TIDMMSYS

RNS Number : 2520B

Microsaic Systems plc

30 September 2022

30 September 2022

Microsaic Systems plc

("Microsaic", "Microsaic Systems" or the "Company")

Interim Results for the six months ended 30 June 2022

Microsaic Systems plc (AIM: MSYS), the developer of

micro-electronic instruments and analytical solutions, is pleased

to announce its unaudited interim results for the six months ended

30 June 2022 ("H1 2022"). Performance has exceeded Board

expectations with the new high-tech services division launch in

April helping with the transition from product-only sales to

customer-centric service solutions in science and engineering

services that include analytical and AI software service programmes

designed for the medical device, environmental, aerospace and food

industries.

Highlights

-- Unaudited revenues of GBP735k: an increase of 47% on H1 2021 (GBP499k)

-- Increase in gross profit by 164% to GBP433k (H1 2021: GBP164k)

-- Adjusted EBITDA loss of GBP661k an improvement of 21% on H1 2021 (GBP839k loss)

-- Total comprehensive loss reduced by 65% to GBP705k (H1 2021: GBP2.01m loss)

-- Cash at 30 June 2022 was GBP2.56m (H1 2021: GBP4.48m)

-- International deployment of Microsaic's products and services

in applications such as water monitoring of chemicals and pathogens

continues to expand. Units have been installed in Ireland and the

UK and are being shipped to Japan and the US for installation

during H2 2022

-- Laboratory services that have been completed are for toxic

shock, insulin and a range of metabolites carried out under

contract by Microsaic as mass spectrometry services. Other

laboratory service work scheduled for H2 2022 include ceramides and

pesticides

-- Mass spectrometry units have been installed and demonstrated

in Modern Water mobile monitoring vehicles

-- March: Bob Moore joined the Board. Bob is a UK qualified

lawyer and brings over 35 years' commercial and legal experience to

the Company

-- April: New manufacturing services framework and an initial

contract worth GBP400k with Innovenn UK Limited, a division of

DeepVerge plc, supplying services for multi-sensor upgrades of

environmental and human health diagnostic equipment

-- April: Launch of Microsaic Services Division provi ding

integrated solutions in science and engineering services that

include analytical and AI software service programmes designed for

the medical device, environmental, aerospace and food

industries

Post Period Events

-- August: Microsaic appointed as an Authorised Partner for

Kingfield Electronics Limited ("Kingfield") for front-end research,

development, and engineering product development in scientific

instrumentation and micro-engineering adding these complementary

services to Kingfield's existing electronics aerospace, defence,

and process and scientific instrumentation clients

-- August: ISO 9001:2015 Surveillance Audit secured

Outlook

-- The growth in revenues, at higher margins, illustrates that

Microsaic is able to access additional revenues from other

innovative companies seeking a high quality product design,

development and manufacturing service. As a result, the Board

expects the solid sales momentum noted in H1 to continue through

H2.

Gerry Brandon, Acting Executive Chairman of Microsaic Systems

plc, commented:

"The change in business strategy which began in 2021 has carried

through to 2022. The result of which can be seen in the increased

revenues and gross profit which have led to reduced losses. We look

forward to continued growth with our existing collaboration

partners and already see new business opportunities developing for

2023 through the Authorised Partnership with Kingfield Electronics

Limited. The Board notes a strong momentum of sales growth in H1

and expects this to continue through H2 with a strong

orderbook."

Enquiries:

Microsaic Systems plc

Gerry Brandon, Acting Executive Chairman +44 (0)734 0055 648

Singer Capital Markets (Nominated Adviser & Joint

Broker)

Aubrey Powell / George Tzimas / Asha Chotai +44 (0)20 7496

3000

Turner Pope Investments (TPI) Limited (Joint Broker)

Andy Thacker / James Pope +44 (0)20 3657 0050

About Microsaic Systems

Microsaic has over 20 years' experience in microelectronics and

development of instrumentation. The Company has a robust and

innovative patent portfolio in cutting-edge technology designed and

developed for "Industry 4.0" application serving markets in

diversified Industries, Human and Environmental Health. Microsaic's

system solutions have enabled analytical detection and

characterisation at the point-of-need, whether within a

conventional laboratory setting, or within a bioprocessing facility

for continuous detection of data at multiple steps in the process

workflow.

Microsaic's products and solutions are commercially available

through global markets via a network of regional and local

partners, targeting its core laboratory, manufacturing and

point-of-need applications.

CHAIRMAN'S STATEMENT

Introduction

The shift in commercial strategy from product-only sales to

customer-centric service solutions began with the launch of the

Microsaic Services Division earlier this year resulting in an

uplift in revenues of 47% to GBP735k in H1 2022 (H1 2021: GBP499k)

and a healthy order book for the second half of the year. With 20

years of expertise in research and development of miniaturised

mass-spectrometry equipment, with 60 patents in scientific

analytical instrumentation, the combination of science and

engineering services now delivers turn-key project management,

hardware and software product development, and product lifecycle

management systems with quality management to ISO 9001:2015

standards.

Relevant Global Trends

Microsaic has adapted to a changing world where supply chains

and health-care systems have been disrupted by Covid and the

Ukraine war, creating new opportunities in science and engineering

services. Our proprietary technology and know-how is being deployed

to address a number of needs and shifting trends in the way

companies and even national bodies seek to source

technology-enabled solutions.

