TIDMWTE

RNS Number : 2963G

Westmount Energy Limited

29 March 2022

29 March 2022

WESTMOUNT ENERGY LIMITED

("Westmount" or the "Company")

Interim Results

Westmount Energy Limited (UK AIM: WTE.L, USA OTCQB: WMELF), the

AIM-quoted oil and gas investment company focussed on the

Guyana-Suriname Basin is pleased to announce its unaudited Interim

Results for the six months ended 31 December 2021.

Copies of the Company's interim results are available on the

Company's website, www.westmountenergy.com , and will be posted to

shareholders shortly.

2021 Highlights

-- Groundwork continues for the next drilling campaigns on the

Kaieteur and Canje blocks via detailed analysis and integration of

sub-surface data acquired in the 2020-2021 drilling campaign and

the reassessment of play and prospect risks

-- Environmental permitting process is ongoing at the Guyanese

EPA with respect to potential new drilling programs on the Canje

and Kaieteur blocks from 2022

-- High quality reservoirs identified in first drilling campaign

on Kaieteur and Canje blocks - but no standalone commercial

discoveries to date

-- Tanager-1 Discovery contains gross 65.3 MMbbls (42.7 MMbbls

Net to Kaieteur Block) contingent resources (2C, unrisked)(2) in

high quality Maastrichtian reservoir - but is non-commercial as a

standalone development

-- Cash balance of GBP1.1M at 31 December 2021; no debt

-- Sector consolidation manoeuvres - proposed 'all paper'

acquisition of JHI Associates Inc. by Eco (Atlantic) Oil & Gas

Ltd.

CHAIRMAN'S REVIEW

Although the COVID-19 pandemic continued to ebb and flow

throughout the 2(nd) half of 2021 a rapid global economic recovery

was underway by year end, sparking tightening supply chains,

increased inflationary pressures and rising interest rates. Within

the oil sector these forces translated into robust demand,

struggling supply even within the OPEC+ disciplinary framework and

dwindling stockpiles. With the booming demand for oil and gas,

accentuated in part by poor regional performance of some renewable

sources of energy, outpacing supply, prices continued to surge with

Brent settling above USD$91/bbl by the end of January 2022. All of

this prior to the emergence of geopolitical turmoil sparked by the

Russian invasion of Ukraine on 24 February 2022, with increased

volatility and oil price rises accelerating thereafter, briefly

touching USD$140/bbl for Brent in early March. Oil prices continue

to rally on the back of coordinated sanctions imposed by western

governments and businesses, including an outright ban on Russian

energy imports by the US administration, a phasing out of Russian

oil imports by the UK before year end and ongoing discussions

within the EU where some members risk considerable economic pain if

such a ban is agreed.

During the second half of the year Guyana has continued its

journey towards becoming a significant oil producing nation with

rapidly progressing offshore developments, including the expected

installation of at least six Floating Production Storage and

Offloading (FPSO) units on the Stabroek Block by 2027 (with a

production capacity of more than 1 million BOPD) and the potential

for up to 10 FPSOs based upon the current discovered resource

inventory of in excess of 10 billion barrels of oil

equivalent.(1,2) Three of these FPSOs are already operating or are

under construction - with the Liza Phase 1 (Destiny FPSO) expected

to reach a production rate of 140,000 BOPD during 2022 (20,000 BOPD

above nameplate capacity), Liza Phase 2 (Unity FPSO) on stream

since February 2022 with ramp-up to its full production capacity of

220,000 BOPD expected later in the year and with a third field

development, Payara (Prosperity FPSO), also with 220,000 BOPD

capacity, on track for start-up in 2024. In addition, the Stabroek

consortium has submitted a 4(th) development plan for government

and regulatory review, with respect to the Yellowtail discoveries,

targeting a gross production capacity of 250,000 BOPD and first oil

in 2025. A number of follow-on developments are also envisaged,

including a 5th project centred on the Uaru discovery(1) , subject

to government approvals and project sanctioning.

