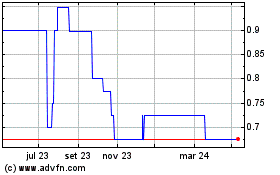

Anemoi International Ltd (AMOI)

Anemoi International Ltd: Final Results For Year Ended 31 December 2022

10-Jul-2023 / 10:56 GMT/BST

=----------------------------------------------------------------------------------------------------------------------

Anemoi International Ltd

Anemoi International Ltd

(Reuters: AMOI.L, Bloomberg: AMOI:LN)

("Anemoi", "AMOI" or the "Company")

Final Results For Year Ended 31 December 2022

The information set out below is extracted from the Company's Report and Accounts for the year ended 31 December 2022,

which will be published today on the Company's website. A copy will also be submitted to the National Storage Mechanism

where it will be available for inspection. Cross-references in the extracted information below refer to pages and

sections in the Company's Report and Accounts for the year ended 31 December 2022.

Group Results 2022 versus 2021 GBP

-- Group Operating Loss for the year GBP(0.8)m vs GBP(0.6)m

-- Group Loss before taxation for the year GBP(0.8)m vs GBP(0.6)m

-- Group Earnings Per Share (basic and diluted)*1 GBP(0.01) vs GBP(0.02)

-- Book value per share*2 GBP0.03 vs GBP0.03

-- Net Cash GBP2.2m vs

GBP2.7m

*1 based on weighted average number of shares in issue of 157,041,665 (2021: 38,933,104)

*2 based on actual number of shares in issue as at 31 December 2022 of 157,041,665 (2021: 157,041,665)

2021 HIGHLIGHTS

-- id4 growth below budget

Sebastien Lalande, founder and CEO departs Company

Costs slashed and business refocused on intermediate as well as end user sales Id4 revenues and profitability

insufficient to support Public Company costs

Board have been pursuing broad- based acquisition search for Reverse Take Over (RTO) candidate

A number of potential candidates identified that fulfil RTO rules, which require the post transaction market value to

be in excess of GBP30 million

Board targeting Q3 update announcement on potential transaction

2022 can be viewed as a year of "one step forward, two steps sideways". The Board's frustration with management's

inability to take responsibility for results ultimately resulted in the departure of Sebastien Lalande, id4's

co-founder and CEO. Costs have been further reduced and id4's sales efforts, as highlighted above, are now focused on

BtoB as well as BtoC, thus allowing id4 to work in collaboration with larger, better established software houses that

offer complimentary solutions, but which do not offer an integrated KYC/AML as part of their software.

During the past few months the Board have pursued a number of potential M&A opportunities and have now reduced the

number that fulfil the required criteria for an RTO for a listed entity to two potential candidates.The Board will

update on discussions during Q3 2023.

Duncan Soukup

Chairman

4 July 2023

Directors Report

The Directors present their report and the audited financial statements for the period ended 31 December 2022.

BUSINESS REVIEW AND PRINCIPAL ACTIVITIES

Anemoi International Ltd (the "Company") is a British Virgin Island ("BVI") International business company ("IBC"),

incorporated and registered in the BVI on 6 May 2020.

DIRECTORS AND DIRECTORS' INTERESTS

id4 AG was formed as part of the merger of the former id4 AG ("id4") with and into its parent, Apeiron Holdings AG on

14 September 2021. id4 was incorporated and registered in the Canton of Lucerne in Switzerland in April 2019 whilst

Apeiron Holdings AG was incorporated and registered in December 2018. Following the merger, Apeiron Holdings AG was

renamed id4 AG.

The Directors of the Company who held office during the year and to date, including details of their interest in the

share capital of the Company, are as follows:

Name

Date Appointed Date Resigned Shares held

Executive Director

C Duncan Soukup 6 May 2020 7,925,142

T Donell 17 December 2021 21 October 2022 -

R Schimmel 17 December 2021 28 February 2022 -

Non-Executive Directors

14 August 2020

-

5 July 2021

Gareth Edwards Luca Tomasi Kenneth Morgan T Donell 7 February 2022 -

24 May 2022

-

21 October 2022

Company Secretary Charles Duncan Soukup

Registered Agent Hatstone Trust Company (BVI) Limited, Folio

Chambers, PO Box 800,Road Town, Tortola, British Virgin Islands

Registered Office Folio Chambers, PO Box 800, Road Town,

Tortola, British Virgin Islands

Auditor RPG Crouch Chapman LLP, 5th Floor, 14-16 Dowgate Hill,

London EC4R 2SU RELATED PARTY TRANSACTIONS

Details of all related party transactions are set out in note 16

to the financial statements. OPERATIONAL RISKS

The directors recognise that commercial activities invariably

involve an element of risk. A number of the risks to which the

business is exposed, such as the condition of the UK and Swiss

domestic economies in relation to asset management and investment

in systems, are beyond the Company's influence. However, such risk

areas are monitored and appropriate mitigating action, such as

reviewing the substance and timing of the Company's operational

plans, is taken wherever

practicable in response to significant changes. The directors

consider the risk areas the Company is exposed to in the light of

prevailing economic conditions and the risk areas set out in this

section are subject to review.

In relation to asset management, the Company's approach to risk

reflects the Company's granular business model and position in the

market and involves the expertise of its directors, management and

third-party advisers. Operational progress and key investment and

disposal decisions are considered in regular management team

meetings as well as being subject to informal peer review.

Higher level risks and financial exposures are subject to

constant monitoring. Major investment and disposal decisions are

subject to review by the directors in accordance with a protocol

set by the Board.

The Company is dependent upon the Directors, and in particular,

Mr C. Duncan Soukup, who serves as the Chairman, to identify

potential acquisition opportunities and to execute any acquisition.

The unexpected loss of the services of Mr Soukup or the other

Directors could have a material adverse effect on the Company's

ability to identify potential acquisition opportunities and to

execute an acquisition.

The Company may invest in or acquire unquoted companies, joint

ventures or projects which, amongst other things, may be leveraged,

have limited operating histories, have limited financial resources

or may require additional capital. FINANCIAL RISKS

Details of the financial instrument risks and strategy of the

Company are set out in note 18. RISKS AND UNCERTAINTIES

A summary of the key risks and mitigation strategies is

below:

Risk Mitigation

Insufficient cash resources to meet liabilities, Short term and annual business plans are prepared and

1. continue as a going concern and finance key are reviewed on an ongoing basis.

projects.

Loss of key management/staff resulting in failure Regular review of both the Board's and key

2. to identify and secure potential investment management's abilities. Review of salaries and

opportunities and meet contractual requirements. benefits including long term incentives and ongoing

communication with key individuals.

Failure to maintain strong and effective relations The Board and senior management seek to establish and

3. with key stakeholders in investments resulting in maintain an open and transparent dialogue with key

loss of contracts or value. stakeholders.

Key management are professionally qualified. In

4. Failure to comply with law and regulations in the addition the Company appoints relevant professional

jurisdictions in which we operate. advisers (legal, tax, accounting etc) in the

jurisdictions in which we operate.

The Group is currently poised to take advantage of

Significant changes in the political environment, disruption to the global economy with a low cost base

including the impact of the conflict in Ukraine,, and flexibility to scale up as and when the economy

5. results in loss of resources/market and/or recovers.

business failure.

Increased focus on compliance within the financial

investment world will benefit the company long term. DIRECTORS' RESPONSIBILITIES

The Directors have elected to prepare the financial statements

for the Company in accordance with UK Adopted International

Accounting Standards ("IFRS").

The Directors are responsible for keeping proper accounting

records which disclose with reasonable accuracy at any time the

financial position of the Company, for safeguarding the assets and

for taking reasonable steps for the prevention and detection of

fraud and other irregularities.