The Covid pandemic, has amongst other things, also emphasised

the need for national capability, supply chain resilience and

on-shoring with core competence of delivering both upstream and

downstream services to manufacturers to ensure continuity rather

than relying on off-shore capabilities. Microsaic is able to

address this demand for more localised solutions by supplying

through partners which are already present in the major

markets.

The health costs associated with ageing populations with limited

economic capacity have highlighted the need for automation and

technology-driven efficiencies in healthcare, particularly for

surveillance in disease biomarkers as the move to digital health

diagnostics becomes inevitable, either in GP offices or bedside

observations of proteins in patient treatments.

At the same time, there is a heightened realisation of the

finite, shared resources of our planet and the need to manage

levels of pollutants by measuring them. Microsaic's miniaturised

portable mass spectrometry units have application in monitoring

pollution and are being rolled out as part of the DeepVerge Modern

Water mobile monitoring services. The complementary systems have

the ability to monitor contaminants in the air, in soil, rivers,

lakes and sea and in wastewater. All areas offer the opportunity to

identify recycling processes - which all play a role in the

management of the circular economy.

There is no doubt that the conflict in Ukraine has demonstrated

that defence and security are a necessity, and also need to be

deployed in an agile and affordable manner. This comes with supply

chain resilience, the availability of technology which is closer to

home and the provision of science and engineering services to the

Defence Science and Technology Laboratory, Ministry of Defence and

the Home Office.

Collaboration across partner core competences

Microsaic and DeepVerge plc ("DeepVerge") have been working

together since March 2021 when the parties signed a 3-year

framework agreement under which Microsaic supplies its own

miniaturised mass spectrometry equipment and services on a

non-exclusive basis across DeepVerge's global sales, marketing and

distribution channels, for healthcare diagnostic and environmental

health applications.

In April 2022, Microsaic and Innovenn UK Limited, a subsidiary

of DeepVerge, entered into a new Manufacturing Services Framework

Agreement ("MSFA") with an initial contract worth GBP400,000

supplying services for Multi-Sensor Upgrades of Environmental and

Human Health Diagnostic Equipment.

These new services leverage the considerable depth and breadth

of technical design, engineering and delivery expertise within the

Microsaic team and diversifies the Company's revenues beyond

equipment sales of Mass Spectrometers, in line with the Company's

shift in strategy. By offering the skillsets that created the

smallest compact mass spectrometer in the world, collaboration

partners, such as DeepVerge and Kingfield Electronics Limited, who

recently appointed Microsaic as their Authorised Partner, can

outsource engineering development of existing and new analytical

instrumentation equipment while concentrating on growing their

business.

Going Concern

Having considered the plans and prospects of the business, the

Board of Directors believes that the Company has enough cash to

cover its anticipated working capital requirements for the next 12

months. Therefore, the Directors have adopted the going concern

basis of reporting in preparing the financial statements.

Outlook

The growth in revenues, at higher margins, illustrates that

Microsaic is able to access additional revenues from other

innovative companies seeking a high quality product design,

development and manufacturing service. As a result, t he Board

expects the solid sales momentum noted in H1 to continue through

H2.

Gerard Brandon

Acting Executive Chairman

30 September 2022

Financial Review

Statement of Comprehensive Income

In H1 2022, total revenues of GBP734,914 were GBP235,629 (47.2%)

above H1 2021 (GBP499,285). Reflecting the shift in strategy,

service and support revenues were GBP502,317 (H1 2021: GBP12,170)

and represented 68.4% of total revenue (H1 2021: 2.4%). In

comparison, product revenue of GBP165,011 (H1 2021: GBP367,474)

represented 22.4% of total revenue (H1 2021: 73.6%) whilst

consumables and spares revenues of GBP67,586 (H1 2021: GBP119,641)

represented 9.2% of total revenue (H1 2021: 24.0%).

A new accounting policy for cost of sales has been introduced to

reflect the staff time directly attributable to the new service

lines (further information is included in note 5) and therefore the

comparative periods have been restated accordingly (note 14). Gross

margin in H1 2022 was 59.0%, exceeding the margin achieved in H1

2021 of 32.8% (restated), as a result of a higher proportion of

services sales which generate higher margins.

Operating expenses of GBP1,134,310 were stable and also slightly

lower by GBP27,304 (2.4%) than the comparative period (H1 2021

restated: GBP1,161,614).

With increased gross profit and relatively flat operating

expenses, the loss from operations before share-based payments of

GBP700,934 marks a 26.3% improvement on the loss in H1 2021

(restated: GBP950,652).

Share-based payments of GBP126,002 fell substantially by

GBP1,031,700 (89.1%) compared with H1 2021 (restated: GBP1,157,702)

chiefly reflecting the full vesting of directors share options in

H1 2021 and with no further option grants since February 2021.

Adjusted EBITDA is deemed by the Board to be a key performance

indicator of the Company's profitability. The adjusted EBITDA loss

in H1 2022 was GBP661,491 compared with GBP838,804 in H1 2021, an

improvement of GBP177,313. Note 7 details the reconciliation

between Adjusted EBITDA loss and comprehensive loss for the

period.

