TIDMXPF

RNS Number : 2700I

XP Factory PLC

04 August 2023

4 August 2023

XP Factory Plc

("XP Factory", the "Company" or the "Group")

Trading Update and Change of Financial Year End

"Transformational growth delivered"

XP Factory, one of the UK's pre-eminent experiential leisure

businesses operating the Escape Hunt and Boom Battle Bar brands, is

pleased to provide an update on trading for the six months to 30

June 2023.

H1 2023 Highlights:

-- Group turnover of GBP18.8m up 131% (H1 2022: GBP8.1m)

-- Double digit like-for-like sales growth delivered across

both owner-operated brands:

o Boom: up 19% in the 26 weeks to 2 July 2023

o Escape Hunt: up 20% in the 26 weeks to 2 July 2023

-- Owner operated site level EBITDA(1) of c.GBP3.8m up 245%

(H1 2022: GBP1.1m)

-- Franchise EBITDA of c.GBP1.5m up c.30% (H1 2022: GBP1.1m)

-- Boom franchise sites in Chelmsford and Ealing acquired

in June 2023

-- Continued high ratings from customer reviews

-- Record pre-bookings for corporate sales provides confidence

underpinning expectations for full year

-- GBP3.6m cash as at 30 June 2023 (31 Dec 2022: GBP3.2m)

1. site level EBITDA calculated before IFRS16 Adjustments and

before pre-opening costs.

Trading

Trading in the six months to 30 June 2023 reflects the

transformational expansion of the Group during 2022. Turnover grew

over 130% to GBP18.8m (H1 2022 GBP8.1m) driven by an increase in

the number of sites open compared to the same period in 2022 and

strong like-for-like growth in both Boom Battle Bar and Escape

Hunt. As at 30 June 2023, the Group comprised 27 Boom Battle Bar

sites, 13 owned and 14 franchised (H1 2022: 17, of which 4 owned

and 13 franchised), and 46 Escape Hunt sites, 23 are owned and 23

franchised (H1 2022 42, of which 19 owned and 23 franchised).

Escape Hunt

Turnover from the Escape Hunt owner operated business was

GBP6.1m, up 41% on the same period in 2022 (H1 2022: GBP4.3m).

Like-for-like growth across the estate, adjusting for the VAT

benefit received in the first quarter of 2022, was 20%. Pleasingly,

like-for-like growth from the most mature seven sites in the

network was 14%. Notwithstanding meaningful wage cost increases put

through in H1 2023, site level EBITDA margins were well in excess

of 35% and continue to exceed internal benchmarks. Escape Hunt

benefits from relatively little exposure to other non-discretionary

operating costs.

The Escape Hunt international franchise estate also recorded

strong growth, with franchise revenue of GBP0.3m up 15% on the same

period in 2022.

Boom Battle Bar

Turnover from the Boom owner operated estate was GBP11.1m, an

increase of more than 400% compared to the same period in 2022 (H1

2022: GBP2.2m). The increase reflects like-for-like sales growth of

19% from the owner operated sites open in the same period in 2022,

together with the new sales from a significantly expanded estate.

Gross margins have continued to improve across the network and the

business is achieving greater gross margin consistency week to week

and between sites. This is particularly pleasing since inflationary

pressures saw input costs increase at the start of the year but the

Board took the decision to maintain sales prices rather than pass

on the increases to consumers. Whilst the Boom estate has a greater

exposure to cost pressures than Escape Hunt, with labour rates and

utility bills increasing meaningfully versus prior year, it has

been encouraging to see labour levels running consistently at

targeted levels for the last few months and utility bills beginning

to reduce. Taking H1 seasonality into account, EBITDA margins

continue to trend towards their mature targets.

Royalties related to turnover within the franchise estate grew

to GBP1.1m, up 83% on the same period in 2022. (H1 2022:

GBP0.6m)

Network development

A new Escape Hunt venue in Woking was in build at the end of the

period and has since opened in July. Trading at the new site to

date has been encouraging. Three Boom sites were in build as at 30

June 2023. The newest site in Dubai opened on 17 July 2023 and has

so far traded exceptionally well. Sites in Canterbury and Southend

are well advanced and due to open in the coming months.

In June, the Group completed the acquisitions of two further

former Boom franchise sites in Chelmsford and Ealing which were

owned by the same franchisee. The acquisitions have been financed

through vendor loans and are expected to be fully funded from the

cashflows of the two sites, providing attractive returns.