International Accounting Standard 1 requires that financial

statements present fairly for each financial period the Company's

financial position, financial performance and cash flows. This

requires the faithful representation of the effects of

transactions, other events and conditions in accordance with the

definitions and recognition criteria for assets, liabilities,

income and expenses set out in the International Accounting

Standards Board's 'Framework for the preparation and presentation

of financial statements'. In virtually all circumstances, a fair

presentation will be achieved

by compliance with all applicable International Financial

Reporting Standards as adopted by the United Kingdom. A fair

presentation also requires the Directors to:

-- select and apply appropriate accounting policies;

-- present information, including accounting policies, in a

manner that provides relevant, reliable, comparable and

understandable information;

-- provide additional disclosures when compliance with the

specific requirements in UK adopted IFRSs is insufficient to enable

users to understand the impact of particular transactions, other

events and conditions onthe entity's financial position and

financial performance; and

-- prepare the financial statements on the going concern basis

unless it is inappropriate to presume thatthe Company will continue

in business.

All of the current Directors have taken all the steps that they

ought to have taken to make themselves aware of any information

needed by the Company's auditors for the purposes of their audit

and to establish that the auditors are aware of that

information.The Directors are not aware of any relevant audit

information of which the auditors are unaware.

The financial statements are published on the Group's website.

The maintenance and integrity of the Group's website is the

responsibility of the Directors. The Directors' responsibility also

extends to the ongoing integrity of the financial statements

contained therein. AGM

The Annual General Meeting was held at Anjuna, 28 Avenue de la

Liberté, 06360 Éze France on 29 June 2023 at 11.30 (CEST).

AUDITORS

A resolution to confirm the appointment of RPG Crouch Chapman as

the Company's auditors was submitted to the shareholders at the

Annual General Meeting. Approved by the Board and signed on its

behalf by

C.Duncan Soukup

Chairman 04 July 2023

Anemoi International Ltd ("Anemoi" or the "Company") is a

company registered on the Main Market of the London Stock

Exchange.

The Company is subject to, and complies with, the relevant

Financial Conduct Authority's ("FCA") Listing Rules ("Listing

Rules"), the Market Abuse Regulation and the Disclosure Guidance

and Transparency Rules of the Financial Conduct Authority.

On 17 December 2021 the Company confirmed its shares were

re-admitted to trading on the London Stock Exchange's main

market.The Board recognises the importance and value for the

Company and its shareholders of good corporate governance. The

Company Statement on Corporate Governance is in full below. BOARD

OVERVIEW

In formulating the Company's corporate governance framework, the

Board of Directors have reviewed the principles of good governance

set out in the QCA code (the Corporate Governance Code for Small

and Mid- Sized Quoted Companies 2018 published by the Quoted

Companies Alliance) so far as is practicable and to the extent they

consider appropriate with regards to the Company's size, stage of

development and resources. However, given the modest size and

simplicity of the Company, at present the Board of Directors do not

consider it necessary to adopt the QCA code in its entirety but

does apply the principles, as set out below.

The purpose of corporate governance is to create value and

long-term success of the Group through entrepreneurism, innovation,

development and exploration as well as provide accountability and

control systems to mitigate risks involved. COMPOSITION OF THE

BOARD AND BOARD COMMITTEES

As at the date of this report, the Board of Anemoi International

Ltd comprises of one Executive Director and three Non- Executive

Directors. BOARD BALANCE

The current Board membership provides a balance of industry and

financial expertise which is well suited to the Group's activities.

This will be monitored and adjusted to meet the Group's

requirements. The Board is supported by the Audit Committee,

Remuneration Committee and Regulatory Compliance Committee, all of

which have the necessary character, skills and knowledge to

discharge their duties and responsibilities effectively.

Further information about each Director may be found on the

Company's website at https://anemoi-international.com/

investor-relations/board-of-directors/. The Board seeks to ensure

that its membership has the skills and experience that it requires

for its present and future business needs.

The Board has a procedure allowing Directors to seek independent

professional advice in furtherance of their duties, at the

Company's expense. RE-ELECTION OF DIRECTORS

In line with the QCA Code, all Directors are subject to re-

election each year, subject to satisfactory performance. BOARD AND

COMMITTEE MEETINGS

The Board meets sufficiently regularly to discharge its duties

effectively with a formal schedule of matters specifically reserved

for its decision.

Due to the short period of time following the completion of the

re-listing and the period end, the Board as it stands did not need

to meet. However during the period prior to the relisting and the

previous Board composition the Board met on a number of occasions

in order to conduct the activity required of the business:

Director Meetings attended

Duncan Soukup 3

Tim Donell 3

Luca Tomasi 3

Kenneth Morgan 3 AUDIT COMMITTEE

During the financial period to 31 December 2022, the Audit

Committee consisted of Luca Tomasi (Chairman) and one other

director.

The key functions of the audit committee are for monitoring the

quality of internal controls and ensuring that the financial

performance of the Group is properly measured and reported on and

for reviewing reports from the Company's auditors relating to the

Company's accounting and internal controls, in all cases having due

regard to the interests of Shareholders. The Committee has formal

terms of reference.

Former auditor, Jeffreys Henry LLP unexpectedly resigned in

December 2022. In the first quarter of 2023 therefore, the Group

experienced a delay in the audit process. New auditor, RPG Crouch

Chapman, was appointed on 19 April 2023.The Company has indicated

its independence to the Board. At present, the Group does not have

an internal audit function. However, the committee believes that

management has been

able to gain assurance as to the adequacy and effectiveness of

internal controls and risk management procedures. There is no

policy held on auditor rotation. REMUNERATION COMMITTEE

During the financial period to 31 December 2022, the

Remuneration Committee consisted of Luca Tomasi and one other

director. It is responsible for determining the remuneration and

other benefits, including bonuses and share based payments, of the

Executive Directors, and for reviewing and making recommendations

on the Company's framework of executive remuneration.The Committee

has formal terms of reference.

The remuneration committee is a committee of the Board. It is

primarily responsible for making recommendations to the Board on

the terms and conditions of service of the executive Directors,

including their remuneration and grant of options. STATEMENT ON

CORPORATE GOVERNANCE

The corporate governance framework which Anemoi has implemented,

including in relation to board leadership and effectiveness,

remuneration and internal control, is based upon practices which

the board believes are proportionate to the risks inherent to the

size and complexity of Anemoi's operations.

The Board considers it appropriate to adopt the principles of

the Quoted Companies Alliance Corporate Governance Code ("the QCA

Code") published in April 2018.The extent of compliance with the

ten principles that comprise the QCA Code, together with an

explanation of any areas of non-compliance, and any steps taken or

intended to move towards full compliance, are set out below: 1.

Establish a strategy and business model which promote long-term

value for shareholders

The Company is a Holding Company which has in the past and will

in the future seek to acquire assets which in the opinion of the

Board should generate long term gains for its shareholders.The

current strategy and business operations of the Company are set out

in the Chairman's Statement on page 4. Shareholders and potential

investors must realise that the objectives set out in that document

are simply that; "objectives" and that the Company may without

prior notification change these objectives based upon opportunities

presented to the Board or market conditions.

The Group's strategy and business model and amendments thereto,

are developed by the Executive Chairman and his senior management

team, and approved by the Board. The management team, led by the

Executive Chairman, is responsible for implementing the strategy

and overseeing management of the business at an operational

level.

The Board is actively considering a number of opportunities and,

ultimately, the Directors believe that this approach will deliver

long-term value for shareholders. In executing the Group's

strategy, management will seek to mitigate/hedge risk whenever

possible.

As a result of the Board's view of the market, the Board has

adopted a two-pronged approach to future investments: 1.

Opportunistic: where an acquisition or investment exists because of

price dislocation (the price of a stock collapses but fundamentals

are unaffected) or where the Board identifies a special "off

market" opportunity; 2. Finance: The Board seeks opportunities in

the FinTech sector.