The comprehensive loss of GBP704,711 is 64.9% lower than H1 2021

(restated: GBP2,008,203) reflecting the aforementioned changes

which have been implemented. The H1 2021 comprehensive loss is

GBP98,722 higher than previously reported due to the recognition of

an accrued tax credit receivable as set out in note 14.

Accordingly, the basic loss per share of 0.011p has reduced by

72.5% compared to last year (H1 2021 restated: 0.040p per share)

following the improved performance of the business during the

period.

Statement of Financial Position

Total non-current assets of GBP453,533 are GBP53,092 lower (31

December 2021: GBP506,625). The reduction is mainly attributable to

the decrease in right of use assets by GBP35,979, representing the

depreciation charge in the period.

Total current assets of GBP4,317,724 are GBP330,787 lower (31

December 2021: GBP4,648,511). The main contributor to this

reduction is the GBP902,136 lower cash balance at the period end of

GBP2,562,741 (31 December 2021: GBP3,464,876) and this is discussed

further in the Statement of Cash Flows section which follows. The

main increase offsetting the cash reduction is the rise by

GBP480,657 in trade and other receivables to GBP1,112,605 (31

December 2021: GBP631,948). The main component of that increase is

trade receivables of GBP820,566 which have increased by GBP493,505

(31 December 2021: GBP327,061).

Total assets of GBP4,771,257 are GBP383,879 lower (31 December

2021: GBP5,155,136), mainly due to the movement in total current

assets as explained above.

Total equity of GBP4,194,511 is GBP378,709 lower (31 December

2021: GBP4,573,220). The movements during the period were the

comprehensive loss of GBP704,711 offset by the exercise of warrants

and directors fees paid in shares totalling GBP285,000 and a

share-based reserve movement of GBP41,002 in respect of

leavers.

Current liabilities of GBP453,081 are GBP27,283 higher (31

December 2021: GBP425,798). This is mainly due to trade and other

payables of GBP379,382 which are up by GBP24,711 (31 December 2021:

GBP354,611).

Total non-current liabilities of GBP123,665 are GBP32,453 lower

(31 December 2021: GBP156,118). This is mainly due to a GBP37,538

reduction in non-current lease liabilities to GBP18,620 (31

December 2021: GBP56,158) as right of use assets approach the end

of their term and their renewal dates.

Statement of Cash Flows:

Cash and cash equivalents fell GBP902,136 from GBP3,464,876 at

31 December 2021 to GBP2,562,741 at 30 June 2022.

The main component of this reduction was due to cash used in

operating activities (see note 12), which increased to GBP997,506

and was GBP90,260 higher than H1 2021 (GBP907,246). Cash absorbed

by operating activities before working capital movements improved

by GBP309,342 to GBP579,451 (H1 2021: GBP888,793), primarily due to

lower losses. However, this was offset by working capital movements

amounting to a net increase in cash absorbed of GBP418,055 (H1

2021: GBP18,453 increase). The largest component of the working

capital movements was due to an increase in trade receivables by

GBP485,413 (H1 2021: GBP298,503 increase) which is expected to

improve in H2 2022.

Net cash used in investing activities in H1 2022 of GBP65,500

(H1 2021: GBP50,832) increased by GBP14,668. The movements were an

increase in the purchases of property, plant and equipment by

GBP25,526 to GBP65,019 (H1 2021: GBP39,493), off-set by a decrease

in the purchases of intangibles by GBP7,333 to GBP6,331 (H1 2021:

GBP13,664) and interest received was GBP3,525 higher at GBP5,850

(H1 2021: GBP2,325).

Net cash from financing activities amounted to GBP160,870 (H1

2021: GBP5,044,261). The main difference compared to the

comparative period are net proceeds of share issues from warrant

exercises of GBP200,000 compared with net cash raised from the

February 2021 fundraising of GBP5,083,140.

STATEMENT OF COMPREHENSIVE INCOME (UNAUDITED)

FOR THE SIX MONTHSED 30 JUNE 2022

6 months 6 months Year to

to 30 June to 30 June 31

December

2022 2021 2021

Notes Unaudited Unaudited Audited

RESTATED(1) RESTATED(1)

GBP GBP GBP

------------------------------------------------------------------------------------ --------------- ---------------

Revenue 4 734,914 499,285 906,876

Cost of sales 14 (301,538) (335,356) (526,125)

--------------------------------------------------- -------------- --------------- --------------- ---------------

Gross profit 433,376 163,929 380,751

Other operating income - 47,033 67,283

Research and development expenses (219,491) (312,755) (738,145)

Professional fees - Corporate transactions - (65,789) (65,789)

Other operating expenses 14 (914,819) (783,070) (1,678,335)

--------------------------------------------------- -------------- --------------- --------------- ---------------

Total operating expenses (1,134,310) (1,161,614) (2,482,269)

Loss from operations before share-based payments (700,934) (950,652) (2,034,235)

--------------------------------------------------- -------------- --------------- --------------- ---------------

Share-based payments 11 (126,002) (1,157,702) (1,363,764)

--------------------------------------------------- -------------- --------------- --------------- ---------------

Loss from operations after share-based payments (826,936) (2,108,354) (3,397,999)

--------------------------------------------------- -------------- --------------- --------------- ---------------

Financial cost (4,104) (1,554) (4,604)

