TIDMYU.

RNS Number : 8065S

Yu Group PLC

14 March 2023

Yü Group PLC

("Yü Group" or the "Group")

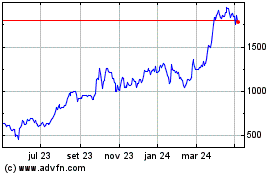

Final results for the year ended 31 December 2022

DELIVERING THE GROWTH STORY AT PACE

Yü Group PLC (AIM; YU.), the independent supplier of gas,

electricity and water to the UK corporate sector, announces its

final audited results for the year to 31 December 2022.

Bobby Kalar, Group Chief Executive Officer, stated:

"I'm pleased to report another fantastic year for Yü Group. We

have once again clearly demonstrated our ability to surpass

financial performance metrics and, with the strong momentum we have

in the business, we are confident of this recurring theme

continuing into 2023.

Our record breaking financial performance and significant

strategic progress is a testament to the strength of the Group.

Revenue increased 79%, EBITDA increased 359%, contracted revenue is

up 57% and cash increased by GBP11.9m. Reflecting our continued

confidence in the business we are also pleased to recommend the

reinstatement of a progressive dividend policy. To achieve this

despite the backdrop of a turbulent energy market is credit to the

strong foundations we have in place and the ability and character

of the team.

It's been a busy year! Developing and integrating our smart

metering business, Yü Smart from a standing start to a fully

functioning business performing at pace has been a particular

highlight. I'm proud to lead a team who have seized this

opportunity to build and grow new capabilities. I clearly see the

ability for the Group to accelerate its profitability by leveraging

off our growing revenues and providing new services. Cash flow and

cash management will remain a key focus, including through our

smart meter rollout.

The EBRS scheme has worked well and rightly delivered support to

our business customers. We will continue working with BEIS to

champion assistance to UK businesses.

Whilst our industry has been plagued by negative impacts and a

lack of investment and support, I am immensely proud to report our

progress and development. The market opportunity is huge, we have a

scalable platform, and we are primed and ready to grow.

We have got off to a fantastic start in 2023 with our

exceptional performance continuing. Whilst we remain vigilant, we

look forward to delivering continued shareholder value in 2023 and

beyond."

Financial & Operational Highlights:

31 December 2022 2021 Change

------------------------------------ --------- ---------

GBP'000 unless stated

Financial:

Revenue 278,587 155,423 +79%

Adjusted EBITDA 1 7,909 1,724 +359%

Profit before tax 5,840 3,392 +72%

Earnings per share (pence):

Adjusted, fully diluted 30p 14p +114%

Statutory, Basic 29p 27p +7%

Final dividend per share

(pence) 3p - +3p

Operating cash inflow/(outflow) 14,737 (774) +GBP15.5m

Net Cash (2) 18,810 6,782 +177%

Overdue customer receivables 5 days 7 days -2 days

(days) (3)

Operational:

Average Monthly Bookings

(GBP'm) GBP24.5m GBP13.8m +78%

Contracted Revenue for next

FY (GBP'm) GBP247m GBP157m +57%

Meter Points (#) 25,500 31,900 -20%

Smart meter installations

(#) 1,033 N.A. -

==================================== ========= ======== =========

Strong financial performance

-- Strong revenue growth, up 79%, to GBP278.6m (FY21:

GBP155.4m). Confidence in continuing growth supported by forward

order book in excess of GBP350m, of which GBP247m (up 57% in the

year) delivers in FY23.

-- Adjusted EBITDA up 359% to GBP7.9m (2021: GBP1.7m) with

adjusted operating margin improved significantly to 2.8% (FY21:

1.1%).

-- Profit before tax up 72% to GBP5.8m (FY21: GBP3.4m), after

non-cash charge of GBP0.9m relating to derivative accounting (2021:

GBP3.3m gain) reflected.

-- Earnings per share, adjusted and fully diluted, increased 114% to 30p (FY21: 14p).

-- Strong operating cash inflow of GBP14.7m (FY21: GBP0.8m

outflow), with GBP18.8m net cash (net of GBP0.2m lease liability)

available as at 31 December 2022 (2021: GBP6.8m).

-- Board proposes a final dividend of 3p per share (2021: nil)

as part of progressive dividend policy, balancing working capital

and investing for growth.

Significant strategic progress

-- Further enhancement of 'Digital by Default' platform

improving customer experience, driving efficiencies, and creating

value through data science.

-- Successful roll out of Yü Smart benefiting customers and

improving debtor control and profitability. Yü Smart is expected to

generate a positive EBITDA contribution in FY23.

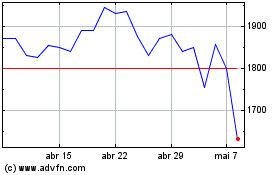

Current trading and outlook

-- Very strong start to 2023 with average monthly bookings

significantly ahead of the record GBP24.5m in FY22 and contracted

revenue of GBP247m as at 31 December 2022 for FY23.

-- Meter points now accelerating following strategic

rationalisation in FY22 and after the late 2021 uplift from the

acquisition of the AmpowerUK portfolio.

-- Improving customer cash collection performance and reduced

bad debt exposure, alongside continued overhead efficiency benefits

from 'Digital by Default' and positive contribution from Y ü Smart,

all provide potential for additional margin growth.

-- Management target further improvement in adjusted EBITDA

margin from the 2.8% generated in FY22 (FY21: 1.1%).

Analyst presentation

A presentation for analysts will be held at 10am GMT today,

Tuesday 14 March 2023. Anyone wishing to attend should please

contact yugroup@teneo.com for further information.

1 Adjusted EBITDA is earnings before interest, tax, depreciation

and amortisation, and unrealised gains or losses on derivative

contracts. For FY21, adjusted EBITDA also excludes share based

payments and non-recurring expenses. See reconciliation in note 7

to the financial statements below.

(2) Net cash refers to cash and cash equivalents less the debt

in the Group being GBP0.2m of lease liabilities.

(3) Overdue customer receivables is expressed in days of sales,

and relates to the total balance, net of provisions, of accrued

income which is outside of the normal billing cycle, plus overdue

trade receivables (net of VAT and CCL).

For further information, please contact:

Yü Group PLC

Bobby Kalar

Paul Rawson +44 (0) 115 975 8258

Liberum

Edward Mansfield

William Hall

Cara Murphy +44 (0) 20 3100 2000

--------------------

Teneo

Giles Kernick

Alec Tidbury +44 (0) 20 7353 4200

--------------------

Notes to editors

Information on the Group

Yü Group PLC is a leading supplier of gas and electricity

focused on servicing the corporate sector throughout the UK. We

drive innovation through a combination of user-friendly digital

solutions and personalised, high quality customer service. The

Group plays a key role supporting businesses in their transition to

lower carbon technologies with a commitment to providing

sustainable energy solutions.

Yü Group has a clear strategy to deliver sustainable profitable

growth and value for all of our stakeholders, built on strong

foundations and with a robust hedging policy. In 2022 the Group

launched Yü Smart and Yü Charge to support growth through new

opportunities in smart metering and EV charge installation. With a

significant opportunity in a GBP50bn+ addressable market, Yü Group

continues to deliver on the medium term goal of GBP500m of revenues

with an adjusted EBITDA margin in excess of 4%.

CHAIRMAN'S STATEMENT

Delivering high growth, shareholder returns, innovation and

expert risk management.

-- Maintaining a steadfast commitment to "best-in-class"

corporate governance as we scale the business to meet our highly

ambitious targets in a GBP50bn+ market.