In parallel with the development of the already discovered

resource offshore Guyana, the multi-billion barrels undiscovered

upside in the basin continues to attract aggressive exploration

investment, driven by large prospects, low breakeven costs, low

carbon emissions and the energy transition dynamics. In October

2021, on the back of a string of exploration successes, estimates

of gross discovered resources on the Stabroek Block were revised

upwards to approximately 10 billion barrels of oil equivalent. The

preceding exploration drilling 'purple patch' included discoveries

at Redtail-1, Yellowtail-2, Uaru-2, Mako-2, Longtail-3, Turbot-2,

Whiptail-1, Whiptail-2, Pinktail-1 and Cataback-1 bringing the

total number of reported significant discoveries to date on the

Stabroek Block to twenty-one. This successful run has continued

into the new year with two further discoveries (Fangtooth-1 and Lau

Lau-1) announced in early January 2022.(2) The positive outcome at

Fangtooth-1 is of particular significance as this was the first

well dedicated to a deep exploration target in the Stabroek area,

with the results indicating the potential for commercial

exploitation of the deeper plays and offering encouragement for the

drilling of deep targets elsewhere in the basin, including on the

Kaieteur and Canje Blocks. Furthermore, a follow-up well, Tarpon-1,

has been spudded on Stabroek circa 100 kms to the northwest of the

Liza Field targeting Lower Campanian clastics and a deeper Jurassic

carbonate play. This is one of 12 exploration and appraisal wells

scheduled for drilling on the Stabroek Block in 2022(2) -

signalling continued aggressive evaluation of the multi-billion

barrels exploration potential in the basin within fixed prospecting

licence timeframes.

Separately, in January 2022, the Joint Venture of CGX Energy

Inc. and Frontera Energy Corporation reported the Kawa-1 discovery

located in the north of the Corentyne Block. This well was spudded

in a water depth of 355 metres and drilled to a Total Depth of

6,578 metres. Wireline logging indicates that the well encountered

61m of net hydrocarbon bearing reservoirs within Maastrichtian,

Campanian, Santonian and Coniacian intervals. Reservoir fluids are

uncertain as MDT fluid samples were not obtained from the well,

though the presence of liquid hydrocarbons has been interpreted in

the Santonian reservoir, from other analyses.(3) Kawa-1 was plugged

and abandoned and the commercial potential of the discovery has yet

to be determined. The Joint Venture is planning to follow-up with

the Wei-1 exploration well, in the second half of 2022, targeting

stacked Campanian and Santonian channel sandstone reservoirs.

In the Surinamese sector, the Total/Apache consortium has

increased the number of discoveries on Block 58 from four to five

with the announcement of the Krabdagu-1 discovery in February

2022(4) . Prior stacked reservoir discoveries on Block 58 reported

generally light oil and gas-condensate pay in shallower Campanian

reservoirs overlying light oil pay in deeper Santonian reservoirs -

pointing towards some potential challenges around valorization of

large associated gas volumes. The Krabdagu-1 well encountered 90

metres of net oil pay in good quality Maastrichtian and Campanian

reservoirs and is currently undergoing flow testing. Total, as

operator, continues to focus on appraisal of the shallower

Maastrichtian-Campanian reservoirs with a view to progression

towards FID for the initial standalone oil development on Block 58.

Results at Sapakara South-1 appraisal well, drilled 4 kms east of

the Sapakara-1 discovery well, were announced in November 2021 -

confirming the presence of 30m net high-quality black oil in

Maastrichtian-Campanian sandstones which flowed 4,800 BOPD during a

restricted flow test, with analysis indicating a connected in-place

resource of more than 400 MMbbls in a single reservoir. However,

disappointing Maastrichtian-Campanian appraisal outcomes were

reported during the period on the eastern side of Kwaskwasi and at

Keskesi South-1.(4) In addition, during November 2021, the

Total/Apache consortium reported a non-commercial discovery at the

Bonboni-1 exploration well in the north of Block 58. This well

encountered high quality water bearing reservoirs in the primary

Maastrichtian-Campanian targets though a single Maastrichtian

sandstone contained 16m of net oil pay with an estimated 25(o) API

oil gravity.

Exploration drilling results continue to support the presence of

multiple plays, quality reservoirs and the potential for

stacked-pay drilling opportunities within the basin. Although the

Upper Cretaceous Maastrichtian-Campanian Liza play dominates in

terms of number of discoveries and discovered volumes to date the

deeper Santonian pools on Block 58, in conjunction with the deeper

hydrocarbons reported at Liza-3, Tripletail-1, Yellowtail-2,

Uaru-2, Turbot-2, Longtail-3, Hassa-1 and Fangtooth-1 on the

Strabroek Block, together with the hydrocarbon shows reported at

Sapote-1 on the Canje Block, and the logged net pay in the

Santonian-Coniacian intervals at Kawa-1 on the Corentyne Block, all

suggest an extensive emerging deeper play fairway within the basin.

