TIDMTIR

RNS Number : 3253D

Tiger Royalties and Investments PLC

20 June 2023

For immediate release 20 June 2022

TIGER ROYALTIES AND INVESTMENTS PLC

(FORMERLY TIGER RESOURCE PLC)

("Tiger" or the "Company")

FINAL RESULTS FOR THE YEARED 31 DECEMBER 2022

The Company is pleased to announce its audited results for the

year ended 31 December 2022 and to confirm that the 2023 Annual

Report and Financial Statements ("Annual Report") will be posted to

shareholders and the Annual Report will thereafter be available for

inspection at www.tiger-rf.com.

Annual General Meeting (AGM)

The Company plans to hold an Annual General Meeting in late July

or August 2023 and the wording of each resolution to be tabled will

be sent out in due course to shareholders in the formal Notice of

Annual General Meeting.

Notes :

Extracts from the Annual Report are set out below. The financial

information set out below does not constitute the Company's

statutory accounts for the periods ended 31 December 2021 or 31

December 2022 but it is derived from those accounts.

Statutory accounts for 31 December 2021 have been delivered to

the Registrar of Companies and those for 31 December 2022

will be delivered following the Company's Annual General

Meeting. The auditors have reported on those accounts, their

reports were unqualified and did not contain statements under

section 498(2) or (3) of the Companies Act 2006. The audit report

for the year ended 31 December 2022 did however draw attention to a

material uncertainty relating to going concern.

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the Company's obligations under Article 17 of MAR.

For further information please contact:

Tiger Royalties and

Investments Plc Raju Samtani, Director +44 (0)20 7581 4477

Beaumont Cornish Roland Cornish

(Nomad) Felicity Geidt +44 (0)20 7628 3369

Novum Securities Ltd Jon Belliss +44 (0)20 7399 9425

(Broker)

CHAIRMAN'S STATEMENT

Dear Shareholder

The year under review has disappointingly seen Tiger's net asset

value per share (NPV) decrease by 47% to 0.09 pence from 0.17 pence

per share as at 31 December 2022.

During the period under review, the emerging resource sector

remained in the doldrums of uncertainty. The headwinds against

confidence completely surmounted the optimism which has been

universally generated for new age metals over recent years.

After many years of very low interest rates, the spectre of 5-6%

borrowing rates has concerned both individuals and corporations as

many have never experienced periods of high interest rates with the

consequential effect on their finances and disposal incomes. Higher

inflation levels are now seen almost globally and it has led

economists to conclude that leading economies are potentially

heading into recessionary times.

It is my view that a good deal of the excess inflation was

caused by erratic supply chains, leading to short-term

unavailability, and thus causing price hikes due to a mismatch of

supply and demand fundamentals. In any event, the main precursor

was the price hikes in energy, culminating with high wholesale oil

and gas prices in the late summer of 2022. The expected falls in

inflation with the subsequent retreat in energy prices have failed

to materialise and supply chain problems persist due to a very low

unemployment rate, with a view that many workers have failed to

return to the workforce following the end of the Covid

restrictions.

In recent times, financial analysts and trading houses as well

as CEO's of Copper producing companies have forecast real supply

concerns from 2025 onwards. Whilst this is true for Copper, the

same scenario is also relevant for a number of other commodities,

including Nickel, Cobalt and Lithium. Even as I write this report,

price volatility within these metals is considerable, but Copper

and Nickel despite forecast shortages, seem to defy this random

price fluctuation.

During the year, Tiger sold its investments in Block Energy Plc,

Corallian Energy Ltd, Pantheon Resources Plc, Reabold Resources Plc

and a partial holding in Jubilee Metals Group Plc. We believe that

investments currently held by the Company in African Pioneer Plc,

Galileo Resources Plc and Jubilee Metals Group Plc are well exposed

to the new age metal opportunities and as such when these

commodities recover particular so for Copper, we should see a

rerate in their share prices, thus benefitting Tiger's portfolio.

The Board continues to be proactively involved in both Kendrick

Resources Plc and African Pioneer Plc and we look forward to

helping to progress these investments.

The Board is conscious of the fact that resources currently

available to the Company for working capital purposes and to make

new investments are limited and we will consider ways to

recapitalise the Company to facilitate investments or a transaction

going forward. We continue to look for new opportunities in the new

age metal space and potential mineral opportunities which meet the

Company's criteria will be targeted and reversed in existing shells

or packaged as a new listing. However, considering the ongoing

current economic climate, very few new junior deals are coming to

market and it is therefore more likely that we will look at adding

value to potential assets by reversing such assets in target

companies rather than seeking new listings.

The common theme over the last few years has been that the major

mining companies have been light on metal inventory and have

generally relied on junior exploration companies for new

production. Our belief for majors to materialise has been rather

slow to materialise, but it is now assuming at some pace and we are

seeing more and more M&A activity in the in the natural

resource sector with significant mergers and takeovers currently

being considered.

We remain committed to proactive investment opportunities, and

we believe that the day of the small miner and explorer is

re-emerging and that Tiger's shareholders will benefit from the

changing dynamics in the industry. We look forward to opportunities

arising from the emergence of electric vehicles and the climate

change revolution which will no doubt result in a rapidly changing

and very different commodity and investment environment.

I would like to thank my fellow directors and management for the

efforts during the year and look forward to enjoying a more upbeat

and vibrant environment in which to implement our strategy.

Colin Bird

Chairman

19 June 2023

PORTFOLIO REVIEW

The table below includes investments held by the Company, and

are disclosed in note 6 to the financial statements.

