TIDMTAN

RNS Number : 8320Y

Tanfield Group PLC

09 September 2022

This announcement contains inside information for the purposes

of Article 7 of the UK version of Regulation (EU) No 596/2014 which

is part of UK law by virtue of the European Union (Withdrawal) Act

2018, as amended ("MAR"). Upon the publication of this announcement

via a Regulatory Information Service, this inside information is

now considered to be in the public domain.

Tanfield Group Plc

("Tanfield" or "the Company")

Interim Results for the six-month period to 30 June 2022

Tanfield, an investing company as defined by AIM Rules,

announces its half year results for the period ending 30 June 2022.

The unaudited financial information will shortly be available on

the Company website at www.tanfieldgroup.com .

Background

-- Tanfield is a 49% shareholder in the equity of Snorkel

International Holdings LLC ("Snorkel") following the joint venture

between the Company and Xtreme Manufacturing LLC ("Xtreme") (the

"Contemplated Transaction"), a company owned by Don Ahern of Ahern

Rentals Inc, relating to Snorkel, in October 2013 .

-- T he Snorkel investment is valued at GBP19.1m. The outcome of

the US and UK Proceedings referenced below could have an impact on

this valuation.

-- On 22 October 2019, the Company announced that it had

received a Summons and Complaint, filed in Nevada (the "US

Proceedings") by subsidiaries of Xtreme, relating to the

Contemplated Transaction .

-- On 24 October 2019, the Company announced it had become

necessary to issue and serve a claim in the English High Court

against Ward Hadaway (the "UK Proceedings"), the solicitor acting

for the Company at the time of the Contemplated Transaction, in

order to fully protect the Company's rights pending the outcome of

the US Proceedings.

-- On 26 February 2021, Ward Hadaway was granted permission to

join Foulston Siefkin, Tanfield's US based law firm who were

retained in 2013 to draft the documents governed by US law relating

to the Contemplated Transaction, into the UK Proceedings. As a

result, the Company amended its claim to include Foulston Siefkin

as a second defendant.

-- The Company's operating loss in H1 2022 increased to GBP311k

(H1 2021: GBP187k) as a consequence of increased legal fees during

the period, with the retained loss for the period increasing

further to GBP499k (H1 2021: GBP268k) as a consequence of increased

finance expense.

-- The Board believe that further loan funding may be necessary

to ensure that the Company continues to protect its investment in

Snorkel. As announced on 24 August 2022, the Company continues to

receive the support of its Shareholders via loan note subscriptions

in order to provide the necessary funding for its day-to-day

running costs, including the ongoing costs of the US and UK

Proceedings, and the Board are of the opinion that further funding

will be made available.

Overview of investments

As announced on 24 August 2022, during the first 6 months of

2022 Snorkel has continued to recover from the impact of the global

COVID-19 pandemic and has seen sales in the first 6 months increase

to US$88.6m, up from US$71.7m for the same period in 2021. Further

information relating to the recent performance of Snorkel can be

found in the 24 August 2022 announcement.

The Board confirm that both the US and UK Proceedings are

continuing to progress and that the Board believes a positive

outcome to either/both proceedings is possible. So far as it is

necessary, the Company will continue to vigorously defend and

advance its position in both proceedings, whilst continuing to seek

advice.

Further updates will be provided to Shareholders as and when

appropriate.

For further information:

Tanfield Group Plc 020 7220 1666

Daryn Robinson

WH Ireland Limited - Nominated Advisor / Broker

James Joyce / Megan Liddell 020 7220 1666

STATEMENT OF COMPREHENSIVE INCOME

FOR THE SIX MONTHSING 30 JUNE

2022

Year

to

Six months Six months 31 Dec

to to 21

30 Jun 30 Jun

22 (unaudited) 21 (unaudited) (audited)

GBP000's GBP000's GBP000's

------------------------------ ----- ---- ------------------- ----------------- ------------

Revenue - - -

Staff costs (52) (51) (93)

Other operating income 10 9 19

Other operating expenses (269) (145) (295)

-------------------------------------------- ------------------ ----------------- ------------

Loss from operations (311) (187) (369)