Additional deep drilling with multiple targets is scheduled for

2022 at Beebei Potaro-1 (Repsol, Kanuku Block), at Wei-1 (CGX

Energy Inc., Corentyne Block), at Rasper-1 (Apache, Block 53) and

at Zanderij-1 (Shell, Block 42) where the operator is targeting the

Santonian and deeper intervals.

It is against this backdrop that the hydrocarbon plays and

prospect inventories on the Kaieteur and Canje blocks are being

reassessed - by integrating the analysis of the extensive core and

fluid samples collected during the 2020-2021 drilling campaigns, by

updating the regional petroleum system models and by high grading

prospects for the next phase of drilling.

Kaieteur Block

The first well on the Kaieteur block, Tanager-1, remains the

deepest well drilled in the Guyana-Suriname Basin to date. It was

spudded on 11 August 2020, using the Stena Carron drillship. The

well was drilled in a water depth of 2,900 metres and reached a

total depth of 7,633 metres circa mid-November 2021. Evaluation of

LWD, wireline logging and sampling data confirmed 16 metres of net

oil pay (20(o) API oil) in high-quality sandstone reservoirs of

Maastrichtian age. Although high quality reservoirs were also

encountered at the deeper Santonian and Turonian intervals, initial

interpretation of the reservoir fluids was reported to be

equivocal, requiring further analysis - results of which have yet

to be disclosed. Post well analysis and integration of the data

collected continues with a view to highgrading the next drilling

target on the Kaieteur block.

A post-well Netherland, Sewell & Associates Inc. ("NSAI")

published CPR (14 February 2021) indicates that the Tanager-1

Maastrichtian discovery contains a 'Best Estimate' Unrisked Gross

(2C) Contingent Oil Resource of 65.3 MMBBLs (Low to High Estimates

17.7 MMBBLs to 131 MMBBLs) - with a 'Best Estimate' Unrisked Net

(2C) Contingent Oil Resource attributable to the Kaieteur Block of

42.7 MMBBLs (Low to High Estimates 11.3 MMBBLs to 86 MMBBLs).

However, this discovery is currently considered to be

non-commercial as a standalone development.

Subsequent to the Tanager-1 discovery, on 24 May 2021, it was

announced that Hess Corporation ("Hess") had increased its working

interest ("WI") in the Kaieteur Block, offshore Guyana, from 15% to

20% via the farm-down of a 5% WI by Cataleya Energy Limited

("CEL"). Although the details of this farm-in transaction were not

disclosed, this farm-in, by one of the Stabroek block partners and

a leading player in the Guyana-Suriname basin, suggests confidence

in the prospective resource potential of the Kaieteur Block and

augurs well for the continuing exploration of the area.

On 23 August 2021 it was announced that the date for elective

nomination, by the operator, of the prospect target for the 2(nd)

well on the Kaieteur Block has been extended by seven months and on

22 March 2022 a further extension of the nomination date was agreed

to 2 October 2023. The Kaieteur Block partners agreed to this

extension to facilitate continuing geological and geophysical

analysis by the operator and integration of recent and ongoing deep

play drilling program results on adjacent blocks into the Kaieteur

prospect nomination decision. Under a farm-in agreement executed

with ExxonMobil (operator) in 2016, any drilling consequent to the

2(nd) well prospect nomination decision will commence within nine

months of the nomination date. The operator, as farminee, continues

to bear all farmor JV expenses during the prospect nomination

extension period.

In September 2021, the operator, ExxonMobil, submitted an

application for environmental authorization to the Environmental

Protection Agency (EPA) to proceed with a 12 well exploration

campaign on the Kaieteur Block.

The Kaieteur Block is currently operated by an ExxonMobil

subsidiary, Esso Production & Exploration Guyana Limited (35%),

with Cataleya Energy Limited ("CEL") (20%), Ratio Guyana Limited

("RGL") (25%) and a subsidiary of Hess Corporation, Hess Guyana

(Block B) Exploration Limited (20%) as partners. Westmount retains

a holding of approximately 5.3% of the issued share capital of

Cataleya Energy Corporation ("CEC") the parent company of CEL and

circa 0.04% of the issued share capital of Ratio Petroleum Energy

Limited Partnership ("Ratio Petroleum") the ultimate holding entity

with respect to RGL.