Number Cost Valuation Valuation Valuation

31/12/22 31/12/22 31/12/22 31/12/21 31/03/23

GBP GBP GBP GBP

African pioneer Plc 8,810,056 100,000 202,631 190,297 183,249

Bezant Resources Plc 83,870,371 326,885 71,290 125,806 50,322

Block Energy Plc - - - 5,625 -

Caerus Mineral Resources

Plc 1,000,000 100,603 45,000 140,000 40,000

Corallian Energy Limited - - - 20,427 -

Galileo Resources Plc 6,516,667 78,335 84,717 63,863 65,167

Goldquest Mining Corporation 173,500 30,259 14,796 13,437 15,034

Jubilee Metals Group Plc 869,600 74,513 88,264 190,060 70,002

Kendrick Resources Plc 83,333 50,217 812 - 775

Pantheon Resources Plc - - - 24,349 -

Reabold Resources Plc - - - 5,445 -

TOTAL 760,812 507,510 779,309 424,549

------------ ---------- ---------- ----------

The Company sold 625,000 shares of Block Energy Plc, 13,618

shares of Corallian Energy Ltd, 300,000 shares of Jubilee Metals

Group Plc, 31,500 shares of Pantheon Resources Plc and 3,025,068

share of Reabold Resources Plc, during the year.

Details of changes in the fair value of investments are shown in

note 6 of the Financial Statements.

African Pioneer Plc (LSE: AFP) www.africanpioneerplc.com

African Pioneer Plc's (APP's) principal business is to explore

opportunities within the natural resources sector in Sub-Saharan

Africa with a focus on base metals including copper, nickel, lead

and zinc. Tiger's current holding in APP is 8,810,056 ordinary

shares representing a 4.6% interest in the company . During the

last 12 months, APP has carried out a drilling exercise on its

Ongombo licence which has had considerable success in identifying

near surface material. These drilling results will allow the

company to consider an open pit /2-3 year mine project when

evaluating a potential mine which should facilitate entry into the

proposed underground mine. The re-evaluation of the Mineral

Resource completed by independent consultants Addison Mining

Services and announced by APP in May 2023 achieved a significant

milestone for the company. On APP's Zambian licences, First Quantum

has reported considerable success with their initial fieldwork and

drilling programmes including some deeper holes drilled. The

outcome

has shown the project to be extremely high in potential with

First Quantum stating their belief that the orebody style resembles

that of the Kamoa-Kakula mine in the nearby Congo and the Western

Foreland style mineralisation associated with Kamoa. This

represents a potential significant major discovery for Zambia,

First Quantum and of course, APP. Apart from these deeper holes

drilled, there has been near surface mineral discoveries with

indication of grades somewhat higher than traditional Copperbelt

expectations. Tiger remains excited on the prospects of further

news on APP's project and believes that further progress on APP's

assets should have a positive impact on the performance of this

investment.

Bezant Resources Plc (AIM - BZT: LN) www.bezantresources.com

Bezant Resources Plc ("Bezant") is a mineral exploration and

development company quoted on AIM and focused on developing a

pipeline of copper-gold projects to provide a new generation of

economically and socially sustainable mines. The company's

portfolio of assets includes their flagship Hope and Gorob

Copper-Gold project in Namibia which covers a significant portion

of the highly prospective Matchless Copper Belt. The company also

has an interest in the Mankayan Project in the Philippines which is

a porphyry system via its 26.36% shareholding in IDM International

which, through Crescent Mining Development Corporation continues to

make good progress on initial Pre-Feasibility Studies on the

Mankayan copper-gold project in the Philippines. The company's

Kanye Manganese Project in Botswana comprises a collection of

prospecting licenses covering a total area of approximately

4,043km2 and is located in south-central Botswana south of the town

of Jwaneng. Kanye has the potential for the discovery of

high-quality manganese deposits suitable for supplying the valuable

battery market.

Galileo Resources Plc (AIM - GLR - LN)

www.galileoresources.com

Galileo Resources PLC ("Galileo") is an AIM quoted natural

resource exploration company specializing in the acquisition and

development of base metal projects with a focus on copper. The

company recently announced the results of an initial Inferred

Mineral Resource Estimate ("MRE") in accordance with the JORC code

2012 edition for its Luansobe copper project in Zambia, completed

by independent consultants Addison Mining Services. Galileo holds a

75% interest in the Project. Highlights of the MRE included

approximately 5.8 million tonnes gross at 1% total Cu above a

cut-off grade of 0.25% total Cu for 56,000 tonnes of contained Cu,

potentially amenable to open pit mining and approximately 6.3

million tonnes gross at 1.5% total Cu above a cut-off grade of 1%

total Cu for 97,000 tonnes of contained Cu, potentially amenable to

underground mining. Elsewhere, Galileo is committed to a

substantial reconnaissance programme over the potentially

prospective lithium terrain on its Kamativi licence in western

Zimbabwe comprising of stream sediment, rock chip and soil

sampling. The company has to date collected 4,359 samples of which

1,282 were sent for laboratory analysis. The programme has

identified several targets in a number of areas within the Licence

area where the peak analytical values, metal associations and

continuity are sufficiently coherent to allow an early follow up

programme including trenching and where warranted, drilling.

Jubilee Metals Group Plc (AIM - JLP: LN)

www.jubileemetalsgroup.com

Jubilee Metals Group Plc ("Jubilee") is a diversified metal

recovery business with a world-class portfolio of projects in South

Africa and Zambia. Jubilee's shares are traded on the AIM Market of

the London Stock Exchange (JLP) and the South African Alt-X of JSE

Limited (JBL). The company's business model focuses on the

retreatment and metals recovery from mine tailings, waste, slag,

slurry and other secondary materials generated from mining

operations. Effectively, whilst extracting maximum financial

returns from its operations, Jubilee responsibly rehabilitates

environments scarred by the surface footprint of historical mining

operations and solving air and water pollution issues associated

with those installations. The company's expanding multi-project

portfolio across South Africa and Zambia provides exposure to a

broad commodity basket including Platinum Group Metals ('PGMs'),

chrome, lead, zinc, vanadium, copper and cobalt.

STATEMENT OF COMPREHENSIVE INCOME YEARED 31 DECEMBER 2022

Notes 2022 2021

GBP GBP

Change in fair value of investments 6 (159,847) 26,695

Revenue:

Investment income - 1,610

Other income - 32,864

Administrative expenses 2 (297,115) (313,214)

LOSS BEFORE TAXATION (456,962) (252,045)

Taxation 4 - -

TOTAL COMPREHENSIVE LOSS FOR THE YEAR (456,962) (252,045)

---------- ----------

Basic loss per share 5 (0.10)p (0.06)p

Diluted loss per share 5 (0.10)p (0.06)p

All profits are derived from continuing operations.

