TIDMTXP

RNS Number : 0832U

Touchstone Exploration Inc.

24 March 2023

ANNUAL 2022 FINANCIAL AND OPERATING RESULTS

CALGARY, ALBERTA (March 24, 2023) - Touchstone Exploration Inc.

( " Touchstone ", "we", "our", "us" or the " Company " ) (TSX, LSE:

TXP) reports its operating and financial results for the three

months and year ended December 31, 2022. Selected information is

outlined below and should be read in conjunction with our December

31, 2022 audited consolidated financial statements, the related

Management's discussion and analysis and our December 31, 2022

Annual Information Form, all of which will be available under our

profile on SEDAR ( www.sedar.com ) and on our website (

www.touchstoneexploration.com ). Unless otherwise stated, all

financial amounts herein are rounded to thousands of United States

dollars .

Fourth Quarter 2022 Financial and Operating Highlights

-- Achieved initial natural gas production from our Coho-1 well,

which produced average net volumes of 5,729 Mcf/d (955 boe/d) in

the quarter and contributed $1,114,000 of net natural gas

sales.

-- Produced quarterly average volumes of 2,229 boe/d, a 67

percent increase relative to the 1,336 boe/d produced in the prior

year equivalent quarter.

-- Realized petroleum and natural gas sales of $9,919,000

compared to $8,212,000 in the prior year equivalent quarter,

reflecting natural gas sales from Coho and a 12 percent increase in

average crude oil pricing in the fourth quarter of 2022.

-- Generated an operating netback of $4,319,000, representing a

17 percent increase from the prior year equivalent quarter.

Operating netbacks were $21.05 per boe, a 30 percent decrease from

the $29.96 per boe reported in the fourth quarter of 2021,

attributed to natural gas volumes brought online in the

quarter.

-- Recognized current income tax expenses of $1,092,000 in the

quarter compared to $208,000 in the fourth quarter of 2021, driven

by $979,000 in supplemental petroleum tax expenses based on our

average realized crude oil price exceeding the $75.00 per barrel

threshold in the period.

-- Reported funds flow from operations of $691,000 in the

quarter compared to $1,309,000 in the prior year equivalent

quarter, as a $637,000 increase in operating netbacks was offset by

increased general and administration, term loan interest and

current income tax expenses.

-- Recognized a net loss of $1,921,000 ($0.01 per basic share)

in the quarter compared to net earnings of $6,514,000 ($0.03 per

basic and diluted share) reported in the same period of 2021,

principally driven by $6,323,000 of impairment reversals (net of

tax) recorded on December 31, 2021.

-- Following the December Canadian and United Kingdom private

placements that raised net proceeds of $12,269,000, we exited the

quarter with a cash balance of $16,335,000, a working capital

surplus of $4,992,000 and a principal balance of $27,000,000

remaining on our term credit facility, resulting in a net debt

position of $16,008,000.

Annual 2022 Financial and Operating Highlights

-- Commissioned and delivered natural gas from the Coho facility

on October 10, 2022, representing the first onshore natural gas

field to come onstream in Trinidad in 20 years.

-- Reported average daily production volumes of 1,581 boe/d,

reflecting an 18 percent increase from 2021. Relative to 2021, the

2022 annual increase was attributed to incremental natural gas

production from the Coho-1 well, as average 2022 crude oil and

liquids production were consistent with 2021 levels.

-- Generated funds flow from operations of $3,540,000 (2021 -

$4,172,000) and an annual operating netback of $19,281,000 or

$33.42 per boe (2021 - $13,031,000 and $26.55 per boe).

-- Recognized a net loss of $3,197,000 ($0.01 per basic share)

compared to net earnings of $5,719,000 ($0.03 per basic and diluted

share) in 2021, primarily attributed to $6,323,000 in impairment

reversals (net of tax) recognized in the prior year based on

increased forecasted crude oil pricing.