-- An experienced, seasoned board and a highly resolute, expert

management team have continued to thrive and continued to deliver

impressive results in the face of multiple "Black Swan"

challenges.

It is my pleasure to update you on the Group's further progress

toward more meaningful and sustainable profitability, and for the

first time in recent years, the proposed resumption of a modest

dividend. We continue to scale our activities at pace, whilst

maintaining a robust and mature approach to governance, margin

protection and effective risk mitigation.

Since my appointment as Independent Non-Executive Chairman in

January 2020, the Group has successfully weathered and emerged

stronger from a succession of "black swan" events. Although still

with us, the effects of the pandemic from 2020 onward and severe

disruption in the energy supply markets leading to many failed

suppliers in 2021 are starting to abate. In 2022 the war in Ukraine

and movements in the macro-politics of energy supply in general,

ushered in a period of extreme market volatility resulting in

greatly increased commodity prices.

Whilst, more recently, commodity prices have normalised (partly

due to unusually warm temperatures across Europe, a slight increase

in available gas storage levels and relatively lower seasonal

demand) we are very aware of the impact across the markets that

such market volatility can have. In particular, we give great

regard to the effects of this volatility on our loyal customers as

well as any resultant changes or moves in the regulatory and

political context to which, as suppliers of energy to UK business,

we are subject.

I'm pleased and proud to report that the Group, supported by an

experienced Board and a resolute, highly expert management team,

has continued to thrive and deliver impressive results in the face

of these multiple challenges; the ultimate testament to the

strength of the Group.

Continuing to deliver on our strategic priorities

Our mantra and priorities remain the same, being Bigger, Better,

Faster and Stronger.

Financially, we have delivered results ahead of management's

expectations for the year, and our momentum continues to build. Our

FY22 revenue increased significantly, up 79.2% to GBP278.6m.

Adjusted EBITDA has grown from GBP1.7m to GBP7.9m. Profit before

tax is up 71% to GBP5.8m (FY21: GBP3.4m). Adjusted, fully diluted,

EPS increased from 14p to 30p, a 114% increase. Importantly these

results flowed through into cash with net cash held at the end of

the period increased to GBP18.8m, up from GBP6.8m in 2021.

Reflecting our strengthened balance sheet your Board has

recommended a final dividend of 3p per share as part of the

reinstatement of a progressive dividend policy. We have

deliberately proposed a modest dividend to allow for capital to

continue to be invested in to support our continued organic growth

and provide flexibility to undertake additional value-accretive

potential M&A activities which could further enhance the

business and accelerate shareholder returns.

Beyond these financial returns, we are pleased to report strong

performance across other metrics: including in customer service and

employee engagement.

Encouraged by the indefatigable and entrepreneurial vision of

our CEO and supported by a close-knit senior team of

industry-leading quality, we have continued to invest in technology

to maintain the key customer-centric differentiation of our

challenger, agile, business. We continue to position ourselves as

the most agile and leading challenger to the more established and

larger market participants in a GBP50bn+ market.

Our strategies are demonstrably delivering results and enable

the Group to grow our customer book and increase our top-line sales

whilst paying close attention to the quality of our margins across

the links in the value-added chain and cash collection.

Simultaneously we are promoting continual operational efficiencies

within the Group's operations as we drive scale. The recognition

that came from having won the Utility Week "Award for Digital

Transformation" is a testament to the impact of the work undertaken

to date. We have an ongoing programme of further innovations

scheduled for 2023 and beyond.

Our acquisition of certain assets of Magnum Utilities Ltd in the

year, which has been rebranded and is now fully operational as Y

Smart, also launches a new income stream for the Group and is set

to unlock significant business control, pricing, rental and big

data-mining benefits over the near and medium term.

The Directors have an ongoing mission and mandate to identify

and consider further value-enhancing M&A opportunities in order

to progress the profitability of the Group. These are supplementary

to our ambitious targets for accelerating prudent organic

growth.

Strength in depth

Your Board's constant philosophy has been to establish, maintain

and encourage a team ready to scale the Group to beyond the GBP500m

mark of revenue. We have at Board, ExCo and senior leadership

levels, established highly experienced and ambitious specialist

teams. We continue to ensure that all of our teams are fit and

capable of realising the Group's ambition to achieve measured

acceleration in the increase of revenue and adjusted EBITDA.

The Group's operational evolution into new business unit ("BU")

structures, reporting to the CEO, has seen the establishment of

focused senior management teams to further drive specified business

objectives. Close integration and cultural alignment ensure that

optimal outcomes receive meritocratic focus as we continue to

unlock cross-functional synergies and extract the maximum from

every link in the value added chains across the business.

Significant and stretching short-term and long-term targets have

been appropriately set to align outcomes with reward.

Your Board anticipates a highly positive impact from this

approach, both on the Group's overall performance in 2023 and

beyond.

Engagement with our stakeholders and regulatory bodies

During FY22 the Group appointed Liberum as its nominated adviser

and broker ("NOMAD") as part of a set of wider objectives to

enhance our shareholder reach. Our advisers provide us with robust

support in ensuring compliance with AIM regulations, whilst also

enhancing the quality of our engagement with both institutional and

individual investors.

The Board and management team of the Group take a pro-active

approach to engagement with our main Regulators, being Ofgem,

Ofwat, the FCA and AIM. We have established and continue to develop

best practices across the varying regulated areas as they evolve.

During the year there has been an increased level of engagement

with Ofgem and BEIS in response to changes in external market

conditions and the need to address any potential increase in

political and/or reputational risk.

Our approach to customers in debt, and aspects of the management

of some of the Group's key assets have been topics of useful

dialogue. During the year the Group successfully mobilised to

deliver various urgent Government business customer support schemes

originating from BEIS. The most material of these was the Energy

Bill Relief Scheme ("EBRS") which provides a large proportion of

business customers with a significant reduction in their energy

bills from 1 October 2022 to 31 March 2023.

We continue to engage with stakeholders and will fully and

promptly pass through all benefits due to our customers to support

them through this period of unprecedentedly volatile and high

energy commodity prices. Post the EBRS scheme, we will also

implement further schemes as appropriate. We note that current

lower commodity market pricing conditions still suggest a

significant, though hopefully less material, impact on our business

customers' bills.

Ensuring good governance and risk management

To reflect our newer activities in the installation of smart

meters and EV charging units, the Group has established a Safety,

Health, Environmental and Quality ("SHEQ") Committee comprised of

Bobby Kalar (CEO), John Glasgow (Independent non-executive

Director) and other appropriately qualified colleagues.

Your Board maintains a steadfast commitment to "best-in-class"

corporate governance. We seek to ensure that we can take advantage

of the significant market opportunities available to us whilst

keeping a tight focus on the mitigation of risk. This we effect by

ensuring that our governance framework, structures, and day-to-day

practices are fit and robust enough to be able to treat and

navigate even abnormal or atypical market developments, both now

and in the future, as "business as usual".

We continue to evolve the Group's internal capability as we

scale, including through further developing our own internally

available risk and internal control resources.

Reports on the activities of the Board, including the various

topics considered and the Board's Committees, are set out in the

Corporate Governance section of the annual report.

Our risk management framework and principal risks and

uncertainties are outlined further in the annual report, and have

been well tested and reviewed by management, the Audit Committee

and the Board.