STATEMENT OF CHANGES IN EQUITY YEARED 31 DECEMBER 2022

Other components of equity

Share capital Share Warrants Capital Retained Total

premium reserve redemption earnings Equity

reserve

GBP GBP GBP GBP GBP GBP

As at 1 January 2021 1,724,930 1,949,871 - 1,100,000 (3,797,955) 976,846

Shares issued during the

year 8,500 36,550 - - - 45,050

Total comprehensive income

for the year - - - - (252,045) (252,045)

As at 31 December 2021 1,733,430 1,986,421 - 1,100,000 (4,050,000) 769,851

---------- ---------- --------- ------------ ------------ ----------

As at 1 January 2022 1,733,430 1,986,421 1,100,000 (4,050,000) 769,851

Shares issued during the

year 91,686 26,619 65,067 - - 183,372

Total comprehensive income

for the year - - - - (456,962) (456,962)

As at 31 December 2022 1,825,116 2,013,040 65,067 1,100,000 (4,506,962) 496,261

---------- ---------- ------- ---------- ------------ ----------

STATEMENTS OF FINANCIAL POSITION AS AT 31 DECEMBER 2022

Notes 2022 2021

GBP GBP

NON- CURRENT ASSETS

Investments in financial assets at

fair value through profit or loss 6 507,510 779,309

------------ ------------

Total Non-Current Assets 507,510 779,309

CURRENT ASSETS

Trade and other receivables 7 45,819 4,723

Cash and cash equivalents 150,631 34,394

------------ ------------

Total Current Assets 196,450 39,117

------------ ------------

TOTAL ASSETS 703,960 818,426

------------ ------------

CURRENT LIABILITIES

Trade and other payables 9 (207,699) (48,575)

Total Current Liabilities (207,699) (48,575)

------------ ------------

NET ASSETS 496,261 769,851

------------ ------------

EQUITY

Share capital 10 1,825,116 1,733,430

Share premium 2,013,040 1,986,421

Warrants reserve 11 65,067 -

Capital redemption reserve 1,100,000 1,100,000

Retained earnings (4,506,962) (4,050,000)

------------ ------------

TOTAL EQUITY 496,261 769,851

------------ ------------

CASH FLOW STATEMENTS YEARED 31 DECEMBER 2022

Notes 2022 2021

GBP GBP

CASH FLOW FROM OPERATIONS

Loss before taxation (456,962) (252,045)

Adjustments for:

Dividends receivable - (1,610)

Change in fair value of investments 159,847 (26,695)

Other income - (32,864)

----------- -----------

Operating loss before movements in

working capital (297,115) (313,214)

(Increase)/Decrease in receivables (1,092) 18,513

Increase/(Decrease) in payables 159,120 (58,909)

NET CASH OUTFLOW FROM OPERATING ACTIVITIES (139,087) (353,610)

----------- -----------

CASH FLOW FROM INVESTING ACTIVITIES

Other income - 2,664

Dividends received - 1,610

Sale of investments 111,952 63,634

Purchase of investments - (100,603)

----------- -----------

NET CASH INFLOW FROM INVESTING ACTIVITIES 111,952 (32,695)

----------- -----------

CASH FLOW FROM FINANCING ACTIVITIES

Issue of shares 143,372 -

NET CASH INFLOW FROM FINANCING ACTIVITIES 143,372 -

----------- -----------

Net Increase/(decrease) in cash and

cash equivalents in the year 116,237 (386,305)

Cash and cash equivalents at the beginning

of the year 34,394 420,699

----------- -----------

Cash and cash equivalents at the end

of the year 150,631 34,394

----------- -----------

NOTES TO THE FINANCIAL STATEMENTS FOR THE YEARED 31 DECEMBER

2022

1. ACCOUNTING POLICIES

Basis of preparation

Tiger Royalties and Investments Plc ("Tiger" or the "Company")

is a public investment company limited by shares incorporated and

domiciled in England and Wales. The principal activities are

discussed in the Strategic Report and the address of the registered

office is included on page 1 of the annual report. T he functional

currency for the Company is Sterling as that is the currency of the

primary economic market in which the Company operates. The

financial statements have been prepared under the historical cost

convention except for the measurement of certain non-current asset

investments at fair value. The measurement bases and principal

accounting policies of the Company are set out below. The financial

statements have been prepared using International Financial

Reporting Standards (IFRS) issued by the International Accounting

Standards Board (IASB) and endorsed by the United Kingdom.

New and amended IFRS Standards that are effective for the

current year

A number of new standards and interpretations have been adopted

by the Company for the first time in line with their mandatory

adoption dates, but none are applicable to the Company and hence

there would be no impact on the financial statements.

New and revised IFRS Standards in issue but not yet

effective

At the date of approval of these financial statements, the

Company has not applied the following new and revised IFRS

Standards that have been issued but are not yet effective:

IFRS 17 (including Insurance Contracts

the June 2020 and

December 2021 amendments

to IFRS 17)

Amendments to IFRS Sale or Contribution of Assets between an Investor

10 and IAS 28 and its Associate or Joint Venture

--------------------------------------------------------

Amendments to IAS Classification of Liabilities as Current or Non-current

1

--------------------------------------------------------

Amendments to IAS Disclosure of Accounting Policies

1 and IFRS Practice

Statement 2

--------------------------------------------------------

Amendments to IAS Definition of Accounting Estimates

8

--------------------------------------------------------

Amendments to IAS Deferred Tax related to Assets and Liabilities arising

12 from a Single Transaction

--------------------------------------------------------

IFRS 3 Conceptual framework

--------------------------------------------------------

Amendments to IFRS Reference to the Conceptual Framework

3

--------------------------------------------------------

Amendments to IAS Property. Plant and Equipment-Proceeds before Intended

16 Use

--------------------------------------------------------

Amendments to IAS Non-current liabilities with covenants

1

--------------------------------------------------------

Amendments to IFRS Lease liability sale & leaseback

16

--------------------------------------------------------

The directors do not expect that the adoption of the Standards

listed above will have a material impact on the financial

statements of the Company in future periods.