-- We executed an incident-free $11,330,000 capital program,

primarily focused on completing the Coho natural gas facility and

progressing construction of the Cascadura natural gas and liquids

facility. Cascadura facility construction operations commenced in

October 2022 following receipt of all required regulatory

approvals.

-- Formally executed an extension of the exploration period of

the Ortoire licence to July 31, 2026, allowing us to continue

exploration activities on acreage that have not been deemed

commercial. The gross 1,317-acre Coho area and the gross 2,377-acre

Cascadura area were previously approved for commercial development

in February 2021 and March 2022, respectively.

-- Responsible operations remained a top priority throughout

2022, as Touchstone had no lost time injuries and released its

second sustainability report encompassing the 2021 year. We

proactively responded to the June 2022 vandalism incident that

resulted in a crude oil spill and are pleased to report that all

reclamation efforts were completed in September 2022.

Post Period-End Highlights

-- Net average natural gas volumes from Coho-1 were 900 boe/d

and 864 boe/d in January 2023 and February 2023, respectively.

-- Daily crude oil sales averaged 1,286 bbls/d in January 2023

with a realized price of $66.48 per barrel and averaged 1,341

bbls/d in February 2023 with a realized price of $67.14 per

barrel.

-- The National Gas Company Of Trinidad and Tobago Limited

("NGC") notified us that they expect to be ready to receive first

natural gas from the Cascadura facility on or about June 30, 2023.

We remain on track to complete the Cascadura facility prior to this

date to ensure production can commence as soon as NGC is in a

position to receive first natural gas.

-- We safely reached budgeted total depth of our Royston-1X

sidetrack well on the Ortoire block on February 24, 2023. The well

has been cased, and we expect to commence production testing in

late March 2023.

-- In January 2023, we entered into an asset exchange agreement

for certain onshore Trinidad assets with a privately held

Trinidadian entity. Pursuant to the agreement, we agreed to swap

our operated 100 percent working interests in the Fyzabad, San

Francique and Barrackpore producing blocks for the counterparty's

working interest in the Rio Claro, Balata East and Balata East Deep

Horizons blocks for no cash consideration with the asset exchange

becoming effective upon closing. The agreement remains subject to

certain closing conditions, including receipt of applicable

regulatory approvals and an extension of the Rio Claro licence.

Financial and Operating Results Summary

Three months % change Year ended December % change

ended December 31,

31,

------------------------------- --------- ---------

2022 2021 2022 2021

------------------------------- -------- -------- --------- ---------- ---------- ---------

Operational

Average daily production

Crude oil(1) (bbls/d) 1,274 1,336 (5) 1,340 1,342 -

NGLs(1) (bbls/d) - - - - 2 n/a

------------------------------- -------- -------- --------- ---------- ---------- ---------

Crude oil and liquids

(bbls/d) 1,274 1,336 (5) 1,340 1,344 -

Natural gas(1) (Mcf/d) 5,729 - n/a 1,444 - n/a

------------------------------- -------- -------- --------- ---------- ---------- ---------

Average daily production

(boe/d) (2) 2,229 1,336 67 1,581 1,344 18

------------------------------- -------- -------- --------- ---------- ---------- ---------

Average realized prices(3)

Crude oil(1) ($/bbl) 75.10 66.81 12 85.52 60.28 42

NGLs(1) ($/bbl) - - - - 46.32 n/a

------------------------------- -------- -------- --------- ---------- ---------- ---------

Crude oil and liquids

($/bbl) 75.10 66.81 12 85.52 60.25 42

Natural gas(1) ($/Mcf) 2.11 - n/a 2.11 - n/a

------------------------------- -------- -------- --------- ---------- ---------- ---------

Realized commodity

price ($/boe) (2) 48.36 66.81 (28) 74.43 60.25 24

------------------------------- -------- -------- --------- ---------- ---------- ---------

Production mix (%

of production)

Crude oil and liquids 57 100 85 100

Natural gas(1) 43 - 15 -

Operating netback

($/boe) (2)