Summary: retaining agility and control

Global and market conditions have thrown us several interesting

challenges and yet we have emerged stronger than ever. We continue

to deliver our Bigger, Better, Faster and Stronger strategic

objectives whilst maintaining our characteristic agility as a

determined challenger/disruptor.

Whilst we are pleased with the turn-around in the Group's

performance over the last few years we continue to guard against

complacency regarding the ongoing improvements in our governance

and operational structures.

I'm enthusiastic and confident about what the future holds for

your company and very much look forward to further updating

Shareholders at our scheduled annual general meeting.

CHIEF EXECUTIVE OFFICER'S STATEMENT

Record financial performance and clear momentum.

-- A record breaking financial, operational and growth

performance, exceeding our expectations and delivering shareholder

value.

-- I am in no doubt that we will continue to deliver strong

results and growth over the coming years.

It has been an incredible year for the Group and despite

continued uncertainty in wholesale commodity markets I'm very

pleased with our performance. I am in no doubt that we will

continue to deliver strong results and growth over the coming

years.

Our plan was to be Bigger, Better, Faster and even Stronger than

in 2021. Having achieved this outcome in 2022, our plan for 2023 is

continue this momentum and demonstrate our evolution into a pure

scale mode.

Our revenue, adjusted EBITDA, cash generation, and numerous

operational indicators exceeded management expectations in 2022. We

have also hit the ground running and continuing to build momentum

into 2023. I therefore remain very confident in the Group's ability

to continue to deliver our ambitious strategy and unlock

significant shareholder value.

Demonstrating resilience and growing in an evolving market

2022 continued to provide market challenges to energy suppliers.

In March 2022, as we woke to the announcement that Russia had

invaded Ukraine, we saw unprecedented volatility in the wholesale

gas market sending all time high forward prices even higher.

The energy industry has seen perennial speculation about the

sustainability and profitability of disruptive challengers in the

gas and power supply markets. While the domestic supplier sector

has experienced headwinds with the energy price cap, I see a clear

path to significant growth opportunities in the business supply

sector.

Commodity markets have normalised more recently, but prices

compared to historic norms remain high, though less than their peak

in Q3 2022. In light of this reduction in prices, and the peak over

winter 2022/23, we do not anticipate any material impact on the

Group through the new amended Government support scheme from April

2023.

We remain fully hedged in our commodity position which is

evidenced in our improved profitability despite the market

volatility. However, we have seen some operational disruption,

particularly as market prices have been so volatile leading to the

need for the Group to temporarily and proactively suspend new sales

acquisition activities at several points during 2022. This reduced

the level of new customer bookings that could otherwise have been

achieved. We have also seen, perhaps understandably, customers more

willing to fix prices for only a short period, again reducing the

forward contract book, though we still exit 2022 with record levels

of forward revenue contracted.

Despite this we have managed to continue to deliver high service

levels and have significant momentum into 2023, with bookings being

at record levels despite this market context and volatility.

Shaking the tree as a growing and leading challenger supplier

remains our focus. We pride ourselves on bringing innovation to a

benign market, underpinned by our digital by default approach. This

continues to provide differentiation for the Group.

We also now see a less crowded business-to-business market, with

fewer larger suppliers which leads to a more sustainable market,

and also has the benefit of enabling the Group to differentiate as

a leading challenger. Barriers to entry are high, and compliance

with regulatory requirements even more heightened in view of the

wider context.

In summary, in a volatile market we have performed very well; we

have maintained our discipline and we combine innovation, including

through digital, with robust risk management. I'm convinced, as

markets settle, we can improve our performance even further.

Forming Y Smart

The Group acquired the management team and certain processes and

policies of Magnum Utilities Ltd in May 2022, forming the basis of

Y Smart - a new business set up to deliver installation and

maintenance services for smart meters.

I'm pleased with the integration of this new team, who were busy

over the summer of 2022 securing appropriate accreditations to

operate from August 2022.

Whilst the business will first and foremost focus on installing

smart meters for our supply customers, the service is also being

offered to other suppliers (in the domestic or non-domestic

sectors) and has already secured a contract with a third-party

supplier.

The integration and formation of this new team is an exciting

evolution for the Group, backed by a mandate from Government to

accelerate the implementation. Smart meters provide significant

benefits to our customers and to the Group's operation, and our

involvement in the engineering activities is expected to provide

further profitability improvement in 2023 and beyond.

Ambitious objectives

In addition to the establishment of Y Smart, we have ambitious

further targets to deliver benefits over the short to medium term.

These include:

Organically scaling the business

Revenue increased by 79% in 2022, to GBP279m. With bookings

continuing the strong momentum from Q4 2022 as we enter 2023, and

significant differentiation in our offering including through

digital, we target significant organic revenue increase for 2023

and beyond.

Reduction of bad debt

Our charge for bad debt has increased in 2022 (from 3.1% to 7.7%

of revenue), reflecting the higher commodity markets though also a

consequence of the Supplier of Last Resort ("SoLR") appointments

made in late 2021 and early 2022. The lack of some customer

information through the SoLR process led to difficulties in

following our normal debt processes, and it took some time to work

through the non-paying customer book (albeit such customers

generated higher gross margins). For 2023, we target a significant

reduction in bad debt through this newly cleansed book. We also

plan further operational improvements to reduce this cost

significantly.

Value enhancing acquisitions

We have demonstrated over the last three and a half years our

ability to identify and implement value enhancing acquisitions. We

will continue to assess potential acquisitions and will utilise our

strong balance sheet where the target meets our strategic

objectives.

Providing shareholder value

My team have delivered across numerous stretch targets in 2022

and I have every confidence that they will continue to over deliver

in 2023 and further. Alongside these targets, we have also worked

hard to improve our stakeholder engagement, including with

shareholders.

Our confidence in the Group's balance sheet is reflected in the

establishment of a progressive dividend policy, commencing with our

recommendation to shareholders of a 3p per share final dividend for

FY23. The ex-dividend date is 1 June 2023, with a payment date of

20 June 2023.

We have also worked hard to develop our investor reach, working

with Liberum and other stakeholders to engage with numerous

potential investors, as well as ensuring engagement with existing

stakeholders.

The Group continues to transform. I'm pleased to see the

increased business scale being reflected in the engagement we have

with existing and potential shareholders.

Outlook

-- Current trading remains strong as we enter 2023 and we are

confident of achieving current market expectations;

-- Significant revenue growth expected, supplementing the

GBP247m contracted at the end of 2022 to deliver in 2023;

-- Management target continued improvement in adjusted EBITDA

margin, with reduced bad debt and continued overhead efficiency

benefit as we benefit from our investment in digital;

-- Y Smart now fully operational and targeted to install several thousand meters in 2023; and

-- Continue to seek strategic acquisitions where they enhance returns.

Continuing to deliver

Despite turbulence in the wider market, I'm pleased and proud to

note that we over delivered against our financial and operational

targets in 2022.

The opportunity ahead of us remains huge, and I and the rest of

the Board and management will continue to drive performance to

unlock shareholder benefit. I would also like to thank the entire Y

Group team for their continued efforts.

I look forward to updating the market on our progress in the

coming months.

FINANCE REVIEW

Increased revenue, adjusted EBITDA and cash.

