TIDMAEX

RNS Number : 9593X

Aminex PLC

28 April 2023

28 April 2023

FINAL RESULTS for year ended 31 december 2022 AND ANNUAL

REPORT

Aminex PLC ('Aminex' or the 'Company') is pleased to announce

its audited financial results for the year ended 31 December

2022.

Highlights

Outlook:

-- The operator of the Ruvuma PSA, ARA Petroleum Tanzania

Limited ("APT") continues to progress operations at the Ntorya

field, with the following planned for 2023:

o Two-week well testing programme on NT-2, utilising a mobile

testing unit, principally to sample the gas and establish an

accurate measurement of the gas composition, required for the

design of in-field processing facilities and the export pipeline to

the Madimba Gas Plant

o Conclusion of negotiations and execution of a Gas Sales

Agreement

o Finalisation of terms for the construction of (i) an export

pipeline from Ntorya to the Madimba Gas Plant to accommodate gas by

October 2023; and (ii) in-field gas gathering and processing

facilities

o Entering into a rig contract to (i) drill, test and complete

the Chikumbi-1 well ("CH-1") as a gas producer; and (ii) workover

and recomplete the NT-1 well as a gas producer

o Following the processing of 3D seismic data, an optimal well

location has been determined for the CH-1 well

-- APT has also submitted a near final Field Development Plan to

the Tanzania Petroleum Development Corporation which, upon

approval, will lead to the issuance of a Development Licence for

the Ntorya field

-- Orca Energy, though its subsidiary, Pan African Energy

Tanzania, has commenced its 3D seismic acquisition programme over

its Songo Songo licence which includes an incursion of 12.5km(2)

over part of the Kiliwani North Development Licence ("KNDL") at no

cost to the KNDL parties. The acquisition programme is expected to

be completed by Q3 2023.

During 2022:

-- APT completed the 3D seismic programme over the Ntorya area in October 2022

-- An Addendum to the Ruvuma PSA setting out the fiscal terms

for gas (as opposed to oil) production from the Ruvuma PSA was

signed by all parties on 25 November 2022

-- Successfully raised approximately US$4.35 million

(approximately GBP3.30 million) before expenses in April 2022 to

fund the Company to the expected receipt of revenue from first gas

production at the Ntorya field

-- Company now debt-free following the share placement

-- Ruvuma PSA Farm-Out Carry of US$35 million covered Aminex for

all 2022 Ruvuma costs with US$30.72 million of the Carry remaining

as at 31 December 2022

-- Further reduction in gross G&A costs (before one-off

costs and exceptional items) to US$1.46 million per annum in 2022,

a reduction of 19% from 2021 and a significant reduction from 2018

levels when cost control measures commenced

-- Loss for the year of US$4.06 million (2021: loss of US$8.56 million)

The Annual Report may be viewed on the Company's website

www.aminex-plc.com by clicking on the following link:

Aminex PLC Annual Report 2022

The Company will announce details of the Annual General Meeting

in due course.

Paper copies of the Annual Report together with the Notice of

Annual General Meeting, including the Form of Proxy, will be mailed

shortly to those shareholders who have elected to receive paper

copies.

The Executive Chairman's Statement from the Annual Report

follows below:

Executive Chairman's Statement

Dear Shareholder,

We believe 2023 will be a watershed year for our Company, with

multiple macro and local developments converging to produce

shareholder value.

Since my last Executive Chairman's Statement, energy prices have

remained significantly higher than their April 2020 historic lows,

with a Brent crude oil spot price average of US$100 per barrel for

2022. The higher energy prices, linked to the lack of investment in

new oil and gas projects, sanctions against Russian oil and gas

exports, and growing demand in the developing world, are projected

to continue into the near and mid-term. Higher energy prices and

shortages have emphasised the importance of fossil fuels,

particularly natural gas, for the coming decades as an essential

and cleaner energy source for global economic development.

Moreover, the macro-political uncertainty and significant demand

for energy in the developing world will, we believe, translate into

continued growing demand for gas globally.