Realized commodity

price(3) 48.36 66.81 (28) 74.43 60.25 24

Royalties(3) (15.24) (22.15) (31) (25.37) (18.85) 35

Operating expenses(3) (12.07) (14.70) (18) (15.64) (14.85) 5

------------------------------- -------- -------- --------- ---------- ---------- ---------

Operating netback(3) 21.05 29.96 (30) 33.42 26.55 26

------------------------------- -------- -------- --------- ---------- ---------- ---------

Financial

($000's except per

share amounts)

Petroleum and natural

gas sales 9,919 8,212 21 42,944 29,568 45

Cash (used in) from

operating activities (1,189) 1,406 n/a 5,752 1,611 257

Funds flow from operations(3) 691 1,309 (47) 3,540 4,172 (15)

Net (loss) earnings (1,921) 6,514 n/a (3,197) 5,719 n/a

Per share - basic

and diluted (0.01) 0.03 n/a (0.01) 0.03 n/a

Exploration capital

expenditures 2,290 2,946 (22) 9,788 20,106 (51)

Development capital

expenditures 219 5,190 (96) 1,542 7,757 (80)

------------------------------- -------- -------- --------- ---------- ---------- ---------

Capital expenditures(3) 2,509 8,136 (69) 11,330 27,863 (59)

------------------------------- -------- -------- --------- ---------- ---------- ---------

Working capital surplus(3) (4,992) (6,925) (28)

Principal long-term

bank loan 21,000 27,000 (22)

Net debt(3) - end

of period 16,008 20,075 (20)

------------------------------- -------- -------- --------- ---------- ---------- ---------

Share Information

(000's)

Weighted average shares

- basic 217,106 210,732 3 213,211 210,160 1

Weighted average shares

- diluted 217,106 218,102 - 213,211 217,678 (2)

Outstanding shares

- end of period 233,037 210,732 11

Notes:

(1) In the table above and elsewhere in this announcement,

references to "crude oil" refers to light and medium crude oil and

heavy crude product types combined; references to "NGLs" refers to

condensate; and references to "natural gas" refers to conventional

natural gas, all as defined in National Instrument 51-101 Standards

of Disclosure for Oil and Gas Activities ("NI 51-101"). Refer to

"Advisories - Product Type Disclosures" for further

information.

(2) In the table above and elsewhere in this announcement,

references to "boe" mean barrels of oil equivalent that are

calculated using the energy equivalent conversion method. Refer to

"Advisories - Oil and Natural Gas Measures" for further

information.

(3) Non-GAAP financial measure. Refer to "Advisories - Non-GAAP

Financial Measures" for further information.

Touchstone Exploration Inc.

Touchstone Exploration Inc. is a Calgary, Alberta based company

engaged in the business of acquiring interests in petroleum and

natural gas rights and the exploration, development, production and

sale of petroleum and natural gas. Touchstone is currently active

in onshore properties located in the Republic of Trinidad and

Tobago. The Company's common shares are traded on the Toronto Stock

Exchange and the AIM market of the London Stock Exchange under the

symbol " TXP " .

For further information about Touchstone, please visit our

website at www.touchstoneexploration.com or contact:

Touchstone Exploration Inc.

Paul Baay, President and Chief Executive Officer Tel: +1 (403) 750-4487

Scott Budau, Chief Financial Officer

James Shipka, Chief Operating Officer

Shore Capital (Nominated Advisor and Joint Broker)

Daniel Bush / Toby Gibbs / Iain Sexton Tel: +44 (0) 207 408

4090

Canaccord Genuity (Joint Broker)

Adam James / Gordon Hamilton Tel: +44 (0) 207 523 8000

FTI Consulting (Financial PR)

Nick Hennis / Ben Brewerton Tel: +44 (0) 203 727 1000

Email: touchstone@fticonsulting.com

Advisories

Forward-Looking Statements

Certain information provided in this announcement may constitute

forward-looking statements and information (collectively,

"forward-looking statements") within the meaning of applicable

securities laws. Such forward-looking statements include, without

limitation, forecasts, estimates, expectations and objectives for

future operations that are subject to assumptions, risks and

uncertainties, many of which are beyond the control of the Company.

