any part of, this announcement and no liability

whatsoever is accepted by it for the accuracy of any information or

opinion contained in this announcement or for the omission of any

information.

This announcement includes statements that are, or may be deemed

to be, "forward-looking statements". These forward-looking

statements can be identified by the use of forward-looking

terminology, including the terms "believes", "estimates", "plans",

"anticipates", "targets", "aims", "continues", "expects",

"intends", "hopes", "may", "will", "would", "could" or "should" or,

in each case, their negative or other variations or comparable

terminology. These forward-looking statements include matters that

are not facts. They appear in a number of places throughout this

announcement and include statements regarding the Directors'

beliefs or current expectations concerning, amongst other things,

the amount of capital which will be returned by the Company and the

taxation of such amounts in the hands of Shareholders. By their

nature, forward-looking statements involve risk and uncertainty

because they relate to future events and circumstances. Investors

should not place undue reliance on forward-looking statements,

which speak only as of the date of this announcement.

The information given in this announcement and the

forward-looking statements speak only as at the date of this

announcement. The Company, Shard Capital and their respective

affiliates expressly disclaim any obligation or undertaking to

update, review or revise any forward-looking statement contained in

this announcement to reflect actual results or any change in the

assumptions, conditions or circumstances on which any such

statements are based unless required to do so by the Financial

Services and Markets Act 2000, the Listing Rules, the Prospectus

Regulation Rules or other applicable laws, regulations or

rules.

The Existing Ordinary Shares and the New Ordinary Shares have

not, nor will they be, registered under the US Securities Act of

1933, as amended (the "US Securities Act") or with any securities

regulatory authority of any state or other jurisdiction of the

United States or under the applicable securities laws of Australia,

Canada, Japan or the Republic of South Africa. The Existing

Ordinary Shares and the New Ordinary Shares to be issued by the

Company may not be offered or sold directly or indirectly in or

into the United States unless registered under the US Securities

Act or offered in a transaction exempt from or not subject to the

registration requirements of the US Securities Act or subject to

certain exceptions, into Australia, Canada, Japan or the Republic

of South Africa or to, or for the account or benefit of, any

national, resident or citizen of Australia, Canada, Japan or the

Republic of South Africa. The Company has not been, and will not

be, registered under the US Investment Company Act of 1940, as

amended.

The distribution of this announcement may be restricted by law

in certain jurisdictions and persons into whose possession any

document or other information referred to herein comes should

inform themselves about and observe any such restriction. Any

failure to comply with these restrictions may constitute a

violation of the securities laws of any such jurisdiction.

The value of shares and the income from them is not guaranteed

and can fall as well as rise due to stock market and currency

movements. When you sell your investment you may get back less than

you originally invested. All of the value of an investor's

investment in the Company will be at risk. Past performance is not

a guide to future performance and the information in this circular

or any documents relating to the matters described in it cannot be

relied upon as a guide to future performance. Persons needing

advice should contact a professional adviser.

INTRODUCTION

Background to and reasons for the Acquisition

The Company was incorporated on 5 September 2018 with the

objective of creating value for its Shareholders through an

acquisition-led growth strategy with a focus on acquiring

businesses in the biotechnology, innovative marketing and

e-commerce sectors. The Company's Ordinary Shares were admitted to

trading on the Official List with a Standard Listing on 26 July

2019 when it raised GBP767,000 via a placing at 5 pence per

ordinary share. On 16 August 2021 trading in the Ordinary Shares on

the Official List was suspended in accordance with the Listing

Rules following an announcement made by the Company in relation to

the potential Acquisition.

The Company believes that the acquisition of 3DBT presents a

compelling potential value opportunity for the Company as it allows

it to acquire technology which has benefitted from the development

of products now leading into commercial terms with partners and

licensing partners.

History of 3DBT

3DBT is a biotechnology start-up and spin-out from Newcastle

University (UK) It was founded by Professor Che Connon and Dr.

Ricardo Gouveia on 8 November 2018. Professor Che Connon has over

20 years' experience in extracellular matrix biology and is

currently a professor of tissue engineering at the Newcastle

University (UK). He has successfully spun-out three biotechnology

companies. Dr. Ricardo Gouveia is a New Harvest Research Fellow and

expert in cell biology and biomaterials.