In Tanzania, we stand by last year's assessment of the country's

significantly improved commercial and business climate. Moreover,

we see the business climate continuing to improve. Specifically,

the Tanzanian authorities appear fully committed to natural gas

development and are making considerable efforts to accelerate

natural gas production from Ruvuma. Moreover, the Tanzanian

authorities, aware of their need to increase energy production to

grow the country's economy, have embarked on further industrial

development. These efforts include planning and constructing

numerous facilities along existing gas delivery infrastructure

directly connected to or near our Tanzanian assets which will

increase local gas demand substantially in the short to medium

term. In addition, discussions have been reported between Tanzanian

Government officials and their counterparts in neighbouring

countries exploring the possibility of securing a long-term gas

supply from Tanzania, which will contribute to future gas demand in

the East African region. These positive developments in the

Tanzanian gas sector bode well for the commercialisation of our

assets soon.

Non-Operating Strategy

Our move from an operating to a non-operating business has

enabled the Company to de-risk while anchoring shareholder value

by:

1. Shifting operational risk on our most valuable asset, Ruvuma,

to ARA Petroleum Tanzania Limited ("APT"), a highly co mpetent,

capable, and well-funded operator.

2. Further de- risking by APT to accelerate gas production,

targeting October 2023, shifting the operational narrative of

Ruvuma from a dependence on the spudding and outcome of the

Chikumbi-1 well ("CH-1") to a more anchored and broader development

effort as we move toward early gas production.

3. Reducing our operating expenses and overhead significantly to

protect the Company while the project is still not generating

cash.

4. Successfully acquiring the necessary funds via our equity

placing in April 2022 to ensure our running costs are covered

(before one-offs and exceptional items) until receipt of Ruvuma

revenues commences.

Aminex's non-operating strategy has made it a stronger, more

secure company with a low-cost base and an entirely carried

position on Ruvuma and is debt free. It provides a solid financial

situation until the commencement of cash flow receipts from Ruvuma.

Moreover, APT has reduced the time to cash flow receipts with an

accelerated gas production plan, which is strongly supported by the

Tanzanian Government and aligned with its need for gas in the short

and medium term. The success of this strategy is now in sight as it

appears Ruvuma's revenue will come significantly sooner than our

original projection.

Ruvuma PSA

The Farm-Out completed with APT in October 2020 carries the

Company to material levels of production and revenue without the

need to return to shareholders for additional funding for the

development of the Ntorya field. This revenue is now projected

sooner, given the acceleration of production agreed upon between

the operator and the Tanzania Petroleum Development Corporation

("TPDC"). The Company holds a 25% interest in the Ruvuma PSA with a

US$35 million carry of its share of costs. The carry, equivalent to

US$140 million of gross field expenditure, is expected to see the

Company through to potentially significant gas production volumes

with commensurate revenues. The Farm-Out is a result of successful

exploration and evaluation work by Aminex, which recognised the

underlying value and opportunities in the Ruvuma Basin, while

effectively pivoting to a non-operating role to ensure full

exploitation of resources and de-risking the Company.

With the acquisition of 3D seismic data completed in November

2022 and the culmination of seismic data processing in March 2023,

we now have an optimal well location for CH-1 grounded in

significant 3D seismic data. We anticipate the spudding of CH-1,

and a workover of the Ntorya-1 well ("NT-1") later this year. We

also expect a completed well-test of the Ntorya-2 well ("NT-2")

soon, providing information that will facilitate the construction

of a 35-kilometre pipeline to the Madimba gas processing facility

by the Government of Tanzania. The full 3D seismic results will be

available by mid-2023 and will permit a thorough revision of the

gas reserve and resource potential for the field later in the year.

Finally, we expect to sign a Gas Sales Agreement and obtain a

Development Licence for the Ntorya Area, securing the long-term

development of Ruvuma imminently.

2023 will be a watershed year for the development of Ruvuma with

the completion of the 3D seismic survey, the monetising of this

extensive gas resource through production into existing

infrastructure and transportation to an established power and

industrial market in Tanzania. Since acquiring operatorship, APT

has continued demonstrating focused determination, technical

prowess, and a total commitment to the project.