Forward-looking statements are statements that are not historical

facts and are generally, but not always, identified by the words

"expects", "plans", "anticipates", "believes", "intends",

"estimates", "projects", "potential" and similar expressions, or

are events or conditions that "will", "would", "may", "could" or

"should" occur or be achieved. The forward-looking statements

contained in this announcement speak only as of the date thereof

and are expressly qualified by this cautionary statement.

Specifically, this announcement includes, but is not limited to,

forward-looking statements relating to the Company's development

and exploration plans and strategies, including Cascadura facility

construction operations and the expected timing of completion and

initial production therefrom, as well as the timing of anticipated

Royston-1X well completion and testing operations; the anticipated

closing of the asset exchange transaction, including the

anticipated future receipt and timing of regulatory approvals

including the required licence extension and the timing thereof;

and Touchstone's current and future financial position including

the sufficiency of resources to fund future capital expenditures

and maintain financial liquidity.

Although the Company believes that the expectations and

assumptions on which the forward-looking statements are based are

reasonable, undue reliance should not be placed on the

forward-looking statements because the Company can give no

assurance that they will prove to be correct. Since forward-looking

statements address future events and conditions, by their very

nature they involve inherent risks and uncertainties. Actual

results could differ materially from those currently anticipated

due to a number of factors and risks. Certain of these risks are

set out in more detail in the Company's 2022 Annual Information

Form dated March 23, 2023 which will be available under the

Company's profile on SEDAR ( www.sedar.com ) and on the Company's

website ( www.touchstoneexploration.com ). The forward-looking

statements contained in this announcement are made as of the date

hereof, and except as may be required by applicable securities

laws, the Company assumes no obligation or intent to update

publicly or revise any forward-looking statements made herein or

otherwise, whether as a result of new information, future events or

otherwise.

Non-GAAP Financial Measures

This announcement may reference various non-GAAP financial

measures, non-GAAP ratios, capital management measures and

supplementary financial measures as such terms are defined in

National Instrument 52-112 Non-GAAP and Other Financial Measures

Disclosure. Such measures are not recognized measures under GAAP

and do not have a standardized meaning prescribed by International

Financial Reporting Standards ("IFRS" or "GAAP") and therefore may

not be comparable to similar financial measures disclosed by other

issuers. Readers are cautioned that the non-GAAP financial measures

referred to herein should not be construed as alternatives to, or

more meaningful than, measures prescribed by IFRS, and they are not

meant to enhance the Company's reported financial performance or

position. These are complementary measures that are commonly used

in the oil and natural gas industry and by the Company to provide

shareholders and potential investors with additional information

regarding the Company's performance. Below is a description of the

non-GAAP financial measures, non-GAAP ratios, capital management

measures and supplementary financial measures disclosed in this

announcement.

Funds flow from operations

Funds flow from operations is included in the Company's

consolidated statements of cash flows. Touchstone considers funds

flow from operations to be a key measure of operating performance

as it demonstrates the Company's ability to generate the funds

necessary to finance capital expenditures and repay debt.

Management believes that by excluding the temporary impact of

changes in non-cash operating working capital, funds flow from

operations provides a useful measure of the Company's ability to

generate cash that is not subject to short-term movements in

non-cash operating working capital.

Operating netback

Touchstone uses operating netback as a key performance indicator

of field results. The Company considers operating netback to be a

key measure as it demonstrates Touchstone's profitability relative

to current commodity prices and assists Management and investors

with evaluating operating results on a historical basis. Operating

netback is a non-GAAP financial measure calculated by deducting

royalties and operating expenses from petroleum and natural gas

sales. The most directly comparable financial measure to operating

netback disclosed in the Company's consolidated financial

statements is petroleum and natural gas revenue net of royalties.