Canje Block

The first well on the Canje block, Bulletwood-1, was spudded on

31 December 2020 using the Stena Carron drillship and was completed

in early March 2021. The well was safely drilled in a water depth

of 2,846 metres to its planned target depth of 6,690 meters. The

primary target in the well was a Campanian age confined channel

complex. The well encountered quality reservoirs but non-commercial

hydrocarbons. There has been limited disclosure of the well results

to date as detailed analysis of the data collected is ongoing.

However, the initial results confirm the presence of the

Guyana-Suriname petroleum system and the potential prospectivity of

the Canje Block.

Initial drilling operations at the second well on the Canje

block, Jabillo-1, commenced on 14 March 2021 using the Stena Carron

drillship. Previously published information indicated that

Jabillo-1 was targeting a Late Cretaceous, Liza-age equivalent,

basin floor fan(2) . After interruption for a brief period of

maintenance work on the drillship drilling operations at Jabillo-1

recommenced circa the 5 June 2021 and were completed in early July.

The well was safely drilled in a water depth of 2,903 metres to its

planned target depth of 6,475 meters. The well did not encounter

commercial hydrocarbons.

The third well on the Canje block, Sapote-1, was spudded circa

29 August 2021, using the Stena DrillMAX drillship, and reached TD

in late October 2021. This well is located in the southeast of the

Canje Block, approximately 60kms north of the Campanian and

Santonian Maka Central-1 stacked pay discovery. The well was safely

drilled in a water depth of 2,549 metres to a total depth of 6,758

meters. It encountered non-commercial hydrocarbons in one of the

deeper exploration targets.

Westmount holds an indirect interest in the Canje Block as a

result of its circa 7.2% interest in the issued share capital of

JHI Associates Inc. ("JHI"). The company also holds an additional

indirect interest in the Canje Block as a result of its

shareholding in Eco (Atlantic) Oil and Ltd. ("EOG") and following

the investment in JHI Associates Inc. ("JHI") announced by EOG on

28 June 2021. Subsequent to this EOG transaction and a previous

2018 farm-out to Total JHI was fully carried/funded for the 2021

three well drilling campaign and is also funded for additional

drilling.

On 14 March 2022, EOG announced that it had signed a

Commercially Binding Term Sheet to acquire 100% of JHI, including

its wholly owned subsidiary JHI Associates (BVI) Inc., via a

cashless transaction.(5)

The Canje Block is currently operated by an ExxonMobil

subsidiary, Esso Exploration & Production Guyana Limited (35%),

with TotalEnergies E&P Guyana B.V. (35%), JHI Associates (BVI)

Inc. (17.5%) and Mid-Atlantic Oil & Gas Inc. (12.5%) as

partners.

Orinduik Block

Westmount continues to hold an indirect interest in the Orinduik

Block as a result of its circa 0.7% interest in the issued share

capital of Eco (Atlantic) Oil and Gas Ltd. ("EOG"). Over the last

nine months the focus of the Orinduik Block JV partners has been on

the analysis and assimilation of the 2019/20 drilling results and

data gathering program, the reprocessing and re-interpretation of

the 3D seismic data, and the highgrading of the Cretaceous light

oil prospect inventory with a view to target selection for the next

drilling campaign on the Orinduik Block.

The Orinduik Block is currently operated by Tullow Guyana B.V.

(60%), with TOQAP Guyana B.V. (25%) and EOG (15%) as partners.

TOQAP Guyana B.V. is jointly owned by TotalEnergies E&P Guyana

B.V. (60%) and Qatar Petroleum (40%).

Portfolio Effect

Westmount's investment strategy has been to provide shareholders

exposure to a portfolio of drilling outcomes in the Guyana-Suriname

Basin. Since 2019, we have participated, indirectly via our

investee companies, in six wells (Jethro-1, Joe-1, Tanager-1,

Bulletwood-1, Jabillo-1 and Sapote-1), offshore Guyana, which have

yielded three oil discoveries (Jethro, Joe and Tanager), but no

standalone commercial success to date. While these initial drilling

outcomes are below our expectations for the portfolio, the results

provide encouragement and must be viewed in the context of 'large

step-out' wells evaluating giant stratigraphic prospects while

seeking to establish the perimeter of the multiple Tertiary and

Cretaceous play fairways both to the northeast and southwest of the

prolific Stabroek block.