Finance expense (188) (81) (145)

Finance income - - -

------------------------------ ----- ----- ------------------ ----------------- ------------

Net finance expense (188) (81) (145)

Loss from operations before

tax (499) (268) (514)

Taxation - - -

------------------------------ ----- ----- ------------------ ----------------- ------------

Loss & total comprehensive income for

the period attributable to equity

shareholders (499) (268) (514)

-------------------------------------------- ------------------ ----------------- ------------

Loss per share from

operations

Basic and diluted (p) (0.31) (0.16) (0.32)

BALANCE SHEET

AS AT 30 JUNE 2022

30 Jun 30 Jun 31 Dec

22 21 21

(unaudited) (unaudited) (audited)

GBP000's GBP000's GBP000's

------------------------------------ ----- ----- -------------- -------------- ------------

Non current assets

Non current Investments 19,100 19,100 19,100

-------------------------------------------------- -------------- -------------- ------------

19,100 19,100 19,100

----- ----- -------------- -------------- ------------

Current assets

Trade and other receivables 67 36 23

Cash and cash equivalents 1,368 739 588

-------------------------------------------------- -------------- -------------- ------------

1,435 775 611

----- ----- -------------- -------------- ------------

Total assets 20,535 19,875 19,711

-------------------------------------------------- -------------- -------------- ------------

Current liabilities

Trade and other payables 132 54 72

-------------------------------------------------- -------------- -------------- ------------

132 54 72

----- ----- -------------- -------------- ------------

Non-current liabilities

Other payables 2,958 1,631 1,695

-------------------------------------------------- -------------- -------------- ------------

2,958 1,631 1,695

----- ----- -------------- -------------- ------------

Total liabilities 3,090 1,685 1,767

-------------------------------------------------- -------------- -------------- ------------

Equity

Share capital 8,145 8,145 8,145

Share premium 17,336 17,336 17,336

Share option reserve - 331 -

Special reserve 66,837 66,837 66,837

Merger reserve 1,534 1,534 1,534

Retained earnings (76,407) (75,993) (75,908)

-------------------------------------------------- -------------- -------------- ------------

Total equity 17,445 18,190 17,944

-------------------------------------------------- -------------- -------------- ------------

Total equity and total liabilities 20,535 19,875 19,711

-------------------------------------------------- -------------- -------------- ------------

STATEMENT OF CHANGES IN EQUITY

Share Share Share Merger Special Retained Total

capital premium option reserve reserve earnings

reserve

GBP000's GBP000's GBP000's GBP000's GBP000's GBP000's GBP000's

--------------- --------- --------- --------- --------- --------- --------- ----------

Six months to

30 June 2022

(unaudited)

At 1 January

2022 8,145 17,336 - 1,534 66,837 (75,908) 17,944

--------------- --------- --------- --------- --------- --------- --------- ----------

Comprehensive

income

Loss for the

period - - - - - (499) (499)

--------------- --------- --------- --------- --------- --------- --------- ----------

Total

comprehensive

income

for the

period - - - - - (499) (499)

At 30 June

2022 8,145 17,336 - 1,534 66,837 (76,407) 17,445

--------------- --------- --------- --------- --------- --------- --------- ----------

Six months to 30 June

2021

(unaudited)

At 1 January

2021 8,145 17,336 331 1,534 66,837 (75,725) 18,458

--------------- --------- --------- --------- --------- --------- --------- ----------

Comprehensive

income

Loss for the

period - - - - - (268) (268)

--------------- --------- --------- --------- --------- --------- --------- ----------

Total

comprehensive

income

for the

period - - - - - (268) (268)

--------------- --------- --------- --------- --------- --------- --------- ----------

At 30 June

2021 8,145 17,336 331 1,534 66,837 (75,993) 18,190

--------------- --------- --------- --------- --------- --------- --------- ----------

Year to

December 2021

(audited)

At 1 January

2021 8,145 17,336 331 1,534 66,837 (75,725) 18,458

--------------- --------- --------- --------- --------- --------- --------- ----------

Comprehensive

income

Loss for the

year - - - - - (514) (514)