Finance income 7,083 2,983 6,237

--------------------------------------------------- -------------- --------------- --------------- ---------------

Loss before tax (823,957) (2,106,925) (3,396,366)

Tax on loss on ordinary activities 119,246 98,722 267,785

--------------------------------------------------- -------------- --------------- --------------- ---------------

Total comprehensive loss for the period (704,711) (2,008,203) (3,128,581)

--------------------------------------------------- -------------- --------------- --------------- ---------------

Loss per share attributable to the equity

holders of the Company

Basic and diluted loss per ordinary shares

(1)See note 14 for an explanation of the prior

period restatement. 6 (0.011)p (0.040)p (0.056)p

--------------------------------------------------- -------------- --------------- --------------- ---------------

STATEMENT OF FINANCIAL POSITION (UNAUDITED) AS AT 30 JUNE

2022

30 June 30 June 31 December

2022 2021 2021

Notes Unaudited Unaudited Audited

RESTATED(1)

GBP GBP GBP

----------------------------------------------------------- -------------- --------------

ASSETS

Non-current assets

Intangible assets 66,637 77,294 74,405

Property, plant and equipment 296,342 112,645 305,687

Right of use assets 90,554 15,037 126,533

------------------------------ ------------- ------------ -------------- --------------

Total non-current assets 453,533 204,976 506,625

------------------------------ ------------- ------------ -------------- --------------

Current assets

Inventories 255,346 377,156 283,902

Trade and other receivables 1,112,605 524,049 631,948

Corporation tax receivable 387,032 317,290 267,785

Cash and cash equivalents 2,562,741 4,483,252 3,464,876

------------------------------ ------------- ------------ -------------- --------------

Total current assets 4,317,724 5,701,747 4,648,511

------------------------------ ------------- ------------ -------------- --------------

TOTAL ASSETS 4,771,257 5,906,723 5,155,136

------------------------------ ------------- ------------ -------------- --------------

EQUITY AND LIABILITIES

Equity

Share capital 1,731,413 1,702,913 1,702,913

Share premium 28,262,518 28,006,018 28,006,018

Share-based payment reserve 2,817,181 2,743,064 2,888,707

Retained losses (28,616,601) (26,904,040) (28,024,418)

------------------------------ ------------- ------------ -------------- --------------

Total Equity 4,194,511 5,547,955 4,573,220

------------------------------ ------------- ------------ -------------- --------------

Current liabilities

-------------

Trade and other payables 379,382 245,346 354,611

------- ----

Lease liability 73,699 16,143 71,187

------------------------------ ------- ---- ------------ -------------- --------------

Total current liabilities 453,081 261,489 425,798

------------------------------ ------------- ------------ -------------- --------------

Non-current liabilities

Provision 9 105,045 97,279 99,960

Lease liability 18,620 - 56,158

------------------------------ ------------- ------------ -------------- --------------

Total non-current liabilities 123,665 97,279 156,118

------------------------------ ------------- ------------ -------------- --------------

Total liabilities 576,746 358,768 581,916

------------------------------ ------------- ------------ -------------- --------------

TOTAL EQUITY AND LIABILITIES 4,771,257 5,906,723 5,155,136

------------------------------ ------------- ------------ -------------- --------------

(1)See note 14 for an explanation of the prior period restatement.

-------------------------------------------------------------------------------------------

STATEMENT OF CHANGES IN EQUITY (UNAUDITED) AS AT 30 JUNE

2022

Share

based

Share Share payment Retained Total capital premium reserve

Losses equity

RESTATED(1)

GBP GBP GBP GBP GBP

------------------------------------------------------------------- --------------------------

At 1 January 2021 1,140,913 24,867,886 324,264 (25,090,083) 1,242,980

Total comprehensive loss for

the period as presented in

the unaudited interim financial

statements to 30 June 2021 - - - (2,106,925) (2,106,925)

Impact of restatement of R&D

tax credit recognition (see

note 14) - - - 98,722 98,722

Transactions with owners

Shares issued 562,000 5,058,000 - - 5,620,000

Share issue costs - (1,919,868) 1,503,008 - (416,860)

Transfer in respect of lapsed

share options - - (194,246) 194,246 -

Share based payments-share

options - - 1,110,038 - 1,110,038

--------------------------------- -------------------------------- --------------------------

At 30 June 2021 1,702,913 28,006,018 2,743,064 (26,904,040) 5,547,955

--------------------------------- -------------------------------- --------------------------

At 1 July 2021 1,702,913 28,006,018 2,743,064 (26,904,050) 5,547,955

Total comprehensive loss for

the period - - - (1,120,378) (1,120,378)

Transactions with owners

Shares issued - - - - -

Share issue costs - - - - -

Transfer in respect of lapsed - - - - -

share options

Share based payments-share

options - - 145,643 - 145,643

--------------------------------- -------------------------------- --------------------------

At 31 December 2021 1,702,913 28,006,018 2,888,707 (28,024,418) 4,573,220

--------------------------------- -------------------------------- --------------------------

At 1 January 2022 1,702,913 28,006,018 2,888,707 (28,024,418) 4,573,220

Total comprehensive loss for

the period - - - (704,711) (704,711)

Transactions with owners

Shares issued 28,500 256,500 - - 285,000

Share issue costs - - - - -

Transfer in respect of lapsed

share options - - (112,528) 112,528 -

Share based payments share

options - - 41,002 - 41,002

--------------------------------- -------------------------------- --------------------------

At 30 June 2022 1,731,413 28,262,518 2,817,181 (28,616,601) 4,194,511

--------------------------------- -------------------------------- --------------------------

(1)See note 14 for an explanation of the prior period restatement.