Going concern

The operations of the Company have been financed mainly through

operating cash flows. As at 31 December 2022, the Company held cash

balances of GBP150,631 (2021: GBP34,394) and an operating loss has

been reported. Historically, the Company has generated cash flow

from the sale of investments in quoted natural resource

companies.

Cash and cash equivalents were GBP150.631 (2021:34,394) as at 31

December 2022 and the Company held investment in financial

investments at 31 December 2022 of GBP507,510. Although an

operating loss is not expected in the year subsequent to the date

of these accounts, it is possible, as a result of volatile markets,

that the Company may need to raise funding to provide additional

working capital to finance its ongoing activities. The management

team has successfully raised funding for similar projects and

companies in the past, however there is no guarantee that adequate

funds will be available when needed in the future.

Based on its current reserves and the Board's assessment that

the Company should be able to raise additional funds, as and when

required to meet its working capital requirements, the Board have

concluded that they have a reasonable expectation that the Company

can continue in operational existence for the foreseeable future.

In addition, the Board confirms that Directors fees will continue

to accrue or be paid in shares (subject to AIM rules and other

regulatory issues) until the Company undertakes either a fundraise

and has sufficient excess working capital to settle such fees, or

is involved in a significant transaction which would significantly

uplift the prospects for the Company. For these reasons the

financial statements have been prepared on the going concern basis,

which contemplates continuity of normal business activities and the

realisation of assets and discharge of liabilities in the normal

course of business.

There is a material uncertainty relating to the conditions above

that may cast significant doubt on the Company's ability to

continue as a going concern and therefore the Company may be unable

to realise its assets and discharge its liabilities in the normal

course of business.

This financial report does not include any adjustments relating

to the recoverability and classification of recorded assets amounts

or liabilities that might be necessary should the entity not

continue as a going concern.

Valuation of available-for-sale Investments and adoption of

IFRS9

Available-for-sale investments under both IFRS9 and IAS39 are

initially measured at fair value plus incidental acquisition costs.

Subsequently, they are measured at fair value in accordance with

IFRS 13. This is either the bid price or the last traded price,

depending on the convention of the exchange on which the investment

is quoted.

All gains and losses are taken to profit and loss. In proceeding

periods gains and losses on available-for-sale investments were

recognised in other comprehensive income and accumulated in the

available-for-sale assets reserve except for impairment losses,

until the assets are derecognised, at which time the cumulative

gains and losses previously recognised in other comprehensive

income are recognised in profit or loss.

Revenue

Dividends receivable from equity shares are taken to profit or

loss on an ex-dividend basis. Income from bank interest received is

recognised on a time-apportionment basis. Dividends are stated net

of related tax credits.

Expenses

All expenses are accounted for on accruals basis.

Cash and cash equivalents

This consists of cash held in the Company's bank accounts.

Foreign currency

Assets and liabilities denominated in foreign currency are

translated into sterling at the rates of exchange ruling at balance

sheet date. Exchange gains or losses on monetary items are recorded

in profit or loss. Exchange gains or losses on investments in

financial assets are recorded in other comprehensive income.

Treasury shares

The cost of purchasing treasury shares and the proceeds from the

sale of treasury shares up to the original price is taken to the

retained earnings reserve; any surplus on the disposal of treasury

shares (measured against the weighted average purchase price) is

taken to the share premium account.

Reserves

Share premium account

The share premium account is used to record the aggregate amount

or value of premiums paid in excess of the nominal value of share

capital issued, less deductions for issuance costs.

Capital Redemption Reserve

The Capital redemption reserve is used to redeem or purchase of

Company's own shares.

Warrants reserve

The warrant reserve presents the proceeds from issuance of

warrants, net of issue costs. Warrant reserve is non-distributable

and will be transferred to share capital account and accumulated

losses upon exercise of warrants.

Geographical segments

The internal management reporting used by the chief operating

decision maker consists of one segment. Hence in the opinion of the

Directors, no separate disclosures are required under IFRS 8. The

Company's revenue in the year is not material and consequently no

geographical segment information has been disclosed.

Deferred tax

Deferred tax liabilities are generally recognised for taxable

temporary differences and deferred tax assets are generally

recognised for all deductible temporary differences to the extent

that it is probable that taxable profits will be available against

which those deductible temporary differences can be utilised except

for differences arising on investments in subsidiaries where the

Company is able to control the timing of the reversal of the

difference and it is probable that the difference will not reverse

in the foreseeable future.

Deferred tax is also based on rates enacted or substantively

enacted at the reporting date and expected to apply when the

related deferred tax asset is realised or liability settled.

Deferred tax is charged or credited in the statement of

comprehensive income, except when it relates to items charged or

credited directly to equity, in which case the deferred tax is also

dealt within equity.

Current tax

The tax currently payable is based on taxable profit for the

year. Taxable profit differs from profit as reported in the income

statement because it excludes items or expenses that are taxable or

deductible in other years and it further excludes items that are

never taxable or deductible. The Company's liability for current

tax is calculated using tax rates that have been enacted or

substantively enacted by the end of the reporting period.

Significant management judgement in applying accounting policies

and estimation uncertainty

When preparing the financial statements, management makes a

number of judgements, estimates and assumptions about the

recognition and measurement of assets, liabilities, income and

expenses.

Fair value of financial assets

Establishing the fair value of financial assets may involve

inputs other than quoted prices. As is further disclosed in note 6,

all of the Company's financial assets which are measured at fair

value are based on level 1 inputs, which reduces the level of

estimation involved in their valuation.

Recognition of deferred tax assets

The extent to which deferred tax assets can be recognised is

based on an assessment of the probability of the Company's future

taxable income against which the deductible temporary differences

can be utilised. In addition, significant judgement is required in

assessing the impact of any legal or economic limits or

uncertainties in various tax jurisdictions. In the opinion of the

directors a deferred tax asset has not been recognised as future

profits cannot be forecasted with reasonable certainty.