-- We continue strong momentum in financial results, governed via our clear financial framework

In overview

-- Revenue increased 79% to GBP279m

-- Contracted revenue for FY23 of GBP247m, up 57% on prior year

-- Adjusted EBITDA increased to GBP7.9m, up GBP6.2m year on year

-- Profit before tax increased 72% to GBP5.8m

-- Operating cash inflow of GBP14.7m, with net cash available of GBP18.8m

-- Adjusted, fully diluted, EPS of 30p, up 16p in the year

-- Final dividend of 3p per share recommended

Financial metrics Change 2022 2021

GBPm unless stated

------------------------------- ------- -------

Revenue +79.2% 278.6 155.4

Gross margin % +6.0% 15.8% 9.8%

Net customer contribution % +1.5% 8.2% 6.7%

General overheads % +0.3% (5.3%) (5.6%)

Adjusted EBITDA % +1.7% 2.8% 1.1%

------------------------------- ------- ------- ------

Adjusted EBITDA +6.2 7.9 1.7

------------------------------- ------- ------- ------

Profit before tax +2.4 5.8 3.4

------------------------------- ------- ------- ------

Net cash flow +16.6 11.9 (4.7)

------------------------------- ------- ------- ------

Closing cash balance +12 19.0 7.0

------------------------------- ------- ------- ------

Overdue customer receivables -2 days 5 days 7 days

------------------------------- ------- ------- ------

Earnings per share (adjusted,

fully diluted, pence) +16p 30p 14p

------------------------------- ------- ------- ------

Dividend per share (pence) +3p 3p -

=============================== ======= ======= ======

Results summary

Our financial performance for the year ended 31 December 2022

delivered above management expectations in revenue, EBITDA and

cash, and the Board is confident in continuing this strong

trajectory.

Revenue of GBP278.6m represents a 79.2% growth in year, and we

exited 2022 with GBP246.8m (up 57% on the prior year) already

contracted to deliver in 2023.

Adjusted EBITDA (the Board's key profitability measure) at

GBP7.9m (2021: GBP1.7m) represents 2.8% (2021: 1.1%) of revenue.

This performance reflects higher net customer contribution margins

(as we secure additional customer lifecycle value) combined with

improved overhead efficiency from the Group's investment in

digital.

Adjusted EBITDA reconciliation 2022 2021

GBPm

-------------------------------------- ------

Adjusted EBITDA 7.9 1.7

% of revenue 2.8% 1.1%

-------------------------------------- ------ -----

Adjusted items:

Non-recurring costs - (0.6)

Unrealised (loss)/gain on derivative

contracts (0.9) 3.3

Share based payment charge (FY21

only) - (0.2)

Depreciation and amortisation (1.1) (0.7)

-------------------------------------- ------ -----

Statutory operating profit 5.9 3.5

====================================== ====== =====

Reported profit before tax has increased by 72% to GBP5.8m,

reflecting significantly higher adjusted EBITDA (up 359%) in the

year, though non-cash derivative accounting gains reported in FY21

have not, as expected, continued.

The Group continues to follow its stated financial framework

to:

-- drive significant organic growth, supplemented by M&A where value enhancing;

-- improve profitability via increasing customer margins and

unlocking significant overhead leverage savings through our Digital

by Default investments; and

-- maintain robust cash management.

The Board is pleased to announce the proposal of a final

dividend of 3p per share, established under a progressive dividend

policy.

Building recurring revenue

The Group has recorded a 79.2% growth in revenue year on year

(an increase of GBP123.2m) and has good visibility for FY23.

FY22 revenue included a significant contribution from new

bookings, despite some customers in H1 and Q3 2022 delaying

entering new contracts based on the high commodity market

environment. Record monthly bookings of new customers, at GBP48.6m

for Q4 2022, were noted. FY22 revenue also included GBP70m (2021:

GBP11m) from uncontracted ("Non-Firm") customers.

Contracted revenue continues to provide significant forward

visibility in to FY23, with GBP247m already contracted at the end

of 2022 (2021: GBP157m to deliver in 2022). Contract bookings

remain strong as we enter FY23, providing management with

significant confidence that the Group will continue its significant

growth trajectory on an organic basis.

Non-Firm volume on supply as at 31 December 2022 was 99GWh,

representing (based on 31 December 2022 tariffs) annualised revenue

of GBP59m. Non-Firm volume averaged 123GWh in FY22 due to the

particularly significant H1 2022 contribution from our appointment

as Supplier of Last Resort for AmpowerUK, Xcel Power and Whoop

Energy in late 2021 and early 2022.

Investment in Yü Smart

Adjusted EBITDA includes GBP1.1m of operational expenditure

during the ramp up of our new smart metering and EV charger

installation business.

The Group acquired the management and support team, policies and

intellectual property of Magnum Utilities Limited for a total

investment (consideration and implementation costs) of GBP0.2m.

Metering assets of GBP0.3m have also been acquired, in order for

the Group to finance installations to provide an annuity revenue

stream.

The Group expects to achieve significant returns from this new

activity with positive EBITDA from engineering activities in FY23

replacing costs previously outsourced by the Group. In addition,

management expects further benefits through increased penetration

of smart meters, including:

-- additional real-time data to improve billing and hedging accuracy;

-- increased growth rates through the ability to offer more

appropriate products to certain business segments;

-- revenue and bad debt protection, including the potential for

customers to access Pay As You Go products; and

-- asset returns, from the installation of assets.

In relation to assets, the Board is considering an investment

strategy to invest in customer assets, largely funded by debt,

which would provide potentially significant additional shareholder

value.

Leveraging overheads and delivering profit

The Group's overheads were 5.3% of revenue (2021: 5.6%), which

includes 0.4% (as % of revenue) impact from the investment in Yü

Smart. Excluding Yü Smart overheads were 4.9% of revenue, a 0.7%

improvement, driven through digital and scale benefits, with

further value expected over the short to medium term.

Management is targeting a 3.7% overhead at GBP0.5bn revenue,

representing a GBP8m adjusted EBITDA improvement at that scale.

General overheads actual and management FY22 Medium-Term

target Target

GBPm

----------------------------------------- ----------

Revenue GBP279m GBP500m

General overheads %:

Cost to acquire 1.1% 0.9%

Cost to serve 1.7% 1.4%

New business and innovation 0.4% 0.2%

General administrative 2.1% 1.5%

---------- -----------

Total general overheads % 5.3% 3.7%

----------------------------------------- ---------- -----------

Overhead cost GBP14.8m* GBP18.5m

----------------------------------------- ---------- -----------

Overhead saving at scale GBP8.0m

========================================= ========== ===========

* General overheads comprises GBP15.85m operating costs charged

to the income statement, less depreciation and amortisation (as per

note 4) of GBP1.05m.

The Group has recognised a GBP0.9m loss (2021: GBP3.3m gain) on

derivative accounting. This is mechanically a result of the falling

commodity markets leading to a lower mark-to-market asset in

respect of a small proportion of forward commodity hedges. The

Group holds a GBP3.0m financial derivative asset (2021: GBP4.0m) as

at 31 December 2022 which is expected to unwind over the medium

term. The Board notes that the derivative accounting gain or loss

is a non-cash item, hence its consistent exclusion from the Group's

adjusted EBITDA result.

Taxation charge of GBP1.1m (2021: GBP1.1m credit) is through

deferred taxation, with the Group carrying forward large trading

loss allowances (with an asset value of GBP4.7m) to be set against

the Group's future taxable profits. The credit in FY21 included the

benefit from an increased corporation tax rate announced, which

enhanced the value of carried forward allowances.

Cash and balance sheet management

Cash increased by GBP11.9m in the year. The Group remains debt

free save for GBP0.2m of operating lease liability.