-----------------------------------------------------------------------------------------------

STATEMENT OF CASH FLOWS (UNAUDITED)

FOR THE SIX MONTHSED 30 JUNE

2022

6 months 6 months Year to

to 30 June to 30 June 31 December

2022 2021 2021

Notes Unaudited Unaudited Audited

GBP GBP GBP

------------------------------------------------------------------------------ ----------- -------------

Cash flows from operating activities

Cash absorbed by operations 12 (997,506) (907,246) (1,827,851)

Corporation tax received - - 218,568

---------------------------------------------- ---------------- ------------ ----------- -------------

Net cash used in operating activities (997,506) (907,246) (1,609,283)

---------------------------------------------- ------------------------------ ----------- -------------

Cash flows from investing activities

Purchases of intangible assets (6,331) (13,664) (28,883)

Purchases of property, plant and equipment (65,019) (39,493) (305,334)

Interest received 5,850 2,325 6,237

---------------------------------------------- ------------------------------ ----------- -------------

Net cash used in investing activities (65,500) (50,832) (327,980)

---------------------------------------------- ------------------------------ ----------- -------------

Cash flows from financing activities

Proceeds from share issues 200,000 5,500,000 5,500,000

Share issue costs - (416,860) (416,860)

Repayment of lease liabilities (39,130) (38,879) (78,070)

---------------------------------------------- ------------------------------ ----------- -------------

Net cash from/(used in) financing

activities 160,870 5,044,261 5,005,070

---------------------------------------------- ------------------------------ ----------- -------------

Net increase/(decrease) in cash and

cash equivalents (902,136) 4,086,183 3,067,807

Cash and cash equivalents at beginning

of the year 3,464,876 397,069 397,069

---------------------------------------------- ------------------------------ ----------- -------------

Cash and cash equivalents at the end

of the period 2,562,741 4,483,252 3,464,876

---------------------------------------------- ------------------------------ ----------- -------------

NOTES TO THE INTERIM FINANCIAL INFORMATION (UNAUDITED)

1. Nature of operations

Microsaic Systems plc is registered in England and Wales. The

Company's registered office is GMS House, Boundary Road, Woking,

GU21 5BX. The Company has no subsidiaries, so the financial

information relates to the Company only. Microsaic is a high

technology company developing compact, chip-based mass

spectrometers that are designed to improve the efficiency of

pharmaceutical R&D.

2. Basis of preparation

The interim financial statements of the Company for the six

months ended 30 June 2022, which are unaudited, have been prepared

in accordance with the accounting policies set out in the annual

report and accounts for the year ended 31 December 2021, which were

prepared under International Financial Reporting Standards ("IFRS")

with the exception of Revenue and Cost of sales policies which have

been amended for the year ending 31 December 2022, as per notes 4,

5 and 14. Comparable information for the six months ended 30 June

2021 has been restated in accordance with these policies.

This report does not constitute statutory accounts as defined in

Section 434 of the Companies Act 2006 and has not been audited. The

financial information for the full preceding year is based on the

statutory accounts for the year ended 31 December 2021. Those

statutory accounts have been filed with the Registrar of Companies.

The auditor's report on those statutory accounts was

unqualified.

As permitted, this interim report has been prepared in

accordance with the AIM Rules for Companies and not in accordance

with IAS 34 "Interim Financial Reporting" and therefore it is not

fully compliant with IFRS.

The interim financial statements are presented in pounds

sterling.

3. Critical accounting estimates and judgements

Accounting estimates and judgements are continually evaluated

and are based on past experience and other factors, including

expectations of future events that are believed to be reasonable

under the circumstances.

The Company makes estimates and assumptions concerning the

future. The resulting accounting estimates could, by definition,

differ from the actual outcome.

The following estimates and assumptions are those that, in

addition to those set out in the annual report and accounts for the

year ended 31 December 2021, have a risk of causing a material

adjustment to the carrying amounts of assets and liabilities:

Carrying value of trade receivables

The Company has applied a simplified "provision matrix" for

calculating expected credit losses as a practical expedient. The

percentage ranges are applied to the receivable balance.

Current 1-30 days 31-60 61-90 91-120 121-150 151-180 181 days

past due days past days past days past days past days past + past

due due due due due due

0%-1% 1%-2% 1%-2% 1%-2% 2%-5% 5%-10% 10%-20% 10%-50%

---------- ----------- ----------- ----------- ----------- ----------- ---------

The directors have reviewed the expected credit losses

calculated in accordance with the "provision matrix" above and

believe that there is no change required to the provision in

respect of recoverability.

4. Revenues

IFRS 15 provides a single, principles based five-step model to

be applied to all contracts with customers. The five-step framework

includes:

Identify the contract(s) with a customer;

Identify the performance obligations in the contract; Determine

the transaction price;

Allocate the transaction price to the performance obligations in

the contract; and Recognise revenue when the entity satisfies a

performance obligation.