Operating netback per boe is a non-GAAP ratio calculated by

dividing the operating netback by total production volumes for the

period. Presenting operating netback on a per boe basis allows

Management to better analyze performance against prior periods on a

comparable basis.

Capital expenditures

Capital expenditures is a non-GAAP financial measure that is

calculated as the sum of exploration and evaluation asset

expenditures and property, plant and equipment expenditures

included in the Company's consolidated statements of cash flows and

is most directly comparable to cash used in investing activities.

Touchstone considers capital expenditures to be a useful measure of

its investment in its existing asset base.

Working capital and net debt

Touchstone closely monitors its capital structure with a goal of

maintaining a strong financial position to fund current operations

and future growth. Working capital and net debt are capital

management measures used by Management to steward the Company's

overall debt position and assess overall financial strength.

Working capital is calculated as current assets minus current

liabilities as they appear on the consolidated balance sheets. Net

debt is calculated by summing the Company's working capital and the

principal (undiscounted) long-term amount of senior secured

debt.

Supplementary Financial Measures

Realized commodity price per boe - is comprised of petroleum and

natural gas sales as determined in accordance with IFRS, divided by

the Company's total production volumes for the period.

Royalties per boe - is comprised of royalties as determined in

accordance with IFRS, divided by the Company's total production

volumes for the period.

Operating expenses per boe - is comprised of operating expenses

as determined in accordance with IFRS, divided by the Company's

total production volumes for the period.

For information regarding such measures, including

reconciliations to the nearest GAAP measures, please refer to the

"Advisories - Non-GAAP Financial Measures" section in the Company's

Management's discussion and analysis for the year ended December

31, 2022 accompanying our 2022 audited consolidated financial

statements which are available on our website (

www.touchstoneexploration.com ) and under our SEDAR profile (

www.sedar.com ) .

Oil and Natural Gas Measures

Where applicable, natural gas has been converted to barrels of

oil equivalent based on six thousand cubic feet to one barrel of

oil. The barrel of oil equivalent rate is based on an energy

equivalent conversion method primarily applicable at the burner

tip, and given that the value ratio based on the current price of

crude oil as compared to natural gas is significantly different

than the energy equivalency of the 6:1 conversion ratio, utilizing

the 6:1 conversion ratio may be misleading as an indication of

value.

Product Type Disclosures

This announcement includes references to crude oil, NGLs,

natural gas, total production and average daily production. Under

NI 51-101, disclosure of production volumes should include

segmentation by product type as defined in the instrument. In this

announcement, references to "crude oil" refers to "light crude oil

and medium crude oil" and "heavy crude oil" combined product types;

references to "NGLs" refers to condensate; and references to

"natural gas" refers to the "conventional natural gas" product

type, all as defined in the instrument.

The Company's total and average production for the three months

and years ended December 31, 2022 and 2021 and the references to

"crude oil", "NGLs" and "natural gas" disclosed herein consist of

the following product types as defined in NI 51-101 using a

conversion of 6 Mcf to 1 boe where applicable.

Three months ended Year ended December

December 31, 31,

----------------------------

2022 2021 2022 2021

---------------------------- ---------- --------- ---------- ----------

Production

Light and medium crude

oil (bbls) 111,114 113,724 461,612 447,619

Heavy crude oil (bbls) 6,126 9,193 27,524 42,280

---------------------------- ---------- --------- ---------- ----------

Crude oil (bbls) 117,240 122,917 489,136 489,899

NGLs - condensate (bbls) - - - 842

Conventional natural gas

(Mcf) 527,105 - 527,105 -

---------------------------- ---------- --------- ---------- ----------

Total production (boe) 205,091 122,917 576,987 490,741

---------------------------- ---------- --------- ---------- ----------

Average daily production

Light and medium crude

oil (bbls/d) 1,207 1,236 1,265 1,226

Heavy crude oil (bbls/d) 67 100 75 116

---------------------------- ---------- --------- ---------- ----------

Crude oil (bbls/d) 1,274 1,336 1,340 1,342

NGLs - condensate (bbls/d) - - - 2

Conventional natural gas

(Mcf/d) 5,729 - 1,444 -

---------------------------- ---------- --------- ---------- ----------

Average daily production

(boe/d) 2,229 1,336 1,581 1,344

---------------------------- ---------- --------- ---------- ----------

Abbreviations

bbl(s) barrel(s)