Change of year end

The Board has decided to change the Group's year end from 31

December to 31 March. Both Boom and Escape Hunt have peak trading

periods that coincide with Christmas and the Board believes that

there will be a number of benefits to the change including:

-- Earlier and better visibility of the likely outturn for any

financial year given the significance of December trading for the

full year results

-- The audit will take place during the Group's quietest months

between April and June, which is expected to lead to greater

efficiency of process for both internal staff and auditors

-- The change will align the Group with several other leisure operators

As a result of the change, the Group's current financial year

will comprise 15 months from 1 January 2023 to 31 March 2024. The

Board intends to report as follows, in each case with appropriate

comparatives:

-- Unaudited interim results for the six months to 30 June 2023

- publication by 30 September 2023

-- Unaudited interim results for the twelve months to 31

December 2023 - publication by 31 March 2024

-- Audited final results for the fifteen months to 31 March 2024

- publication by 30 September 2024

-- Unaudited interim results for the six months to 30 September

2024 - publication by 31 December 2024

Summary and outlook

The Board was delighted with the trading performance in the

first four months of 2023, delivering numbers ahead of internal

expectations. Normal seasonality patterns for the industry see May

and June typically a little softer, but as with its peers, this was

exacerbated somewhat this year, due to the uncharacteristically hot

weather and the adverse impact of rail strikes in London.

Nonetheless, the Group closed H1 in line with its plan.

Notwithstanding the ongoing rhetoric of the cost of living crisis

and rising interest rates, trading in July was significantly ahead

of May and June and early indications are positive for August.

Looking further out, the Company is experiencing record levels of

corporate and group bookings for H2 2023, which together with

July's performance helps underpin the board's confidence in a full

year performance in line with market expectations.

Commenting, Richard Harpham, Chief Executive of XP Factory plc

said "We are delighted to have delivered such transformational

growth compared to the same period in 2022. The performance in

Escape Hunt has been outstanding and we are delighted to see the

young Boom business continue to mature with ongoing improvements to

its operating metrics. We are mindful of the pressures on consumers

and on our cost base which bring an element of short term caution

but we remain optimistic for the future of both our businesses and

for the 2023 outturn."

Enquiries:

XP Factory Plc

https://www.xpfactory.com/

Richard Harpham (Chief Executive

Officer)

Graham Bird (Chief Financial

Officer)

Kam Bansil (Investor Relations) +44 (0) 20 7846 3322

S inger Capital Markets , NOMAD

and Broker

https://www.singercm.com

Peter Steel

Alaina Wong

James Fischer +44 (0) 20 7496 3000

IFC Advisory - Financial PR

https://www.investor-focus.co.uk/

Graham Herring

Florence Chandler +44 (0) 20 3934 6630

Notes to Editors:

About XP Factory plc

The XP Factory Group is one of the UK's pre-eminent experiential

leisure businesses which currently operates two fast growing

leisure brands. Escape Hunt is a global leader in providing

escape-the-room experiences delivered through a network of

owner-operated sites in the UK, an international network of

franchised outlets in five continents, and through digitally

delivered games which can be played remotely.

Boom Battle Bar is a fast-growing network of owner-operated and

franchise sites in the UK that combine competitive socialising

activities with themed cocktails, drinks and street food in a high

energy, fun setting. Activities include a range of games such as

augmented reality darts, Bavarian axe throwing, 'crazier golf',

shuffleboard and others. The Group's products enjoy premium

customer ratings and cater for leisure or teambuilding, in small

groups or large, and are suitable for consumers, businesses and

other organisations. The Company has a strategy to expand the

network in the UK and internationally, creating high quality games

and experiences delivered through multiple formats and which can

incorporate branded IP content. ( https://xpfactory.com/ )

Facebook: EscapeHuntUK BoomBattleBar

Twitter: @EscapeHuntUK @boombattlebar

Instagram: @escapehuntuk @boombattlebar

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTUOOVROBUWRAR

(END) Dow Jones Newswires

August 04, 2023 02:00 ET (06:00 GMT)

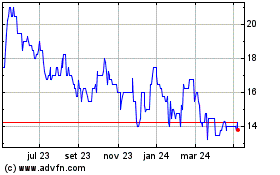

Xp Factory (LSE:XPF)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

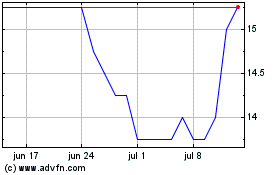

Xp Factory (LSE:XPF)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025