In any case, the drilling to date has confirmed the presence of

high-quality reservoirs of various stratigraphic ages in the

Kaieteur, Canje and Orinduik areas, which are capable of supporting

deep-water developments when containing commercial volumes of light

oil. Recent public domain presentation and commentary suggests that

trap adequacy and hydrocarbon migration/timing are the key

exploration risks inferred from these initial drilling results,

outwith of the Stabroek Block sweet-spot. These results together

with the analysis and synthesis of the extensive well data

gathering programs executed by the respective operators should

improve understanding of the plays, reduce sub-surface risk and

inform prospect selection for the next round of drilling on these

blocks. We remain hopeful that the geoscience learning curve

combined with the portfolio effect provided by drilling an extended

sequence of prospects in this prolific basin will win out over

individual prospect risks to yield a commercial discovery. We look

forward to the next drilling campaign across these blocks which

will commence as soon as the re-evaluation groundwork has been

completed. ExxonMobil, the operator of the Kaieteur and Canje

blocks, has already submitted an application for environmental

authorization to the Environmental Protection Agency (EPA) with

respect to potential 12 well drilling programs on both the Kaieteur

and Canje blocks.

Investment portfolio summary

As of 31 December 2021, Westmount had a cash balance of GBP1.1M

and is debt free.

Westmount continues to hold a total of 5,651,270 shares in JHI,

representing approximately 7.2% of the issued common shares in JHI

as of 28 June 2020.

Westmount continues to hold a total of 567,185 common shares in

CEC, representing approximately 5.3% of the issued share capital of

CEC as of 10 August 2020.

Westmount continues to hold 1,500,000 shares in EOG,

representing approximately 0.75% of the common shares in issue as

of 6 September 2021.

Westmount continues to hold 89,653 shares in Ratio Petroleum

representing approximately 0.04% of the issued share capital.

The reported financial loss for the period is primarily made up

of a non-cash loss on financial assets held at fair value through

the profit and loss, some of which is as a result of Foreign

Exchange movements on the portfolio Investments when valued at the

period end.

The proposed 'all paper' acquisition of JHI by EOG, announced on

14 March 2022, offers a consideration to JHI shareholders of 1.1994

new common shares in EOG for each JHI share held, which would lead,

upon completion, to JHI shareholders holding approximately 34% of

the enlarged issued share capital of EOG.(5) At the time of going

to press we are awaiting receipt of an information circular from

JHI with further details of the proposed transaction.

Summary/Outlook

Notwithstanding unprecedented volatility, some forecasters are

predicting USD$185/bbl by year end if Russian supply continues to

be disrupted though price rises in the near term might be tempered

via 'demand destruction' and/or a revived Iran nuclear deal and/or

the re-emergence of COVID-19 regional lockdowns in China. Longer

term the conflicting challenges of growing the global energy supply

by about 20 percent over the next 20 years while reaching net zero

emissions by 2050 is being undermined by underinvestment in the oil

and gas sector. As the 'unintended consequences' in 2021 have shown

energy transition is complex and multi-dimensional which suggests

that reliable sources of energy such as low cost, low carbon oil

and gas that can be rapidly commercialised, will have a role to

play in the energy system for decades to come.

Drilling activity in the Guyana-Suriname basin continues to

accelerate driven by the industry's focus on 'advantaged barrels'

as a result of the unique combination of prospect sizes, reservoir

quality, low carbon intensity and low breakeven metrics

($25/bbl-$35/bbl), that is available offshore Guyana. While the

initial drilling outcomes from the Westmount portfolio have yet to

deliver a standalone commercial discovery, the results to date

provide encouragement and must be viewed in the context of initial

'large step-out' wells evaluating giant stratigraphic prospects

while seeking to establish the perimeter of the multiple play

fairways both to the northeast and southwest of the prolific

Stabroek block. We are also heartened by the industry's continuing

appetite for exploration acreage in the Guyana-Suriname basin -

such as the Hess 5% farm-in on the Kaieteur Block (post Tanager-1)

and the award of three blocks in the Surinamese Shallow Offshore

Bid Round 2020/21 to Chevron (Block 5) and TotalEnergies + Qatar

Petroleum (Blocks 6 and 8). Furthermore, the applications for

environmental authorisation submitted to the Guyanese EPA by

ExxonMobil the operator of the Canje and Kaieteur blocks augurs

well for potentially extensive new drilling programs on these

blocks after the re-evaluation groundwork is completed.