The Company recognises revenue from the following four

sources:

Sale of products;

Sale of consumables and spare parts; Product service and product

support; and Consultancy services.

All revenues and trade receivables arise from contracts with

customers. Revenue is measured based on the consideration which the

Company expects to be entitled in a contract with a customer and

excludes amounts collected on behalf of third parties. The sale of

products, consumables and spare parts is recognised when the sole

performance obligation is met which is usually on delivery to the

customer. For product service, product support and consultancy

services revenue, the performance obligation is satisfied over the

duration of the service period and revenue is recognised in line

with the satisfaction of the performance obligation.

Sale of products

The Company sells compact mass spectrometers (Microsaic 4500

MiD(R)) mainly through OEMs and Distributors. A small proportion of

its sales are direct to the customer. Discounts are offered and

agreed as part of the contractual terms. Terms are generally Ex

Works so control passes when the customer collects the goods.

Payment terms are generally 30 days from the date of invoice.

Sales of consumables and spare parts

The Company sells consumables and spare parts mainly through

OEMs and Distributors. Terms are generally Ex Works so control

passes when the customer collects the goods. Discounts are offered

and agreed as part of the contractual terms. Payment terms are

generally 30 days from the date of invoice.

Product service and product support revenue

Service and support to our OEMs and Distributors includes

training their sales and service teams and servicing the products

from time to time. Discounts are offered and agreed as part of the

contractual terms. Terms are Ex Works so control passes when the

customer receives the service. Payment terms are generally 30 days

from the date of invoice.

Usually, there is no obligation on the Company for returns,

refunds or similar arrangements. Also, the Company does not

manufacture specific items to a customer's specification and no

financing component is included in the terms with customers.

The Company provides assurance warranties which are 15 months

from the date of shipment for OEMs and Distributors. These

warranties confirm that the product complies with agreed-upon

specifications. The Company is looking to provide service

warranties in the future to direct Europe customers, where the

revenue from such warranties will be recognised over the period of

the service agreement.

Consultancy services revenue

Consultancy services comprises science and engineering

consultancy, laboratory services and monitoring services. These

services are delivered over a period of time usually in accordance

with a master services agreement and/or statement of works with an

agreed outcome at the end of the project or project phase.

Consultancy services revenue is recognised by reference to the

stage of completion of the project or project phase at the balance

sheet date as follows:

-- Where there are defined project or project phase milestones,

the revenue is recognised in full on completion of the project or

project phase and on a time basis for the stage of completion where

the project or project phase is not completed at the balance sheet

date. The stage of completion is recognised as the proportion of

time spent on the project or project phase compared with the total

time anticipated to complete the project or project phase;

and/or

-- Where the project is defined with the client in terms of time

spent, the revenue is recognised on the basis of consulting time

spent on the project by the Company at the time-based rates agreed

with the client.

The geographical analysis of revenues (by location of shipment)

was as follows:

6 months 6 months Year to

to 30 June to 30 June 31

December

2022 2021 2021

Unaudited Unaudited Audited

GBP GBP GBP

--------------------------- ------- -------

UK 634,200 220,192 532,364

Japan 8,279 - 1,000

USA 50,703 130,960 187,673

Europe 29,610 42,057 71,887

China 12,122 106,076 106,076

South Korea - - 3,662

Rest of World - - 4,214

-------------- ----------- ------- -------

734,914 499,285 906,876

-------------- ----------- ------- -------

The product group analysis of revenues

was as follows:

6 months 6 months Year to

31

to 30 June to 30 June December

2022 2021 2021

Unaudited Unaudited Unaudited

GBP GBP GBP

--------------------------------------- ---------- --------------- ----------------

Product/Unit Consumables and spares 165,011 367,474 617,614

Service and support income 67,586 119,641 230,831

502,317 12,170 58,431

--------------------------------------- ---------- --------------- ----------------

734,914 499,285 906,876

--------------------------------------- ---------- --------------- ----------------

5. Cost of sales

With effect from 1 January 2022, the company has adopted new

accounting policies for the presentation of cost of sales, to

better reflect the costs associated with the new revenue streams.

The financial impact of this change is set out in note 14, and the

new policies applied are as follows:

Cost of sales of products

The cost of sales of mass spectrometers and related equipment is

the bought in purchase cost of the product or the transfer value

from stock value if a unit has been previously written down.

Usually, the sale is made on an Ex-Works basis but if it were not

the cost of delivery to the customer is also included in cost of

sales.

Cost of sales of consumables and spare parts

The cost of sales of consumable and spare parts is the bought in

purchase cost of the consumable or spare part or the transfer value

from stock value if an item has been previously written down.

Usually, the sale is made on an Ex-Works basis but if it were not

the cost of delivery to the customer is also included in cost of

sales.

Cost of sales of product service and product support income

The cost of sales of service and support income is the

time-based apportionment of the employment costs of the relevant

staff spent on the delivery of the service and support income plus

any related costs of fulfilment such as travel expenses and any

externally incurred direct costs. For the purposes of cost of

sales, the employment costs are considered to be salaries, pensions

and employers national insurance but cost of sales does not include

share-based payments nor any apportionment of training or

overheads.