The above outlined strategy is subject to change depending on

the Board's findings and prevailing market conditions 2. Seek to

understand and meet shareholder needs and expectations

The Board believes that the Annual Report and Accounts, and the

Interim Report published at the half-year, play an important part

in presenting all shareholders with an assessment of the Group's

position and prospects. All reports and press releases are

published in the Investor Relations section of the Company's

website. 3. Take into account wider stakeholder and social

responsibilities and their implications for long-termsuccess

The Group is aware of its corporate social responsibilities and

the need to maintain effective working relationships across a range

of stakeholder groups. These include the Group's consultants,

employees, partners, suppliers, regulatory authorities and entities

with whom it has contracted. The Group's operations and working

methodologies take account of the need to balance the needs of all

of these stakeholder groups while maintaining focus on the Board's

primary responsibility to promote the success of the Group for the

benefit of its members as a whole. The Group endeavours to take

account of feedback received from stakeholders, making amendments

where appropriate and where such amendments are consistent with the

Group's longer term strategy.

The Group takes due account of any impact that its activities

may have on the environment and seeks to minimise this impact

wherever possible. Through the various procedures and systems it

operates, the Group ensures full compliance with health and safety

and environmental legislation relevant

to its activities. The Group's corporate social responsibility

approach continues to meet these expectations. 4. Embed effective

risk management, considering both opportunities and threats,

throughout the organisation

The Board is responsible for the systems of risk management and

internal control and for reviewing their effectiveness. The

internal controls are designed to manage and whenever possible

minimise or eliminate risk and provide reasonable but not absolute

assurance against material misstatement or loss. Through the

activities of the Audit Committee, the effectiveness of these

internal controls is reviewed annually.

A budgeting process is completed once a year and is reviewed and

approved by the Board. The Group's results, compared with the

budget, are reported to the Board on a regular basis.

The Group maintains appropriate insurance cover in respect of

actions taken against the Directors because of their roles, as well

as against material loss or claims against the Group. The insured

values and type of cover are comprehensively reviewed on a periodic

basis.

The senior management team meet regularly to consider new risks

and opportunities presented to the Group, making recommendations to

the Board and/or Audit Committee as appropriate.

The Board has an established Audit Committee.

The Company receives comments from its external auditors on the

state of its internal controls.

The more significant risks to the Group's operations and the

management of these have been disclosed in the Director's Report on

page 5. 5. Maintain the Board as a well-functioning, balanced team

led by the Chair

The Board currently comprises three non-executive Directors, and

an Executive Chairman. Directors' biographies are set out in the

Board of Directors section of the Company's website.

All of the Directors are subject to election by shareholders at

the first Annual General Meeting after their appointment to the

Board and will continue to seek re-election every year.

The Board is responsible to the shareholders for the proper

management of the Group and, in normal circumstances, meets at

least four times a year to set the overall direction and strategy

of the Group, to review operational and financial performance and

to advise on management appointments.

The Board considers itself to be sufficiently independent.The

QCA Code suggests that a board should have at least two independent

Non-executive Directors. Both of the Non- executive Directors who

sat on the Board of the Company at the year-end are regarded as

independent under the QCA Code's guidance for determining such

independence.

Non-executive Directors receive their fees in the form of a

basic cash fee based on attendance at board calls and board

meetings. Directors are eligible for bonuses. The current

remuneration structure for the Board's Non-executive Directors is

deemed to be proportionate. 6. Ensure that between them, the

directors have the necessary up-to-date experience, skills and

capabilities

The Board considers that the Non-executive Directors are of

sufficient competence and calibre to add strength and objectivity

to its activities, and bring considerable experience in technical,

operational and financial matters.

The Company has put in place an Audit Committee as well as a

Remuneration Committee.

The Board regularly reviews the composition of the Board to

ensure that it has the necessary breadth and depth of skills to

support the on-going development of the Group.

The Chairman requires that the Directors' knowledge is kept up

to date on key issues and developments pertaining to the Group, its

operational environment and to the Directors' responsibilities as

members of the Board. During the course of the year, Directors

received updates from various external advisers on a number of

regulatory and corporate governance matters.

Directors' service contracts or appointment letters make

provision for a Director to seek personal advice in furtherance of

his or her duties and responsibilities. 7. Evaluate Board

performance based on clear and relevant objectives, seeking

continuous improvement

The Board's performance is measured by the success of the

Company's acquisitions and investments and the returns that they

generate for shareholders and in comparison to peer group

companies. This performance is presented in the Group's monthly

management accounts and reported, discussed and reviewed with the

Board regularly 8. Promote a corporate culture that is based on

ethical values and behaviours

The Board seeks to maintain the highest standards of integrity

and probity in the conduct of the Group's operations. These values

are enshrined in the written policies and working

practices adopted by all employees in the Group. An open culture

is encouraged within the Group. The management team regularly

monitors the Group's cultural environment and seeks to address any

concerns than may arise, escalating these to Board level as

necessary.

The Group is committed to providing a safe environment for its

staff and all other parties for which the Group has a legal or

moral responsibility in this area.

Anemoi has a strong ethical culture, which is promoted by the

actions of the Board and management team. The Group has an

anti-bribery policy and would report any instances of

non-compliance to the Board. The Group has undertaken a review of

its requirements under the General Data Protection Regulation,

implementing appropriate policies, procedures and training to

ensure it is compliant. 9. Maintain governance structures and

processes that are fit for purpose and support good decision-making

bythe Board

The Board has overall responsibility for promoting the success

of the Group. The Chairman has day-to-day responsibility for the

operational management of the Group's activities. The non-executive

Directors are responsible for bringing independent and objective

judgment to Board decisions. Matters reserved for the Board include

strategy, investment decisions, corporate acquisitions and

disposals.

There is a clear separation of the roles of Executive Chairman

and Non-executive Directors. The Chairman is responsible for

overseeing the running of the Board, ensuring that no individual or

group dominates the Board's decision-making and ensuring the

Non-executive Directors are properly briefed on matters. Due to its

current size, the Group does not require nor bear the cost of a

chief executive.

The Chairman has overall responsibility for corporate governance

matters in the Group but does not chair any of the Committees.The

Chairman also has the responsibility for implementing strategy and

managing the day-to-day business activities of the Group. The

Chairman is also responsible for ensuring that Board procedures are

followed and applicable rules and regulations are complied

with.

The Audit Committee normally meets at least once a year and has

responsibility for, amongst other things, planning and reviewing

the annual report and accounts and interim statements involving,

where appropriate, the external auditors.The Committee also

approves external auditors' fees and ensures the auditors'

independence as well as focusing on compliance with legal

requirements and accounting standards. It is also responsible for

ensuring that an effective system of internal control is

maintained. The ultimate responsibility for reviewing and approving

the annual financial statements and interim statements remains with

the Board.

A summary of the work of the Audit Committee undertaken in the

year ended 31 December 2022 is set out above. The Committee has

formal terms of reference, which are set out in the Board of

Directors section of the Company's website.

The Remuneration Committee, which meets as required, but at

least once a year, has responsibility for making recommendations to

the Board on the compensation of senior executives and determining,

within agreed terms of reference, the specific remuneration

packages for each of the Directors. It also supervises the

Company's share incentive schemes and sets performance conditions

for share options granted under the schemes.

A summary of the work of the Remuneration Committee undertaken

in the year ended 31 December 2022 is set out above.The Committee

has formal terms of reference.

The Directors believe that the above disclosures constitute

sufficient disclosure to meet the QCA Code's requirement for a

Remuneration Committee Report. Consequently, a separate

Remuneration Committee Report is not presented in the Group's

Annual Report. 10. Communicate how the Group is governed and is

performing by maintaining a dialogue with shareholders andother

relevant stakeholders

The Board believes that the Annual Report and Accounts, and the

Interim Report published at the half-year, play an important part

in presenting all shareholders with an assessment of the Group's

position and prospects. The Annual Report includes a Corporate

Governance Statement which refers to the activities of both the

Audit Committee and Remuneration Committee. All reports and press

releases are published in the Investor Relations section of the

Group's website.