bbls/d barrels per day

boe barrels of oil equivalent

boe/d barrels of oil equivalent per day

Mcf thousand cubic feet

Mcf/d thousand cubic feet per day

NGLs natural gas liquids

Touchstone Exploration Inc.

Consolidated Balance Sheets

Stated in thousands of United States dollars

As at December December

31, 31, 2021

2022

------------------------------------------ --- ---------- ----------

Assets

Current assets

Cash 16,335 17,936

Accounts receivable 7,487 7,546

Inventory 129 143

Prepaid expenses 1,342 1,055

Assets held for sale 1,122 1,176

26,415 27,856

Exploration and evaluation assets 51,352 50,760

Property, plant and equipment 67,162 61,275

Restricted cash 1,021 1,178

Other assets 481 673

Abandonment fund 1,446 1,278

----------------------------------------------- ---------- ----------

Total assets 147,877 143,020

----------------------------------------------- ---------- ----------

Liabilities

Current liabilities

Accounts payable and accrued liabilities 12,737 16,000

Income taxes payable 1,014 236

Current portion of term loan 6,000 3,000

Liabilities associated with assets held

for sale 1,672 1,695

21,423 20,931

Lease liabilities 1,373 2,265

Term loan 20,962 26,896

Other liabilities - 908

Decommissioning liabilities 11,182 10,012

Deferred income taxes 14,557 14,450

----------------------------------------------- ---------- ----------

Total liabilities 69,497 75,462

----------------------------------------------- ---------- ----------

Shareholders' equity

Shareholders' capital 114,635 101,757

Contributed surplus 4,905 3,466

Other comprehensive loss (13,517) (13,219)

Deficit (27,643) (24,446)

----------------------------------------------- ---------- ----------

Total shareholders' equity 78,380 67,558

----------------------------------------------- ---------- ----------

Total liabilities and shareholders'

equity 147,877 143,020

----------------------------------------------- ---------- ----------

Touchstone Exploration Inc.

Consolidated Statements of Earnings (Loss) and Comprehensive

Income (Loss)

Stated in thousands of United States dollars (except per share

amounts)

Year ended December

31,

2022 2021

---------------------------------------- ---------- ----------

Revenue

Petroleum and natural gas sales 42,944 29,568

Less: royalties (14,641) (9,251)

----------------------------------------- ---------- ----------

Petroleum and natural gas revenue, net

of royalties 28,303 20,317

Other revenue 42 40

Total revenue 28,345 20,357

Expenses

Operating 9,022 7,286

General and administration 7,775 6,301

Net finance 3,042 1,437

Net loss (gain) on asset dispositions 726 (21)

Foreign exchange (gain) loss (333) 185

Equity-based compensation 1,341 888

Depletion and depreciation 4,333 3,415

Impairment (reversal) 195 (13,674)

Other 794 -

Total expenses 26,895 5,817

----------------------------------------- ---------- ----------

Earnings before income taxes 1,450 14,540

Provision for income taxes

Current expense 4,648 1,358

Deferred (recovery) expense (1) 7,463

----------------------------------------- ---------- ----------

Total income tax expense 4,647 8,821

----------------------------------------- ---------- ----------

Net (loss) earnings (3,197) 5,719

Currency translation adjustments (298) 112

----------------------------------------- ---------- ----------

Comprehensive (loss) income (3,495) 5,831

----------------------------------------- ---------- ----------

Net (loss) earnings per common share

Basic and diluted (0.01) 0.03

----------------------------------------- ---------- ----------

Touchstone Exploration Inc.