Cash flow 2022 2021

GBPm

--------------------------- ------

Adjusted EBITDA 7.9 1.7

Working capital movement 6.8 (2.5)

--------------------------- ------ -----

Operating cash flow 14.7 (0.8)

Investing activities (2.6) (3.7)

Financing activities (0.2) (0.2)

--------------------------- ------ -----

Net cash movement in year 11.9 (4.7)

--------------------------- ------ -----

Closing cash balance 19.0 7.0

=========================== ====== =====

Group receivables and payables have broadly increased in

alignment to the Group's business activities, providing a working

capital benefit to cash. A VAT deferral of GBP1.1m related to

Covid-19 was fully repaid in Q1 2022 which has been more than

off-set by increased payables as the Group benefits from its

positive working capital profile.

Capital investment includes GBP2.2m of Digital by Default

investment, targeted to further enhance Group returns through

growth and efficiency benefits. It also includes the capital

investment of GBP0.3m in establishing Yü Smart.

Dividend and capital management

The Board recommends the payment of a final dividend of 3p per

share, being circa GBP0.5m payable in June 2023. The level of

dividend is sized to represent the significant potential

opportunities to utilise Group cash to further develop the

business.

Capital plans, in order of priority, for the Group are:

1. Working capital and securitisation management, including

maintaining or enhancing credit lines for commodity hedging

2. Operational investment in marketing and sales to drive additional organic growth

3. Capital investment in Digital by Default to drive growth and/or overhead efficiency

4. Asset investment, including in smart meters or EV

infrastructure, largely supported through debt

5. Inorganic growth, with targeted acquisitions which meet our hurdle rate

6. Dividend or other shareholder return of investment

The Board targets a progressive dividend policy, broadly aligned

to earnings growth as the Group benefits from the stated

strategy.

Summary: controlled progression

In summary, the Group is well placed to continue to improve

financial returns to shareholders.

There is significant confidence in maintaining strong growth in

revenue; and our investment in digital and our focus on customer

lifecycle value is expected to further improve adjusted EBITDA

margin.

Our approach to commodity hedging continues to deliver despite

significant market volatility. Our investment in Yü Smart provides

a significant profit improvement opportunity from FY23 and

beyond.

The Board is therefore pleased to report these significantly

improved results in FY22 at revenue, adjusted EBITDA and cash

level, and remain focused on continuing to improve these measures

over the short to medium term.

CONDENSED FINANCIAL STATEMENTS

Condensed consolidated statement of profit and loss and other

comprehensive income

For the year ended 31 December 2022

31 December 31 December

2022 2021

Notes GBP'000 GBP'000

------------------------------------------------ ----- ----------- -----------

Revenue 278,587 155,423

Cost of sales (234,462) (140,180)

------------------------------------------------ ----- ----------- -----------

Gross profit 44,125 15,243

------------------------------------------------ ----- ----------- -----------

Operating costs before non-recurring items

and share based payment charges (15,565) (9,407)

Operating costs - non-recurring items 7 - (644)

Operating costs - share based payment charges 22 (284) (249)

------------------------------------------------ ----- ----------- -----------

Total operating costs (15,849) (10,300)

Net impairment losses on financial and contract

assets 16 (21,420) (4,799)

Other (losses) / gains 7 (926) 3,344

------------------------------------------------ ----- ----------- -----------

Operating profit 4 5,930 3,488

Finance income 5 1 -

Finance costs 5 (91) (96)

------------------------------------------------ ----- ----------- -----------

Profit before tax 5,840 3,392

Taxation 9 (1,071) 1,059

------------------------------------------------ ----- ----------- -----------

Profit and total comprehensive income for

the year 4,769 4,451

------------------------------------------------ ----- ----------- -----------

Earnings per share

Basic 8 GBP0.29 GBP0.27

Diluted 8 GBP0.26 GBP0.26

------------------------------------------------ ----- ----------- -----------

Condensed consolidated balance sheet

At 31 December 2022

31 December 31 December

2022 2021

Notes GBP'000 GBP'000

------------------------------- ----- ----------- -----------

ASSETS

Non-current assets

Intangible assets 11 3,111 1,333

Property, plant and equipment 12 3,641 3,751

Right-of-use assets 13 113 193

Deferred tax assets 15 5,300 5,932

Trade and other receivables 16 - -

Financial derivative asset 17 1,562 870

--------------------------------- ----- ----------- -----------

13,727 12,079

------------------------------- ----- ----------- -----------

Current assets

Stock 345 -

Trade and other receivables 16 54,339 37,339

Financial derivative asset 17 1,484 3,102

Cash and cash equivalents 18 18,970 7,049

--------------------------------- ----- ----------- -----------

75,138 47,490

------------------------------- ----- ----------- -----------

Total assets 88,865 59,569

--------------------------------- ----- ----------- -----------

LIABILITIES

Current liabilities

Trade and other payables 19 (73,860) (49,743)

--------------------------------- ----- ----------- -----------

Non-current liabilities

Trade and other payables 19 (206) (541)

--------------------------------- ----- ----------- -----------

Total liabilities (74,066) (50,284)

--------------------------------- ----- ----------- -----------

Net assets 14,799 9,285

--------------------------------- ----- ----------- -----------

EQUITY

Share capital 21 83 82

Share premium 21 11,785 11,690

Merger reserve 21 (50) (50)

Retained earnings/(accumulated

losses) 21 2,981 (2,437)

--------------------------------- ----- ----------- -----------

14,799 9,285

------------------------------- ----- ----------- -----------

Condensed consolidated statement of changes in equity

For the year ended 31 December 2022

Share Share Merger Retained

capital premium reserve earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------------------- -------- -------- -------- --------- --------

Balance at 1 January 2022 82 11,690 (50) (2,437) 9,285

-------------------------------- -------- -------- -------- --------- --------

Total comprehensive income

for the year

Profit for the year - - - 4,769 4,769

-------------------------------- -------- -------- -------- --------- --------

- - - 4,769 4,769

-------------------------------- -------- -------- -------- --------- --------

Transactions with owners

of the Company

Contributions and distributions

Equity-settled share based

payments - - - 210 210

Deferred tax on share based

payments - - - 439 439

Proceeds from share issues 1 95 - - 96

-------------------------------- -------- -------- -------- --------- --------

Total transactions with

owners of the Company 1 95 - 649 745

-------------------------------- -------- -------- -------- --------- --------

Balance at 31 December 2022 83 11,785 (50) 2,981 14,799

-------------------------------- -------- -------- -------- --------- --------

Balance at 1 January 2021 82 11,690 (50) (7,209) 4,513

-------------------------------- -------- -------- -------- --------- --------

Total comprehensive income

for the year

Profit for the year - - - 4,451 4,451

-------------------------------- -------- -------- -------- --------- --------

- - - 4,451 4,451

-------------------------------- -------- -------- -------- --------- --------

Transactions with owners

of the Company

Contributions and distributions

Equity-settled share based

payments - - - 237 237

Deferred tax on share based

payments - - - 84 84

Proceeds from share issues - - - - -

-------------------------------- -------- -------- -------- --------- --------

Total transactions with

owners of the Company - - - 321 321

-------------------------------- -------- -------- -------- --------- --------

Balance at 31 December 2021 82 11,690 (50) (2,437) 9,285

-------------------------------- -------- -------- -------- --------- --------

Condensed consolidated statement of cash flows

For the year ended 31 December 2022

31 December 31 December

2022 2021

GBP'000 GBP'000

----------------------------------------------------- ----------- -----------

Cash flows from operating activities

Profit for the financial year 4,769 4,451

Adjustments for:

Depreciation of property, plant and equipment 325 255

Depreciation of right-of-use assets 80 80

Amortisation of intangible assets 648 352

Unrealised loss/(gains) on derivative contracts 926 (3,344)

Increase in stock (345) -

Increase in trade and other receivables (17,000) (19,700)

Increase in trade and other payables 23,889 17,468

Cash received on obtaining customer contracts - 378

Finance income (1) -

Finance costs 91 96

Taxation 1,071 (1,059)

Share based payment charge 284 249

----------------------------------------------------- ----------- -----------

Net cash from/(used in) operating activities 14,737 (774)

----------------------------------------------------- ----------- -----------

Cash flows from investing activities

Purchase of property, plant and equipment (215) (2,629)

Payment of software development costs (2,210) (1,079)

Payment of consideration on business combination (216) -

----------------------------------------------------- ----------- -----------

Net cash used in investing activities (2,641) (3,708)

----------------------------------------------------- ----------- -----------

Cash flows from financing activities

Net proceeds from share option exercises 96 -

Cash-settled share based payment charge (74) (12)

Interest paid (76) (77)

Principal element of lease payments (121) (120)

----------------------------------------------------- ----------- -----------

Net cash used in financing activities (175) (209)

----------------------------------------------------- ----------- -----------

Net increase/(decrease) in cash and cash equivalents 11,921 (4,691)

Cash and cash equivalents at the start of the year 7,049 11,740

----------------------------------------------------- ----------- -----------

Cash and cash equivalents at the end of the year 18,970 7,049

----------------------------------------------------- ----------- -----------

Notes to the condensed consolidated financial statements

1. Significant accounting policies

Yü Group PLC (the "Company") is a public limited company

incorporated in the United Kingdom, with company number 10004236.

The Company is limited by shares and the Company's ordinary shares

are traded on AIM. These condensed consolidated financial

statements ("Financial Statements") as at and for the year ended 31

December 2022 comprise the Company and its subsidiaries (together

referred to as the "Group"). The Group is primarily involved in the

supply of electricity, gas and water to small and medium sized

entities ("SMEs") and larger corporates in the UK.

Basis of preparation

Whilst the financial information included in this preliminary

announcement has been prepared on the basis of the requirements of

UK-adopted International Accounting Standards in conformity with

the requirements of the Companies Act 2006 and effective at 31

December 2022, this announcement does not itself contain sufficient

information to comply with International Accounting Standards.

The financial information set out in this preliminary

announcement does not constitute the Company's statutory financial

statements for the years ended 31 December 2022 or 2021 but is

derived from those financial statements.

Statutory financial statements for 2021 have been delivered to

the registrar of companies and those for 2022 will be delivered in

due course. The auditors have reported on those financial

statements; their reports were (i) unqualified and (ii) did not

contain a statement under section 498 (2) or (3) of the Companies

Act 2006.

The condensed consolidated financial statements are presented in

British pounds sterling (GBP), which is the functional and

presentational currency of the Group. All values are rounded to the

nearest thousand (GBP'000), except where otherwise indicated.

Going concern

The financial statements are prepared on a going concern

basis.

At 31 December 2022 the Group had net assets of GBP14.8m (2021:

GBP9.3m) and cash of GBP19.0m (2021: GBP7.0m).

Management prepares detailed budgets and forecasts of financial

performance and cash flow (including capital commitments) over the

coming 12 to 36 months. The Board has confidence in achieving such

targets and forecasts and has performed comprehensive analysis of

various risks (including those set out in the Strategic Report) and

sensitivities in relation to performance, the energy market and the

wider economy.

The Group has demonstrated significant progress in its results.

This has led to adjusted EBITDA (a close profitability measure to

cash generated from operations) in 2022 of GBP7.9m (2021: GBP1.7m),

which continues the very strong momentum in the Group's results

occurring since 2018. Management is confident in continuing this

improvement in profitability based on its business model.

The profitability delivered in 2022 has been achieved by robust

and disciplined management of gross margin; the successful

integration of new customer books awarded to the Group by Ofgem

(AmpowerUK, Xcel and Whoop Energy), and includes GBP1.1m op-ex

investment in Yü Smart, a business which is expected to

significantly contribute to the Group's financial performance. The

Group has continued its prudent hedging policy protecting the Group

from the significant commodity market price volatility recently

experienced, and has successfully implemented BEIS's Energy Bill

Relief Scheme ("EBRS").

The Group has embarked on an ambitious Digital by Default

implementation strategy to help drive further cost efficiency which

is expected to further enhance financial performance as the Group

scales.

Group available cash is at a historic high level, with GBP19.0m

available at 31 December 2022, a material increase on the GBP7.0m

at the end of 2021. This increase is despite significant investment

in digital tools to improve profitability over the medium term, and

the investment in Yü Smart.

The Group has no debt other than GBP0.2m (at 31 December 2022)

in respect of the lease for the Group's Nottingham office.

The Board has assessed risks and sensitivities and potential

mitigation steps available to it in detail and continues to monitor

risk and mitigation strategies in the normal course of

business.

Customer receivables and bad debt

The Board consider customer receivable risks in view of

increased energy prices and cost of living pressures which impact

the wider market. With increased levels of bad debt in FY22, the

Board perform sensitivities on material changes to customer payment

behaviour including the timing of payments or if bad debt levels

continue to increase.

The Group has extensive mitigating actions in place. This

includes credit checks at point of sale and throughout the customer

lifecycle, the requirement for some customers to pay reasonable

security deposits at the point of sale, and the offering (ensuring

compliance with regulation and good industry practice) of pay as

you go products which enable certain customers to access more

favourable tariffs. The Group also supports customers with payment

plan arrangements, for those customers who will, when able, provide

payment, and will ultimately (for some customers, as appropriate

based on the circumstances) progress legal and/or disconnection

proceedings to mitigate ongoing bad debt.

The Board has also considered the impact of reduced regulatory

support following the planned removal of the Energy Bill Relief

Scheme ("EBRS") from 1 April 2023, to be replaced with a less

significant scheme for business customers.

In view of the reduced market prices, and the Group's ability to

manage debt through various mitigating actions, the Board is

confident that there will be no material impact relevant to the

going concern assumption.

Hedging arrangements and volatile energy markets

A five year commodity trading arrangement between SmartestEnergy

Ltd and the trading entities of the Group (Yü Energy Holding

Limited and Yü Energy Retail Limited), signed December 2019, ("the

Trading Agreement") enables the Group to purchase electricity and

gas on forward commodity markets. The Trading Agreement enables

forecasted customer demand to be hedged in accordance with an

agreed risk mandate (further detailed in the Group's risk and

uncertainties reporting in the Strategic Report). With the

unprecedented volatility in commodity market prices for forward gas

and electricity, this hedging position and the Board defined risk

strategy has and continues to protect the Group.

As part of the Trading Agreement, SmartestEnergy Ltd holds

security over the trading assets of the Group which could,

ultimately and in extreme and limited circumstances, lead to a

claim on some or all of the assets of the Group. In return, a

variable commodity trading limit is provided, which scales with the

Group, having the benefit of significantly reducing the need to

post cash collateral from cash reserves.

The Board carefully monitors covenants associated with the

Trading Agreement to assess the likelihood of the credit facility

being reduced or withdrawn. Management also maintains close

dialogue with SmartestEnergy Ltd in respect of such covenants and

provides robust oversight of the relevant contracts.