The Group's financial reports and notices of General Meetings of

the Company can be found in the Reports and Documents section of

the Company's website. The results of voting on all resolutions in

future general meetings will be posted to this website, including

any actions to be taken as a result of resolutions for which votes

against have been received from at least 20 per cent of independent

shareholders. C.Duncan Soukup

Chairman

04 July 2023 OPINION

We have audited the financial statements of Anemoi International

Limited and its subsidiaries (the 'Group') for the year ended 31

December 2022 which comprise the Consolidated Statement of Income,

Consolidated Statement of Comprehensive Income, Consolidated

Statement of Financial Position, Consolidated Statement of Cash

Flows, Consolidated Statement of Changes in Equity, and notes to

the financial statements, including a summary of significant

accounting policies. The financial reporting framework that has

been applied in their preparation is applicable law and

International Financial Reporting Standards as adopted in the

United Kingdom (IFRS).

In our opinion, the financial statements:

-- give a true and fair view of the state of the Group's affairs

as at 31 December 2022 and of the Group's loss for the year then

ended;

-- have been properly prepared in accordance with IFRS. BASIS

FOR OPINION

We conducted our audit in accordance with International

Standards on Auditing (UK) (ISAs (UK)) and applicable law. Our

responsibilities under those standards are further described in the

Auditor's responsibilities for the audit of the financial

statements section of our report.We are independent of the group in

accordance with the ethical requirements that are relevant to our

audit of the financial statements in the UK, including the FRC's

Ethical Standard as applied to listed entities, and we have

fulfilled our other ethical responsibilities in accordance with

these requirements. We believe that the audit evidence we have

obtained is sufficient and appropriate to provide a basis for our

opinion. CONCLUSIONS RELATING TO GOING CONCERN

In auditing the financial statements, we have concluded that the

directors' use of the going concern basis of accounting in the

preparation of the financial statements is appropriate.

Our evaluation of the Directors' assessment of the entity's

ability to continue to adopt the going concern basis of accounting

included review of the expected cashflows for a period of 12 months

from the reporting date compared with the liquid assets held by the

Group. Based on the work we have performed, we have not identified

any material uncertainties relating to events or conditions that,

individually or collectively, may cast significant doubt on the

Group's ability to continue as a going concern for a period of at

least twelve months from when the financial statements are

authorised for issue.

Our responsibilities and the responsibilities of the directors

with respect to going concern are described in the relevant

sections of this report. OUR APPROACH TO THE AUDIT

In planning our audit, we determined materiality and assessed

the risks of material misstatement in the financial statements. In

particular, we looked at where the directors made subjective

judgements, for example in respect of significant accounting

estimates. As in all of our audits, we also addressed the risk of

management override of internal controls, including evaluating

whether there was evidence of bias by the directors that

represented a risk of material misstatement due to fraud.

We tailored the scope of our audit to ensure that we performed

sufficient work to be able to issue an opinion on the financial

statements as a whole, taking into account the structure of the

group and the parent company, the accounting processes and

controls, and the industry in which they operate. KEY AUDIT

MATTERS

Key audit matters are those matters that, in our professional

judgement, were of most significance in our audit of the financial

statements of the current period and include the most significant

assessed risks of material misstatement we identified (whether or

not due to fraud), including those which had the greatest effect

on: the overall audit strategy; the allocation of resources in the

audit; and directing the efforts of the engagement team.The matter

identified was addressed in the context of our audit of the

financial statements as a whole, and in forming our opinion

thereon, and we do not provide a separate opinion on these matters.

OUR APPLICATION OF MATERIALITY We consider gross assets to be the

most significant determinant of the Group's financial performance

used by the users of the financial statements. We have based

materiality on 1.5% of gross assets for each of the operating

components. Overall materiality for the Group was therefore set at

GBP0.1m. For each component, the materiality set was lower than the

overall group materiality.

We agreed with the Audit Committee that we would report on all

differences more than 5% of materiality relating to the Group

financial statements. We also report to the Audit Committee on

financial statement disclosure matters identified when assessing

the overall consistency and presentation of the consolidated

financial statements. OTHER INFORMATION

The directors are responsible for the other information. The

other information comprises the information included in the annual

report, other than the financial statements and our auditor's

report thereon. Our opinion on the financial statements does not

cover the other information and, except to the extent otherwise

explicitly stated in our report, we do not express any form of

assurance conclusion thereon. In connection with our audit of the

financial statements, our responsibility is to read the other

information and, in doing so, consider whether the other

information is materially inconsistent with the financial

statements or our knowledge obtained in the audit or otherwise

appears to be materially misstated. If we identify such material

inconsistencies or apparent material misstatements, we are required

to determine whether there is a material misstatement in the

financial statements or a material misstatement of the other

information. If, based on the work we have performed, we conclude

that there is a material misstatement of this other information, we

are required to report that fact. We have

We apply the concept of materiality both in planning and

performing our audit, and in evaluating the effect of

misstatements. We consider materiality to be the magnitude by which

misstatements, including omissions, could influence the economic

decisions of reasonable users that are taken on the basis of the

financial statements.

In order to reduce to an appropriately low level the probability

that any misstatements exceed materiality, we use a lower

materiality level, performance materiality, to determine the extent

of testing needed. Importantly, misstatements below these levels

will not necessarily be evaluated as immaterial as we also take

account of the nature of identified misstatements, and the

particular circumstances of their occurrence, when evaluating their

effect on the financial statements as a whole. nothing to report in

this regard. RESPONSIBILITIES OF DIRECTORS

As explained more fully in the directors' responsibilities

statement set out on page 7 the directors are responsible for the

preparation of the financial statements and for being satisfied

that they give a true and fair view, and for such internal control

as the directors determine is necessary to enable the preparation

of financial statements that are free from material misstatement,

whether due to fraud or error.

In preparing the financial statements, the directors are

responsible for assessing the group's and the parent company's

ability to continue as a going concern, disclosing, as applicable,

matters related to going concern and using the

going concern basis of accounting unless the directors either

intend to liquidate the group or the parent company or to cease

operations, or have no realistic alternative but to do so.

Those charged with governance are responsible for overseeing the

Group's financial reporting process. AUDITOR'S RESPONSIBILITIES FOR

THE AUDIT OF THE FINANCIAL STATEMENTS

Our objectives are to obtain reasonable assurance about whether

the financial statements as a whole are free from material

misstatement, whether due to fraud or error, and to issue our

opinion in an auditor's report. Reasonable assurance is a high

level of assurance, but does not guarantee that an audit conducted

in accordance with ISAs (UK) will always detect a material

misstatement when it exists. Misstatements can arise from fraud or

error and are considered material if, individually or in aggregate,

they could reasonably be expected to influence the economic

decisions of users taken on the basis of the financial

statements.

Irregularities, including fraud, are instances of non-compliance

with laws and regulations. We design procedures in line with our

responsibilities, outlined above, to detect material misstatements

in respect of irregularities, including fraud. The extent to which

our procedures are capable of detecting irregularities, including

fraud, is detailed below:

-- We obtained an understanding of the legal and regulatory

frameworks within which the Groupoperates focusing on those laws

and regulations that have a direct effect on the determination of

material amounts and disclosures in the financial statements.

-- We identified the greatest risk of material impact on the

financial statements fromirregularities, including fraud, to be the

override of controls by management. Our audit procedures to respond

to these risks included enquiries of management about their own

identification and assessment of the risks of irregularities,

sample testing on the posting of journals and reviewing accounting

estimates for biases.