Consolidated Statements of Changes in Shareholders' Equity

Stated in thousands of United States dollars

Year ended December

31,

2022 2021

--------------------------------------- ---------- ----------

Shareholders' capital

Balance, beginning of year 101,757 101,385

Private placements, net of fees 12,269 -

Equity-based settlements 609 372

---------------------------------------- ---------- ----------

Balance, end of year 114,635 101,757

---------------------------------------- ---------- ----------

Contributed surplus

Balance, beginning of year 3,466 2,476

Equity-based settlements (215) (132)

Equity-based compensation expense 1,341 888

Equity-based compensation capitalized 313 234

---------------------------------------- ---------- ----------

Balance, end of year 4,905 3,466

---------------------------------------- ---------- ----------

Other comprehensive loss

Balance, beginning of year (13,219) (13,331)

Other comprehensive (loss) income (298) 112

---------------------------------------- ---------- ----------

Balance, end of year (13,517) (13,219)

---------------------------------------- ---------- ----------

Deficit

Balance, beginning of year (24,446) (30,165)

Net (loss) earnings (3,197) 5,719

---------------------------------------- ---------- ----------

Balance, end of year (27,643) (24,446)

---------------------------------------- ---------- ----------

Touchstone Exploration Inc.

Consolidated Statements of Cash Flows

Stated in thousands of United States dollars

Year ended December

31,

2022 2021

--------------------------------------------------- ---------- ----------

Operating activities

Net (loss) earnings (3,197) 5,719

Items not involving cash from operations:

Net loss (gain) on asset dispositions 726 (21)

Unrealized foreign exchange gain (288) (288)

Equity-based compensation 1,341 888

Depletion and depreciation 4,333 3,415

Impairment (reversal) 195 (13,674)

Other 561 679

Deferred income tax (recovery) expense (1) 7,463

Decommissioning expenditures (130) (9)

Funds flow from operations 3,540 4,172

Net change in non-cash operating working

capital 2,212 (2,561)

Cash from operating activities 5,752 1,611

---------------------------------------------------- ---------- ----------

Investing activities

Exploration and evaluation expenditures (9,788) (20,106)

Property, plant and equipment expenditures (1,542) (7,757)

Abandonment fund expenditures (160) (112)

Proceeds from asset dispositions 1,346 229

Net change in non-cash investing working

capital (6,332) (1,645)

---------------------------------------------------- ---------- ----------

Cash used in investing activities (16,476) (29,391)

---------------------------------------------------- ---------- ----------

Financing activities

Changes in restricted cash 157 (884)

(Repayment) advance of term loan (3,000) 22,396

Other liability payments (573) (392)

Net finance lease payments (206) (326)

Issuance of common shares, net of fees 12,663 240

Net change in non-cash financing working

capital 11 48

Cash from financing activities 9,052 21,082

---------------------------------------------------- ---------- ----------

Decrease in cash (1,672) (6,698)

Cash, beginning of year 17,936 24,281

Impact of foreign exchange on foreign denominated

cash balances 71 353

---------------------------------------------------- ---------- ----------

Cash, end of year 16,335 17,936

---------------------------------------------------- ---------- ----------

Supplementary information for cash flow

from operating activities

Interest paid in cash 2,273 709

Income taxes paid in cash 3,886 1,122

---------------------------------------------------- ---------- ----------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR NKNBNKBKBANB

(END) Dow Jones Newswires

March 24, 2023 03:00 ET (07:00 GMT)

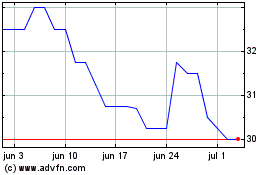

Touchstone Exploration (LSE:TXP)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Touchstone Exploration (LSE:TXP)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024