--------------- --------- --------- --------- --------- --------- --------- ----------

Total

comprehensive

income

for the year - - - - - (514) (514)

Transactions

with owners

in their

capacity as

owners:-

Share based

payments (331) 331 -

--------------- --------- --------- --------- --------- --------- --------- ----------

At 31 December

2021 8,145 17,336 - 1,534 66,837 (75,908) 17,944

--------------- --------- --------- --------- --------- --------- --------- ----------

CASH FLOW STATEMENT

FOR THE SIX MONTHSING 30 JUNE 2021

Year

to

31 Dec

21

Six months Six months

to 30 to 30

Jun 22 Jun 21

(unaudited) (unaudited) (audited)

GBP000's GBP000's GBP000's

------------------------------------------- ----- ------------- ------------- ------------

Loss from operations (499) (268) (514)

Adjustment for:

Finance costs 188 81 145

Changes in operating assets and

liabilities / working capital:

(Increase)/decrease in receivables (44) (12) 1

Increase/(decrease) in payables 60 (36) (18)

-------------------------------------------------- ------------- ------------- ------------

Net cash used in operating activities (295) (235) (386)

-------------------------------------------------- ------------- ------------- ------------

Cash flow from financing activities

Proceeds from borrowings 1,075 450 450

-------------------------------------------------- ------------- ------------- ------------

Net cash generated by financing

activities 1,075 450 450

-------------------------------------------------- ------------- ------------- ------------

Net increase in cash and cash equivalents 780 215 64

Cash and cash equivalents at the

start of period 588 524 524

-------------------------------------------------- ------------- ------------- ------------

Cash and cash equivalents at the

end of the period 1,368 739 588

-------------------------------------------------- ------------- ------------- ------------

1 Basis of preparation

The Interim Report of the Company for the six months ended 30 June

2022 has been prepared in accordance with AIM Rule 18 and not in

accordance with IAS34 "Interim Financial Reporting" therefore is

not fully in compliance with IFRS.

The half year report does not constitute financial statements as

defined in Section 434 of the Companies Act 2006 and does not include

all of the information and disclosures required for full annual

statements. It should be read in conjunction with the annual report

and financial statements for the year ended 31 December 2021 which

is available on request from the Company's registered office, c/o

Weightmans LLP, 1 St James' Gate, Newcastle upon Tyne, NE99 1YQ

or can be downloaded from the corporate website www.tanfieldgroup.com.

2 Accounting Policies

Impact of accounting standards to be applied in future periods

There are a number of standards and interpretations which have

been issued by the International Accounting Standards Board that

are effective for periods beginning subsequent to 31 December 2022

that the Group has decided not to adopt early. The Group does not

believe these standards and interpretations will have a material

impact on the financial statements once adopted.

3 Loss per share

The calculation of the basic and diluted loss per share is based

on the following data:

Year

Six months Six months to

to 30 31 Dec

to 30 Jun 22 Jun 21 21

Number of shares 000's 000's 000's

-------------------------------------------------------- ---- ------------- ----------- ---------

Weighted average number of ordinary shares

for the purposes of basic earnings per

share 162,907 162,907 162,907

-------------------------------------------------------------- ------------- ----------- ---------

Loss From operations GBP000's GBP000's GBP000's

-------------------------------------------------------- ---- ------------- ----------- ---------

Loss for the purposes of basic earnings

per share being net profit attributable

to owners of the parent (499) (268) (514)

-------------------------------------------------------------- ------------- ----------- ------------

Loss per share from operations

Basic and diluted (p) (0.31) (0.16) (0.32)

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR UPUUPBUPPGAR

(END) Dow Jones Newswires

September 09, 2022 02:00 ET (06:00 GMT)

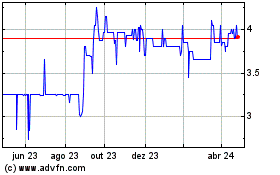

Tanfield (LSE:TAN)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

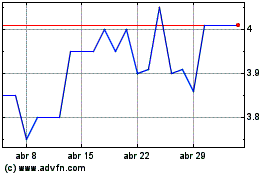

Tanfield (LSE:TAN)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025