Westmount's strategy remains one of offering shareholders

exposure to high impact drilling outcomes. Our primary investee

companies CEC, JHI and EOG are well funded for participation in

near term drilling opportunities. Consolidation manoeuvres may

bring book value realignment while offering risk diversification

and exposure to multiple additional high impact drilling events. In

this context, and in spite of the access challenges, your Board

remains focused on investment opportunities and deployment of

capital that gives additional exposure to drilling in emerging

basins. There are likely to be more consolidation opportunities

amongst the junior players within the Guyana-Suriname Basin, as

exploration matures and in response to risk management demands of

investor capital.

GERARD WALSH

Chairman

28 March 2022

Notes

(1) ExxonMobil 2022 Investor Day Presentation.

(2) Hess 4(th) Quarter 2021 Conference Call Remarks.

(3) CGX Energy Inc. News Releases 2 March 2022 and 4 March

2022.

(4) APA Corporation News Releases 29 July, 29 September and 16

November 2021; 21 February 2022.

(5) Eco (Atlantic) Oil & Gas Ltd. News Release 14 March

2022.

For further information, please contact:

Westmount Energy Limited www.westmountenergy.com

David King, Director Tel: +44 (0) 1534 823059

Anita Weaver

Cenkos Securities plc (Nomad and Tel: +44 (0) 20 7397 8900

Broker)

Nicholas Wells / Neil McDonald (Corporate

Finance)

CONDENSED STATEMENT OF COMPREHENSIVE INCOME

FOR THE PERIODED 31 DECEMBER 2021

Six months Six months Year ended

ended ended

31 Dec 2021 31 Dec 2020 30 Jun 2021

(unaudited) (unaudited) (audited)

GBP GBP GBP

Net loss on

financial

assets held at

fair

value through

profit

or loss (6,895,191) (954,021) (692,288)

Net (loss) /

gain on

financial

liabilities

held at fair

value through

profit or loss - (13,370) 103,205

Finance costs - (21,980) (33,702)

Administration (267,397)

expenses (128,466) (165,217)

FX gain / (100,160)

(loss) 4,187 (89,482)

Share options (25,877)

expense (12,938) (998)

---------------------------------------------------------------------------------------------------------------------------------- -------------------------------------------------------------------- --------------------------------------------------------------------

Operating loss (7,032,408) (1,245,068) (1,016,219)

Loss before tax (7,032,408) (1,245,068) (1,016,219)

Tax - - -

Comprehensive

loss for

the period /

year (7,032,408) (1,245,068) (1,016,219)

================================================================================================================================== ==================================================================== ====================================================================

Basic loss per

share

(pence) (4.88) (0.91) (0.72)

---------------------------------------------------------------------------------------------------------------------------------- -------------------------------------------------------------------- --------------------------------------------------------------------

Diluted loss

per share

(pence) (4.87) (0.91) (0.69)

---------------------------------------------------------------------------------------------------------------------------------- -------------------------------------------------------------------- --------------------------------------------------------------------

All results are derived from continuing operations.

The Company had no items of other comprehensive income during

the period / year.

CONDENSED STATEMENT OF FINANCIAL POSITION

AS AT 31 DECEMBER 2021

31 Dec 2021 31 Dec 2020 30 Jun 2021

(unaudited) (unaudited) (audited)

GBP GBP GBP

ASSETS

Non-current

assets

Financial

assets at

fair

value

through

profit or

loss 7,570,440 13,766,866 14,465,631

---------------------------------------------------------------------------------------------------------------------------------- ---------------------------------------------------------------------------------------------------------------------------------- -------------------------------------------------------------------

7,570,440 13,766,866 14,465,631

Current assets

Other 4,441

receivables 4,519 1,106

Cash and 1,218,922

cash

equivalents 1,094,101 2,245,047

---------------------------------------------------------------------------------------------------------------------------------- ---------------------------------------------------------------------------------------------------------------------------------- -------------------------------------------------------------------

1,098,620 2,246,153 1,223,363

---------------------------------------------------------------------------------------------------------------------------------- ---------------------------------------------------------------------------------------------------------------------------------- -------------------------------------------------------------------

Total assets 8,669,060 16,013,019 15,688,994

================================================================================================================================== ================================================================================================================================== ===================================================================

