TIDMTRT

RNS Number : 2718R

Transense Technologies PLC

05 July 2022

Transense Technologies plc

("Transense" or the "Company")

Year End Trading Update

Transense Technologies plc (AIM: TRT), the developer of

specialist sensor systems, is pleased to provide a trading update

for the financial year ended 30 June 2022 based on unaudited

management information.

Highlights

-- Results for the year in line with market expectations

-- Strong royalty and sales revenue growth

-- Progress in product and business development across all divisions

-- Cash balanced maintained, despite spending circa GBP0.30m on

a share buyback programme - and with the next quarterly royalty

payment of not less than GBP0.43m due in July

-- Resilient business model leads to Board confidence in growth prospects

Revenue, EBITDA & Cash

Revenue for the year has increased by almost 50% to around

GBP2.6m, which is line with market expectations. Adjusted EBITDA*

is also expected to be in line with market expectations, and net

earnings may exceed market expectations as a consequence of an

increased tax credit arising from extending the recognition of

deferred tax assets arising from prior years' losses.

Net cash balances at 30 June 2022 amounted to GBP1.05m (FY21:

GBP1.04m). Trading was cash generative and the Company invested

approximately GBP0.30m in the share buyback programme announced in

February 2022. Royalties for the final quarter of the financial

year, receivable at the end of July 2022, are expected to be not

less than GBP0.43m, further strengthening the available cash

position of the Company.

iTrack Royalties

The underlying royalty income for the financial year from iTrack

increased by more than 75% compared with the prior year, reaching

US$2m. Royalty income is denominated in US dollars, which has

strengthened against Sterling during the year to a level slightly

more favourable than the exchange prevailing at the outset of the

licence in June 2020. The run rate of royalty income now exceeds

GBP1.85m per annum at current exchange rates, representing an

almost threefold increase since inception of the deal.

Surface Acoustic Wave (SAW)

Revenues were above those of the prior year, primarily due to

the sale of torque management systems for motor sport applications

and technical support on pre-production projects, including for the

GE T901 engine programme. In addition, the Company began to realise

income from claims under the Technology Developer Accelerator

Programme ("TDAP") grant announced in May 2022, which could in

total amount to GBP0.13m by the end of FY23.

Business development activities have been expanded and continue

to generate positive responses. The feedback obtained affirms

potential demand for SAW technology across a broad range of

applications, including torque and temperature measurement to

improve the control and efficiency of electric motor drive units.

This in turn has led the Company to commit additional engineering

resource, with key appointments including the new Technical

Director announced recently. Costs attributable to the SAW business

have been contained within budgets set out in the Company's

internal business plan and are also in line with market

expectations.

Translogik

Translogik tyre probe revenues continue to deliver strong growth

with an increase of more than 15% over the prior year. Due to

careful management and close co-operation with key suppliers, the

well publicised shortages of electronic components has not had any

material impact on product availability, and margins have been

protected, partly as a consequence of a high proportion of sales

arising outside the U.K. and denominated in US dollars and

Euros.

The new modular TLGX range is now well established and has been

adopted by a number of leading global tyre original equipment

manufacturers (OEMs) as the hardware choice to complement their

fleet tyre management solutions. As previously reported, the

original TL-G1 probe is being phased out and will shortly be

entirely replaced by the TLGX range.

Not all Tyre Management Systems are operated directly by these

OEMs. We are increasingly engaging with both software and hardware

companies who have a very broad customer base ranging from OEMs to

logistics operations, and this has opened up further new exciting

opportunities for future growth.

Outlook

The directors are mindful that global economic conditions are

likely to become even more challenging in coming months, however,

they consider that the Company's business model provides

considerable resilience. The momentum that has built up in royalty

income now generates sufficient net income to comfortably cover

fixed overheads, and Translogik revenue generated in a

business-to-business setting is expected to be more reliable than

mainstream consumer markets. Furthermore, the directors continue to

believe that controlled investment in SAW technology, supported by

customer contributions and grant income, offers opportunities to

deliver significant levels of commercial revenue in future.

Accordingly, the Board is optimistic about growth prospects despite

the gathering economic headwinds.

Final audited results for the year ended 30 June 2022 and a more

detailed trading update are expected to be released around the end

of September 2022.

* Adjusted EBITDA refers to net earnings before interest,

taxation, depreciation and amortisation adjusted for the cost of

share based payments.

For further information please visit www.transense.com or

contact:

Transense Technologies plc Via Walbrook PR

Nigel Rogers (Executive Chairman)

Melvyn Segal (CFO)

Allenby Capital (Nominated Adviser and Tel: +44 (0)20 3328

Broker) 5656

Jeremy Porter / George Payne (Corporate

Finance)

Tony Quirke (Sales & Corporate Broking)

Walbrook PR Tel: +44 (0)20 7933

Tom Cooper / Nick Rome 8780

Transense@walbrookpr.com

Notes to Editors:

Transense is a developer of specialist wireless sensor systems

used to enable real-time data gathering and monitoring. Products

include the patent protected Surface Acoustic Wave (SAW) sensor

technology, used to improve equipment power, performance,

reliability and efficiency; iTrack, Transense 's Tyre Pressure

Monitoring System, licensed to Bridgestone Corporation, the world's

largest tyre producer, under a ten-year deal in June 2020; and a

range of intelligent tyre monitoring equipment under the Translogik

brand. Target sectors include automotive, aerospace, industrial,

green energy, rail and marine.

The Group's strategy is to maximise shareholder value through

the delivery of sustained revenue growth from all three principal

technologies - SAW, iTrack and Translogik probes - through

leveraging excellence in innovation, know-how in commercialising

technologies, industry partnerships and exposure to global growth

markets.

Transense is headquartered in Oxfordshire, UK, and was admitted

to trading on AIM, a market operated by the

London Stock Exchange (AIM: TRT), in 1999. www.transense.com

For further information please contact transense@walbrookpr.com

.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTUSUNRUOUBRAR

(END) Dow Jones Newswires

July 05, 2022 02:00 ET (06:00 GMT)

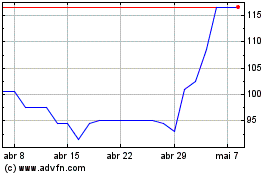

Transense Technologies (LSE:TRT)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Transense Technologies (LSE:TRT)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024