The position in respect of the forward credit exposure is also

monitored and forecasted to understand the potential risks which

may arise:

a) Where commodity market prices increase, the Board considers

credit and contractual exposure to SmartestEnergy Ltd, which (under

a default position) could lead to the unwind of hedges with the

loss of value due to the Group if not successfully recovered under

the contract. With increased market prices, this exposure increased

significantly during 2021 and Q3 and early Q4 of 2022.

b) Where commodity market prices decrease, the Board considers

whether the credit limit provided under the Trading Agreement is

sufficient to prevent the potential for cash calls which may be

more than the Group's available cash reserves. The Board also

considers likely commercial outcomes relevant for such a scenario,

and mitigating actions available to the Group. Mitigating actions

include, where possible, unwinding forward commodity hedge

positions to prevent the credit position increasing further, which

may expose the Group to increased risk over the medium to long

term.

Despite the market volatility experienced in 2022 and early

2023, the Trading Agreement continues to operate well and provides

reliable, efficient and effective access to traded commodity

markets.

The Board also considers its business model and compares it with

competitors which have failed, to determine any other risks related

to the volatile energy markets. This risk is considered lower than

in the previous year, and the Board is satisfied that the Group's

business model is adequately differentiated from these market

issues.

The Board has also considered the impact of reduced regulatory

support following the planned removal of the Energy Bill Relief

Scheme ("EBRS") from 1 April 2023, replaced with a less significant

scheme for business customers. In view of the reduced market

prices, and the Group's ability to manage debt, the Board is

confident that there will be no material impact relevant to the

going concern assumption for the accounts.

After a detailed review, the Board has concluded that there are

no liquidity issues likely to arise (outside of available

mitigating strategies) in relation to the hedging arrangements and

current market context.

Summary

Following extensive review of the Group's forward business plan

and associated risks and sensitivities to these base forecasts (and

available mitigation strategies), the Board concludes that it is

appropriate to prepare the financial statements on a going concern

basis.

Basis of consolidation

The consolidated accounts of the Group include the assets,

liabilities and results of the Company and subsidiary undertakings

in which Yü Group PLC has a controlling interest. Control is

achieved when the Group is exposed, or has rights, to variable

returns from its involvement with the investee and can affect those

returns through its power over the investee. Specifically, the

Group controls an investee if, and only if, the Group has all of

the following: power over the investee (i.e. existing rights that

give it the current ability to direct the relevant activities of

the investee); exposure, or rights, to variable returns from its

involvement with the investee; and the ability to use its power

over the investee to affect its returns. When necessary,

adjustments are made to the financial statements of subsidiaries to

bring their accounting policies into line with the Group's

accounting policies. All intra-Group assets and liabilities,

equity, income, expenses and cash flows relating to transactions

between members of the Group are eliminated in full on

consolidation.

Use of estimates and judgements

The preparation of the financial statements in conformity with

adopted IFRSs requires the use of estimates and judgements.

Although these estimates are based on management's best knowledge,

actual results ultimately may differ from these estimates.

Estimates and underlying assumptions are reviewed on an ongoing

basis. Revisions to accounting estimates are recognised in the

period in which the estimates are revised and in any future periods

affected. The key areas of estimation and judgement are:

-- the estimated consumption (in lieu of accurate meter readings) of energy by customers;

Revenue estimates are based on industry knowledge or source

information, where available, and can therefore represent estimates

which are lower or higher than the actual out-turn of energy

consumption once accurate meter readings are obtained. The

utilisation of smart or automatic meters is significant and growing

in the Group, which reduces the amount estimated.

-- the level of accrual for unbilled revenue;

To estimate the level of accrual for unbilled revenue,

management estimates the level of consumption, and anticipated

revenue, which is due to be charged to the customer, and recognises

such revenue where it is considered that revenue will flow to the

Group. The estimate of customer consumption is based on available

industry data, and also seasonal usage curves that have been

estimated through historical actual usage data. The accrual for

unbilled revenue is based on prudent assumptions where management

has some doubt on the ability to bill such charges to

customers.

-- the accrual for certain energy costs;

Certain gas and electricity costs (for example, balancing of the

Group's commodity purchases across industry participants; or the

allocation to the Group of "unidentified gas" which the industry

spreads across market participants) are based on industry or

management estimates based on knowledge of the market, historic

norms and estimates of the expected out-turn position which may be

over or underestimates.

-- the recoverability of trade receivables and related expected credit loss provision;

Trade receivables recoverability is estimated, with appropriate

allowance for expected credit loss provisions, based on historical

performance and the directors' estimate of losses over the Group's

customer receivable balances. Management also conducts a detailed

review of significant debtor balances at the year end, including

exposure after VAT and CCL, provisions and other accounting

adjustments are considered. Sensitivity analysis on estimates is

provided in note 20.

-- the level of forward energy commodity contracts which are not

strictly for "own use" under IFRS 9;

The Group enters forward purchase contracts to hedge its

position to closely match customers' expected demand over the term

of the contract and does not engage in speculative trading. Factors

such as the shape/granularity of traded products available (which

do not perfectly align with customer demand) and variations in

energy consumed by customers (as a result of varying customer

behaviour and activity, and (particularly for gas) the weather

impact) can influence the extent of trades which are not strictly

for the Group's "own use". Such contracts are accounted for at fair

value through the Group's profit or loss. The Board estimates the

proportion of forward contracts which are to be assessed at fair

value by considering the expected "normalised" forward traded

position, with reference to historical performance on matching

customer demand and the Group's robustly controlled hedging and

risk strategy. Sensitivity analysis on estimates is provided in

note 20.

-- the assumptions input to the IFRS 2 share option charge calculations;

The share option charge requires certain estimates, including

the volatility in share price, risk-free rates and dividend yields,

together with assessment of achievement of certain vesting

conditions including achievement of share price and EBITDA targets

in performance shares.

-- the recoverability of deferred tax assets.

Deferred tax asset recoverability is assessed based on

directors' judgement of the recoverability of the tax losses by the

realisation of future profits over the short to medium term, which

inherently is based on estimates.

Revenue recognition

The Group enters into contracts to supply gas, electricity and

water to its customers. Revenue represents the fair value of the

consideration received or receivable from the sale of actual and

estimated gas, electricity and water supplied during the year, net

of discounts, climate change levy and value-added tax. Revenue is

recognised on consumption, being the point at which the transfer of

the goods or services to the customer takes place, and based on an

assessment of the extent to which performance obligations have been

achieved.

Due to the nature of the energy supply industry and its reliance

upon estimated meter readings, gas, electricity and water revenue

includes the directors' best estimate of differences between

estimated sales and billed sales. The Group makes estimates of

customer consumption based on available industry data, and also

seasonal usage curves that have been estimated through historical

actual usage data. It also considers any adjustments expected where

an estimated meter reading (using industry data) is expected to be

different to the consumption pattern of the customer.

The Group's operations include the supply of metering services,

or the installation of metering assets, on behalf of Group

companies. Such revenues are eliminated on consolidation. Where

services for metering services or metering installation services

are for the benefit of third parties, revenue is recognised in line

with the work performed. Revenue for smart metering services is

recognised at a point in time.

Government support to customers

The Energy Bills Relief Scheme ("EBRS"), and certain less

material (for the Group) other schemes, implemented by HM

Government, through BEIS, results in customers being provided

financial support through a contribution to their energy charges.

Under the EBRS arrangement, amounts receivable from BEIS do not

impact the Group's contract with customers, and therefore the

amounts contributed under EBRS are treated as a cash payment

towards customer bills. As such, revenue recognised is based on the

amount chargeable per the contract with customers which is gross of

the amount contributed through EBRS.