Cost of sales of consultancy services revenue

The cost of sales of consultancy services (comprising science

and engineering consultancy, laboratory services and monitoring

services) is the time-based apportionment of the employment costs

of the relevant staff spent on the delivery of this revenue plus

any related costs of fulfilment such as travel expenses and any

externally-incurred direct costs. For the purposes of cost of

sales, the employment costs are considered to be salaries, pensions

and employers national insurance but does not include share-based

payments nor any apportionment of training or overheads.

6. Loss per share

6 months 6 months Year to 31

to 30 June to 30 June December

2022 2021 2021

Unaudited Unaudited Audited

RESTATED

-------------------------------------------------------------------------------------------------------

Comprehensive loss attributable

to equity shareholders (GBP)

Weighted average number of ordinary

0.01p (704,711) (2,008,203) (3,128,581)

(2021: 0.01p) shares for the

purpose of basic

and diluted loss per share 6,287,359,621 4,989,624,815 5,537,461,036

------------------------------------- --------------------- -------------------- -------------------

Basic and diluted loss per ordinary

share (p) (0.011)p (0.040)p (0.056)p

------------------------------------- --------------------- -------------------- -------------------

The basic loss per share has continued to reduce. It fell by 72%

compared with H1 2021. This was due to a 65% reduction in

comprehensive loss as well as the impact of the share

reorganisation early in 2021 and issues of equity in 2022. The main

contributions to the reduction in comprehensive loss was an

increase in gross profit of 164% and a reduction in share-based

payment costs by 93%. The 6 months to 30 June 2021 loss per share

has been re-stated due to the change in recognition of R&D tax

credit receivable as set out in note 14.

Potential ordinary shares are not treated as dilutive as the

Company is loss making, therefore the weighted average number of

ordinary shares for the purposes of the basic and diluted loss per

share are the same.

7. Adjusted EBITDA Loss

A key indicator of performance for the Company is Adjusted

EBITDA Loss (Loss of earnings before interest, tax, depreciation,

amortisation and other items such as share-based payments and

exceptional one-off expenditure). Detailed below is the Adjusted

EBITDA Loss for the period:

6 months 6 months Year to 31-Dec

to 30 June to 30 June 2021

2022 2021 Unaudited

Unaudited Unaudited

------------------------------------

GBP GBP GBP

------------------------------------ ----------- ------------ ---------------------

Comprehensive loss for period (704,711) (2,008,203) (3,128,581)

Adjust for:

Tax on loss on ordinary activities (119,246) (98,722) (267,785)

Depreciation of property, plant

and equipment 74,364 39,222 90,628

Depreciation of right of use

assets 35,980 34,368 70,499

Amortisation of Intangibles 14,099 20,133 38,241

Net finance cost (2,979) (1,429) (1,633)

Share-based payments (excluding

fee shares) 41,002 1,110,038 1,255,681

Exceptional costs - 65,789 65,789

------------------------------------ ----------- ------------ ---------------------

Adjusted EBITDA Loss (661,491) (838,804) (1,877,161)

------------------------------------ ----------- ------------ ---------------------

8. Employees and employment related costs

6 months 6 Months Year to 31

to 30 June to 30 June December

2022 2021 2021

Unaudited Unaudited Audited

Staff Numbers RESTATED

Directors 3 4 4

Other staff 19 17 18

----------------------------------------- ----------- ----------- ----------

Average Headcount 22 21 22

----------------------------------------- ----------- ----------- ----------

Employment costs (including Directors) GBP GBP GBP

----------------------------------------- ----------- ----------- ----------

Wages and salaries 514,539 590,195 1,123,276

Social security costs 74,710 67,452 160,902

Termination payments 21,125 - 18,189

Pension costs 77,578 80,296 173,051

Employment related share-based

payments 82,943 1,143,800 1,332,240

----------------------------------------- ----------- ----------- ----------

770,895 1,881,743 2,807,699

----------------------------------------- ----------- ----------- ----------

9. Provisions

Total unaudited

Dilapidations Warranty GBP

GBP GBP

-------------------------------------------- -------------- --------- ---------------

Balance at 1 January 2022 75,779 24,181 99,960

Provided for/(Reduction) during the period 8,199 (3,114) (5,085)

-------------------------------------------- -------------- --------- ---------------

Balance at 30 June 2022 83,978 21,067 105,045

-------------------------------------------- -------------- --------- ---------------

The dilapidations provision has been updated for the estimated

impact of inflation. The warranty provision methodology was updated

to reflect more recent performance with the increased value of

products under warranty offset by reduced warranty claim rates and

costs.

10. Commitments

As at 30 June 2022, purchase commitments relating to purchase

orders placed on, and related contractual arrangements and

obligations, with our third-party manufacturers amounted to

GBP684,978 (31 December 2021: GBP781,990).