Because of the inherent limitations of an audit, there is a risk

that we will not detect all irregularities, including those leading

to a material misstatement in the financial statements or

non-compliance with regulation. This risk increases the more that

compliance with a law or regulation is removed from the events and

transactions reflected in the financial statements, as we will be

less likely to become aware of instances of non-compliance.The risk

is also greater regarding irregularities occurring due to fraud

rather than error, as fraud involves intentional concealment,

forgery, collusion, omission or misrepresentation. A further

description of our responsibilities for the audit of the financial

statements is located on the Financial Reporting Council's website

at: www.frc.org.uk/auditorsresponsibilities. This description forms

part of our Auditor's Report. OTHER MATTERS THAT WE ARE REQUIRED TO

ADDRESS

We were appointed on 19 April 2023 and this is the first year of

our engagement as auditors for the Group.

We confirm that we are independent of the Group and have not

provided any prohibited non-audit services, as defined by the

Ethical Standard issued by the Financial Reporting Council.

Our audit report is consistent with our additional report to the

Audit Committee explaining the results of our audit. USE OF OUR

REPORT

This report is made solely to the Group's members, as a body.

Our audit work has been undertaken so that we might state to the

Group's members those matters we are required to state to them in

an auditor's report and for no other purpose. To the fullest extent

permitted by law, we do not accept or assume responsibility to

anyone other than the Group and the Group's members, as a body, for

our audit work, for this report, or for the opinions we have

formed.

(Senior Statutory Auditor) For and on behalf of RPG Crouch

Chapman LLP

Chartered Accountants Registered Auditor

5th Floor, 14-16 Dowgate Hill London

EC4R 2SU

4 July 2023 CONSOLIDATED STATEMENT OF INCOME for the year ended

31 December 2022

2022 2021

Note GBP GBP

Continuing Operations

Revenue 3 137,288 5,603

Cost of sales (60,765) (3,525)

Gross profit / (loss) 76,523 2,078

Administrative expenses excluding exceptional costs (750,192) (160,880)

Exceptional administration costs 5 (58,166) (445,796)

Total administrative expenses (808,358) (606,676)

Operating loss before depreciation (731,835) (604,598)

Depreciation and Amortisation 9 (95,994) (3,874)

Impairment - -

Operating loss (827,829) (608,472)

Net financial income/(expense) 6 (504) 4,942

Share of profits of associated entities 15 4,541 -

Profit/(loss) before taxation (823,792) (603,530)

Taxation (685) -

Profit/(loss) for the period (824,477) (603,530)

Earnings per share - GBP (using weighted average number of shares)

Basic and Diluted (0.01) (0.02)

Basic and Diluted 8 (0.01) (0.02)

The notes on pages 20 to 30 form an integral part of this financial information.

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

for the year ended 31 December 2022

2022 2021

GBP GBP

Profit for the financial year (824,477) (603,530)

Other comprehensive income:

Exchange differences on re-translating foreign operations 171,836 (11,779)

Total comprehensive income (652,641) (615,309)

Attributable to:

Equity shareholders of the parent (652,641) (615,309)

Total Comprehensive income (652,641) (615,309)

The notes on pages 20 to 30 form an integral part of this financial information.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

for the year ended 31 December 2022

2022 2021

Note GBP GBP

Assets

Non-current assets

Goodwill 9 1,462,774 1,462,774

Intangible assets 9 1,482,645 1,299,266

Property, plant and equipment 9 10,406 10,146

Investments in associated entities 15 4,541 -

Total non-current assets 2,960,366 2,772,186

Current assets

Trade and other receivables 10 386,005 628,636

Cash and cash equivalents 11 2,189,610 2,734,633

Total current assets 2,575,615 3,363,269

Liabilities

Current liabilities

Trade and other payables 12 652,057 729,724

Total current liabilities 652,057 729,724

Net current assets 1,923,558 2,633,545

Net assets 4,883,924 5,405,731

Shareholders' Equity

Share capital 14 117,750 117,750

Share premium 5,773,031 5,768,771

Preference shares 14 246,096 246,096

Other Reserves 13 70,070 74,330

Foreign exchange reserve 300,281 (2,389)

Retained earnings (1,623,304) (798,827)

Total shareholders' equity 4,883,924 5,405,731

Total equity 4,883,924 5,405,731

The notes on pages 20 to 30 form an integral part of this financial information.

These financial statements were approved and authorised by the board on 04 July

2023.Signed on behalf of the board by: C. Duncan Soukup

Chairman CONSOLIDATED STATEMENT OF CASH FLOWS

as at 31 December 2022

2022 2021

Notes

GBP GBP

Cash flows from operating activities

Operating profit/(loss) (827,829) (608,472)

Increase/(decrease) in trade and other receivables 242,631 -

(Decrease)/increase in trade and other payables (77,607) (47,914)

Net exchange differences (130,723) 19,688

Depreciation and amortisation 9 95,994 3,874

Cash generated by operations (697,534) (632,824)

Taxation (685) -

Net cash flow from operating activities (698,219) (632,824)

Cash flows from investing activities

Sale/(purchase) of intangible assets (149,371) -

Acquisition of subsidiary - 18,333

Net cash flow in investing activities - continuing operations (149,371) 18,333

Cash flows from financing activities

Interest Paid (42) (14,632)

Repayment of loans and borrowings (60) -

Issue of ordinary share capital - 2,415,000

Parent company loan issuance/(repayment) - 81,893

Net cash flow from financing activities (102) 2,482,261

Net increase in cash and cash equivalents (847,692) 1,867,770

Cash and cash equivalents at the start of the period 2,734,633 878,642

Effects of foreign exchange rate changes 302,669 (11,779)

Cash and cash equivalents at the end of the period 2,189,610 2,734,633

The notes on pages 20 to 30 form an integral part of this financial information. CONSOLIDATED STATEMENT OF CHANGES IN EQUITY for the year ended 31 December 2022

Attributable to owners of the Company

Foreign Total

Share Share Preference Other Exchange Retained Shareholders

Capital Premium Reserves Reserves Earnings

Shares Equity

GBP GBP GBP GBP GBP

GBP GBP

Balance as at 31 December 2020 804,855 - - 74,330 9,390 (195,297) 693,278

Issuance of Preference shares - - 246,096 - - - 246,096

Conversion of Share Capital to (1,018,479) 1,018,479 - - - - -

par value

Acquisition of Subsidiary 50,386 2,616,280 - - - - 2,666,666

Issuance of Share Capital 280,988 2,134,012 - - - - 2,415,000

Foreign Exchange on translation - - - - (11,779) - (11,779)

Total comprehensive income for - - - - - (603,530) (603,530)

the period

Balance as at 31 December 2021 117,750 5,768,771 246,096 74,330 (2,389) (798,827) 5,405,731

Other Reserves - Options - 4,260 - (4,260) - - -

Foreign Exchange on translation - - - - 302,670 - 302,670

Total comprehensive income for - - - - - (824,477) (824,477)

the period

Balance as at 31 December 2022 117,750 5,773,031 246,096 70,070 300,281 (1,623,304) 4,883,924

The notes on pages 20 to 30 form an integral part of this

financial information. 1. GENERAL INFORMATION

Anemoi International Ltd (the "Company") is a British Virgin

Island ("BVI") International business company ("IBC"), incorporated

and registered in the BVI on 6 May 2020.

id4 AG is a wholly owned subsidiary of Anemoi and was formed as

part of the merger of the former id4 AG ("id4") with and into its

parent, Apeiron Holdings AG on 14 September 2021. id4 was

incorporated and registered in the Canton of Lucerne in Switzerland

in April 2019 whilst Apeiron Holdings AG was incorporated and

registered in December 2018. Following the merger, Apeiron Holdings

AG was renamed id4 AG.

On the 17th December 2021, the entire share capital of id4 AG

was purchased by Anemoi International Ltd.