2. OPERATING EXPENSES

Operating profit is stated after charging:

2022 2021

GBP GBP

Auditor's remuneration:

* Audit of the financial statements 12,750 12,750

* Taxation compliance services 1,500 1,500

---------- --------------------

14,250 14,250

---------- --------------------

Notes

Legal fees 4,080 1,200

Corporate finance costs 24,278 33,402

Directors' fees 3 109,000 109,000

Occupancy and support costs 72,000 72,000

Other administrative overheads 61,482 68,267

Stock Exchange costs 12,025 15,095

Administrative expenses 297,115 313,214

---------- ----------------------

3. DIRECTORS' EMOLUMENTS

2022 2021

GBP GBP

Directors' fees 109,000 109,000

------------------------ ----------

Other than directors, there were no employees in the current or

prior year. No pensions or other benefits were paid to the

Directors in the current or prior period.

The emoluments of each director during the year were as follows:

2022 2021

Amount Amount outstanding

outstanding at year end

at year

2022 end 2021

GBP GBP GBP GBP

Colin Bird 36,000 20,616 36,000 3,414

Michael Nolan 25,000 27,083 25,000 2,083

Raju Samtani 30,000 16,548 30,000 2,745

Alex Borrelli 18,000 20,937 18,000 1,605

The amounts above shown as outstanding to the Directors relate

to fees and/or salaries for the 6 month period to 31 December 2022

for Colin Bird and Raju Samtani and for the 13 month period to 31

December 2022 for Alex Borrelli and Michael Nolan. Fees and/or

salaries due to Alex Borrelli and Michael Nolan for the 7 months

period to 30 June 2022 were settled in January 2023.

4. TAXATION

2022 2021

GBP GBP

Corporation tax:

Current year - -

------------ ------------

The major components of tax expense and the reconciliation of the expected

tax expense based on the domestic effective tax rate of 19% (2021 - 19%)

and the reported tax expense in the statement of comprehensive income are

as follows:

2022 2021

GBP GBP

Loss on ordinary activities before

tax (456,962) (252,045)

------------ ------------

Expected tax charge at 19% (2021 -

19%) (86,823) (47,889)

Effects of:

Exempt dividend income - (306)

Difference between accounting gain

and taxable gain on investment 30,524 (5,072)

Excess management expenses carried

forward 56,299 53,267

Non-trade loan relationship deficit

carried forward - -

Actual tax charge - -

------------ ------------

5. LOSS PER SHARE

Basic 2022 2021

Loss after tax for the purposes of loss

per share attributable to equity shareholders (456,962) (252,045)

Weighted average number of shares 450,705,455 445,817,308

Basic loss per ordinary share (0.10)p (0.06)p

Diluted

Loss for year after tax (456,962) (252,045)

Weighted average number of shares 450,705,455 445,817,308

Diluted weighted average number of shares 450,705,455 445,817,308

Diluted loss per ordinary share (0.10)p (0.06)p

6. INVESTMENTS IN FINANCIAL ASSETS AT FAIR VALUE THROUGH PROFIT OR LOSS

2022

Listed Investments Other Investments Total

(Quoted/Others)

Canada 14,796 - 14,796

UK 248,443 244,271 492,714

263,239 244,271 507,510

--------------------- ------------------ ---------------

2021

Listed Investments Other Investments Total

(Quoted)

GBP GBP GBP

Canada 13,437 - 13,437

UK 330,297 435,575 765,872

343,734 435,575 779,309

--------------------- -------------------- -------------

Listed Investments Other Investments Total

(Quoted/Others)

GBP GBP GBP

Opening book cost 230,861 641,096 871,957

Opening unrealised depreciation 112,873 (205,521) (92,648)

------------------- ------------------ ----------

Valuation at 1 January 2022 343,734 435,575 779,309

Movements in the year :

Purchase at cost - - -

Sales proceeds - (111,952) (111,952)

Realised gains/(losses) on

sales based on historic cost - 806 806

Increase/(Decrease) in unrealised

depreciation (80,495) (80,158) (160,653)

263,239 244,271 507,510

------------------- ------------------ ----------

Book cost at year end 281,079 479,733 760,812

Closing unrealised depreciation (17,840) (235,462) (253,302)

Valuation at 31 December 2022 263,239 244,271 507,510

------------------- ------------------ ----------

2022 2021

GBP GBP

Realised (loss)/gain based on historical cost 806 (85,461)

Realised (loss)/gain based on carrying value

at previous balance sheet date 806 (85,461)

Unrealised fair value movement for the year (160,653) 112,156

Total recognised (losses)/gains on investments

in the year (159,847) 26,695

---------- ------------

The gains/(losses) on the Company's investments are analysed below. Accounting standards

prohibit the recognition of uplifts in the

value of impaired assets in profit and loss.

Security 31 December 31 December

2022 2021

Profit Profit

and loss and loss

African Pioneer Plc 12,334 90,297

------------ ------------

Bezant Resources Plc (54,516) (89,534)

------------ ------------

Block Energy Plc 2,531 (14,687)

------------ ------------

Caerus Minerals Plc (95,000) 39,398

------------ ------------

Corallian Energy Ltd (9,533) -

------------ ------------

WisdomTree Copper (ETFS Copper) - 3,301

------------ ------------

Galileo Resources Plc 20,854 (43,662)

------------ ------------

Goldquest Mining Corporation 1,359 (14,705)

------------ ------------

Jubilee Metals Group Plc (61,295) 40,936

------------ ------------

Kendrick Resources Plc 812 -

------------ ------------

Pantheon Resources Plc 18,342 10,647

------------ ------------

Reabold resources Plc 4,265 (4,128)

------------ ------------

Royal Dutch Shell Plc - 8,832

------------ ------------

Total movements (159,847) 26,695

------------ ------------

Financial instruments measured at fair value

The following table presents financial assets and liabilities

measured at fair value in the statement of financial position in

accordance with the fair value hierarchy. This hierarchy groups

financial assets and liabilities into three levels based on the

significance of inputs used in measuring the fair value of the

financial assets and liabilities. The fair value hierarchy has the

following levels:

- Level 1: quoted prices (unadjusted) in active markets for identical assets or liabilities;

- Level 2: inputs other than quoted prices included within Level

1 that are observable for the asset or liability, either directly

(i.e., as prices) or indirectly (i.e., derived from prices);

and

- Level 3: inputs for the asset or liability that are not based

on observable market data (unobserved inputs).