Kiliwani North and Kiliwani South - Kiliwani North Development

Licence ("KNDL")

Orca Energy, via its subsidiary PanAfrican Energy Tanzania

("PAET"), is expected to complete its acquisition of 3D seismic

over its Songo Songo license area by Q3 2023. The new 3D seismic

programme includes an incursion of 12.5 km2 over part of the KNDL

that borders the Songo Songo field to the west as part of their

full-field survey. The data, at no cost to the KNDL partners, will

be valuable in identifying fault trends, improving reservoir

definition, and understanding the Kiliwani North and South

structures. We expect to receive processed data by the end of 2023

or early 2024, allowing Aminex to re-evaluate further prospectivity

of KNDL and opportunities for further development. It will enable a

more robust discussion with future partners to operate the asset

and secure additional funding through a farm-out. We have continued

with impairment of the Kiliwani North and Kiliwani South assets

during the year. We will update shareholders with progress in due

course.

Nyuni Area PSA

In April 2022, we commenced a process with the relevant

authorities in Tanzania to return the licence, given our belief

that although the Nyuni Area acreage offers upside exploration

potential to complement the development projects at Ntorya and

Kiliwani North, the significant risks of exploration and the lack

of a farm-out partner was far too much risk for a company of our

size. The Tanzanian authorities requested that we continue efforts

to secure a farm-in partner over the next year, to which we have

agreed.

Cost Cutting

We continued to cut costs and reduce corporate overheads,

including reducing General and Administrative expenses ("G&A").

The Company saw a small increase of 5% in headline G&A for the

year of US$0.14 million compared to 2021, but a decrease in base

running costs (which excludes non-cash and one-off items), before

recharges, to US$1.46 million for the year, compared with US$1.81

million for 2021, a reduction of 19% (see Finance Review for

further details). The cumulative annual reductions in the Company's

gross G&A costs (before one-off expenses and exceptional items)

to US$1.46 million per annum in 2022 represents a 72% reduction

from 2018 levels. Through these cost saving initiatives, the

Company has established an appropriate structure of capabilities

and competencies that match the current requirements of the

business with a more flexible approach that de-risks our business

and can help create or attract strategic opportunities.

Outlook and Funding

On 1 April 2022, we announced the fully subscribed placement for

approximately US$4.35 million, providing an essential pillar in our

effort to de-risk and anchor value. The funds ensure a solid

financial foundation for the Company through to the expected

commencement of cash flow receipts from Ruvuma. We are thankful for

the participation of all the investors, including our largest

shareholder, Eclipse Investments LLC.

We expect 2023 to be a decisive year with significant

information flow regarding multiple workstreams. The operator's

capacity to run numerous critical negotiations and a significantly

broader technical engagement, fully supported by the Tanzanian

authorities, has significantly shortened the time to gas

production, now targeted for October 2023. This development has

shifted the narrative of Ruvuma, further de-risking the project

from a dependence on the spudding and outcome of CH-1 to a more

anchored and broader development effort as we move toward early gas

production. Such de-risking continues to honour the upside

potential that will come from the drilling of CH-1, the 3D seismic

interpretation, and the full development of the field. These

developments are potential game-changers for all stakeholders in

the Ruvuma development.

Finally, I would like to thank our shareholders for their

continued support and patience and hope that our operations in 2023

will ultimately reward us all with success on Ntorya.

Yours sincerely,

Charles Santos

Executive Chairman

Ends

For further information:

Aminex PLC +44 203 355 9909

Charles Santos, Executive Chairman

Davy +353 1 679 6363

Brian Garrahy

Shard Capital Partners +44 207 186 9952

Damon Heath

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACSBRGDSBBDDGXI

(END) Dow Jones Newswires

April 28, 2023 13:13 ET (17:13 GMT)

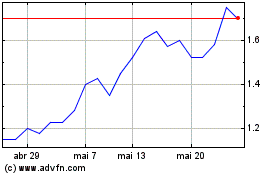

Aminex (LSE:AEX)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Aminex (LSE:AEX)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025