Id4 CLM (UK) Ltd is a wholly owned subsidiary of Anemoi,

incorporated on 26 November 2021 in England and Wales. Id4 CLM (UK)

Ltd is a private limited company, limited by shares. 2. ACCOUNTING

POLICIES

The Group financial statements consolidate those of the Company

and its subsidiaries (together referred to as the "Group"). The

Group prepares its accounts in accordance with applicable UK

Adopted International Accounting Standards "IFRS".

The financial statements are expressed in GBP.

The principal accounting policies are summarised below. They

have been applied consistently throughout the period covered by

these financial statements 2.1. FUNCTIONAL CURRENCY

The presentational currency of the financial statements is GBP,

whereas the functional currency of the Group is US Dollars.

Transactions in foreign currencies are initially recorded in the

functional currency by applying the spot exchange rate on the date

of the transaction. Monetary assets and liabilities denominated in

foreign currencies are retranslated into the presentational

currency at the spot exchange rate on the balance sheet date. Any

resulting exchange differences are included in the statement of

comprehensive income. Non-monetary assets and liabilities, other

than those measured at fair value, are not retranslated subsequent

to initial recognition. 2.2. CHANGES IN ACCOUNTING POLICIES AND

DISCLOSURES

The Group changed to UK Adopted International Accounting

Standards for the year ended 31 December 2021 onwards from

International Financial Reporting Standards (IFRSs) as adopted by

the European Union for the year ended 31 December 2020.

Standards issued but not yet effective: There were a number of

standards and interpretations which were in issue during the

current period but were not effective at that date and have not

been adopted for these Financial Statements. The Directors have

assessed the full impact of these accounting changes on the

Company. To the extent that they may be applicable, the Directors

have concluded that none of these pronouncements will cause

material adjustments to the Group's Financial Statements.They may

result in consequential changes to the accounting policies and

other note disclosures.The new standards will not be early adopted

by the Group and will be incorporated in the preparation of the

Group Financial Statements from the effective dates noted

below.

The new standards include:

IFRS 17 Insurance contracts 1

IAS 1 Presentation of financial statements and IFRS Practice

Statement 2 1 IAS 8 Accounting policies, changes in accounting

estimates and errors 1 IAS 12 Income Taxes 1

IFRS 7 Financial Instruments: Disclosures (Supplier Finance

Arrangements (Amendments to IAS 7 and IFRS 7)) 2 IFRS 16 Leases

(Amendment - to clarify how a seller-lessee subsequently measure

sale and leaseback transactions) 2 IAS 1

Presentation of financial statements (Amendment - Classification

of Liabilities as Current or Non-Current) 2 IAS 1 Presentation of

financial statements (Amendment - Non-current Liabilities with

Covenants) 2 1. Effective for annual periods beginning on or after

1 January 2023 2. Effective for annual periods beginning on or

after 1 January 2024 2.3. JUDGEMENT AND ESTIMATES

The preparation of financial statements in conformity with IFRS

requires the Directors to make judgements, estimates and

assumptions that affect the application of policies and reported

amounts of assets, liabilities, income and expenses. The estimates

and associated assumptions are based on historical experience and

various other factors that are believed to be reasonable under the

circumstances, the results of which form the basis of making the

judgements about carrying values of assets and liabilities that are

not readily apparent from other sources. Actual results may differ

from these estimates.

The estimates and underlying assumptions are reviewed on an

ongoing basis. Revisions to accounting estimates are recognised in

the period in which the estimate is revised if the revision affects

only that period, or in the period of the revision and future

periods if the revision affects both current and future

periods.

The key judgement areas relate to the carrying value of

intangible assets which are reviewed annually for indication of

impairment. Deferred consideration as per note 16 is not currently

recognised on the acquisition of .id4. AG. The deferred

consideration is contingent on the meeting of financial targets by

December 2026.The Board is still confident of meeting targets

however the length of time and nature of recurring revenue, which

form much of the financial targets, have suggested that withholding

recognition of deferred consideration until such time as greater

steps toward the targets have been made is the prudent judgement.

2.4. PROPERTY, PLANT AND EQUIPMENT

Property, plant and equipment are stated at cost less

depreciation and any provision for impairment. Cost includes the

purchase price, including import duties, non-refundable purchase

taxes and directly attributable costs incurred in bringing the

asset to the location and condition necessary for it to be capable

of operating in the manner intended. Cost also includes capitalised

interest on borrowings, applied only during the period of

construction.

Fixed assets are depreciated on a straight-line basis between 3

and 15 years from the point at which the asset is put into use.

2.5. INTANGIBLE ASSETS

GOODWILL

For impairment testing purposes, management considers the

operations of the Group to represent a single cash generating unit

(CGU), providing software and digital solutions to the financial

services industry. The directors have assessed the recoverable

amount of goodwill which in accordance with IAS 36 is the higher of

its value in use and its fair value less costs to sell (fair

value), in determining whether there is evidence of impairment.

The fair value of the CGU as at 31 December 2022 is considered

by the directors to be fairly represented when a discounted cash

flow valuation of detailed forecasts over 5 years in addition to a

subsequent transition period of 3 years before terminal value

assumptions to establish a fair value. Forecasts assumed a discount

rate of 20% and terminal growth rate of 2% respectively.

As such, the directors do not consider there to be any

indication that the goodwill is impaired. DEVELOPMENT COSTS

An intangible asset, which is an identifiable non-monetary asset

without physical substance, is recognised to the extent that it is

probable that the expected future economic benefits attributable to

the asset will flow to the Group and that its cost can be measured

reliably. Such intangible assets are carried at cost less

amortisation. Amortisation is charged to 'Administrative expenses'

in the Statement of Comprehensive Income on a straight-line basis

over the intangible assets' useful economic life.The amortisation

is based on a straight-line method typically over a period of 1-5

years depending on the life of the related asset.

Expenditure on research activities is recognised as an expense

in the period in which it is incurred. Development costs are

capitalised as an intangible asset only if the following conditions

are met:

-- an asset is created that can be identified;

-- it is probable that the asset created will generate future

economic benefit;

-- the development cost of the asset can be measured

reliably;

-- it meets the Group's criteria for technical and commercial

feasibility; and

-- sufficient resources are available to meet the development

costs to either sell or use as an asset. 2.6. TAXATION

The Company is incorporated in the BVI as an IBC and as such is

not subject to tax in the BVI. Id4AG is incorporated in Switzerland

is subject to tax in the Canton of Lucerne. Id4 CLM (UK) Ltd is

incorporated in England and Wales and therefore subject to tax in

the UK. 2.7. FOREIGN CURRENCY

Transactions in currencies other than the entity's functional

currency (foreign currencies) are recorded at the rate of exchange

prevailing on the dates of the transactions. At each reporting

date, monetary assets and liabilities that are denominated in

foreign currencies are retranslated at the rates prevailing on the

financial reporting date. Exchange differences arising are included

in the statement of income for the period.

Year-end GBPUSD exchange rate as at 31 Dec 2022: 1.2103 (2021:

1.3497)

Average GBPUSD exchange rate as at 31 Dec 2022: 1.2800 (2021:

1.3573)

Year-end GBPEUR exchange rate as at 31 Dec 2022: 1.1273 (2021:

1.1925)

Average GBPEUR exchange rate as at 31 Dec 2022: 1.1599 (2021:

1.1528)

Year-end GBPCHF exchange rate as at 31 Dec 2022: 1.1187 (2021:

1.2336)

Average GBPCHF exchange rate as at 31 Dec 2022: 1.1762 (2021:

1.2191) 2.8. BORROWING COSTS

Borrowing costs directly attributable to the acquisition,

construction or production of qualifying assets are added to the

cost of those assets until such a time as the assets are

substantially ready for their intended use or sale. All other

borrowing costs are recognised in profit and loss in the period

incurred. 2.9. FINANCIAL INSTRUMENTS AND RISK MANAGEMENT

Financial assets and liabilities are recognised on the Group's

statement of financial position when the Group becomes party to the

contractual provisions of the instrument.