3DBT has developed a proprietary platform technology termed

"tissue templating" that facilitates the production of a variety of

animal tissue types for multiple uses, commonly referred to as

"tissue engineering". Tissue templating technology is bio-inspired,

i.e., its methodology has been learnt by careful study of how cells

behave in their natural environs (principally undertaken at

Newcastle University with UK government funding). This bio-inspired

approach radically differs from traditional tissue engineering

approaches as it uniquely harnesses the power of cells to grow and

create the entire tissue and does not involve the use of synthetic

scaffolds.

The intellectual property of 3DBT relates, in part, to the ways

cells receive instructions from their external environment and the

subsequent arrangement of these cells as well as the highly ordered

extracellular material the same cells deposit. Together, these

processes create a functional tissue structure resembling down to

the nanoscopic level the tissue from which the original cells were

taken, e.g., cornea, muscle or skin. During the research and

development of these 3DBT tissue constructs, significant and

unexpected discoveries were made in the form of soluble components

that sped up the tissue templating process. Human tissue growth in

nature can take months or years to fully form, but 3DBT has found

ways to accelerate this in the lab using patented (application

stage) soluble factors. The Company believes that these potent cell

and tissue forming factors could be stand-alone products for 3DBT,

acting as early revenue streams ahead of the longer-term plans for

the 3DBT tissue constructs. Therefore, the City-mix(TM) serum-free

media and Etsyl(TM) skin care product lines were created by

3DBT.

City-mix(TM) is a plant-based and environmentally-friendly

direct replacement to the expensive animal-derived or synthetic

proteins and growth factors commonly used in the culture of animal

cells. Uniquely, 3DBT's City-mix(TM) products offer a

cost-effective animal-free alternative to animal serum for the

expansion of important cell types. Etsyl(TM) is another supplement

which stimulates collagen production from cells and holds great

promise as an active ingredient in high-end skin care products.

3DBT has undertaken research and development activities to date

that have resulted in three strands of intellectual property being

developed, with each strand having a different sectoral focus,

timeline to development and ultimately, revenue. 3DBT has developed

intellectual property in the following sectors:

-- Serum-free media: 3DBT's City-mix(TM) is a serum-free media

for culturing muscle and fat cells (by way of an animal- free

process) which can be used for lab-grown meat and leather

production;

-- Skin Care Products: Lipopeptide Etsyl(TM) is a product that

actively increases collagen production in human skin cells. It can

be used as an active ingredient in cosmetic skin cream and other

topical dermatological products;

-- Tissue Templating Applications (using a platform to grow

different tissues with natural structure and function) in respect

of the following:

-Human skin substitutes : native-like human skin substitutes,

for clinical and industrial applications;

-Substitute cornea : a potential corneal substitute which is

made from human cells in Serum-Free Media. Its purpose is to

function as a comparable and a direct replacement to human corneal

donor tissue;

-Cultured meat: highly structured muscle tissue for use in the

cultivated protein market produced through the cultivation of

animal cells; and

-Lab-grown leather: lab-grown leather which is an alternative

source of animal leather.

Strategy for the Enlarged Group

3DBT's business model is to develop intellectual property around

each of its applications, and to then licence out the patent-

protected intellectual property to manufacturers, wholesalers and

distributers of the end products. 3DBT currently manufactures

product for serum-free media and an active ingredient for skin care

products.

KEY TERMS OF THE ACQUISITION

Pursuant to the Acquisition Agreement, the Company has

conditionally agreed to acquire the entire issued share capital of

3DBT. The consideration for the entire issued share capital will

consist entirely of the issue of the Consideration Shares to the

Sellers.

The Consideration Shares to be issued pursuant to the

Acquisition will be credited as fully paid and rank pari passu in

all respects with the Existing Ordinary Shares in issue, including

the right to receive all future dividends or other distributions

declared, made or paid after the date of issue. The Acquisition

Agreement contains customary warranties and indemnities relating to

3DBT and its business and assets, given by the Warrantors in

relation to general and operational warranties and a customary tax

covenant in favour of the Company. Claims under the Acquisition

Agreement are subject to certain financial, time and other

limitations. The Company has also given warranties in favour of the

Sellers relating to its status, business, assets and financial

information.

The Acquisition Agreement may be terminated by the Company in

certain customary limited circumstances, including where the

Company becomes aware of a material breach of warranty or material

breach of interim covenant prior to Admission. The Acquisition

Agreement may also be terminated by the Sellers in event of

material breach of the warranties given by the Company.