Financial instruments

Non-derivative financial instruments

Non-derivative financial instruments comprise trade and other

receivables, cash and cash equivalents and trade and other

payables.

Trade and other receivables

Trade and other receivables are recognised initially at fair

value. Subsequent to initial recognition they are measured at

amortised cost using the effective interest method, less any

impairment and expected credit losses.

Impairment

The Group has elected to measure credit loss allowances for

trade receivables and accrued income at an amount equal to lifetime

expected credit losses ("ECLs"). Specific impairments are made when

there is a known impairment need against trade receivables and

accrued income. When estimating ECLs, the Group assesses

reasonable, relevant and supportable information, which does not

require undue cost or effort to produce. This includes quantitative

and qualitative information and analysis, incorporating historical

experience, informed credit assessments and forward looking

information. Loss allowances are deducted from the gross carrying

amount of the assets.

Trade and other payables

Trade and other payables are recognised initially at fair value.

Subsequent to initial recognition they are measured at amortised

cost using the effective interest method.

Cash and cash equivalents

Cash and cash equivalents comprise cash balances and short-term

deposits (monies held on deposit are accessible with one month's

written notice). Cash and cash equivalents exclude any cash

collateral posted with third parties and bank accounts which are

secured by the Group's bankers (or others). It also excludes cash

held in bank accounts which have, as part of government schemes

such as EBRS, cash balances which are not yet transferred to the

Group's main operating bank accounts.

Bank overdrafts that are repayable on demand and form an

integral part of the Group's cash management are included as a

component of cash and cash equivalents.

Derivative financial instruments

The Group uses commodity purchase contracts to hedge its

exposures to fluctuations in gas and electricity commodity prices.

Most commodity purchase contracts are expected to be delivered

entirely to the Group's customers and therefore the Group

classifies them as "own use" contracts and outside the scope of

IFRS 9 "Financial Instruments". This is achieved when:

-- a physical delivery takes place under all such contracts;

-- the volumes purchased or sold under the contracts correspond

to the Group's operating requirements; and

-- no part of the contract is settled net in cash.

This classification as "own use" allows the Group not to

recognise the commodity purchase contracts on its balance sheet at

the year end.

The commodity purchase contracts that do not meet the criteria

listed above are recognised at fair value under IFRS 9. The gain or

loss on remeasurement to fair value is recognised immediately in

profit or loss.

Classification of financial instruments issued by the Group

Financial instruments issued by the Group are treated as equity

only to the extent that they meet the following two conditions:

(a) they include no contractual obligations upon the Group to

deliver cash or other financial assets or to exchange financial

assets or financial liabilities with another party under conditions

that are potentially unfavourable to the Group; and

(b) where the instrument will or may be settled in the Group's

own equity instruments, it is either a non-derivative that includes

no obligation to deliver a variable number of the Company's own

equity instruments or is a derivative that will be settled by the

Company exchanging a fixed amount of cash or other financial assets

for a fixed number of its own equity instruments.

To the extent that this definition is not met, the proceeds of

issue are classified as a financial liability. Where the instrument

so classified takes the legal form of the Company's own shares, the

amounts presented in these financial statements for called up share

capital and share premium account exclude amounts in relation to

those shares.

Details of the sensitivity analysis performed in relation to the

Group's financial instruments are included in note 20.

Intangible assets

Intangible assets that are acquired separately by the Group are

stated at cost less accumulated amortisation and accumulated

impairment losses.

Intangible assets acquired in a business combination are

initially recognised at their fair value at the acquisition date.

After initial recognition, intangible assets acquired in a business

combination are reported at their initial fair value less

amortisation and accumulated impairment losses.

Goodwill arising on business combination is accounted for in

line with the business combination disclosure.

Software and system assets are recognised at cost, including

those internal costs attributable to the development and

implementation of the asset in order to bring it into use. Cost

comprises all directly attributable costs, including costs of

employee benefits arising directly from the development and

implementation of software and system assets.

Amortisation is charged to the statement of profit and loss on a

straight-line basis over the estimated useful lives of the

intangible assets from the date they are available for use. The

estimated useful lives are as follows:

-- Licence - 35 years

-- Customer contract books - Over the period of the contracts

acquired (typically 2 years)

-- Software and systems - 3 to 5 years

Goodwill is not amortised, as it is subject to impairment

review.

Property, plant and equipment

Items of property, plant and equipment are measured at cost less

accumulated depreciation and accumulated impairment losses.

Depreciation is recognised in profit or loss on a straight-line

basis over the estimated useful lives of each part of an item of

property, plant and equipment. The estimated useful lives for the

current and comparative periods are as follows:

-- Freehold land - Not depreciated

-- Freehold property - 30 years

-- Plant and machinery - 5 to 15 years

-- Computer equipment - 3 years

-- Fixtures and fittings - 3 years

Assets under construction include smart metering, or other

metering, assets which are acquired by the Group on the basis that

they will be installed on customer premises.

Assets under construction are not depreciated until the period

they are brought into use.

Business combinations

The acquisition method of accounting is used to account for

business combinations regardless of whether equity instruments or

other assets are acquired.

The consideration transferred is the sum of the acquisition-date

fair values of the assets transferred, equity instruments issued or

liabilities incurred by the acquirer to former owners of the

acquiree and the amount of any non-controlling interest in the

acquiree.

All acquisition costs are expensed as incurred to profit or

loss.

On the acquisition of a business, the consolidated entity

assesses the financial assets acquired and liabilities assumed for

appropriate classification and designation in accordance with the

contractual terms, economic conditions, the consolidated entity's

operating or accounting policies and other pertinent conditions in

existence at the acquisition date.

Contingent consideration to be transferred by the Group is

recognised at the acquisition-date fair value. Subsequent changes

in the fair value of the contingent consideration classified as an

asset or liability are recognised in profit or loss. Contingent

consideration classified as equity is not remeasured and its

subsequent settlement is accounted for within equity.

The difference between the acquisition-date fair value of assets

acquired and liabilities assumed, and the fair value of the

consideration transferred is recognised as goodwill. If the

consideration transferred and the pre-existing fair values are less

than the fair value of the identifiable net assets acquired, being

a bargain purchase to the Group, the difference is recognised as a

gain directly in profit or loss on the acquisition date, but only

after a reassessment of the identification and measurement of the

net assets acquired and the consideration transferred.

Business combinations are initially accounted for on a

provisional basis. The Group retrospectively adjusts the

provisional amounts recognised and recognises additional assets or

liabilities during the measurement period, based on new information

obtained about the facts and circumstances that existed at the

acquisition date. The measurement period ends on the earlier of (i)

12 months from the date of the acquisition or (ii) when the

acquirer receives all the information possible to determine fair

value.

In determining whether an acquisition of an acquired set of

activities and assets is a business, the "concentration test"

methodology as outlined in IFRS 3 is utilised. Where substantially

all the fair value of the gross assets acquired are attributable to

a single identifiable asset group, such as a customer list, then a

business combination will not occur.

Leased assets

The Group as a lessee

For any new contract entered into the Group considers whether a

contract is, or contains, a lease. A lease is defined as "a

contract, or part of a contract, that conveys the right to use an

asset (the underlying asset) for a period of time in exchange for

consideration". To apply this definition the Group assesses whether

the contract meets three key evaluations which are whether:

-- the contract contains an identified asset, which is either

explicitly identified in the contract or implicitly specified by