11. Share-based payments

The share-based payments charge 6 months 6 Months Year to 31

comprises: to 30 June to 30 June December

2022 2021 2021

Unaudited Unaudited Audited

RESTATED

GBP GBP GBP

---------------------------------- ----------- ------------ ----------

Directors' fees settled in shares 41,941 33,762 76,559

Share options granted 41,002 1,110,038 1,255,681

---------------------------------- ----------- ------------ ----------

Employment related share-based

payments 82,943 1,143,800 1,332,240

Brokers' fees settled in shares 43,059 13,902 31,524

---------------------------------- ----------- ------------ ----------

126,002 1,157,702 1,363,764

---------------------------------- ----------- ------------ ----------

The Directors' fees settled in shares in respect of the years

commencing 5 February 2021 and 5 February 2022 and Broker's fees

settled in shares in respect of the year commencing 5 February 2021

are both in respect of paying annual fees in advance at the placing

price of 5 February 2021 being a valuation of 0.1p per ordinary

share of 0.01p nominal value. The restatement above reflects the

inclusion of Brokers' fees settled in shares previously included as

Directors' fees settled in shares.

12. Cash absorbed by operations

6 months 6 months Year to

to 30 June to 30 June 31

December

2022 2021 2021

Unaudited Unaudited Audited

RESTATED

GBP GBP GBP

-------------------------------------------------------------- --------------- ---------------

Total comprehensive loss for the year (704,711) (2,008,203) (3,128,581)

Adjustments for:

Amortisation of intangible assets 14,099 20,133 38,241

Depreciation of right of use assets 35,980 34,367 70,499

Depreciation of property, plant and equipment 74,364 39,222 90,628

Transfer of property, plant and equipment

to

cost of goods - 23,867 23,164

Profit on disposal of right of use assets - - (113)

Decrease in provision for warranty (3,114) (26,756) (24,075)

Increase in provision for dilapidations 8,199 - -

(Decrease)/Increase in provision for expected

credit losses 4,755 (18,532) (65,825)

Share-based payments (inclusive of fees

settled in shares) 126,002 1,157,702 1,363,764

Increase/(Decrease) in inventory provision (14,033) (10,442) 32,535

Tax on loss on ordinary activities (119,246) (98,722) (267,785)

Interest on lease liability 4,104 1,554 4,433

Interest received (5,850) (2,983) (6,237)

-------------- --------------- ---------------

Cash absorbed by operations before movements

in working capital (579,451) (888,793) (1,869,352)

-------------- --------------- ---------------

Movements in working capital:

Decrease/(Increase) in inventories 42,587 202,883 253,152

(Increase)/Decrease in trade and other

receivables (485,413) (298,503) (398,083)

Increase/(Decrease) in trade and other

payables 24,771 59,419 168,684

Accrued furlough income - 17,748 17,748

-------------- --------------- ---------------

Net movement in working capital (418,055) (18,453) 41,501

Cash absorbed by operations (997,506) (907,246) (1,827,851)

---------------------------------------------- -------------- --------------- ---------------

13. Related party transactions

Microsaic and DeepVerge plc ("DeepVerge") have two directors in

common: Gerard Brandon and Nigel Burton. In particular, Gerard

Brandon is Executive Chairman of Microsaic and CEO of

DeepVerge.

On 19 April 2022, Microsaic signed a new Manufacturing Services

Framework Agreement ("MSFA") with Innovenn UK Limited, a division

of DeepVerge plc ("DeepVerge"), to refine and miniaturise existing

monitoring equipment for environmental and human health

diagnostics, together with an initial contract worth GBP400,000.

The MSFA framework sets out the terms and conditions for Microsaic

to improve and manufacture certain DeepVerge products and to

provide the design, assembly, quality, and project management

functions necessary to produce and ship equipment based on

DeepVerge approved specifications, design, and quality

requirements.

In summary for the six months ended 30 June 2022, revenue from

DeepVerge sales totalled GBP546,718 and purchases from DeepVerge

were GBPnil. At 30 June 2022, GBP632,021 was owed by DeepVerge to

Microsaic in relation to the revenue recognised in H1 2022 and

GBP65,610 was owed by Microsaic to DeepVerge.

At 30 June 2022, Director Nigel Burton owed GBP14,100 in respect

of tax and national insurance which was settled in July 2022.

14. Prior period restatement

The year to 31 December 2021 Cost of Sales and other operating

expenses have been restated to reclassify amounts of GBP7,424 for

the 6-month period to 30 June 2021 and GBP15,233 for the 12-month

period to December 2021. There was no effect on the final

results.

To reflect the change in revenue, further detail with regards to

the product group of how revenue is generated has been included

within note 4.

An adjustment was made to the Income statement for the tax

credit receivable through R&D claims. Previously, the accrued

tax credit receivable was not included at each half year. This has

been included for the 6-month period to 30 June 2022 at GBP119,246

(being GBP134,355 for the 6 months less an adjustment of GBP15,089

in respect of the year ended 31 December 2021) on the basis that

the directors believe it is probable that it will be recovered. The

6 month period to 30 June 2021 has accordingly been re-stated to

include an amount of GBP98,722. Subsequently this has impacted the

calculation of loss per share, note 6.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR SEAFAUEESEEU

(END) Dow Jones Newswires

September 30, 2022 02:00 ET (06:00 GMT)

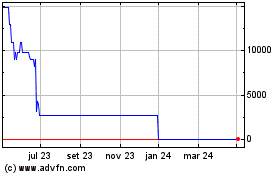

Microsaic Systems (LSE:MSYS)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

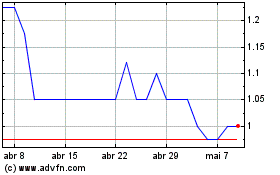

Microsaic Systems (LSE:MSYS)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024