LIABILITIES AND EQUITY

Current liabilities

Trade and

other

payables 39,070 55,885 39,534

Derivative

financial

instruments - 146,703 -

Borrowings - 414,699 -

---------------------------------------------------------------------------------------------------------------------------------- ---------------------------------------------------------------------------------------------------------------------------------- -------------------------------------------------------------------

39,070 617,287 39,534

---------------------------------------------------------------------------------------------------------------------------------- ---------------------------------------------------------------------------------------------------------------------------------- -------------------------------------------------------------------

Total

liabilities 39,070 617,287 39,534

---------------------------------------------------------------------------------------------------------------------------------- ---------------------------------------------------------------------------------------------------------------------------------- -------------------------------------------------------------------

EQUITY

Share 16,652,482

capital 16,652,482 16,652,482

Share option 469,670

account 482,608 444,791

Retained (1,472,692)

earnings (8,505,100) (1,701,541)

---------------------------------------------------------------------------------------------------------------------------------- ---------------------------------------------------------------------------------------------------------------------------------- -------------------------------------------------------------------

Total equity 8,629,990 15,395,732 15,649,460

Total

liabilities

and equity 8,669,060 16,013,019 15,688,994

================================================================================================================================== ================================================================================================================================== ===================================================================

CONDENSED STATEMENT OF CHANGES IN EQUITY

FOR THE PERIODED 31 DECEMBER 2021

Share capital Share option Retained

account account earnings Total equity

GBP GBP GBP GBP

----------------------------- --------------- -------------- ------------- --------------

As at 1 July 2020 13,955,623 443,793 (456,473) 13,942,943

Comprehensive Income Loss

for the year ended 30

June 2021 - - (1,016,219) (1,016,219)

Share issue 2,696,859 - - 2,696,859

Transactions with owners

Share options expense - 25,877 - 25,877

As at 30 June 2021 16,652,482 469,670 (1,472,692) 15,649,460

------------------------------ --------------- -------------- ------------- --------------

Comprehensive Income

Loss for the period ended

31 December 2021 - - (7,032,408) (7,032,408)

Transactions with owners

Share options expense - 12,938 - 12,938

As at 31 December

2021 16,652,482 482,608 (8,505,100) 8,629,990

------------------------------ --------------- -------------- ------------- --------------

Share capital Share option Retained Total

account account earnings equity

GBP GBP GBP GBP

---------------------------- --------------- -------------- ----------- ------------

As at 1 July 2019 5,829,872 444,846 (344,980) 5,929,738

Comprehensive Income

Profit for the year ended

30 June 2020 - - (111,493) (111,493)

Share issue 8,125,751 - - 8,125,751

Transactions with owners

Share options

credit - (1,053) - (1,053)

As at 30 June

2020 13,955,623 443,793 (456,473) 13,942,943

----------------------------- --------------- -------------- ----------- ------------

CONDENSED STATEMENT OF CASH FLOWS

FOR THE PERIODED 31 DECEMBER 2021

Six months Six months

ended ended Year ended

31 Dec 31 Dec

2021 2020 30 Jun 2021

(unaudited) (unaudited) (audited)

GBP GBP GBP

Cash flows from operating

activities

Total comprehensive loss for

the period / year (7,032,408) (1,245,068) (1,016,219)

Adjustments for:

Net loss on financial assets

at fair value through profit

or loss 6,895,191 954,021 692,288

Net loss / (gain) on financial

liabilities at fair value

through profit or loss - 13,370 (103,205)

Interest on borrowings - 21,980 33,702

Share options expense 12,938 998 25,877

Movement in other receivables (78) (1,106) (4,441)

Movement in trade and other

payables (464) 9,479 (6,874)

Purchase of investments - (2,997,161) (737,334)

Proceeds from sale of investments - 356,011 356,011

---------------------------------------------------------------------------------------------------------------------------------- -------------------------------------------------------------------- -------------------------------------------------------------------

Net cash out flow from operating

activities (124,821) (2,887,476) (760,194)

--------------------------------------------------------------------- -------------------------------------------------------------------- -------------------------------------------------------------------

Cash flows from financing

activities

Repayment of convertible loan

notes - - (456,548)

Proceeds from issue of ordinary

shares - 2,696,859 -

--------------------------------------------------------------------- -------------------------------------------------------------------- -------------------------------------------------------------------

Net cash generated from financing

activities - 2,696,859 (456,548)

---------------------------------------------------------------------------------------------------------------------------------- -------------------------------------------------------------------- -------------------------------------------------------------------