Conditions of the Acquisition

Completion of the Acquisition is conditional, inter alia,

upon:

-- approval by the FCA, and the publication, of a Prospectus

relating to the issue of the Consideration and Placing Shares;

-- the Takeover Panel agreeing to grant a waiver of the

obligation of the members of the Concert Party under Rule 9 of the

City Code;

-- the passing of the Resolutions at the General Meeting;

-- the Consideration Shares and the Placing Shares having been

issued and allotted unconditionally subject only to their

Admission;

-- the Placing having become unconditional in all respects save

for any condition relating to Admission;

-- there having occurred in the period between the signing date

and Completion no material breach of any of the Warrantors' interim

covenants in the Acquisition Agreement, no material breach of

warranties and no material adverse change in relation to 3DBT;

and

-- Admission.

If the conditions are not satisfied or waived (if capable of

waiver) on or before the 28 February 2022 (or such later date as

the Company and the Sellers' representative may agree), the Buyer

and the Sellers' representative shall meet in good faith and

cooperate to agree a course of action, failing such agreement

within 20 Business Days of such notice, the Buyer shall be entitled

to terminate this Agreement (save for certain customary provisions

which shall survive termination).

Lock-in undertaking

Pursuant to the Acquisition Agreement, the Sellers and the

Existing Directors shall also enter into a lock-in agreement with

the Company conditionally on Admission on standard terms. Under the

lock-in agreement, each Locked-in Party will severally agree that

it will not, without the consent of the Company, dispose of the

legal or beneficial interest in the Ordinary Shares or grant a

right or charge over such Ordinary Shares for a period of 12 months

from Admission.

PROPOSED PLACING

In conjunction with the Acquisition and subject to Admission,

the Company proposes to raise up GBP1.75 million, before expenses,

via a placing to institutional and other investors. The Placing is

expected to take place at the Placing Price of 7.37 pence per

share.

The Company has engaged Shard Capital to act as the Company's

placing agent and adviser for the purposes of the Placing . The

Placing is not expected to be underwritten. The Placing is expected

to be conditional, inter alia, on:

-- the Acquisition Agreement becoming unconditional in all respects save for Admission;

-- the Takeover Panel agreeing to grant a waiver of the

obligation of the members of the Concert Party under Rule 9 of the

City Code;

-- approval by the FCA of the Prospectus and the publication of the Prospectus;

-- the Resolutions being passed at the General Meeting; and

-- Admission occurring no later than 8:00 a.m. on 28 February 2022.

BOARD COMPOSITION

At Completion, it is expected that Professor Che John Connon be

appointed a director of the Company. None of the Existing Directors

are expected to resign.

Professor Connon is Director of Business Development for the

Faculty of Medical Sciences, Newcastle University (UK) and will

continue in this role following Completion. He has lead a word

leading academic research team that seeks to engineer functional

replacement tissues using a cell derived, bio-inspired approach. He

was the first to 3d bio-print a human cornea and understand the

bio-mechanical properties of the corneal stem cell niche.

Professor Connon has received continuous UK government research

funding since 2007 and has published over 100 papers in

international journals and has edited several books in regenerative

medicine, stem cell bioprocessing and hydrogels in tissue

engineering. Professor Connon has embraced academic entrepreneurial

activities and has successfully founded (and remains a Director of)

three Bio-tech spin-outs from Newcastle University (UK),

comprising:

-- Atelerix. Ltd a company that supplies hydrogels for the

storage and shipment of cells at controlled room temperature for

clinical and scientific purposes.

-- 3D Bio-Tissues Ltd has developed a powerful platform that

allows for the production of structured tissues.

-- CellulaREvolution Ltd supplies technologies to assist in the

manufacture of adherent cells for biotechnology needs.

TAKEOVER PANEL

The Company is subject to the City Code. Under Rule 9 of the

City Code, any person who acquires an interest (as de ned in the

City Code) in shares which, taken together with shares in which he

is already interested in and which persons acting in concert with

him are interested, carry 30 per cent. or more of the voting rights

of a company which is subject to the City Code, is required to make

a general offer to all the remaining shareholders to acquire their

shares.

