Transense Technologies PLC Share Repurchase Programme (7146A)

27 Setembro 2022 - 3:02AM

UK Regulatory

TIDMTRT

RNS Number : 7146A

Transense Technologies PLC

27 September 2022

The information communicated within this announcement is deemed

to constitute inside information as stipulated under the Market

Abuse Regulations (EU) No. 596/2014 which is part of UK law by

virtue of the European Union (withdrawal) Act 2018. Upon the

publication of this announcement, this inside information is now

considered to be in the public domain.

27 September 2022

Transense Technologies plc

("Transense", or "the Company")

Share Repurchase Programme

Transense Technologies plc (AIM: TRT), the developer of

specialist sensor systems, is pleased to announce that it will

commence a programme to conduct market purchases of ordinary shares

of 10 pence each in the Company ("Ordinary Shares") up to a maximum

aggregate purchase price of GBP650,000 (the "Programme").

The Company has entered into an arrangement with Shard Capital

Stockbrokers ("Shard") in relation to the Programme where Shard

will make the trading decisions concerning the timing of the market

purchases of Ordinary Shares independently of and uninfluenced by

the Company, with such trading decisions being in accordance with

the terms of the Programme. Purchases may continue during any

periods during the term of the Programme when the Company itself

would be prohibited from dealing by the UK version of the Market

Abuse Regulation 596/2014/EU (which is part of UK law by virtue of

the European Union (Withdrawal) Act 2018) ("UK MAR"). The Company

reserves the right to terminate the Programme if at any time it

deems this to be appropriate and would make an announcement in

advance of so doing.

The Company confirms that it currently has no unpublished inside

information.

The Programme will commence today, 27 September 2022, and will

continue until 30 November 2023 unless terminated earlier.

The Programme will be conducted by the Company in accordance

with and under the terms of the general authority granted by the

Company's shareholders at the Company's Annual General Meeting on

23 November 2021 to purchase up to 1,643,774 Ordinary Shares. This

authority will expire at the earlier of the end of the next Annual

General Meeting of the Company or 23 February 2023. Purchases under

the Programme prior to the Annual General Meeting of the Company to

be held on 1 December 2022 will be restricted to an aggregate of

GBP150,000, and the balance of the Programme will continue after

the Annual General Meeting subject to renewal of the appropriate

authority by the shareholders.

Any market purchases will be conducted in compliance with the

following restrictions regarding price conditions:

-- the minimum price (exclusive of any expenses) at which any

Ordinary Share may be purchased shall be its nominal value of 10

pence

-- the maximum price (exclusive of any expenses) at which any

Ordinary Share may be purchased shall be the higher of: (i) an

amount equal to 5 per cent, above the average of the middle market

quotations of an Ordinary Share as derived from the London Stock

Exchange Daily Official List for the five business days immediately

preceding the date of such purchase, and (ii) the higher of the

price of the last independent trade and the highest current

independent bid on the trading venue where the purchase is carried

out.

Due to the limited liquidity in the Ordinary Shares, any market

purchase of Ordinary Shares pursuant to the Programme on any

trading day could represent a significant proportion of the daily

trading volume in the Ordinary Shares on AIM and could exceed 25

per cent. of the average daily trading volume. This means that the

Company will not benefit from the exemption contained in Article

5(1) of UK MAR.

The objective of the Programme is to offset the dilutive impact

of share awards to directors and employees.

Ordinary Shares acquired as a result of the Programme will be

held by the Company in treasury and in accordance with the

Companies Act 2006, will not have any voting rights. It is

anticipated that any Ordinary Shares held in treasury but surplus

to unexercised option requirements from time to time will be

cancelled.

For further information please visit www.transense.com or

contact:

Transense Technologies plc Via Walbrook PR

Nigel Rogers (Executive Chairman)

Melvyn Segal (CFO)

Allenby Capital (Nominated Adviser and Broker) Tel: +44 (0)20

Jeremy Porter / George Payne (Corporate Finance) 3328 5656

Tony Quirke (Sales & Corporate Broking)

Walbrook PR Tel: +44 (0)20

Tom Cooper / Nick Rome 7933 8780

Transense@walbrookpr.com

Notes to Editors:

Transense is a developer of specialist wireless sensor systems

used to enable real-time data gathering and monitoring. Products

include the patent protected Surface Acoustic Wave (SAW) sensor

technology, used to improve equipment power, performance,

reliability and efficiency; iTrack, Transense 's Tyre Pressure

Monitoring System, licensed to Bridgestone Corporation, the world's

largest tyre producer, under a ten-year deal in June 2020; and a

range of intelligent tyre monitoring equipment under the Translogik

brand. Target sectors include aerospace, electric motors &

drives, industrial machinery and performance automotive.

The Company 's strategy is to maximise shareholder value through

the delivery of sustained revenue growth from all three principal

technologies - SAW, iTrack and Translogik probes - through

leveraging excellence in innovation, know-how in commercialising

technologies, industry partnerships and exposure to global growth

markets.

Transense is headquartered in Oxfordshire, UK, and was admitted

to trading on AIM, a market operated by the

London Stock Exchange (AIM: TRT), in 1999. www.transense.com .

For further information please contact transense@walbrookpr.com .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

POSFLFEAARIRFIF

(END) Dow Jones Newswires

September 27, 2022 02:02 ET (06:02 GMT)

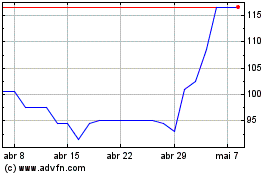

Transense Technologies (LSE:TRT)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Transense Technologies (LSE:TRT)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024