Net decrease in cash and cash

equivalents (124,821) (190,617) (1,216,742)

Cash and cash equivalents

at the beginning of the period

/ year 1,218,922 2,435,664 2,435,664

---------------------------------------------------------------------------------------------------------------------------------- -------------------------------------------------------------------- -------------------------------------------------------------------

Cash and cash equivalents

at the end of the period /

year 1,094,101 2,245,047 1,218,922

---------------------------------------------------------------------------------------------------------------------------------- -------------------------------------------------------------------- -------------------------------------------------------------------

NOTES TO THE UNAUDITED CONDENSED FINANCIAL STATEMENTS

FOR THE PERIODED 31 DECEMBER 2021

1. Accounting Policies

Basis of accounting

The interim financial statements have been prepared in

accordance with the International Accounting Standard ("IAS") 34,

Interim Financial Reporting.

The interim financial statements do not include all the

information and disclosures required in the annual financial

statements and should be read in conjunction with the Company's

annual financial statements for the year ended 30 June 2021. The

annual financial statements have been prepared in accordance with

International Financial Reporting Standards ("IFRS").

The same accounting policies and methods of computation are

followed in the interim financial statements as in the Company's

annual financial statements for the year ended 30 June 2021.

2. Investments

Six

months Year

Six months ended ended

ended 31 30

31 December December June

2021 2020 2021

(unaudited) (unaudited) (audited)

GBP GBP GBP

Argos Resources

Limited, at market

value 12,400 21,300 27,300

Cost, 1,000,000

shares 310,775 310,775 310,775

(31 December 2020:

1,000,000 shares,

30 June 2021:

1,000,000 shares)

Cataleya Energy

Corporation, at

market

value 4,204,032 4,149,230 4,105,846

Cost, 567,185

shares 4,518,215 4,518,215 4,518,215

(31 December 2020:

567,185, 30 June

2021: 567,185

shares)

Eco Atlantic Oil &

Gas Oil Limited,

at market value 273,000 348,000 433,500

Cost, 1,500,000

shares 240,000 240,000 240,000

(31 December 2020:

1,500,000 shares,

30 June 2021:

1,500,000 shares)

JHI Associates Inc,

at market value 3,072,878 9,245,741 9,884,072

Cost, 5,651,270

shares 7,770,027 7,355,249 7,770,027

31 December 2020:

5,363,770 shares,

30 June 2021:

5,651,270 shares)

Ratio Petroleum

Energy Limited

Partnership

shares, at market

value 8,130 - 14,913

Cost, 89,653 shares 22,256 - 22,256

(31 December 2020:

nil shares, 30

June 2021: 89,653

shares)

Ratio Petroleum - 2,595 -

Energy Limited

Partnership

warrants, at market

value

Cost, nil warrants - 48,200 -

(31 December 2020:

89,653 warrants,

30 June 2021:nil

warrants)

Total market value 7,570,440 13,766,866 14,465,631

------------------------------------------------------------------- ---------------------------------------------------------------- -------------------------------------------------------------

Total cost 12,861,273 12,472,439 12,861,273

------------------------------------------------------------------- ---------------------------------------------------------------- -------------------------------------------------------------

Total fair value

adjustment (5,290,833) 1,294,427 1,604,358

Reverse prior year

fair value

adjustment (1,604,358) (2,191,025) (2,191,024)

------------------------------------------------------------------- ---------------------------------------------------------------- -------------------------------------------------------------

Current period fair

value movement (6,895,191) (896,598) (586,666)

------------------------------------------------------------------- ---------------------------------------------------------------- -------------------------------------------------------------

Realised loss - (57,423) (105,622)

Unrealised loss (6,895,191) (896,598) (586,666)

------------------------------------------------------------------- ---------------------------------------------------------------- -------------------------------------------------------------

Current period

income statement

impact (6,895,191) (954,021) (692,288)

------------------------------------------------------------------- ---------------------------------------------------------------- -------------------------------------------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FLFLRVVITFIF

(END) Dow Jones Newswires

March 29, 2022 02:00 ET (06:00 GMT)

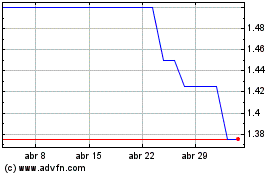

Westmount Energy (LSE:WTE)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Westmount Energy (LSE:WTE)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024