The level within which the financial asset or liability is

classified is determined based on the lowest level of significant

input to the fair value measurement.

The financial assets and liabilities measured at fair value in

the statement of financial position are grouped into the fair value

hierarchy as follows:

Level 1 Level Level Total

31 December 2022 GBP 2 3 GBP

GBP GBP

Assets

Investments held at fair

value 507,510 - - 507,510

-------- -------- ------- --------

Total 507,510 507,510

Level 1 Level 2 Level Total

GBP GBP 3 GBP

31 December 2021 GBP

Assets

Investments held at fair value 758,882 20,427 779,309

-------- -------- ------- --------

Total 758,882 - 20,427 779,309

There have been no significant transfers between levels in the

reporting period.

Reconciliation of Level 3 fair value measurements of financial

instruments

Level 3 investments

GBP

Balance at 1 January 2021 30,000

--------------------

Total gains or (losses) in other comprehensive income -

--------------------

Purchases/(Sales) (9,573)

--------------------

Transfers in/(out) -

--------------------

Balance at 1 January 2022 20,427

--------------------

Total gains or (losses) in other comprehensive income -

--------------------

Purchases/(Sales) (20,427)

--------------------

Transfers in/(out) -

--------------------

Balance at 31 December 2022 -

--------------------

Measurement of fair value

The methods and valuation techniques used for the purpose of

measuring fair value are outlined in note 1 and remain unchanged

compared to the previous reporting period. The fair values of

short-term receivables, cash and short-term payables do not differ

from their carrying values due to their short maturity

profiles.

Listed / quoted securities

Equity securities held by the Company are denominated in GBP and

CAD$, and are publicly traded on the main London Stock Exchange,

the Alternative Investment Market of the London Stock Exchange and

the Toronto Venture Exchange. Fair values have been determined by

reference to their quoted bid prices at the reporting date.

7. TRADE AND OTHER RECEIVABLES

2022 2021

GBP GBP

Other debtors 40,526 1,913

Prepayments 5,293 2,810

------- ------

45,819 4,723

------- ------

An expected credit loss impact assessment under IFRS 9 is not

required, as the Company does not hold any trade or intercompany

debtors as at the balance sheet date.

8. DEFERRED TAX

The Company has the below tax losses and related potential

deferred tax:

Description 2022 2021 Potential Potential

GBP GBP Deferred Deferred

tax asset tax asset

2022 2021

GBP GBP

Non trade deficits 11,794 11,794 2,948 2,241

---------- ---------- ----------- -----------

Excess management charges 2,780,941 2,483,826 695,235 471,927

---------- ---------- ----------- -----------

Capital losses 771,434 772,240 192,858 146,726

---------- ---------- ----------- -----------

3,564,169 3,267,860 891,041 620,894

---------- ---------- ----------- -----------

Deferred tax assets are not recognised due to the

unpredictability of future profit streams arising from the disposal

of investments held by the Company. Tax losses may be carried

forward indefinitely and will only be recoverable if suitable

profits arise in the future. Deferred tax positions arising from

unrealised gains and losses on the company's financial assets will

vary depending on changes in the fair values of those assets up

until the date of disposal.

9. TRADE AND OTHER PAYABLES

2022 2021

GBP GBP

Trade payables 84,280 6,625

Directors 85,184 9,847

Accruals 38,235 32,103

-------- -------

207,699 48,575

-------- -------

10. CALLED UP SHARE CAPITAL

The share capital of Tiger consists of fully paid ordinary

shares with a nominal value of 0.1p each and deferred shares with a

nominal value of 0.9p each. Ordinary shares of 0.1p are eligible to

receive dividends and the repayment of capital and represent one

vote at the shareholders' meeting of The Company. The deferred

shares carry no dividend or voting rights.

2022 2021

GBP GBP

Authorised:

Ordinary Share Capital 10,000,000 10,000,000

----------- -----------

142,831,939 (2021: 142,831,939) deferred shares of

0.9 p each 1,285,487 1,285,487

----------- -----------

2022 2021

GBP GBP

Opening Ordinary shares - 447,942,308 at 0.1p each

(2021: 439,442,308 Ordinary shares of 0.1p each) 447,943 439,443

Issued during the year

91,686,246 shares at issue price of GBP0.002 (nominal 91,686 -

value of 0.1p each) - (i)

8,500,000 shares at issue price of 0.53p (nominal

value 0.1p each) - (ii) - 8,500

Ordinary shares in issue as at 31 December 2021 -

539,628,553 at 0.1 p each (2021 : 447,942,308 shares

of 0.1p each) nominal value 539,629 447,943

----------- -----------

142,831,939 (2021: 142,831,939) deferred shares of

0.9p each 1,285,487 1,285,487

----------- -----------

1,825,116 1,733,430

----------- -----------

The Deferred shares have no income or voting rights.

Included in allotted called and fully paid share capital are

4,500,000 shares with a nominal value of GBP4,500 held by the

company in treasury.

(i) This share issue included 10,936,246 shares allotted to two

directors in lieu of accrued net salary of GBP21,872. Please see

note 12(4) for further details.

(ii) On 15 March 2021, The Company issued 8.5 million shares of

0.1 p each at an issue price of 0.53p each share each to settle

outstanding fees due to Sanderson Capital Partners td (existing

shareholder in the Company), totalling GBP45,050.

11. Share Warrants

2022 2021

Number of Exercise price Number of Exercise price

warrants warrants

----------- --------------- ---------- ---------------

Outstanding at 1 January - - - -

----------- --------------- ---------- ---------------

Issued 91,686,246 0.3p - -

----------- --------------- ---------- ---------------

Outstanding at 31 December 91,686,246 -

----------- --------------- ---------- ---------------

Each of the participants in the Fundraising/shares issue on 20

December 2022 received one warrant exercisable at 0.3 pence for

each Fundraising Share which they subscribed, valid for two

years.