Cash and cash equivalents comprise cash in hand and demand

deposits and other short-term highly liquid investments with

maturities of three months or less at inception that are readily

convertible to a known amount of cash and are subject to an

insignificant risk of changes in value.

Trade payables are not interest-bearing and are initially valued

at their fair value and are subsequently measured at amortised

cost.

Equity instruments are recorded at fair value, being the

proceeds received, net of direct issue costs.

Share Capital - Ordinary shares are classified as equity.

Incremental costs directly attributable to the issue of new shares

or options are shown in equity as a deduction, net of taxation,

from the proceeds.

Borrowings are initially measured at fair value and are

subsequently measured at amortised cost, plus accrued interest.

2.10. GOING CONCERN

The financial statements have been prepared on the going concern

basis as management consider that the Group will continue in

operation for the foreseeable future and will be able to realise

its assets and discharge its liabilities in the normal course of

business. The Group has fully assessed its financial commitments

and at the year-end had net cash reserves of GBP2.2m.

In arriving at this conclusion management have prepared cash

flow forecasts considering operating cash flows and capital

expenditure requirements for the Group, as well as available

working capital. 3. SEGMENT INFORMATION

Following the acquisition of id4 AG on 17 December 2021 the

Group operated a software services segment as outlined below.

Sale of Sale of

Services* Goods Total

GBP GBP GBP

Revenue 137,288 - 137,288

Based on these segments, the reportable segments under IFRS 8 is

as follows:

Software Sales Other segments Total

GBP GBP GBP

Segment income statement

Revenue 137,288 - 137,288

Expenses (445,813) (419,272) (865,086)

Depreciation/Amortisation (95,994) - (95,994)

Profit/loss before tax (404,519) (419,272) (823,792)

Attributable income tax expense (685) - (685)

Profit/loss for the period (405,204) (419,272) (824,477)

Software Sales Other segments Total

GBP GBP GBP

Segment statement of financial position

Non-current assets 1,493,052 1,467,314 2,960,366

Current assets 299,028 2,276,587 2,575,615

Assets 1,792,080 3,743,901 5,535,981

Current liabilities 930,401 (278,344) 652,057

Liabilities 930,401 (278,344) 652,057

Net assets 861,679 4,022,245 4,883,924

Shareholders' equity 861,679 4,022,245 4,883,924

Total equity 861,679 4,022,245 4,883,924

* Sale of Services refers to SaaS based software sales at id4. 4. OPERATING LOSS FOR THE PERIOD

The operating profit for the year is stated after charging:

2022 2021

GBP GBP

Wages and salaries 353,859 68,323

Social security costs 14,222 3,141

Pension costs 12,961 1,261

Audit fees 46,790 7,137

Legal and professional fees 233,491 50,951

Non audit fees paid to Jeffreys Henry were GBPnil (2021:GBP25k) for acting as reporting accountants.

5. EXCEPTIONAL COSTS

2022 2021

GBP GBP

Exceptional costs

Professional fees relating to id4 merger and SPA 58,166 -

Professional fees relating to Acquisition of id4 AG and Relisting - 445,796

Total Exceptional costs 58,166 445,796

6. NET FINANCIAL EXPENSE

2022 2021

GBP GBP

Bank interest payable (3) 16

Loan interest payable 45 14,616

Foreign currency gains/(losses) 462 (19,574)

504 (4,942)

7. INCOME TAX EXPENSE

2022 2021

GBP GBP

Loss before tax (823,792) (603,530)

Tax at applicable rates (685) -

Losses carried forward (823,792) (603,530)

Total tax (685) -

The applicable tax rates in relation to the Group's profits are

BVI 0%,Swiss 12.2%, UK 19% (2021: 0%, 12.3% and 19%). Since the

year end, tax rates in the UK have increased to 25% with effect

from 1 April 2023.

8. EARNINGS PER SHARE

2022 2021

GBP GBP

The calculation of earnings per share is based on

the following loss attributable to ordinary shareholders and number of shares: Profit/

(loss) for the period from continuing operations

(824,477) (603,530)

Profit for the period (824,477) (603,530)

Weighted average number of shares of the Company 157,041,665 38,933,104

Earnings per share: Basic and Diluted (GBP)

(0.01) (0.02)

Number of shares outstanding at the period end: 157,041,665 157,041,665

Number of shares in issue

Opening Balance 157,041,665 30,000,000

Issuance of Share Capital - 127,041,665

Basic number of shares in issue 157,041,665 157,041,665

9. NON-CURRENT ASSETS

Plant

Intangible and

Total Goodwill Assets Equipment

2022 2022 2022 2022

Cost GBP GBP GBP GBP

Cost at 1 January 2022 2,791,454 1,462,774 1,316,819 11,861

FX movement 136,520 - 135,302 1,218

2,927,974 1,462,774 1,452,121 13,079

Additions 149,371 - 149,371 -

Acquisition of subsidiary - - - -

Cost at 31 December 2022 3,077,346 1,462,774 1,601,492 13,079

Depreciation/Amortisation

Depreciation/Amortisation at 1 January 19,268 - 17,553 1,715

FX movement 1,980 - 1,804 176

21,248 - 19,357 1,891

Charge for the year on continuing operations 100,272 - 99,490 783

Acquisition of subsidiary - - - -

Depreciation/Amortisation at 31 December 2022 121,521 - 118,847 2,674

Closing net book value at 31 December 2022 2,955,825 1,462,774 1,482,645 10,406 9. NON-CURRENT ASSETS CONTINUED

Plant

Intangible

and Equipment

Total Goodwill Assets

2021 2021 2021 2021

Cost GBP GBP GBP GBP

Cost at 1 January 2021 - - - -

FX movement - - - -

- - - -

Additions 12,848 - 12,848 -

Acquisition of subsidiary 2,778,606 1,462,774 1,303,971 11,861

Cost at 31 December 2021 2,791,454 1,462,774 1,316,819 11,861

Depreciation/Amortisation

Depreciation/Amortisation at 1 January - - - -

FX movement - - - -

- - - -

Charge for the year on continuing operations 3,848 - 3,814 34

Acquisition of subsidiary 15,420 - 13,739 1,681

Depreciation/Amortisation at 31 December 2021 19,268 - 17,553 1,715 Closing net book value at 31 December 2021 2,772,186 1,462,774 1,299,266 10,146

*The variance to the income statement is due to the difference

in exchange between average and closing rates. Plant Property and

Equipment is depreciated over 4 years.

Intangible Assets are amortised over 5 years.

10. TRADE AND OTHER RECEIVABLES

2022 2021

GBP GBP

Receivables 18,032 17,395

Prepayments 73,636 27,154

Other debtors* 294,337 584,087

Total trade and other receivables 386,005 628,636

*Other debtors includes a loan due from Alfalfa AG of CHF

310,000 in relation to an asset purchase from id4 AG prior to the

acquisition by the Company.

11. CASH AND CASH EQUIVALENTS

2022 2021

GBP GBP

Cash in the Statement of Cash Flows 2,189,610 2,734,633

12. TRADE AND OTHER PAYABLES

2022 2021

GBP GBP

Trade creditors 216,172 243,468

Other creditors* 350,822 322,357

Loans payable** - 60

Accruals 85,063 163,839

Total trade and other payables 652,057 729,724

*Other creditors includes a balance owed to Thalassa Holdings

Ltd from the former Apeiron AG. The balance is non-interest bearing

and due to be settled within the following period.

**This is a balance owed to Thalassa Holdings Ltd from the

Company and is settled on periodic basis.