Following Completion, it is expected that the Concert Party

would be interested in more than 50 per cent. of the Enlarged

Issued Share Capital. Accordingly, the Acquisition is conditional

upon the passing of the Whitewash Resolution at the General

Meeting. The proposed Whitewash Resolution is also conditional on

the Takeover Panel consenting to the whitewash under Rule 9 of the

City Code and their approval of the circular to shareholders

convening the General Meeting. The Takeover Panel's agreement to

grant a waiver under Rule 9 of the City Code will (if granted) be

subject to the approval, by means of a poll vote by the eligible

Existing Shareholders, of the Whitewash Resolution.

A circular together with a notice convening the General Meeting

to approve the Resolutions (which shall include the Whitewash

Resolution) will be posted to Shareholders in due course.

INDEPENT DIRECTOR

Min Yang and Geoffrey Baker are directors of the Company and are

also directors of 3DBT. Min Yang and Geoffrey Baker are also

directors of BSF Angel Funding Limited, a shareholder of 3DBT

(being, therefore, a Seller and a Warrantor) and are members of the

Concert Party. Dennis Ow has been appointed as an independent

director of the Company to manage any such conflicts of interests

and to ensure that the terms of the Acquisition have been

negotiated and agreed on an arm's length basis. Any matters on

which Min Yang and/or Geoffrey Baker have a conflict of interest

have been and will continue to be delegated to and considered by

Dennis Ow.

Under the City Code this precludes Min Yang and Geoffrey Baker

from providing any opinion or recommendation in respect of the

proposed waiver of Rule 9 and the Whitewash Resolution, which will

be a matter for the Independent Director. As members of the Concert

Party they are also excluded from voting in their capacity as

Shareholders on the Whitewash Resolution.

As required by the City Code, Dennis Ow, the Independent

Director, is obtaining competent independent advice regarding the

merits of the Acquisition, which will be the subject of the

Whitewash Resolution, the controlling position which it will

create, and the effect which it will have on Shareholders

generally.

PROSPECTUS

In order to implement the Acquisition, the Placing and

Admission, the Company is required to have approved by the FCA and

to publish a Prospectus, prepared in accordance with the Prospectus

Regulation Rules which sets out, inter alia, further information on

the Acquisition, the Placing and Admission and the Enlarged Group.

Subject to obtaining FCA approval, the Prospectus will be available

at the Company's website: www.bsfenterprise.com as soon as

practicable following its publication and a further announcement

will be made in due course.

GENERAL MEETING

Completion of the Acquisition, the issue of Consideration

Shares, the Placing and certain related matters require the

approval of Shareholders at a general meeting of the Company.

At the General Meeting, it is expected that the Resolutions

proposed will, inter alia, comprise resolutions:

-- To approve the Whitewash Resolution.

-- To grant the directors general authority to allot the

Consideration Shares and the Placing Shares referred to in this

announcement and a further authority to allot shares calculated by

reference to the Enlarged Issued Share Capital.

-- To disapply statutory pre-emption rights in connection with

the allotment of the Consideration Shares and the Placing Shares to

in this announcement and a further authority to allot shares

calculated by reference to the Enlarged Issued Share Capital.

A notice convening the General Meeting to approve the

Resolutions will be posted to Shareholders in due course, subject

to obtaining the approval of the Takeover Panel.

DEFINITIONS

Acquisition the proposed acquisition by the Company

of the entire issued share capital

of 3DBT pursuant to the terms of the

Acquisition Agreement;

Acquisition Agreement means the conditional agreement dated

23 December 2021 made between the Company

and the Sellers relating to the Acquisition

;

Admission means the re-admission of the Existing

Ordinary Shares and the admission of

the New Ordinary Shares to the Official

List by way of a Standard Listing and

to trading on the London Stock Exchange's

Main Market for listed securities;

Business Day means any day other than a Saturday,

Sunday or UK bank or public holiday

that is also a day on which dealings

in domestic securities may take place

on, and with the authority of, the

London Stock Exchange;

City Code the City Code on Takeovers and Mergers;

Company means BSF Enterprise plc, a company

incorporated in England & Wales whose

registered office address is at C/o

Locke Lord (UK) LLP, 201 Bishopsgate,

London EC2M 3AB with company number

11554014;

Completion means completion of the Acquisition;

Concert Party means Sellers and certain existing

Shareholders considered by the Company

and its advisers (subject to agreement

by the Panel) to be acting in concert;

Consideration Shares means the 33,900,003 new Ordinary Shares

to be issued and allotted to the Sellers

at the Placing Price pursuant to the

terms of the Acquisition Agreement;