As a result of this, the fair value of the share options was

determined at the date of the grant using the Black Scholes model,

using the following inputs

Start date Expiry Warrant Risk free Volatility Fair value

date price pence rate of warrants

20 December 20 December

2021 2024 0.3 6% 110% GBP65,067

------------- ------------- ---------- ----------- -------------

12. RELATED PARTY TRANSACTIONS

(1) Lion Mining Finance Limited, a company in which Colin Bird

is director and shareholder, has provided administrative and

technical services to the Company amounting to GBP60,000 plus VAT

in the year (2021 - GBP60,000). There was an amount of GBP69,000

outstanding at 31 December 2022 (2021- 6,000). The Board considers

this transaction to be on an arms' length basis.

(2) The emoluments of the Directors and amounts due to each

director at year end are disclosed in note 3.

(3) Directors' shareholdings are disclosed in the Report of the Directors.

(4) As part of a fundraising completed on 20 December 2022, Mr

Colin Bird and Mr Raju Samtani each invested GBP25,000 to subscribe

for 12,500,000 shares of 0.1 pence each at a price of 0.2 pence per

share. Additionally outstanding salary due to Colin Bird of

GBP12,600 was converted into 6,300,000 Placing Shares and

outstanding salary due to Mr Raju Samtani of GBP9,272 was converted

into 4,636,246 Placing Shares. All shares received as part of the

placing and salary conversion attracted one warrant exercisable at

0.3 pence per share for a period of 2 years from the date of the

placing.

(5) On 18 February 2021, the Company received 28,314,815 shares

in Bezant Resources Plc (Mr Colin Bird and Mr Raju Samtani are

executive directors of the Company and also executive directors and

shareholders of Bezant. In addition, Mr Colin Bird held 2.7%

interest in Metrock), as settlement of outstanding loans of

GBP46,250 which the Company had advanced to Metrock Resources Ltd

during Q4 2020 and fee due of GBP30,200 from Metrock. Initially, on

12 October 2020, the Company negotiated an exclusive mandate to

facilitate an IPO for Metrock. However, subsequently on 22 December

2020, under a revised mandate, both parties mutually agreed not to

proceed with an IPO. Metrock was then acquired by Bezant. As part

of Bezant's Shareholders Purchase Agreement (SPA) with the

shareholders of Metrock, it was agreed that outstanding loans in

Metrock's books will be acquired by Bezant and settled in newly

issued Bezant ordinary shares of 0.002p each at a price of 0.27

pence per share on completion of the SPA ("Bezant Shares").

Accordingly, Tiger was issued 28,314,815 Bezant Shares on

completion of the SPA to settle loans of GBP46,250 which it has

made to Metrock and the GBP30,200 fee referred to above. Upon issue

of the 28,314,815 Bezant Shares, Tiger's total shareholding in

Bezant increased to 83,870,371 shares representing 2.37% of the

Bezant's enlarged issued share capital on completion.

(6) The Company held a 50.75% equity stake in African Pioneer

Plc ("APP"). On 1 June 2021, APP's shares comprising 189,459,550

Ordinary shares of zero par value each ("Ordinary Shares") were

admitted to the Official List (Standard Segment), and to trading on

the Main Market for listed securities of the London Stock Exchange.

Consequently, the Company's shareholding in APP was reduced to

4.65% and APP is no longer a subsidiary of the Company. Tiger's

current holding in APP is 8,810,056 Ordinary Shares, which have

been included in the Company's balance sheet at market valuation

under investment in financial assets at fair value through profit

or loss. Mr Colin Bird and Mr Raju Samtani, who are both Directors

of Tiger and African Pioneer Plc and co-vendors of African Pioneer

Zambia to APP, each received 15,000,000 APP Shares on Standard

Listing. Campden Park Trading, a company owned and controlled by Mr

Colin Bird, received 5,000,000 APP Shares on Standard Listing

carrying a total value of GBP700,000 attributable to Colin Bird and

related companies and GBP525,000 to Raju Samtani upon Standard

Listing.

(7) On 31 March 2021, African Pioneer Plc (Mr Colin Bird and Mr

Raju Samtani, are both Executive Directors & shareholders of

the Company and African Pioneer Plc) repaid GBP18,385 due to the

Company as at 31 December 2020 plus an interest amount of

GBP760.71. Under a loan agreement dated 28 January 2021, Tiger

advanced an unsecured loan of GBP112,981 to African Pioneer plc at

a coupon rate of 10%. African Pioneer Plc repaid this balance plus

an interest amount of GBP1,903.78 on 31 March 2021.

(8) On 1 June 2021, an amount of GBP100,000 due from African

Pioneer Plc to the Company (Mr Colin Bird and Mr Raju Samtani, are

both Executive Directors & shareholders of the Company and

African Pioneer Plc), was converted to 2,857,143 (zero nominal

value) shares of African Pioneer Plc.

(9) Colin Bird and Alex Borrelli are directors of Kendrick

Resources Plc. Refer to portfolio valuation on page 3 for details

for Tiger's current holding in Kendrick Resources Plc.

(10) Colin Bird is a director of Galileo Resources Plc. Refer to

portfolio valuation on page 3 for details for Tiger's current

holding in Galileo Resources Plc.

13. POST-REPORTING DATE EVENTS

There are no events after the balance sheet date that may

warrant disclosure or may require adjustments to these financial

statements.

14. CONTINGENT LIABILITIES

There were no contingent liabilities at 31 December 2022 (2021 -

None).

There were no operating or financial commitments or contracts

for capital expenditure in place for the Company as at the

reporting date (2021: GBPnil).

15. FINANCIAL INSTRUMENTS

Management of Risk

The Company's financial instruments comprise:

-- Investments held at fair value through profit or loss

-- Cash, short-term receivables and payables

Throughout the period under review, it was the Company's policy

that no trading in derivatives shall be undertaken.

The main financial risks arising from the Company's financial

instruments are market price risk and liquidity risk.

Liquidity risk arises principally from cash and cash

equivalents, which comprise cash at bank (repayable on demand). The

Company has no overdraft facilities. The carrying amount of these

assets are approximately equal to their fair value.

Credit risk is not significant, but is monitored. The Board

regularly reviews and agrees policies for managing each of these

risks and they are summarised below. These policies have remained

constant throughout the period.