13. SHARE BASED PAYMENTS

Warrants Outstanding 2022 2021

Number of Options Granted 29,950,000 29,950,000

Vesting Period 5 Years 5 Years

Option strike price 3.00p 3.00p

Current share price (at granting date) 3.00p 3.00p

Volatility 10.85% 10.85%

Risk-free interest rate 0.04% 0.04%

Life of Option 5 Years 5 Years

Fair Value USD 95,638 95,638

Fair Value GBP 70,070 70,070

In recognition of Thalassa's upfront capital commitment by way

of the Thalassa Subscription, the Company has executed a warrant

instrument and on Admission issued to Thalassa 29,950,000

warrants.The exercise period for the warrants is 5 years from the

date of Admission and the exercise price for the warrants is the

Subscription Price.

The warrants have been valued at fair value using the

Black-Sholes model.

14. SHARE CAPITAL

As at As at

31 Dec 2022 31 Dec 2021

GBP GBP

Authorised share capital:

Unlimited ordinary shares of USD0.001 each - -

Fully subscribed shares

29,950,000 ordinary shares of USD0.04 each 1,200,000 1,200,000

Exchange rate adjustment 1.3649 1.3649

29,950,000 ordinary shares in GBP 879,185 879,185

Placing 5,999,999 ordinary shares of GBP0.04 240,000 240,000

(1,092,810)

Conversion of shares to par value of USD.0001 at rate of 1.3649 (1,092,810)

Issuance of 66,666,666 shares for acquisition of id4 AG

50,387 50,387

Placing of 54,375,000 shares of USD0.001 Less fair value of options and warrants 40,988 40,988

Total 117,750 117,750

Number Number

of shares of shares

Fully subscribed shares 157,041,665 157,041,665

Issued shares of no par value - -

Total 157,041,665 157,041,665

Under the Company's articles of association, the Board is

authorised to offer, allot, grant options over or otherwise dispose

of any unissued shares. Furthermore, the Directors are authorised

to purchase, redeem or otherwise acquire any of the Company's own

shares for such consideration as they consider fit, and either

cancel or hold such shares as treasury shares.The directors may

dispose of any shares held as treasury shares on such terms and

conditions as they may from time to time determine. Further, the

Company may redeem its own shares for such amount, at such times

and on such notice as the directors may determine, provided that

any such redemption is pro rata to each shareholder's then

percentage holding in the Company.

On the 14th of April 2021, a total of 5,999,999 new DIs (the

"Placing DIs") were placed by at a price of GBP0.04 per Placing DIs

(the "Placing") with existing and new investors ("Placees") raising

gross proceeds of approximately GBP240,000.The Placing DIs

represent Ordinary Shares representing 20 per cent. of the Ordinary

Share capital of the Company prior to the Placing.

On the 16th of August 2021 the Board announced that the par

value of its issued and outstanding ordinary shares of no par value

had changed to USUSD0.001 per Ordinary Share. The total number of

issued shares with voting rights remained unchanged at 35,999,999

Ordinary Shares. Aside from the change in nominal value, the rights

attaching to the Ordinary Shares (including all voting and dividend

rights and rights on a return of capital) remained unchanged.

On the 17th of December 2021, following the acquisition of id4

AG, 66,666,666 New Ordinary Shares of USD0.001 were issued to the

shareholders of id4 in settlement of consideration for the

acquisition and the Company was readmitted to trading on the London

Stock Exchange.

On the 17th of December 2021, alongside the acquisition of id4

AG, 54,375,000 New Ordinary Shares of USD0.001 were issued in a

further placing with existing and new investors, raising a total of

GBP2,175,000.

The following describes the nature and purpose of each reserve

within equity:

Retained Earnings: All other net gains and losses and

transactions with owners (e.g. dividends) not recognised elsewhere

FX Reserves: Gains/losses arising on retranslating the net assets

of overseas operations into the reporting currency.

Share Premium: Amount subscribed for share capital in excess of

nominal value. Other Reserves: Other reserves include the warrants

outstanding, listed in Note 13.

Preference Shares: Shares for which receive preference of

dividends over ordinary shareholders. 15. ASSOCIATED ENTITIES

Athenium Consultancy Ltd, in which the Group owns 30% shares,

was incorporated on 12 October 2021. Movement on interests in

associates can be summarised as follows:

2022 2021

GBP GBP

Cost as at 1 January - -

Additions 4,541 -

4,541 - 16. RELATED PARTY TRANSACTIONS

Thalassa Holdings Ltd, which holds shares in the Company through

its subsidiary Apeiron Holdings BVI is related by common control

through the Chairman, Duncan Soukup. Services incurred are

recharged from Thalassa Holdings Ltd and its subsidiaries, at the

year-end GBP2,894 (2021: GBP360,264) was owed to Thalassa.

The company accrued GBP134,953 for consultancy and

administrative services provided to the Group, by Fleur De Lys Ltd,

a company owned and controlled by the Chairman Duncan Soukup

(GBP2021: GBP19,263). Of this, Mr Soukup received GBP71,000,

leaving an outstanding balance of GBP63,953 for the 2022

period.

Athenium Consultancy Ltd, a company in which the Group owns

shares, invoiced the group for financial and corporate

administration services totalling GBP150,000 for the period (2021:

nil). 17. CAPITAL MANAGEMENT

The Company's capital comprises ordinary share capital and share

premium alongside a reverse takeover reserve, currency adjustment

reserve and retained earnings. The Group's objectives when managing

capital are to provide an optimum return to shareholders over the

short to medium term through capital growth and income whilst

ensuring the protection of its assets by minimising risk. The Group

seeks to achieve its objectives by having available sufficient cash

resources to meet capital expenditure and ongoing commitments.

At 31 December 2022, the Group had capital of GBP4,883,924

(2021: GBP5,405,731).The Group does not have any externally imposed

capital requirements. 18. FINANCIAL INSTRUMENTS

The Group's financial instruments comprise cash and cash

equivalents together with various items such as trade and other

receivables and trade payables etc, that arise directly from its

operations. The fair value of the financial assets and liabilities

approximates the carrying values disclosed in the financial

statements.

The main risks arising from the Group's financial instruments

are foreign exchange risk, credit risk and liquidity risk. FOREIGN

EXCHANGE RISK

The Group undertakes FOREX and asset risk management activities

from time to time to mitigate foreign exchange risk.

An increase in foreign exchange rates of 5% at 31 December 2022

would have decreased the profit and net assets by GBP115,243 (2021:

GBP130,221). A decrease of 5% would have increased profit and net

assets by GBP115,243 (2021:GBP143,928).

At 31 December 2022 30% of the Group's balances were held in CHF

(2021: 38%), 4% in USD (2021: 32%), 66% in GBP (2021:

31%) with 0% in EUR (2021: 1% a short position). CREDIT RISK

Group credit risk is limited at this early stage and not felt to

be an issue with the absence of receivables of loan provisions. The

Group continues to monitor credit risk when assessing opportunities

given the potential for exposure to geopolitical risks and the

possibility of sanctions which could adversely affect the ability

to perform operations. 18. FINANCIAL INSTRUMENTS CONTINUED

LIQUIDITY RISK

The Group's strategy for managing cash is to maximise interest

income whilst ensuring its availability to match the profile of the

Group's expenditure. All financial liabilities are generally

payable within 30 days and do not attract any other contractual

cash flows. Based on current forecasts the Group has sufficient

cash to meet future obligations. The maturity analysis of the trade

and other payables is as follows:

30 days 30-60 days 60-90 days 90+ days Total

31 December 2022

GBP GBP GBP GBP GBP

Finance lease liabilities -

Trade payables 216,172 - - - 216,172

Other payables 7,312 - - 343,510 350,822

Accruals 42,921 - - 42,142 85,063

266,405 - - 385,652 652,057

19. SUBSEQUENT EVENTS

There were no subsequent events. 20. COPIES OF THE FINANCIAL STATEMENTS