Directors, Board or Board means the current directors of the

of Directors Company or the board of directors from

time to time of the Company, as the

context requires, and "Director" is

to be construed accordingly;

Enlarged Group means, with effect from Completion,

the Company and 3DBT;

Enlarged Issued Share Capital means the share capital of the Company

immediately following the issue of

the New Ordinary Shares;

Existing Directors means Min Yang, Geoffrey Robert Baker

and Dennis Ow;

Existing Ordinary Shares means the 36,900,000 Ordinary Shares

of GBP0.01 each in issue as at the

date of this announcement;

FCA means the UK Financial Conduct Authority;

FSMA means the UK Financial Services and

Markets Act 2000, as amended;

GBP, pounds sterling or means British pounds sterling;

GBP

General Meeting the general meeting of the Company

at which, inter alia, the Resolutions

will be proposed;

Independent Director Dennis Ow;

Independent Shareholders all Shareholders other than the members

of the Concert Party;

Listing Rules means the listing rules made by the

FCA under section 73A of FSMA as amended

from time to time;

Locked-in Parties means the Sellers and the Directors

of the Company holding Ordinary Shares

or interests in Ordinary Shares as

at the date of Admission;

London Stock Exchange means London Stock Exchange plc;

Main Market means the main market for listed securities

of the London Stock Exchange;

Market Abuse Regulation or the UK version of the EU Market Abuse

MAR Regulation (2014/596/EU) (incorporated

into UK law by virtue of the EUWA)

and the relevant provisions of the

EU Market Abuse Regulation (2014/596/EU);

New Ordinary Shares means the Placing Shares and the Consideration

Shares;

Official List means the official list maintained

by the FCA;

Ordinary Shares means the ordinary shares of GBP0.01

each in the capital of the Company

including, if the context requires,

the New Ordinary Shares;

Placing means the proposed placing of the New

Ordinary Shares by the Company at the

Placing Price, conditional inter alia

on Admission;

Placing Price means 7.37 pence per New Ordinary Share;

Placing Shares means the new Ordinary Shares proposed

to be issued and allotted pursuant

to the Placing;

Proposed Director means Professor Che John Connon;

Prospectus means the prospectus relating to the

Acquisition, the Placing, Admission

and the Enlarged Group;

Prospectus Regulation Rules the Prospectus Regulation Rules made

by the FCA under Part VI of the FSMA;

Regulated Activities Order the Financial Services and Markets

Act 2000 (Regulated Activities) Order

2001 (as amended)

Resolutions means the resolutions to be put to

the Shareholders at the General Meeting;

Restricted Jurisdiction means the United States, Canada, Japan,

Australia and the Republic of South

Africa;

Reverse Takeover means a reverse takeover as defined

in the Listing Rules;

SEC means the U.S. Securities and Exchange

Commission;

Securities Act means the U.S. Securities Act of 1933,

as amended;

Sellers means Professor Che Connon, Dr Ricardo

Gouveia, Newcastle University Holdings

Limited and BSF Angel Funding Limited,

being together all of the Sellers of

the entire issued share capital of

3DB T pursuant to the Acquisition Agreement;

Shard Capital Shard Capital Partners LLP, which is

authorised and regulated in the United

Kingdom by the Financial Conduct Authority

(FRN: 538762);

Shareholders means the holders of Ordinary Shares;

Standard Listing means a standard listing under Chapter

14 of the Listing Rules;

Takeover Panel the Panel on Takeovers and Mergers;

United Kingdom or U.K. means the United Kingdom of Great Britain

and Northern Ireland;

United States or U.S. means the United States of America;

US$ or USD US dollars, the lawful currency of

the United States of America;

Warrantors means Professor Che John Connon, Ricardo

Gouveia and BSF Angel Funding Limited,

being certain of the Sellers; and

Whitewash Resolution means the ordinary resolution of the

Independent Shareholders to be taken

on a poll to approve the waiver by

the Panel of the obligation that would

otherwise arise on the Concert Party

to make a general offer under Rule

9 of the City Code to be proposed at

the General Meeting.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQEAEALASDFFFA

(END) Dow Jones Newswires

December 24, 2021 05:57 ET (10:57 GMT)

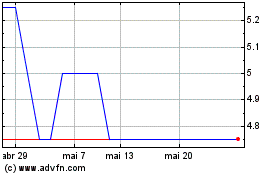

Bsf Enterprise (LSE:BSFA)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Bsf Enterprise (LSE:BSFA)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025