Financial Assets and Liabilities

Financial Assets

Financial Assets at amortised cost 2022 2021

Other debtors 40,526 1,913

-------- --------

Prepayments 5,293 2,810

-------- --------

Cash and cash equivalents 150,631 34,394

-------- --------

Financial Assets at fair value through

other comprehensive income 507,510 779,309

-------- --------

Total 703,960 818,426

-------- --------

Financial Liabilities

Financial Assets at amortised cost 2022 2021

Trade Creditors 111,363 8,708

-------- -------

Other creditors 58,101 7,764

-------- -------

Accrued expenses 38,235 32,103

-------- -------

Total 207,699 48,575

-------- -------

Market risk

Market risk consists of interest rate risk, foreign currency

risk and other price risk. It is the Board's policy to maintain an

appropriate spread of investments in the portfolio whilst

maintaining the investment policy and aims of the Company. The

Investment Committee actively monitors market prices and other

relevant information throughout the year and reports to the Board,

who is ultimately responsible for the Company's investment

policy.

Interest rate risk

Changes in interest rates would affect the Company returns from

its cash balances. A floating rate of interest, which is linked to

bank base rates, is earned on cash deposits. The exposure to cash

flow interest rate risk at 31 December 2022 for the Company was

GBP150,631 (2021: GBP34,394).

A sensitivity analysis based on a movement of 1% on interest

rates would have a GBP1,506 effect on the Company's' profit (2021:

GBP344).

As the Company does not have any borrowings and finances its

operations through its share capital and retained revenues, it does

not have any interest rate risk except in relation to cash

balances.

Foreign currency risk

The Company's total return and net assets can be affected by

currency translation movements as part of the investments held by

the Company are denominated in currencies other than GBP Sterling.

The Directors mitigate the individual currency risks through the

international spread of investments. Hedging transactions may be

used but none have been employed during the period under review

(2021: none).

The fair values of the Company's investments that have foreign

currency exposure at 31 December 2022 are shown below.

2022 2021

CAD CAD

GBP GBP

Investments in financial assets at fair value

through profit or loss 14,796 13,437

The Company accounts for movements in fair value of its

financial assets in other comprehensive income. The following table

illustrates the sensitivity of the equity in regard to the

Company's financial assets and the exchange rates for GBP/ Canadian

Dollar.

It assumes the following changes in exchanges rates:

- GBP/CAD +/- 20% - (2021: +/- 20%)

These percentages used reflect the high level of market

volatility experienced in exchange rates in recent years.

The sensitivity analysis is based on the Company's foreign

currency financial instruments held at each balance sheet date.

If GBP Sterling had weakened against the currencies shows, this

would have had the following effect:

2022 2021

CAD CAD

GBP GBP

Equity 2,959 2,687

If GBP Sterling had strengthened against the currencies shows,

this would have had the following effect:

CAD CAD

GBP GBP

Equity (2,466) (2,240)

Other price risk

Other price risk which comprises changes in market prices other

than those arising from interest rate risk or currency risk may

affect the value of quoted and unquoted equity investments. The

Board of directors manages the market price risks inherent in the

investment portfolio by regularly monitoring price movements and

other relevant market information.

The Company accounts for movements in the fair value of

investments in financial assets in other comprehensive income and

assets designated at fair value through profit or loss in

comprehensive income. The following table illustrates the

sensitivity to equity of an increase / decrease of 50% in market

prices. This level of change is considered to be reasonable based

on observation of current market conditions, in particular resource

stocks and junior mining companies. The sensitivity is based on the

Company's equities at each balance sheet date, with all other

variables held constant.

2022 2021

50% increase 50% decrease 50% increase 50% decrease

in fair in fair in fair in fair

value value value value

GBP GBP GBP GBP

Equity 253,755 (253,755) 389,655 (389,655)

Liquidity risk

The Company maintains appropriate cash reserves and the majority

of the Company's assets comprise realisable securities, most of

which can be sold to meet funding requirements if necessary. Given

the Company's cash reserves, it has been able to settle all

liabilities on average within 1 month.

Credit risk

The risk of counterparty's failure to discharge its obligations

under a transaction that could result in the Company suffering a

loss is minimal. The Company holds its cash balances amounting to

GBP150,631 (2021: GBP 34,394) with a reputable bank and only

transacts with regulated institutions on normal market terms, and

this is the only significant credit risk exposure. The credit

rating for the bank is A+.

Included in total amounts receivable at 31 December 2022 is the

sum of GBP457 (2021 - GBP1,844) which was lodged with the Company's

brokers in relation to future investments.

Concentration risk

The cash balance held with bank of GBP150,631 (2021: GBP34,394)

is the only significant credit risk exposure

Financial liabilities

There are no currency or interest rate risk exposures on

financial liabilities as they are denominated in GBP Sterling and

settled on average within one month.

Capital management

The Company actively reviews its issued share capital and

reserves and manages its capital requirements in order to maintain

an efficient overall financing structure whilst avoiding any

leverage. The capital structure of the Company consists of only

equity (comprising issued capital, reserves, and retained earnings

as disclosed below and the Statements of Changes in Equity) and no

debt.

The Board monitors the discount level of its issued shares,

which is the difference between its Net Asset Value (NAV) and its

actual share price. To improve NAV, the Company may purchase its

own shares in the market. During the current year, the Company has

not purchased any of its own shares (2021: Nil).

Company At 1 January Cash flows Other non-cash At 31 December

2022 changes 2022

Cash and cash equivalents GBP GBP GBP GBP

------------- ----------- --------------- ---------------

Cash 34,394 116,237 - 150,631

------------- ----------- --------------- ---------------

Borrowings - -

------------- ----------- --------------- ---------------

Debt due within one - -

year

------------- ----------- --------------- ---------------

Debt due after one - -

year

------------- ----------- --------------- ---------------

Total 34,394 116,237 - 150,631

------------- ----------- --------------- ---------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR SELFFSEDSEEM

(END) Dow Jones Newswires

June 20, 2023 07:27 ET (11:27 GMT)

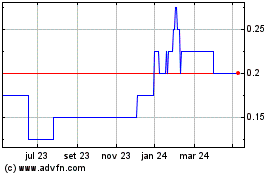

Tiger Royalties And Inve... (LSE:TIR)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Tiger Royalties And Inve... (LSE:TIR)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024